Joint Ventures: Holding the 35% Market Share Red Line?

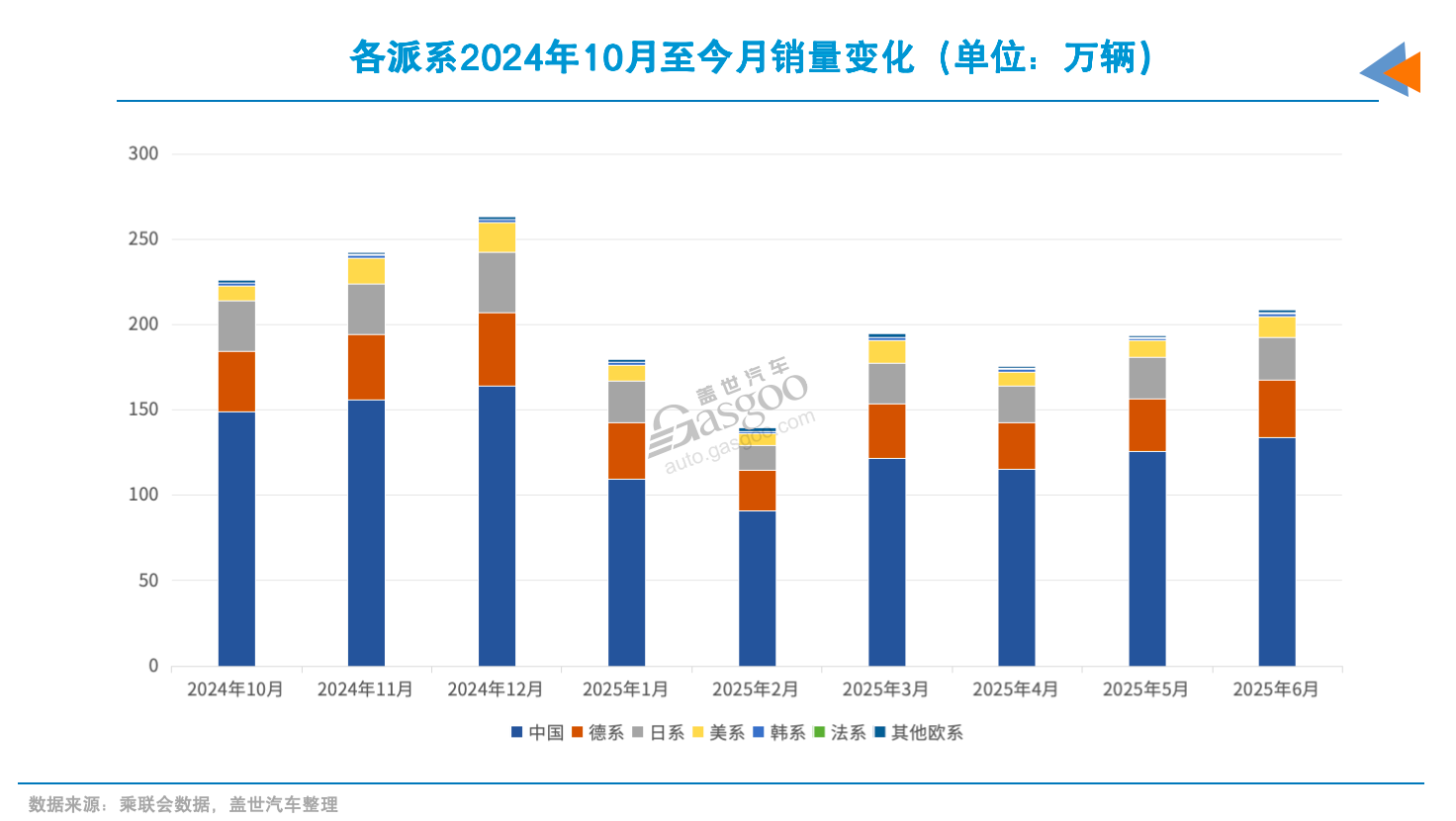

Recently, an opinion has emerged in the industry that "joint venture car companies are entering a significant turning point." This judgment is not unfounded. Since October 2024, the market share of joint venture brands in the domestic market has stopped declining and started to rebound, remaining roughly stable at around 36% in the first half of this year.

For a joint venture brand that has experienced a continuous decline in market share for five years, this is undoubtedly like a shot in the arm. Many industry insiders optimistically believe that the counterattack strategy of joint venture car companies may have already taken effect. Is this really the case, or is it just a temporary phenomenon amid market fluctuations?

The market share has temporarily stopped declining.

The past five years have been a period of intense changes in China's automobile industry, during which the market share of joint venture brands has fallen sharply from a high level, almost halving.

