Mid-Year Report | 2025 Personal Care Small Appliance Market Summary: Breaking Through Amid Differentiation, Innovation Steers the Course

— Category Overview —

Hair dryer | Electric toothbrush | Electric shaver

01

Market Index

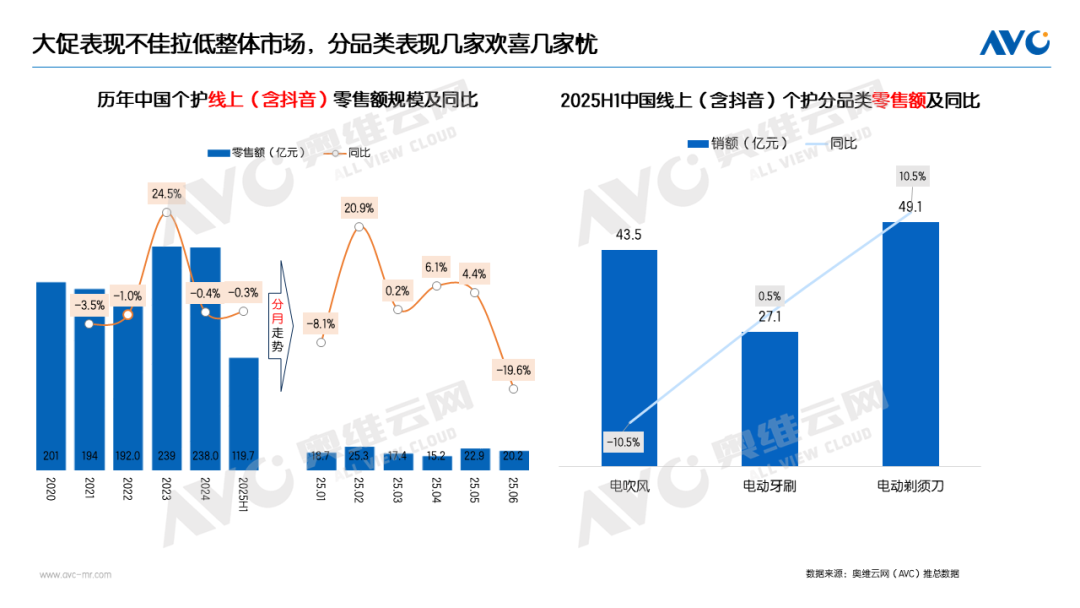

In the first half of 2025, the personal care small appliances market showed diverse development trends, with mixed sales performances across different categories. According to data from AVC (All View Cloud), the total online retail sales of personal care small appliances (including hair dryers, electric toothbrushes, and electric shavers) reached 11.97 billion yuan, representing a year-on-year decrease of 0.3%.

By category, the hair dryer segment experienced a 10.5% year-on-year decline in retail sales due to the saturation of the high-speed hair dryer market and the fading of technological dividends, weakening its previous growth momentum. The electric toothbrush segment achieved a 0.5% scale increase driven by structural upgrades; the deep penetration of intelligent features, breakthroughs in cleaning technology iterations, and segmented designs targeting different user groups have become the core drivers enabling it to withstand market fluctuations. Meanwhile, the electric shaver segment performed exceptionally well, with retail sales soaring 10.5% year-on-year, propelled by the continued penetration of portable products and dual-driven product structure upgrades, emerging as a prominent highlight in the personal care small appliances market in the first half of the year.

