Massive Retreat of Japanese and Korean Battery Manufacturers

The once-dominant Japanese and Korean battery manufacturers are now retreating globally.

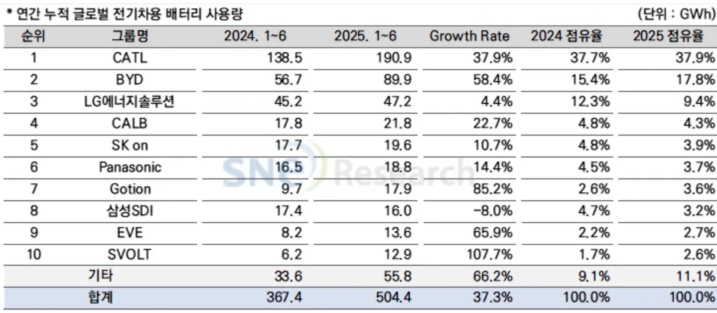

Recently, Korean research institution SNE Research released the latest data, showing that the global electric vehicle (EV, PHEV, HEV) battery installation volume reached 504.4 GWh in the first half of 2025, a year-on-year increase of 37.3%. The market share of a number of Japanese and Korean battery manufacturers, including LG Energy Solution, SK On, Samsung SDI, and Panasonic, further declined.

In the first half of this year, among the world’s top ten companies for power battery installation volume, China accounted for six seats, with a total installed volume of 347 GWh and a total market share of 68.8%, an increase of 4 percentage points year-on-year, reaching a record high. Japanese and Korean companies took four seats, with a total installed volume of 101.6 GWh and a combined market share of 20.1%, down 6.3 percentage points from the same period last year; this is far behind CATL alone (190.9 GWh).

Declining market share

In this list released by a Korean institution, the three major Korean battery companies, LG Energy Solution, SK On, and Samsung SDI, are showing signs of decline, as even their combined efforts could not surpass the second-ranked BYD.

In the first half of this year, BYD's global battery installation volume surged by 58.4% to reach 89.9 GWh, with its global market share rising to 17.8%. In contrast, the combined market share of the three major Korean companies dropped by 5.4 percentage points compared to the same period last year, falling to 16.4%, with a total installed capacity of 82.8 GWh.

LG Energy Solution, while still ranked third with an installed capacity of 47.2 GWh, only achieved a year-on-year growth of 4.4%, with its market share dropping from 12.3% in the same period of 2024 to 9.4%. The financial report released by LG Energy Solution shows that the operating income in the second quarter of 2025 decreased by 9.7% year-on-year to 5.56 trillion KRW (approximately 28.8 billion RMB).

It is understood that LG Energy Solution currently supplies batteries mainly to automakers such as Tesla, Chevrolet, Kia, and Volkswagen. According to analysis by SNE Research, "Due to a decline in the sales of models equipped with LG Energy Solution batteries, Tesla's usage of these batteries has decreased by 28.9%."

SK On ranked fifth with an installed capacity of 19.6 GWh, a year-on-year increase of 10.7%, while its market share declined from 4.8% in the same period of 2024 to 3.9%. The main reason is the weakened demand for its batteries in the European and North American markets. It is noteworthy that SK On has been operating at a net loss since 2021 and has yet to achieve positive profitability. In 2024 alone, the company's loss amounted to as much as 1.1 trillion Korean won (approximately 5.85 billion RMB).

In 2025, SK On will continue to face severe downward pressure on net profit, with losses expected to further expand. Nomura Orient International Securities released a report stating that SK On's operating profit is expected to incur a loss of $340 million (approximately RMB 2.44 billion), extending the loss trend from 2024. This is mainly due to a significant slowdown in global electric vehicle demand growth, resulting in a sharp decline in the utilization rate of its battery factories.

Samsung SDI ranked eighth with an installed capacity of 16GWh, a year-on-year decrease of 8%, making it the only company among the top ten to experience negative growth. Its market share also dropped from 4.7% in the same period of 2024 to 3.2%. An analyst from Morningstar predicted in the report that Samsung SDI will incur an operating loss of 398 billion KRW (approximately 2.06 billion RMB) in 2025, and has downgraded the company’s operating profit forecasts for 2026 to 2029 by 3% to 10%.

As the only Japanese battery manufacturer to rank among the global top ten, Panasonic secured sixth place with an installed capacity of 18.8 GWh. Although this represents a year-on-year increase of 14.4%, its market share fell from 4.5% in the same period of 2024 to 3.7%. Years ago, Panasonic once held the top spot in global power battery installations, owing to its superior cylindrical batteries as the exclusive supplier to Tesla.

Strategic Retrenchment and Adjustment

Facing multiple operational pressures and market challenges, Japanese and Korean battery manufacturers have initiated strategic business adjustments. For instance, LG Energy Solution announced at the beginning of this year that, due to a slowdown in the growth of the global electric vehicle market, the company decided to cut its annual capital investment by 30%. They also explicitly warned that due to changes in policy environments in key markets such as Europe and the United States, their annual revenue growth might significantly fall short of expectations.

In April this year, LG Energy Solutions announced that it would officially withdraw from an $8.45 billion (approximately 60.7 billion RMB) integrated battery industry investment project in Indonesia, ending the cooperation plan that had been in place since the cooperation agreement was signed in 2020. LG Energy Solutions stated that the decision to withdraw was a consensus reached after "comprehensively considering market conditions and the investment environment."

In May this year, according to foreign media reports, due to a slowdown in global electric vehicle demand, Panasonic adjusted the production plans of its battery factories. Panasonic Holdings CEO Yuki Kusumi stated that Panasonic will delay the construction of its third battery plant in the United States and focus on putting its second plant in Kansas into operation.

The Kansas plant is Panasonic's second-largest battery base in the U.S., with an expected investment of approximately $4 billion and a planned annual capacity of 30GWh. It was initially scheduled to begin full production in 2026. However, the latest news indicates that full production will be delayed until 2027 because Panasonic's key customer, Tesla, has seen sluggish sales of related models, prompting Panasonic to reassess its production plans.

It is worth noting that, as Japanese and Korean manufacturers have long focused on producing ternary batteries, the recent global popularity of lithium iron phosphate (LFP) batteries has forced them to adjust their product strategies. Companies such as LG Energy Solution, SK On, and Samsung SDI all hope to enter a broader market through LFP technology.

"Over the past five years, the market share of lithium iron phosphate batteries in the electric vehicle sector has increased by more than threefold. While providing a competitive range, the price of lithium iron phosphate batteries is about 30% cheaper than that of ternary lithium batteries," the International Energy Agency analysis indicates.

LG Energy Solution and its partner General Motors are reportedly upgrading their plant in Tennessee, USA, to convert the ternary production line to produce lithium iron phosphate batteries. SK On plans to mass-produce lithium iron phosphate batteries by 2026. Meanwhile, Samsung SDI has set up its first lithium iron phosphate battery production line at its plant in Ulsan, South Korea.

However, it is not easy for Japanese and Korean manufacturers to try to change their passive market position by focusing on lithium iron phosphate batteries. In this field, Chinese battery manufacturers not only have a leading technological advantage but also dominate in terms of capacity, cost, and supply chain. Moreover, Japanese and Korean manufacturers are also less efficient than Chinese manufacturers in production line expansion.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track