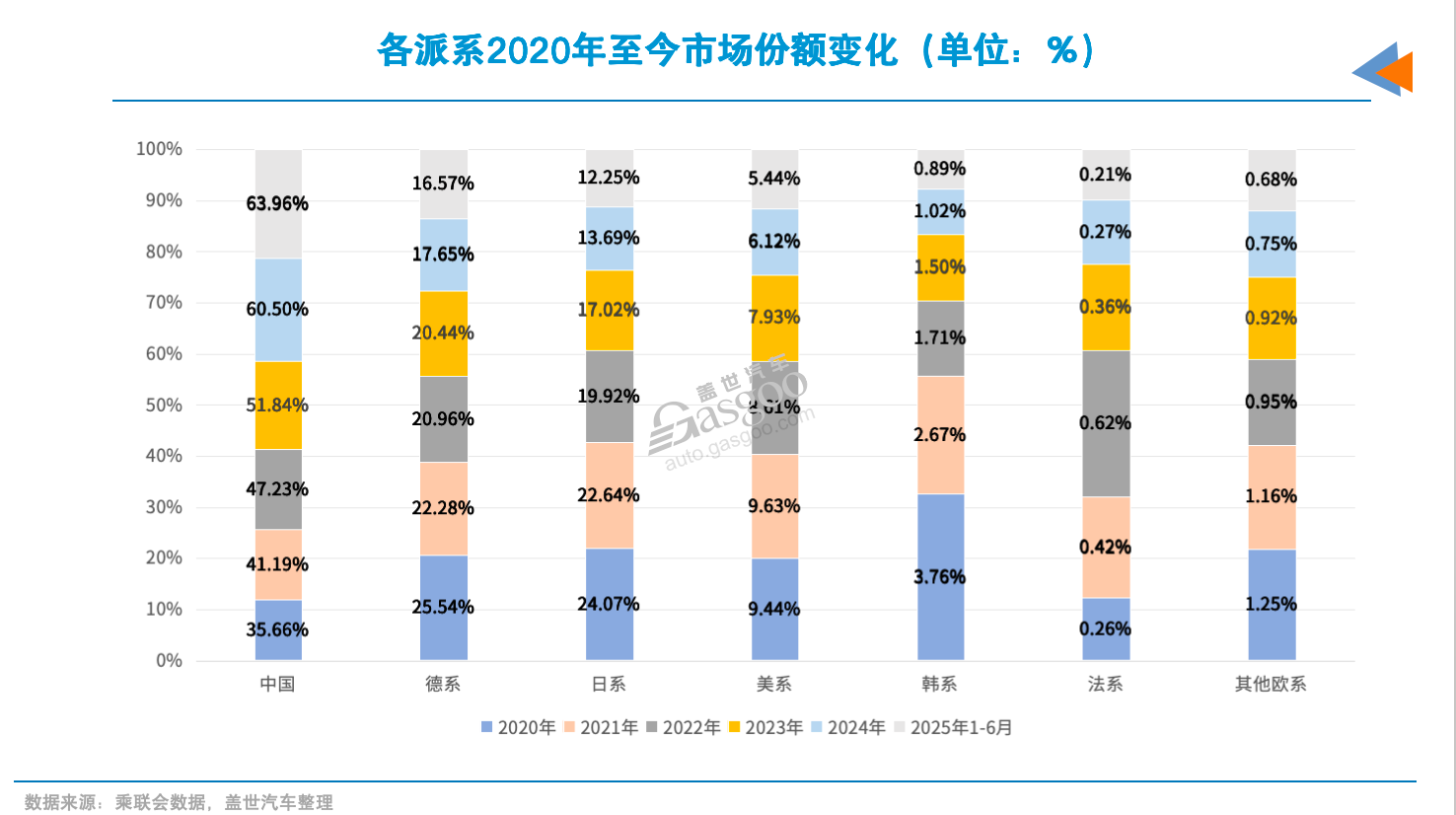

In 2020, joint venture brands still dominated the Chinese passenger car market with a market share of 64%, achieving annual sales of 12.4 million units. German and Japanese brands provided market support, accounting for 25.5% and 24% respectively, with annual sales each exceeding 4.6 million units. American brands held about a 10% share, with annual sales surpassing 1.8 million units. Korean brands also maintained sales at around 700,000 units, not yet completely collapsing.

Mainstream joint venture companies such as Volkswagen, Toyota, Honda, and Nissan have maintained high consumer trust through years of accumulated brand recognition, well-established sales channels, and relatively stable product quality, consistently ranking at the top of sales charts. In 2020, according to multiple TOP15 lists released by the China Passenger Car Association, including manufacturer retail sales, sedan market segments, and SUV market segments, joint venture brands dominated. Especially in the sedan segment, joint venture models occupied 13 spots and swept the top five positions.

However, the market landscape has changed dramatically in a short period of time. With the penetration rate of new energy passenger vehicles rapidly increasing from 5.7% in 2020 to 47.6% in 2024, independent brands such as BYD, Geely, Changan, and Leapmotor seized the opportunity to erode the market share of joint venture brands in the traditional fuel vehicle sector.

