Largest in China! Supplier to Wanhua Chemical and Meirui New Material Pursues IPO

Recently, Hunan Juren New Materials Co., Ltd. (Juren New Materials) received acceptance for its IPO on the Beijing Stock Exchange.

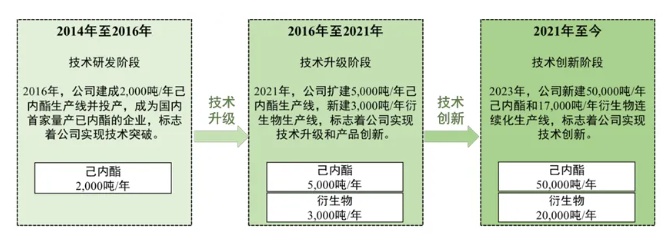

Juren New Materials was established in 2014, headquartered in the Green Chemical Industry Park of Yueyang, Hunan Province, focusing on the research and production of ε-caprolactone (ε-CL) and its derivatives. The company's core technological breakthrough began in 2016—under foreign technology embargoes, it independently built the country's first domestic thousand-ton-scale industrial ε-caprolactone production facility, breaking the monopoly held by Europe and the United States. Since then, the company has continuously upgraded its technology. In 2021, it achieved mass production of polycaprolactone (PCL) biodegradable materials, and in 2023, it put into operation the world's largest single 50,000-ton-per-year green biodegradable material production line. The product performance is comparable to international giants BASF and Eastman.

As of 2025, the company owns 34 patents (including 28 invention patents), has established a full-chain technology transformation system from basic research to pilot incubation to industrialization, and has obtained international certifications such as EU REACH and Korea K-REACH. It has entered the international supply chain systems of BASF, BYK, Lubrizol, and Covestro. Its independently developed large-scale continuous production line reduces production costs by more than 20%. The company has been recognized as a national-level "Little Giant" specialized and innovative enterprise and a national high-tech enterprise.

In addition, its research and development team has jointly established a national-local joint laboratory for environmentally friendly polymer materials with Sichuan University, focusing on the pilot production base for caprolactone and its derivatives. It has also collaborated with higher education institutions such as Wuhan University of Technology, Hunan Normal University, and Xiangtan University to build an industry-university-research cooperation ecosystem.

