JDI Embraces Dan-Sha-Li! Abandoning a Decade-Long Apple Aura, Can the Shift to Automotive Displays Restore Its Glory?

Japan Display (JDI), which has fallen into financial difficulties, recently announced that it will close its Mobara plant in Chiba Prefecture and sell its LCD and OLED production equipment, including the production line that has long supplied the Apple Watch. This not only signifies JDI's official exit from the smartwatch display panel market but also marks the end of its decade-long partnership with Apple.

However, JDI's move is not merely a contraction, but a structural adjustment that bets on the future: shifting from a capital-intensive panel manufacturer to a fabless model, and concentrating resources on new fields such as automotive panels and sensors. Is this transformation JDI's redemption, or just another unfinished dream? This must be analyzed from two major challenges and one key opportunity.

JDI Selling Factories to Survive: The Inevitability and Risks of Transitioning to Fabless

JDI's financial difficulties did not arise overnight. Over the past decade, JDI has been overly reliant on orders from Apple. Although it once grew rapidly due to the explosive demand for iPhones, JDI gradually lost its competitiveness as OLED replaced LCD, having clearly fallen behind in technological investment. In particular, the long-term leadership of Samsung and LG Display in the OLED sector further pushed JDI into trouble, ultimately forcing it to sell assets in exchange for cash.

However, it is not entirely impossible for JDI to shift to a fabless model. In fact, there are already successful cases in the semiconductor industry, such as TSMC, proving that a design-focused, outsourced manufacturing model is feasible. However, it should be noted that the panel industry is different from the semiconductor industry; its manufacturing technology and mass production scale rely more heavily on the accumulation of process experience. Without its own factories, JDI will lose the advantage of experimental technology verification, which may prolong product development cycles. This is the greatest uncertainty in its transformation process.

Automotive Panels and Sensors: JDI's New Battlefield

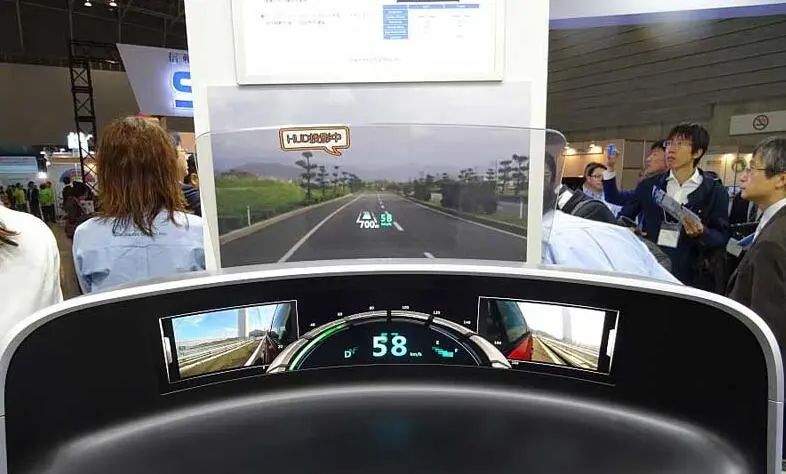

After JDI exited Apple's supply chain, it chose to focus on the automotive display and sensor markets, which is a pragmatic strategic shift. Although the automotive display market does not grow as rapidly as the smartphone market, it is highly stable. With the proliferation of electric vehicles and smart cockpits, the demand for high-end displays and sensing components continues to increase. According to data from a Japanese research institution, the global automotive display market has a compound annual growth rate of approximately 6-8%. For resource-limited JDI, this is a relatively controllable blue ocean market.

However, automotive displays are not without competitive pressure. Manufacturers such as Sharp and Innolux have been established in the field for many years, and automotive displays require extremely high standards for long-term supply stability and durability. This means that JDI not only needs to possess strong technological capabilities but also has to rebuild customer trust. On the other hand, JDI’s investment in the sensor field, if combined with its advantages in low-power display technology, may provide an opportunity to establish differentiated advantages with automakers and in the industrial control sector. This will be key to whether it can make a comeback in the future.

Structural Reorganization and Capital Cooperation: JDI’s Last Stand

The fate of JDI is not an isolated case but rather a reflection of the structural transformation of Japan's electronics industry. In the 1980s, Japan's electronics industry dominated globally in areas such as displays, semiconductors, and home appliances. However, with the acceleration of globalization and the IT cycle in the 1990s, Japanese companies gradually fell into three structural dilemmas: first, overly conservative technical decisions, often commercializing on a large scale only after the technology matured, which avoided burning money but allowed Korean and Taiwanese companies to surpass them through aggressive investments; second, insufficient capital support, as compared to the direct support of the South Korean government for Samsung and LG, Japan's industrial capital was dispersed, lacking the power to drive large-scale investments; third, over-reliance on vertical integration, which emphasized an all-in-one system from materials to manufacturing but lacked flexibility in a rapidly changing market, making it difficult to respond to emerging application demands.

JDI was established in 2012 through the merger of the panel divisions of Sony, Toshiba, and Hitachi amid these structural issues. Originally expected to integrate resources to compete against South Korea and China, it ultimately missed the opportunity for further expansion through cooperation with Apple due to delayed decisions on OLED transformation and insufficient capital. JDI's transformation is not only a technical and market challenge but also a capital battle. Over the past few years, JDI has repeatedly received capital injections from INCJ (Innovation Network Corporation of Japan). Now, by selling the Mobara factory and production equipment, whether the funds obtained can effectively support its transformation period is the key to success or failure.

The significance of this transformation for Japan's display industry

JDI's sale of panel equipment and the end of its partnership with Apple may seem like a sign of failure, but it is more likely an opportunity for rebirth by cutting losses to survive. Automotive panels and sensors are indeed predictable growth markets, but JDI must quickly establish technological differentiation without its own factories and strive for support from the government and the industry chain.

This is a high-risk but necessary bet. If JDI can precisely focus during its transformation and fully leverage the synergy of the Japanese industrial chain, it may still have a chance to return to the center stage in the next decade. Otherwise, this transformation is likely to be another missed opportunity for Japan's display industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track