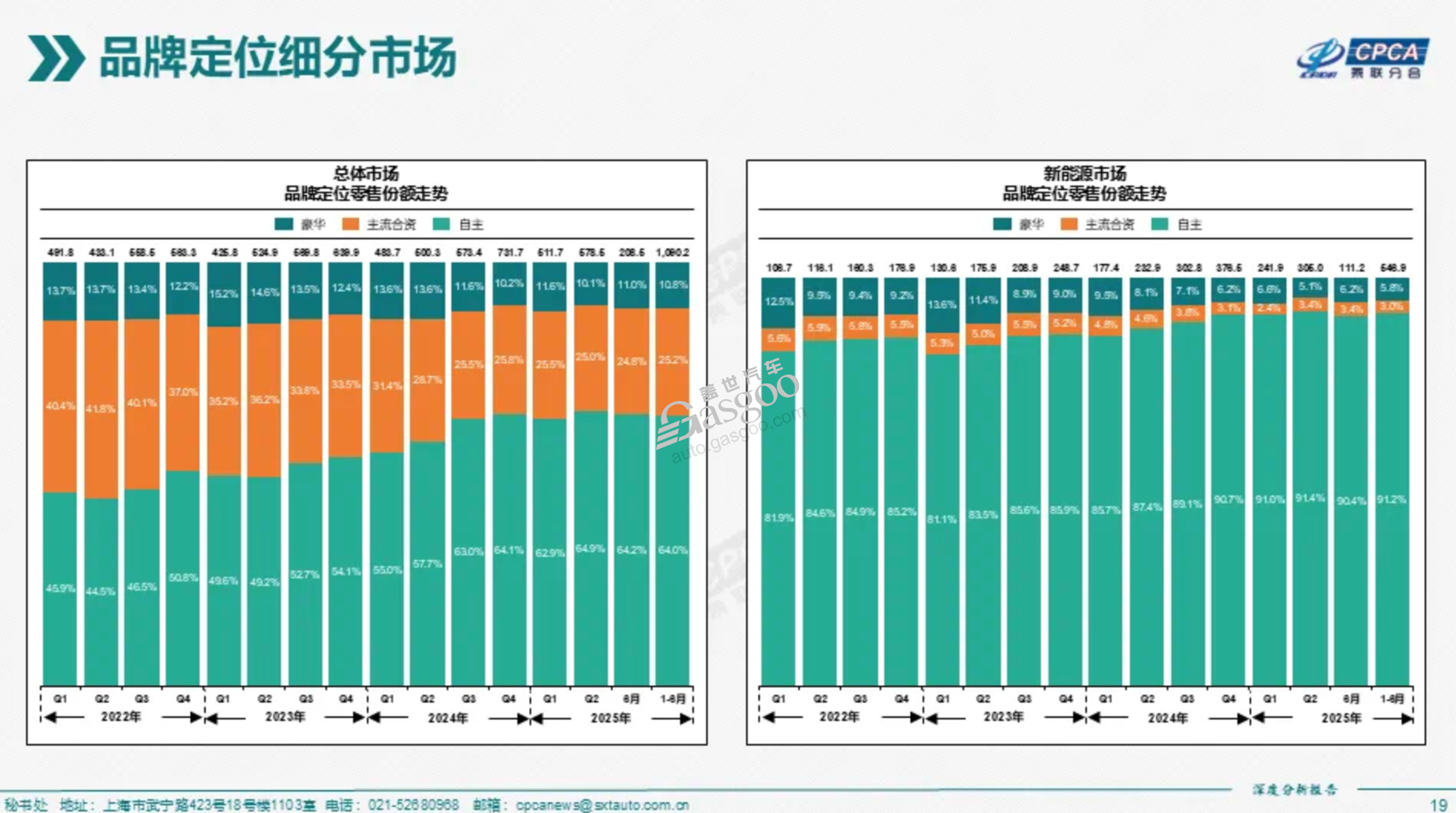

In the new energy vehicle market, the market share of domestic brands has increased from 74.6% in 2020 to 88.7% in 2024, and further surpassed 90% in the first half of this year. In contrast, mainstream joint-venture brands sold only 425,000 new energy vehicles in 2024, accounting for less than 5% of the market share.