Market share remains firmly ranked first domestically

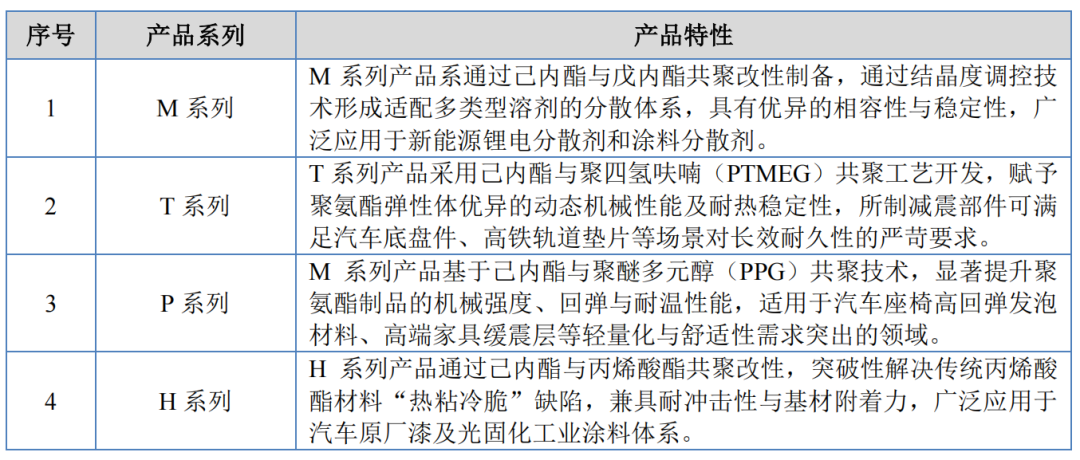

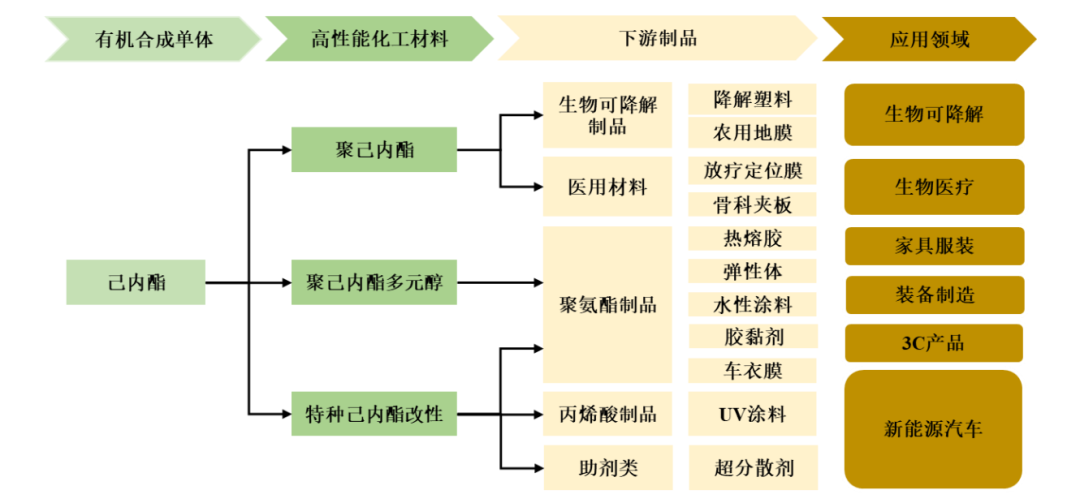

Juren New Materials’ products cover two major categories: caprolactone and its derivatives. The company has established three major derivative systems: polycaprolactone, polycaprolactone polyols (PCL polyols), and specialty caprolactone-modified materials. Four specialized product lines have been developed: dispersants (M series), elastomers (T series), foaming materials (P series), and coating substrates (H series). These products can be applied in fields such as polyurethane products, acrylic products, biodegradable products, medical materials, and additives.

Especially in the field of medical materials, polycaprolactone, due to its low melting point plasticity, shape memory function, and biocompatibility, can be used in medical devices and auxiliary materials such as tumor radiotherapy positioning membranes, coronary stents, orthopedic implant consumables, drug delivery carriers, soft tissue sutures for bone connection, and facial fillers. China's 14th Five-Year Plan proposes to focus on the development of fully degradable vascular stents and other high-value medical devices, and the application of biodegradable plastics in the medical field is expected to further expand in the future.

According to data from the China Petroleum and Chemical Industry Federation, Juren New Material's domestic market share increased from 35.19% in 2022 to 37.21% in 2023, firmly maintaining its position as the largest supplier of caprolactone series products in China.

Explosive growth in performance over the past three years

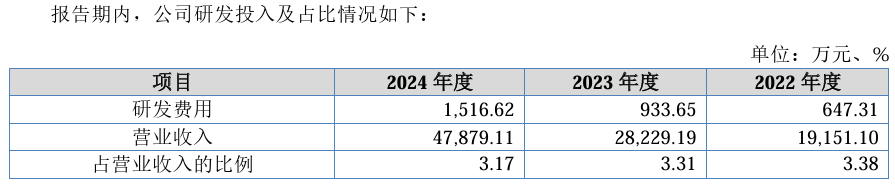

The prospectus shows that Juren New Materials has experienced explosive growth in performance over the past three years.

This growth is attributed to the surge in demand from downstream sectors such as new energy vehicles and biodegradable materials. For instance, its polycaprolactone polyol (PCL polyol) is used in lightweight components for new energy vehicles, with related revenue expected to increase by 120% year-on-year in 2024. Meanwhile, polycaprolactone (PCL), driven by the "plastic ban," has seen its sales double in the biodegradable packaging sector.

In the first quarter of 2025, the company achieved an operating income of 153 million yuan, a year-on-year increase of 58.58%; the net profit attributable to the parent company was 29.7845 million yuan, a year-on-year increase of 45.29%, mainly due to the growth in sales volume of the company's main products, caprolactone and caprolactone derivatives.

The main business operations of Juren New Materials are as follows:

Global Deployment

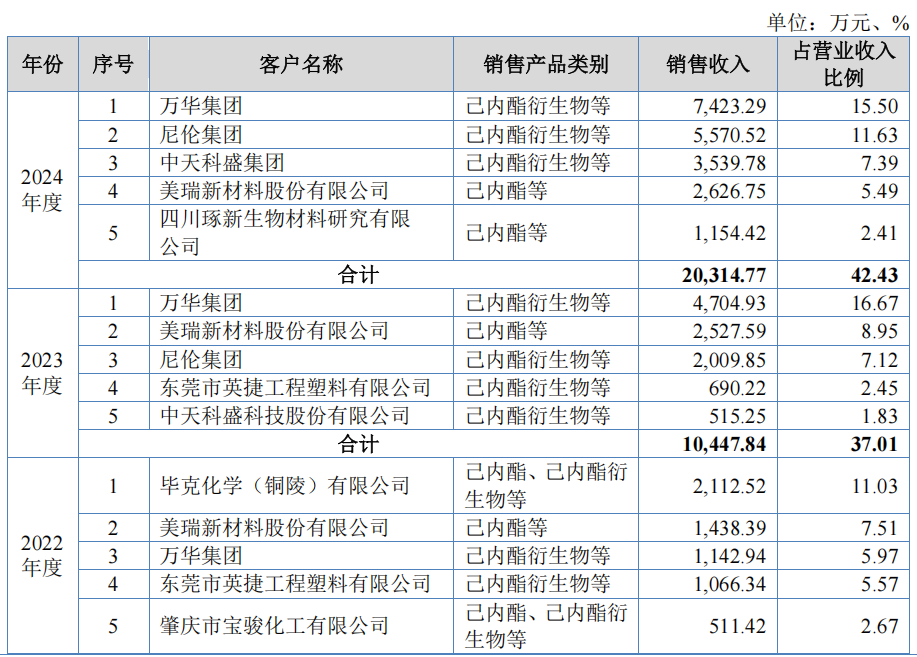

==== New Material has established deep cooperation with industry leading companies such as Wanhua Chemical, Meirui New Material, Nilon Chemical, and Zhongtian Kesheng. Additionally, it is actively expanding collaborative synergies with domestic industry giants like BYD and Hisun Biomaterials in the upstream and downstream of the supply chain. The sales to the top five customers accounted for 42.43% before 2024.

Top five customers from 2022 to 2024:

The funds raised from this IPO will be primarily invested in two areas: first, 235 million RMB will be invested in constructing a 40,000-ton smart factory for specialty polycaprolactone, focusing on high-end medical-grade and electronic-grade products, with an expected annual revenue increase of 2 billion RMB upon reaching full production capacity; second, 27 million RMB will be invested in upgrading the R&D center to tackle bio-based caprolactone and CO₂-based degradable materials, in response to the "dual carbon" policy. Additionally, 30 million RMB will be used to supplement working capital, optimize cash flow, ensure raw material procurement, and expand market development.

What is the market situation of caprolactone?

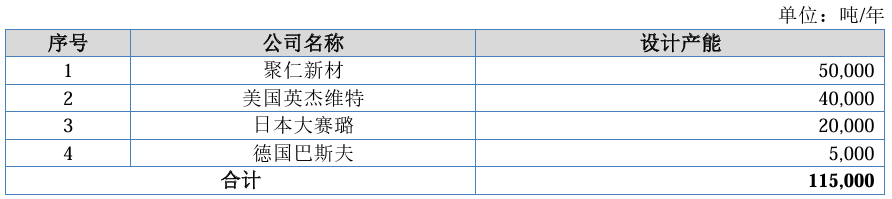

In terms of production capacity, the global total capacity of caprolactone is approximately 115,000 tons per year. Major enterprises with large-scale production include Jurong New Material (50,000 tons/year), Invista (40,000 tons/year) in the United States, Daicel (20,000 tons/year) in Japan, and BASF (5,000 tons/year) in Germany.

From the demand side, the domestic caprolactone market size is approximately 1.5 billion yuan, with an annual growth rate of over 10%, primarily driven by new energy vehicles and biodegradable materials.

Despite significant advantages, multiple challenges still need to be addressed: concerns about raw material fluctuations and overcapacity.

The prices of cyclohexanone and hydrogen peroxide are greatly influenced by the oil market, resulting in a 14.77 percentage point decrease in gross profit margin in 2024.

Some domestic companies are actively advancing the layout of the caprolactone-related industry: Hubei Wangjiang New Materials has received environmental assessment approval for its project to produce 50,000 tons of caprolactone monomer, 50,000 tons of polycaprolactone polyol, and 10,000 tons of polycaprolactone annually; Sinopec Hunan Petrochemical has released the first public information regarding the environmental impact assessment of its 10,000-ton/year caprolactone industrial demonstration unit; Anhui Tiger Vitamin Industrial Co., Ltd. has issued the first public notice for environmental impact assessment for its 100,000-ton/year caprolactone project (Phase I, 15,000 tons/year); Weibojie Biomaterials (Zhejiang) Co., Ltd. has announced the environmental impact assessment for its production base project with an annual output of 30,000 tons of caprolactone and polycaprolactone.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track