02

Channel Structure

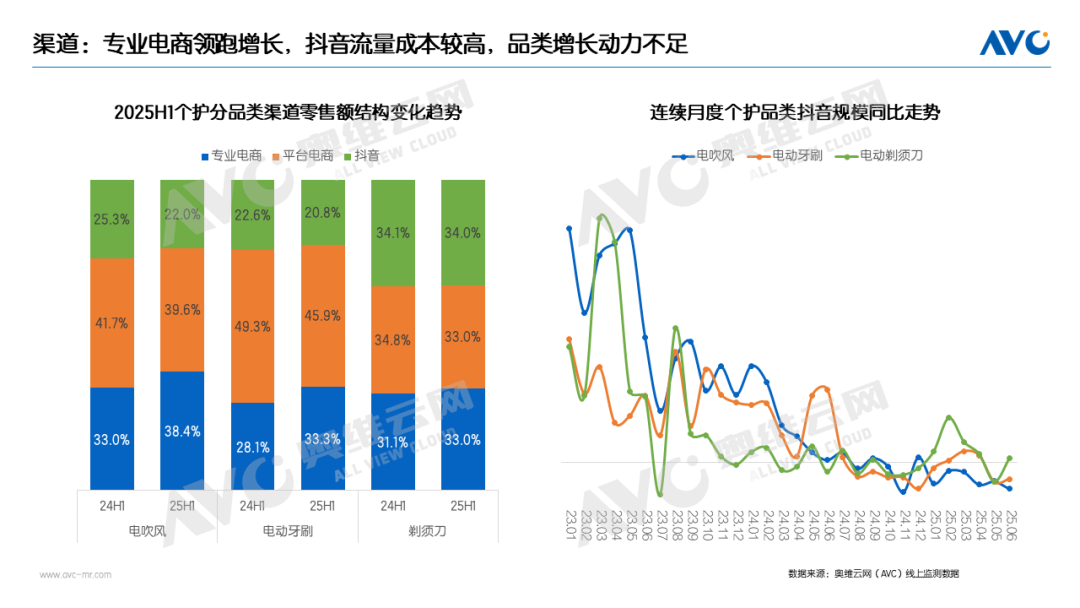

Professional e-commerce platforms have taken the lead in growth by precisely operating and capturing user mindshare in the personal care small appliance category. The retail market shares of hair dryers, electric toothbrushes, and electric shavers increased by 5.4%, 5.2%, and 1.9% respectively. In contrast, the Douyin channel is facing challenges such as market saturation and insufficient growth momentum. How to break through these bottlenecks through content innovation and deeper category cultivation has become an urgent issue to address.

Meituan, Alibaba, and JD.com are going all out as the battle for instant retail intensifies. According to estimates by the research team from the Institute of International Trade and Economic Cooperation of the Ministry of Commerce, the total scale of instant retail in China reached 650 billion yuan in 2023, growing 9.46 times over five years with a compound annual growth rate exceeding 56%. Personal care small appliances, due to their moderate price and immediate usability, highly align with the consumption scenarios of instant retail and are expected to gain more growth opportunities amid this channel transformation.

Channel integration is becoming deeper, with brands leveraging emerging platforms such as Douyin live streaming and Xiaohongshu for user education and brand awareness building. This, in turn, drives traffic back to traditional e-commerce platforms, forming a new pattern of coordinated channel development and supporting scale growth.