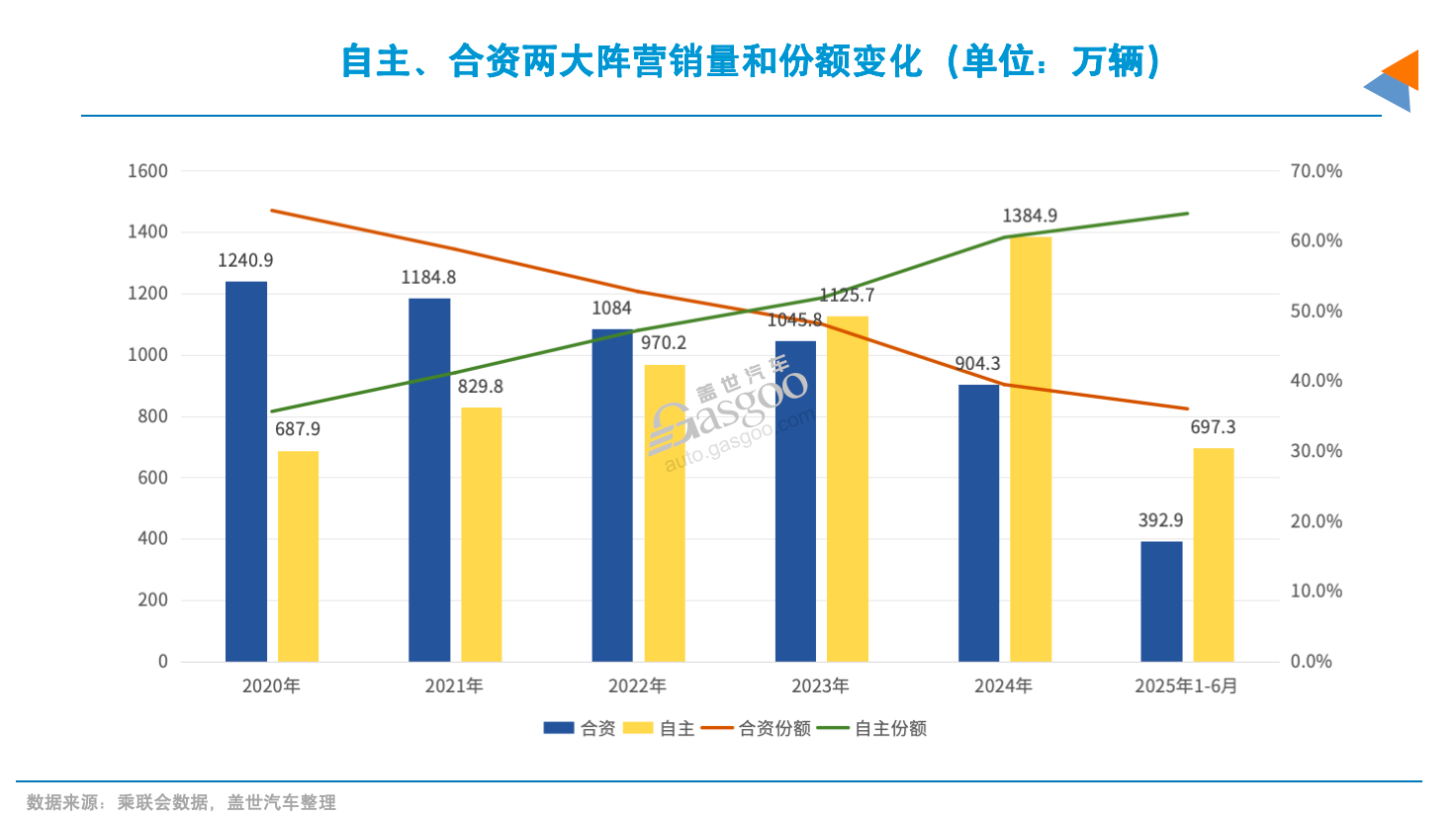

Riding the expansion wave of the new energy passenger vehicle market, from 2020 to 2024, the overall sales of independent brands increased from 6.88 million units to 13.85 million units, with an average annual increase of about 1.74 million units. In the first half of this year, independent brands still maintained a 26% year-on-year growth rate, with sales reaching 6.97 million units. The overall market share nearly doubled in five years, rising from 35.7% in 2020 to 64% in the first half of 2025.

Due to missing the early development dividends of the new energy market, the sales of joint venture brands will have dropped to 9.04 million units by 2024, which is about 3.4 million units less than four years ago, and their market share will have fallen below 40% to 39%.

Specifically, in just four years, the market shares of the German and Japanese car factions have decreased by 8 percentage points and 10 percentage points, respectively. The overall sales of German cars have decreased by approximately 900,000 units, while Japanese cars have decreased by about 1.5 million units. The market share of American brands has fallen to 6%, and both Korean and French brands have only about a 1% share remaining.

In 2024, the monthly market share of joint venture brands even dropped below the 35% threshold at one point. It was not until October of that year that their share gradually rebounded from 34% to 37% in December. Entering 2025, the overall market share of joint venture brands remained at around 36% in the first half of the year.

The stabilization of joint venture brands' market share reflects the effectiveness of their adjustments in market strategies, particularly in maintaining their presence in the fuel vehicle market and in the deployment of intelligent electrification products. Although the overall new energy penetration rate of joint venture brands continues to decline, certain models have demonstrated market potential. For example, products such as the Dongfeng Nissan N7, Volkswagen ID. series, and Toyota bZ series have achieved relatively good market performance.

From the overall market perspective, the joint venture market share maintaining the 35% threshold is not merely a simple shift in sales volume, but rather a buffering balance between the stock of fuel vehicles and the growth of new energy vehicles.

Maintaining the market share relies on the leading segment.

Analysis of sales data shows that the recent stabilization in sales within the joint venture sector is driven by a few leading companies.

In the intense market competition in recent years, significant differentiation has occurred within the major traditional factions such as German, Japanese, and American brands. Ultimately, what truly supports the overall performance of joint venture brands are those representative automakers with complete product lineups, deep localization transformation, and flexible marketing strategies.

German brands demonstrate strong market stability among various factions. Data shows that in the first half of 2025, German brand sales reached 1.807 million units, accounting for 46% of the joint venture camp. Although the market share of German brands has dropped to 16.6%, they still firmly hold the top position in the joint venture camp.

