Luxury Car 4S Store Publicly "Targets" Departing Technicians, Hundreds of Thousands of 4S Staff Facing Difficulties and Obstacles?

As of 2024, 4,419 car dealerships have closed or been restructured, with nearly 10,000 dealerships undergoing a reshuffle over the past five years. Assuming an average of 50 employees per dealership, approximately 500,000 "4S employees" are facing significant entrepreneurial or career challenges.

AC Auto column writer Che Neihan stated that the widespread closure of stores has significantly increased the employment difficulty for "4S people." Coupled with the generally declining profitability of the 4S industry, their salaries and benefits have also experienced a significant reduction.

For many experienced "4S people," opening a repair shop has almost become the ultimate goal, whether choosing to operate independently or in partnership.

However, this group of "4S people" is encountering new obstacles on their path to entrepreneurship in the automotive aftermarket.

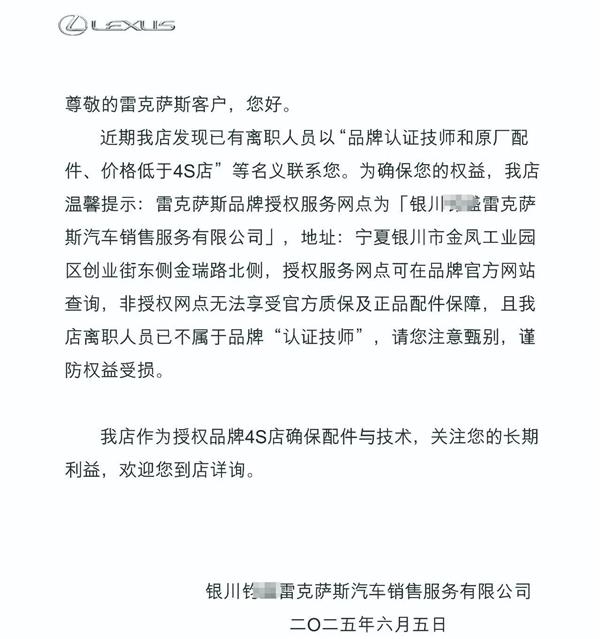

A recent announcement from a Lexus 4S dealership in Yinchuan is quite representative: the dealership reminds car owners that some former employees, claiming to be "brand-certified technicians," are soliciting business by promising to provide "genuine parts" at prices "lower than the 4S dealership."

The announcement emphasizes that, to ensure your rights and interests, car owners are advised to visit officially authorized service centers for repairs. Repairs carried out at unauthorized centers are not eligible for official warranty or genuine parts guarantees. It is also clearly stated that the relevant former employees are no longer “certified technicians” of the brand. Car owners are reminded to carefully identify service personnel to avoid compromising their rights and interests.

Whether this practice of the 4S dealership will be imitated by other dealers remains to be seen, but it is clear that the after-sales countermeasures within the 4S system are being strengthened.

Moreover, the entrepreneurial environment in the aftermarket has become increasingly complex, exhibiting a "castle" phenomenon where "those inside want to get out, and those outside want to get in," adding more variables to the transformation path for "4S personnel."

01. People from 4S shops who devote themselves to after-sales service have a really "tough" time.

In the wave of entrepreneurship in the automotive aftermarket, "4S people" have always been the main force, and many leaders among the top 100 AC automotive chains come from this background.

At that time, it was the golden period for 4S dealerships to profit from new car sales, and the aftermarket was also in a stage of rapid growth. For those "4S people" with advantages in capital, resources, or technology, leaving to start their own businesses seemed like a surefire path to success.

However, times have changed, and the current entrepreneurial environment has undergone drastic changes.

For former 4S employees who have left to pursue independent after-sales service, it has become significantly more difficult to establish themselves by specializing in a single brand.

A regional chain owner candidly stated that many 4S entrepreneurs who start their own businesses relying on technical skills or customer resources often cannot escape the "three-year curse" of specialized repair shops.

In his view, running a repair shop is a systematic project, with technology, management, customer relations, marketing systems, insurance, and government relations all being indispensable components. Technically skilled personnel may neglect management, those with customer resources may not understand refined operations, and if other key capabilities are also lacking, closure of the shop is an inevitable outcome.

Industry observer "Auto After-sales Lao Wang" deeply agrees, pointing out that it is especially difficult for service advisors to start their own businesses; seemingly escaping the den of wolves, they in fact step into a tiger's lair.

First, without a technical team and brand endorsement, entrepreneurs become the first line of defense facing customers directly; if the quality of repairs fails to meet standards, customer trust collapses instantly. Second, there is a lack of effective channels for continuously acquiring new customers. Finally, business management is far more complex than simply repairing cars.

"Opening a repair shop is by no means a safe haven, but rather an even harsher battleground," he concluded.

Facing numerous challenges, industry experts suggest that a feasible way for "4S personnel" to increase their entrepreneurial success rate is for core roles such as technical managers, maintenance technicians, and service advisors to pool their resources to open a shop, achieving complementary capabilities.

A typical case is that, due to management issues at Henan Guanghui’s 4S dealership, the after-sales manager led a team of more than 30 people to start their own business. Relying on their accumulated base of over ten thousand customers, they now operate a comprehensive repair shop covering more than a thousand square meters, supplemented by luxury car modification services. So far, they have achieved remarkable results.

A very practical issue is that, as the “brand certification” halo fades, “4S personnel” must re-establish their value in the independent aftermarket.

In other words, aside from price advantages, effectively building customer trust—particularly in terms of repair quality, authenticity of parts, and reliability of service—has become the most critical challenge for establishing a foothold in the "besieged city."

The Ordeal and Struggle of the "4S People" Left Behind

For those working within the traditional 4S system, even if they choose to "stay," they still find themselves in a state of torment.

