Li Bin's Three Rules: NIO Launches Profit Offensive

NIO has launched a comprehensive effort to achieve profitability, aiming for the fourth quarter of 2025. At an internal meeting, Li Bin proposed three measures akin to a three-point covenant: "selling more cars, ensuring supply chain stability, reducing costs while enhancing software experience." These can also be seen as NIO's action plan for achieving profitability.

At an internal meeting of NIO held on October 17, Li Bin stated that the profit target for the fourth quarter must be achieved and set profit as the first item in the fourth quarter's personal VAU (Vision Action Upgrade, NIO's target management system). Li Bin further emphasized that achieving profitability in the fourth quarter is the entire team's answer sheet that must demonstrate operational efficiency and business capability.

In order to promote profitability in the fourth quarter, Li Bin proposed three specific measures similar to the "Three Chapters": first, focus on marketing key models; second, ensure supply chain stability and cost reduction; third, deliver high-quality software versions on time.

In simple terms, the three specific measures aim to boost sales performance, thereby diluting costs and crossing the breakeven point. Previously, William Li stated that the minimum standard for NIO to achieve profitability in the fourth quarter is to sell 50,000 vehicles per month, with a vehicle gross margin of 17-18%, sales and management expenses controlled at around 10%, and R&D expenses controlled at 6-7%.

In fact, NIO has not given a specific timeline for profitability for the first time. As early as the 2021 financial report conference call, Li Bin set a goal of achieving break-even in the fourth quarter of 2023 and profitability in 2024. During the third quarter 2024 financial report conference call, the profitability timeline was postponed to 2026. In March this year, Li Bin moved the profitability timeline forward to the fourth quarter of 2025.