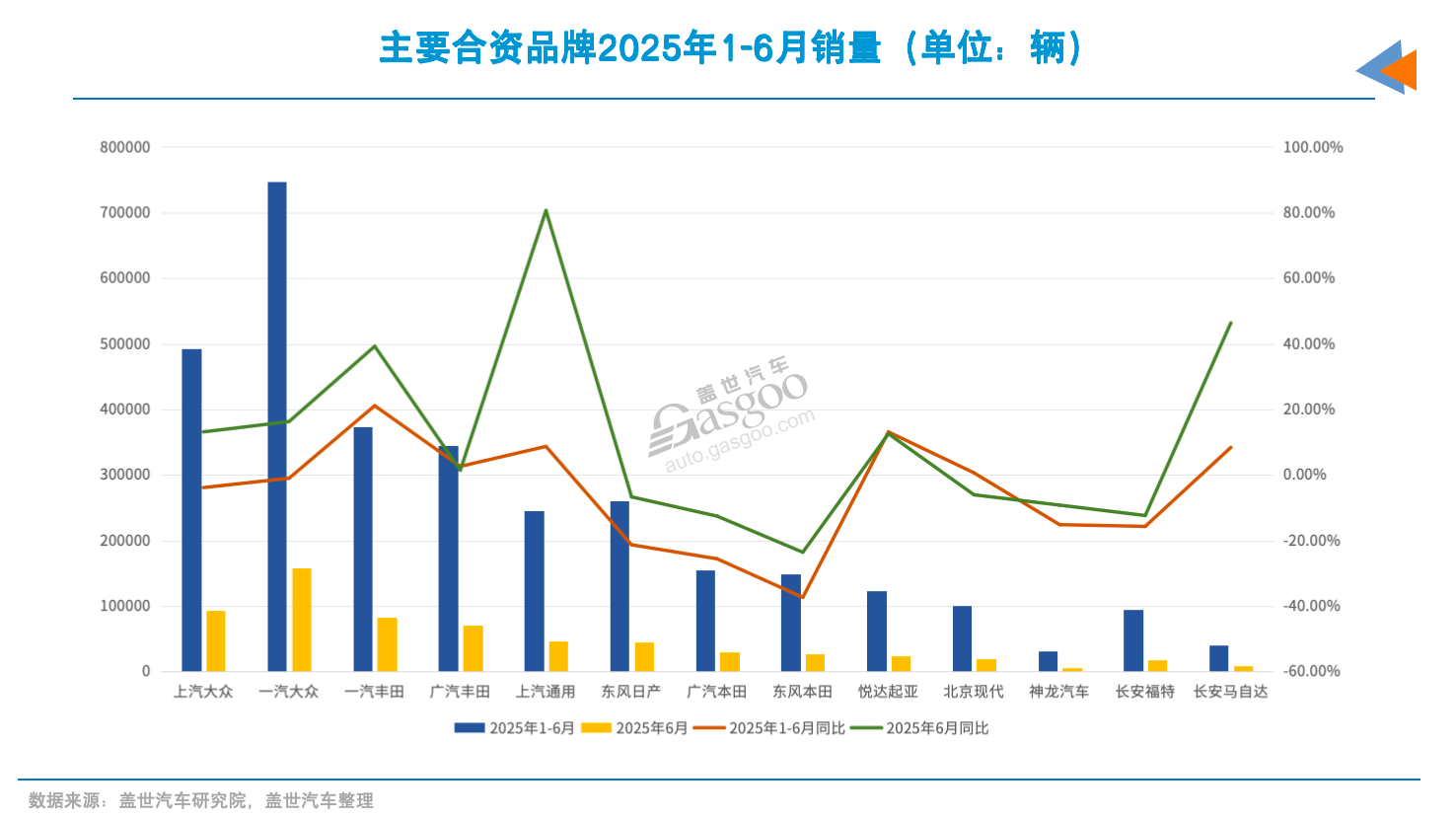

SAIC Volkswagen and FAW-Volkswagen are the core pillars of the German brands, with combined sales of 1.239 million units in the first half of the year. They contributed about 70% to the German brands and accounted for 30% of the total joint venture sales.

In the first half of the year, SAIC Volkswagen's sales reached 492,000 units, with the decline narrowing to 3.9%; FAW-Volkswagen's sales for the same period were 746,000 units, with the year-on-year decline narrowing to 1%. Notably, in June, both "Southern and Northern Volkswagen" achieved double-digit positive growth in sales, overcoming the downturn.

Classic models such as Tiguan, Lavida, Sagitar, and Magotan continued to sell well in the first half of the year, each reaching a scale of 100,000 units, which effectively solidified the foundation of Volkswagen's fuel vehicle lineup. Meanwhile, new energy models like the Volkswagen ID. series have gradually gained market recognition, with combined sales exceeding 40,000 units in the first half of the year.

The success of SAIC Volkswagen and FAW-Volkswagen stems from the effective implementation of the "oil and electric intelligence" strategy. While accelerating the launch of new energy products, they have significantly enhanced the intelligent experience of fuel-powered vehicles through in-depth cooperation with domestic technology companies. Fuel models such as the Teramont Pro and Talagon are now equipped with L2+ level assisted driving systems, which, to a certain extent, has delayed user attrition.

Among American brands, SAIC-GM achieved a year-on-year sales growth of 8.6% in the first half of the year, reaching 245,000 units. In June alone, sales surged by 80.6% to 47,000 units.

Some automotive analysts believe that the significant inventory reduction strategy implemented last year has laid the foundation for the sales rebound this year. At the same time, through intelligent upgrades and a "one-price" strategy, SAIC-GM has enhanced the market competitiveness of mid-size and larger models. For example, the 2025 Buick Envision Plus offers a "one-price" discount of up to 60,000 yuan, driving monthly sales to a record high of 20,000 units. Throughout the first half of the year, sales of the Envision series increased by 200%.