A survey on the career prospects of staff in automotive dealerships shows that 38% hope to continue developing and become experts in their positions; 36% are considering changing careers; 29.9% plan to shift towards the new energy sector; and 24% prefer to start their own businesses.

The image is from "The Matters of After-Sales Service"

At first glance, this set of data appears to offer a variety of choices, but in reality, it reflects the common confusion and lack of clear direction among practitioners in the face of drastic industry changes.

The daily experience of dedicated "4S staff" is often summarized as "low pay, heavy workload, and intense competition."

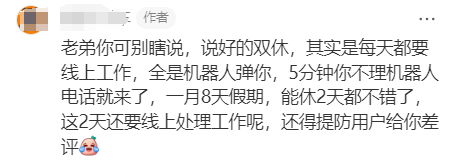

A service consultant's self-narration on social media has resonated widely: nominally having two days off per week is encroached upon by online work; relentless phone calls demanding responses within five minutes and robot reminders are unending; having only eight days off per month, with just two days actually restful, is already a luxury; and even during time off, work must still be handled, all while constantly worrying about negative user reviews.

However, even more suffocating than working under high pressure is helplessly watching the 4S dealership fade into twilight, ultimately having to face the harsh reality of salary cuts, wage arrears, and being forced to fight for their rights.

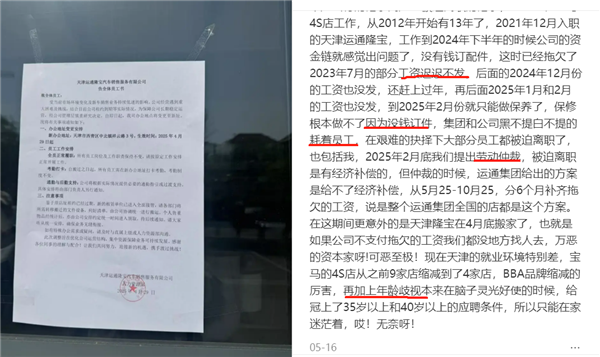

The experience of an employee at the Tianjin Yuntong BMW 4S dealership is highly representative: having joined in 2021, partial salary delays began in 2023, and by 2024, the company's financial issues became apparent. By February 2025, the after-sales service could only perform basic maintenance, and accident repairs were halted due to an inability to order parts. The company continued to delay salary payments, forcing employees who couldn't endure it anymore to resign and apply for labor arbitration. However, the group was unable to pay economic compensation, and the overdue wages could only be promised to be paid in installments.

The employee helplessly pointed out that the employment environment in Tianjin has deteriorated, with the number of BMW 4S dealerships shrinking from nine to four. The overall contraction among luxury brands has been severe, and the widespread age limits of 35 or 40 in recruitment have left unemployed middle-aged workers in a predicament where they can only stay at home feeling lost.

Similar tragedies also unfolded after the closure of the Beijing Xingdebao BMW 4S dealership. Former after-sales employees revealed that most staff had been owed wages from August to October 2024. When the company proposed signing the "Labor Contract Termination Agreement," some employees refused and instead sought labor arbitration. Although the August wages were eventually settled, the wages for September and October, as well as the due compensation, remain unaccounted for.

The torment and struggle are the true portrayal of the "4S people" who stay. They are both waiting for the industry to bottom out and rebound, and paying the cost of transformation with their career golden period.

03. "Cake shrinkage" has become a challenge for all practitioners.

The "statement" issued by the Lexus 4S dealership regarding a departing employee reflects the deep-seated anxiety within the dealership network amid the drastic changes in the current automotive market.

As profits from new car sales continue to shrink, after-sales service should have been the "ballast" for 4S dealerships' survival. However, the loss of after-sales customers is no longer an occasional fluctuation, but a structural turning point in the trend.

First, car owner behavior and consumption patterns have changed significantly.

The F6 Data Institute predicts that by 2025, the average mileage of car owners will continue its downward trend, falling below 10,000 kilometers, directly leading to a decrease in the frequency of visits to shops.

At the same time, economic pressures have made car owners more cautious in their spending, with even high-end car users (vehicles priced above 300,000 yuan) significantly tightening their maintenance and repair expenses.

In addition, as the average vehicle age increases, a large number of out-of-warranty car owners become significantly more price-sensitive. The combination of "genuine parts + high labor costs" at 4S dealerships is generally 30%-60% more expensive than independent after-sales services, and even high-end car owners are increasingly valuing cost-effectiveness.

Secondly, the rapid popularization of new energy vehicles has formed a dual impact on the traditional after-sales model.

On one hand, new energy vehicles have replaced part of the mileage previously covered by fuel vehicles, directly reducing the maintenance demand for the latter. On the other hand, a large number of new energy vehicles are still under warranty, and their after-sales service volume is already smaller than that of fuel vehicles, while being firmly locked within the OEM-authorized system, making it difficult for traditional 4S dealerships to get a share.

Finally, the consecutive closures of luxury brand 4S stores have caused negative chain effects.

This year, several luxury car dealerships have suddenly collapsed, and the after-sales disputes left behind have been exposed by the media, seriously undermining car owners’ trust in the 4S system and making it much more difficult to retain existing customers.

Notably, the aforementioned five major factors impact the entire automotive aftermarket ecosystem. Data shows that in the first half of the year, both the number of vehicles serviced and the output value at repair shops declined, reflecting an overall contraction in maintenance demand.

This means that whether one chooses to stay within the 4S system or venture into independent after-sales entrepreneurship as a "4S person," the fundamental dilemma faced is converging—the entire market share is shrinking. Both sides will inevitably engage in more intense competition for existing customers, falling into a "zero-sum game."

For the "4S people" involved, regardless of which path they choose, the challenges are more daunting than ever before.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track