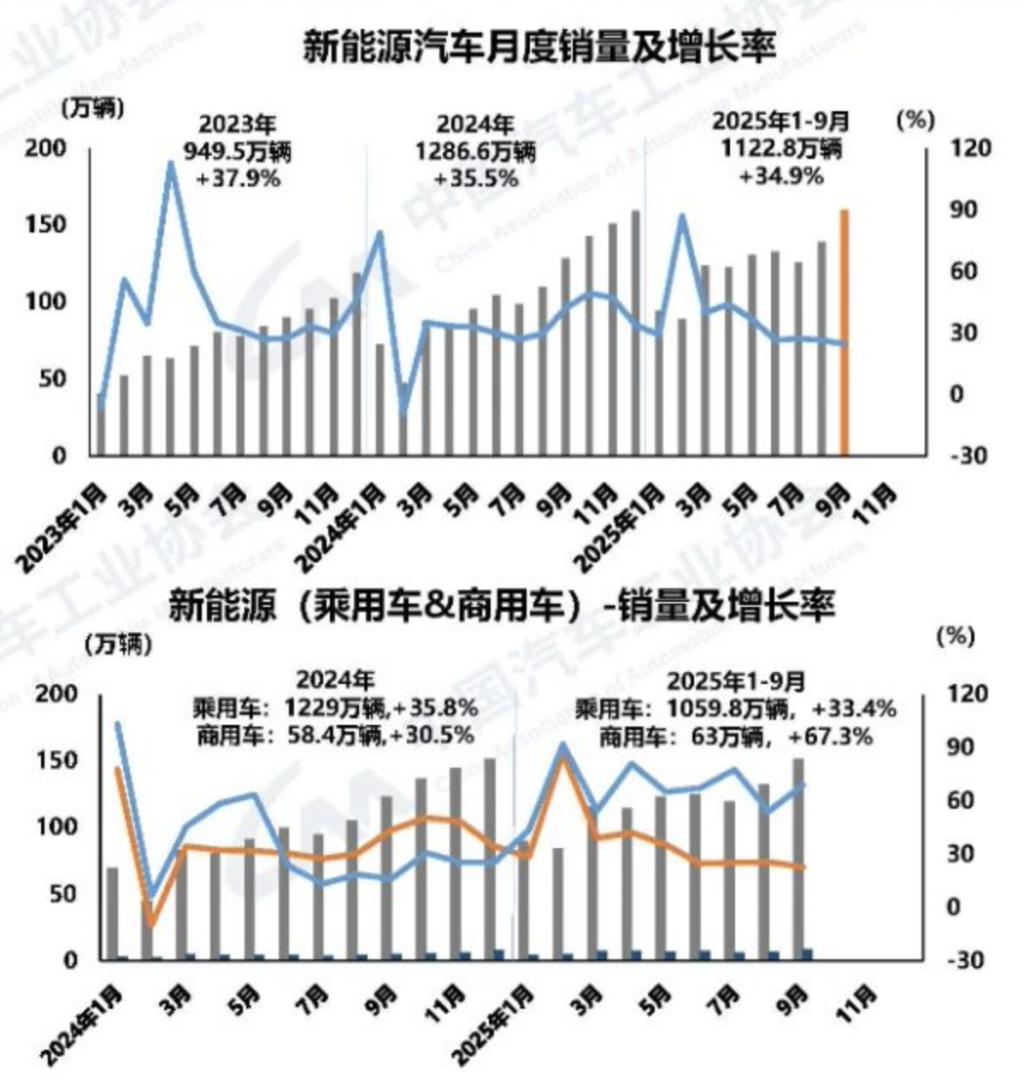

This time, mentioning the profitability in the fourth quarter again might be the easiest quarter for NIO Inc. to achieve. From the market trend perspective, both production and sales of new energy vehicles in September reached record highs, with production and sales completing 1.617 million units and 1.604 million units respectively, representing a year-on-year increase of 23.7% and 24.6%. Meanwhile, under the influence of the phased-out policy of new energy vehicle purchase tax reductions, the year-end surge in the new energy vehicle market may become more pronounced.

NIO's market performance is on the rise. The Leidao L90, which was launched in August, continues to sell well, achieving sales of 10,600 units in its first month, making it the fastest model in NIO's history to reach over 10,000 units sold. The new generation ES8, launched in September, has also shown positive market feedback. William Li has stated that the market response to the new generation ES8 has exceeded expectations, and the company is ramping up production capacity to meet demand.

The hot sales of the high-profit models L90 and the new generation ES8 have ensured an increase in NIO's gross margin. NIO's CFO Qu Yu stated during the second quarter 2025 earnings call that the accumulation of technology, self-research and procurement of key components, and cost control have enabled NIO to not only enhance competitiveness with models like the L90 and ES8 but also achieve systematic and comprehensive cost reductions. By the fourth quarter of this year, the gross margin target for the L90 and ES8 is 20%.

At the same time, the strong sales of the LeDao L90 and the new generation ES8 also present a "sweet burden" in terms of production capacity and delivery. According to the plan, in the fourth quarter, the monthly production capacity for the LeDao and NIO brands will reach 25,000 vehicles, with the Firefly having a monthly capacity of 6,000 vehicles, and priority will be given to ensuring the production capacity of the new generation NIO ES8 and LeDao L90. The production capacity planning not only meets the demand for these two products but also lays the foundation for the goal of 50,000 units sold per month.

Additionally, from the perspective of performance indicators, NIO's profit losses in the first two quarters of this year have shown a narrowing trend. NIO's net loss for the second quarter of 2025 was RMB 4.9948 billion, representing a year-on-year decrease of 1.0% compared to the second quarter of 2024 and a quarter-on-quarter decrease of 26.0% compared to the first quarter of 2025. Excluding organizational optimization costs, NIO's non-GAAP operating loss narrowed by more than 30% quarter-on-quarter.

Car companies aiming to achieve profitability in the fourth quarter are not limited to NIO. Earlier this year, Xiaopeng Motors Chairman He Xiaopeng repeatedly expressed confidence in achieving profitability in the fourth quarter. Xiaomi Auto has also reached a crucial point for turning losses into profits; in the second quarter of 2025, Xiaomi Group's automotive business significantly narrowed its losses to 300 million yuan and is expected to achieve profitability in the third or fourth quarter.

Profit has always been regarded as one of the core indicators for new car manufacturers to stay afloat. Delivering quarterly profit results not only demonstrates that a company has self-sustaining capabilities and can remain in the competitive arena, but also proves its investment value to the capital market. When mainstream new car manufacturers cross the profit line, it undoubtedly secures their ticket for the upcoming market competition.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track