03

Product Trends

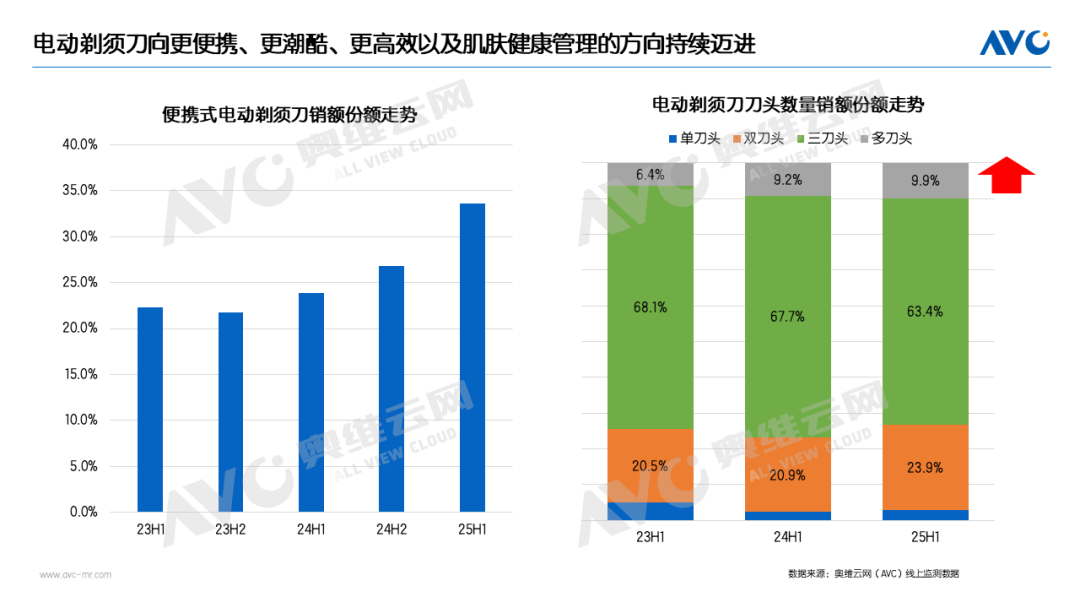

Electric shavers are continuously advancing towards being more portable, trendy, efficient, and better for skin health management.

Portability has become a mainstream trend, with market share rising from 23.9% in the first half of 2024 to 33.6% in the first half of 2025. Meanwhile, there is a significant upgrade in product premiumization, with the average price increasing by 23.7% year-on-year. As more brands enter the market, product innovation is emerging continuously. The design is becoming more refined and compact, with stainless steel and alloy materials enhancing the texture. Customizable elements, magnetic heads, and details such as sliding switches enhance the user experience. The iteration of efficient shaving technology is accelerating, with multi-head designs, optimized blade nets, and increased motor speed significantly improving shaving efficiency. Products suitable for sensitive skin, addressing men's skincare needs, and multi-functional products (shaving + nose hair trimming + facial cleansing + sideburn trimming) further meet consumers' higher demands for a comfortable shaving experience.

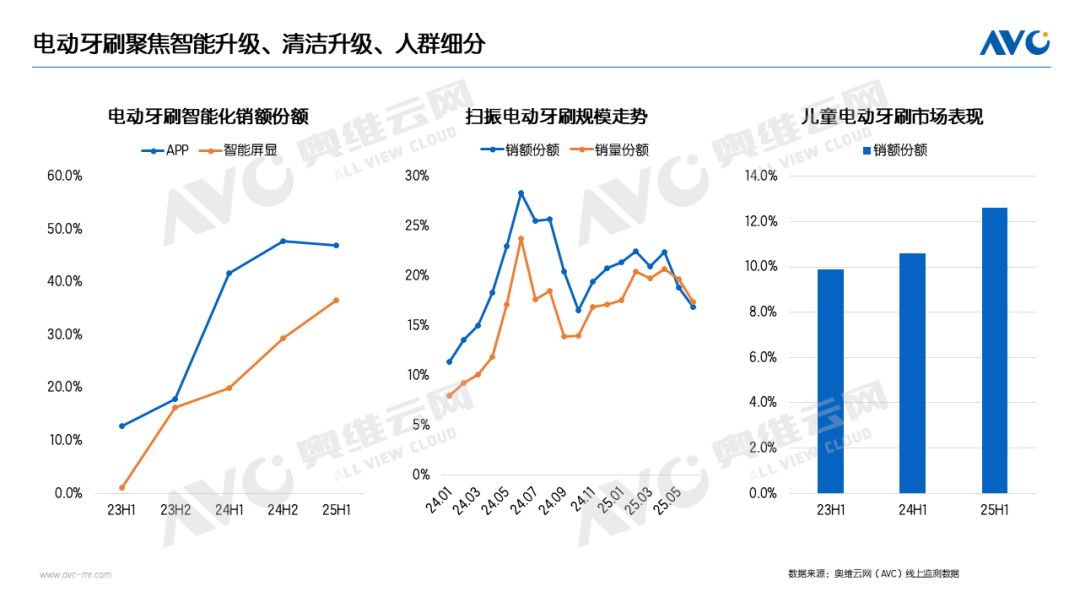

Electric toothbrushes focus on smart upgrades, cleaning enhancements, and market segmentation.