In contrast, Tesla's performance in the Chinese market has noticeably declined, with sales reaching 364,000 vehicles in the first half of 2025, a year-on-year decrease of 14.6%. The decline in its market share is closely related to multiple factors, including frequent price adjustments, the absence of new models, and the accelerated development of domestic competing brands.

Japanese brands also show a clear differentiation trend. Toyota's performance is relatively stable, with FAW Toyota and GAC Toyota having sales of 374,000 and 345,000 vehicles in the first half of the year, representing year-on-year growth of 21.1% and 2.6%, respectively. Among them, FAW Toyota's year-on-year growth rate in June reached as high as 39.2%, returning to the level of 80,000 vehicles.

Like SAIC-GM, Toyota has also benefited from the "one-price" strategy, maintaining its competitiveness in the fuel vehicle market. At the same time, the gradual release of localized R&D achievements has provided important support for its electrification transformation.

For example, the Leahead iA5, launched by GAC Toyota as a new energy model developed primarily by Chinese engineers, has received over 30,000 orders since its launch, with more than 6,000 units delivered in June alone. Some believe that the local chief engineer system established by GAC Toyota has improved product development efficiency and market compatibility.

Dongfeng Nissan's market performance was also relatively positive, with sales of 49,000 units in June and the decline significantly narrowing to 6.7%, thus escaping a double-digit drop.

In the new energy sector, Dongfeng Nissan has also made breakthroughs. Its N7 pure electric model, launched in the first half of the year, has achieved cumulative deliveries of over 10,000 units since mid-May, thanks to its starting price of 119,900 yuan and intelligent features. The model was developed primarily by a local Chinese team, with product definition and software optimization tailored to local user scenarios, reflecting the initial results of Nissan's adjustments to its R&D mechanism in the Chinese market.

However, another Japanese brand, Honda, experienced a more pronounced decline. In the first half of 2025, GAC Honda fell by 12.6%, while Dongfeng Honda dropped by 23.6%. The main issue lies in the impact from competing domestic new energy vehicles, with key models such as Accord and Civic failing to defend their position in the fuel vehicle market.

At the same time, the launch pace and pricing strategy of new energy models have not yet achieved scale effects. For example, when Dongfeng Honda S7 was launched, its pricing was too high, and although the price was significantly reduced later, it still failed to effectively boost sales; GAC Honda P7 also showed poor sales performance in the early stages of its launch. Clearly, Honda has not yet established a clear and stable product architecture in its electrification transition, nor has it formed a product path that is highly aligned with the technological development trends of the domestic market.

Leading brands such as Volkswagen and Toyota have been able to maintain relatively stable market performance mainly due to two key factors: the introduction of intelligent and electrified products entering the market validation phase and beginning to generate sales support; and the timely adjustment of marketing and pricing strategies, which has effectively alleviated pressure on end channels.

According to analysis by Gasgoo Auto Research Institute, brands such as SAIC Volkswagen, FAW Toyota, and SAIC-GM generally adopted the "one-price" model after 2024, which has had a significant stabilizing effect on sales. For example, after the "one-price" discount for SAIC Volkswagen Tharu, its monthly sales approached 20,000 units, setting a new historical record.

At a time when the transition to electrification is still in the adaptation stage, the recovery of market share has secured a strategic adjustment window for joint venture brands, providing a certain guarantee for their subsequent in-depth transformation.

Second-tier automakers explore new paths for survival

While mainstream joint venture brands consolidate their market positions, some second-tier joint venture automakers have begun exploring new survival paths by expanding export operations to seek growth opportunities. This strategic shift is a pragmatic response to the intensely competitive domestic market and the continuous pressure of shrinking market shares. From an outcome-oriented perspective, it is beneficial.

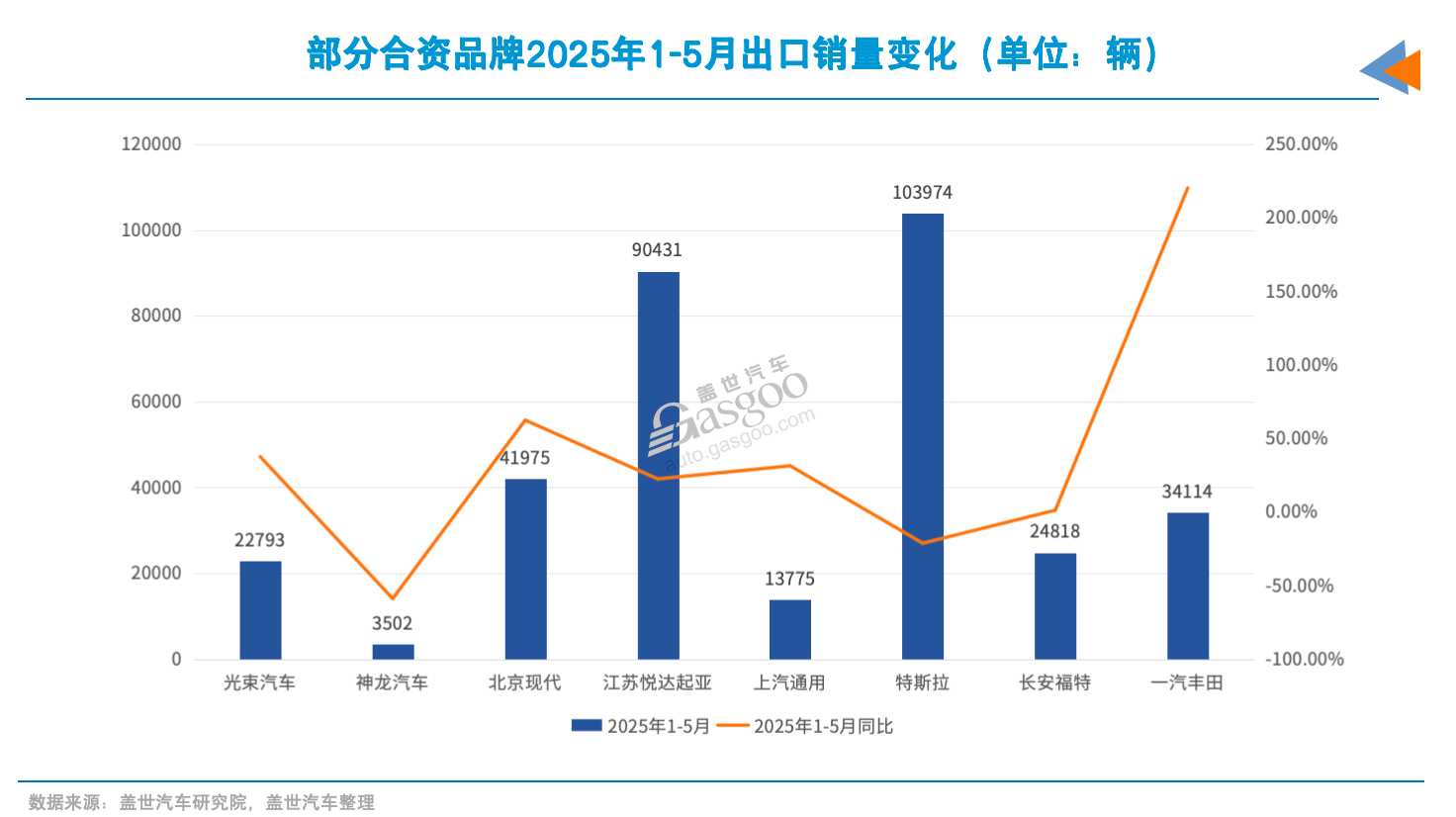

From January to May 2025, brands such as Beam Automotive, Changan Ford, Beijing Hyundai, and Yueda Kia experienced a significant overall sales recovery, mainly driven by export business.

Beijing Hyundai's cumulative sales exceeded 80,000 units in the first five months, with export business contributing half of the total. Yueda Kia's sales during the same period reached 101,000 units, surpassing the full-year sales of 2020. The key to this growth lies in the expansion into emerging overseas markets, effectively offsetting the sluggish domestic market performance. Data shows that Yueda Kia's export sales from January to May exceeded 90,000 units, accounting for nearly 90% of total sales.

A similar trend is also evident in brands such as Changan Ford and Spotlight Automotive. Changan Ford’s export sales reached 74,000 units in 2024, with 25,000 units exported in the first five months of this year, accounting for more than 30% of its total sales. The growth of its export business has become an important driver for turning its performance in China from loss to profit. Last year, Changan Ford achieved a net profit of 2.09 billion yuan.

As a new energy vehicle brand jointly established by BMW and Great Wall, Li Auto's domestic market exposure still needs improvement, but its export business is developing rapidly. In the first five months of this year, Li Auto exported 23,000 vehicles, a year-on-year increase of 37.6%, accounting for more than 70% of its total sales.

It can be seen that exports are becoming an important, even crucial, driving force for the sales growth of some second-tier joint venture car companies. Based on this reality, more and more joint venture brands are regarding export business as a current strategic priority.

In April this year, Changan Mazda launched the "Double Hundred Doubling" strategy, established a new energy vehicle export center, and planned to invest 10 billion yuan in the new energy sector to achieve 10 billion yuan in export trade. In the same month, the global MAZDA 6e rolled off the production line and will be supplied simultaneously to markets in Europe, Southeast Asia, and other regions worldwide. The core of this strategy lies in transforming the manufacturing advantages of the Chinese market into global competitiveness, expanding overseas markets through technology export and capacity upgrades.

Leading companies are also actively exploring export routes to further expand scale effects and improve capacity utilization. FAW Toyota is a typical example. In the first half of 2025, FAW Toyota achieved a year-on-year growth of 21.1%, with sales reaching 370,000 units. Its export business played a positive role in stabilizing sales. During the same period, export sales increased 2.2 times year-on-year to 34,000 units, accounting for 10% of total sales.

Dongfeng Nissan is also shifting its development focus to overseas markets. In July this year, Dongfeng Group and Nissan (China) announced the establishment of a new joint venture company, planning to export complete vehicles and parts to overseas markets. The shareholding ratio between the two parties is 40% to 60%. The new company has a registered capital of 1 billion yuan and a joint venture term of 28 years.