The intelligentization of electric toothbrushes is becoming more prominent, becoming a core competitiveness in the mid-to-high-end market. According to online data from AVC, in the first half of 2025, electric toothbrushes with app functionality will account for 47% of sales value, while those with smart display features will account for 36.6%. Products continue to upgrade, achieving a "thousand teeth, thousand faces" state by automatically adjusting the amplitude and vibration frequency according to different tooth surfaces. Since their debut in 2023, the penetration rate of oscillating electric toothbrushes has been continuously increasing, reaching a retail sales share of 20.3% in the first half of 2025. Some brands combine oscillation with visualization to provide a more intuitive cleaning experience. Children's electric toothbrushes are undergoing dual transformations in intelligentization and fun, with app functionality and smart displays both accounting for more than half. In terms of fun, besides cartoon appearances, designs like voice prompts, voice teaching, and brushing progress bars enhance children's initiative in brushing.

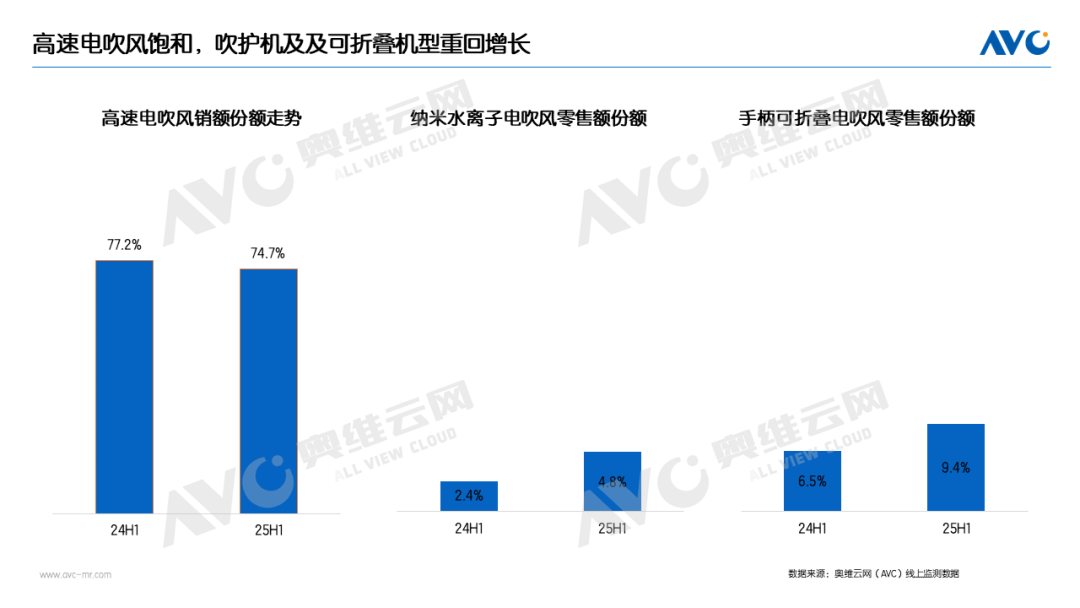

High-speed hair dryers reach saturation, while blow-dryers with protective features and foldable models return to growth.

Since 2021, high-speed hair dryers have experienced four years of rapid development, and now the market has become saturated. In the first half of 2025, the retail market share reached 74.7%, a year-on-year decrease of 2.5%. As the technology becomes increasingly mature, the value proposition of high-end features is gradually diminishing, and the market share of products priced between 200-300 yuan has significantly increased. Furthermore, in the context of severe product homogenization in the saturated high-speed market, hair care devices have returned to consumers' attention. The retail market share of nano water ion products has increased by 2.4% year-on-year, and foldable handles make them convenient for storage, precisely targeting business travelers.

Conclusion

The differentiated landscape of the personal care small appliance market in the first half of 2025 has essentially outlined the development trajectory for the entire year. For brands, it is necessary not only to keenly capture growth opportunities in various categories and continuously drive product innovation to create high-quality products that meet consumer expectations, but also to respond flexibly to channel transformations, optimize channel layouts, and enhance market penetration. Only by constantly adapting to market changes, using innovation as an oar and channels as a sail, can brands ride the waves of the personal care small appliance market and win broader development opportunities.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track