The plan will be launched in 2026, with an initial annual export target of 100,000 vehicles. Export models include electric vehicles such as the N7 and Frontier Pro PHEV, with primary destinations being markets in Southeast Asia, the Middle East, and Latin America.

It should be pointed out, however, that relying on exports is not a long-term solution. If joint venture brands fail to achieve structural upgrades in areas such as product development, intelligent architecture, and localized ecosystem building, then even short-term growth driven by exports will not be enough to ensure long-term competitiveness in the Chinese market.

Therefore, the development model of leading joint ventures that maintain their market share domestically while simultaneously expanding into overseas markets has more practical reference value.

The battle for market share is far from over.

Currently, although the overall market share of joint venture brands has rebounded from its lowest point, judging from the long-term development trend, it is unlikely to return to the historically high levels and may even continue to decline.

Behind this reality lies a fundamental change in the entire competitive environment. The traditional joint venture brand model of "foreign dominance + Chinese execution" has become inadequate in adapting to the current competitive landscape where independent brands hold the market dominance.

More importantly, in the core field of new energy, which determines the future passenger car market structure, mainstream joint venture brands have seen a continuous decline in their market share over the past few years, accounting for only 9% by the first half of this year, with total sales of less than 600,000 vehicles, merely one-tenth of the sales of new energy passenger vehicles by domestic brands. In stark contrast, the penetration rate of new energy passenger vehicles from domestic brands has reached 70%, far exceeding the industry average of 50%, and they occupy more than 90% of the new energy passenger vehicle market.

There is a view that this significant market share gap is not accidental, but the result of a combination of multiple factors such as technology route selection, product development pace, and degree of localization.

Independent brands have achieved comprehensive breakthroughs across multiple dimensions such as technology, products, pricing, and channels. More importantly, they have seized market opportunities during the critical period of electrification and intelligent transformation, establishing a first-mover advantage. This indicates that simply relying on brand premium and traditional technological accumulation is no longer sufficient to cope with the competitive market landscape.

Image Source: China Passenger Car Association

From the overall industry development pattern, the battle for market share is far from reaching its final stage, but the intensity of competition is significantly increasing.

He Xiaopeng, Chairman and CEO of XPeng Motors, predicts that the next five years will be the final phase of the elimination race in the Chinese automotive industry. The existing brands will consolidate into a few parent brands, and the number of sub-brands may be reduced to only a dozen or even fewer. Several automotive executives, industry analysts, and research institutions hold similar views, suggesting that in the future, the Chinese market may have only 10-15 or even fewer automotive groups participating in mainstream competition.

According to incomplete statistics from Gasgoo Auto Research Institute, there are currently over 130 automobile brands available in the domestic market, while the penetration rate of new energy passenger vehicles is approaching 50%. The market concentration still needs to be further improved.

In the context of the global wave of electrification and intelligence rapidly reshaping the industrial landscape, only companies that can efficiently combine local R&D, local manufacturing, and local brand strategies are likely to achieve sustainable market survival. The logic behind this judgment is relatively clear: whether joint ventures or independent brands, many companies that lack core product capabilities, have vague strategic positioning, or lack the ability to independently control technology will gradually be eliminated by the market.

Regarding the development prospects of joint venture brands, Gaishi Automotive Research Institute predicts that the Chinese passenger car market will gradually stabilize at a market structure of "80% domestic brands and 20% foreign brands." It is expected that the overall market share of domestic brands in the passenger car market will reach about 70% this year.

Under this pattern, even joint venture brands with systematic advantages such as Volkswagen, Toyota, and General Motors may continue to experience a gradual decline in market share over the next two to three years due to the sustained impact of independent new energy products, although the decline is relatively controllable.

Some joint venture brands may face even more challenging market conditions. Taking Honda as an example, a structural deviation has emerged between its global strategy and the technological development trends in the Chinese market, which may further weaken its long-term strategic position in China.

In May this year, Honda announced a 30% reduction in its electrification investment, adjusting it from 10 trillion yen to 7 trillion yen, and reallocating resources to product lines centered on hybrid technology. This strategic shift may have a practical basis in the North American market but clearly misaligns with the current Chinese market's technology path, which emphasizes the deep integration of pure electric vehicles and intelligentization.

Although Nissan has shown a positive attitude towards electrification transformation in China and launched representative electric models such as the N7, it cannot hide the overall lack of competitiveness of its products. Some analysts believe that Nissan's strategy is shifting towards the development path of Hyundai and Kia, positioning China as a manufacturing base for electric vehicle exports. This is undoubtedly a feasible solution, but it cannot address the fundamental issue of Nissan's continuously weakening brand influence in China.

Cui Dongshu, Secretary General of the China Passenger Car Association, believes that joint venture automakers need to continue to make efforts in product definition, supply chain integration, and channel stability in order to find a foothold in future competition.

The current stage of competition is no longer evaluated solely by "quantity"; the competition in "quality" has gradually become the core variable in this new phase. This quality competition is reflected on multiple levels: the speed of R&D response, the depth of intelligent product capabilities, and the adaptability of channel and brand service capabilities.

The changes in the market landscape confirm the development pattern of "the east of the river in ten years, the west of the river in thirty years." Whether joint venture brands can achieve a true market turnaround depends on their ability to keep pace with the technological development trends and changes in consumer demand in the Chinese market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track