Is aion adding another new brand?

On August 13, GAC Group announced that it had reviewed and approved the "Proposal on GAC AION's Investment in Huawang Auto," agreeing for its subsidiary, GAC AION, to increase its investment in Huawang Auto by 600 million yuan. After completing this capital increase, GAC Group will directly hold 71.43% of Huawang Auto's shares and indirectly hold 28.57% through GAC AION. This means Huawang Auto is a subsidiary controlled by GAC Group.

HuaWang Auto is the main entity of the high-end new energy vehicle project jointly developed by GAC and Huawei, targeting the market above 300,000 yuan.

The information disclosed in this announcement suggests that the GAC Aion brand lineup may gain a new member.

How is Huawang Auto progressing?

Huawang Auto initially launched as the "GH Project," and progress has been quite rapid.

In November 2024, GAC Group and Huawei signed a cooperation agreement, agreeing to collaborate in areas such as product development, market strategy, and ecosystem services. They will develop intelligent vehicle models based on a new architecture. The brand is positioned to compete directly with high-end brands like Tesla, NIO, and Li Auto, focusing on the 300,000 RMB market segment.

Two months later, in January 2025, GAC Group announced its intention to invest in the establishment of the GH project company, with a registered capital of 1.5 billion yuan. The aim is to jointly launch a new brand with Huawei, targeting the luxury intelligent new energy market.

A month later, the two parties launched the "GAC AI Platform and Application Pilot Project," introducing AI capabilities in areas such as intelligent network development, product design, and enterprise operations to reduce costs, improve efficiency, and accelerate project implementation.

In March, Huawang Automotive Technology (Guangzhou) Co., Ltd. was officially registered with its headquarters located in Guangzhou, Guangdong. The legal representative is He Xianqing, the deputy general manager of GAC Group, who also serves as the chairman of GAC Toyota, GAC Trumpchi, and GAC Aion.

According to GAC Group, Huawang Auto will comprehensively advance in brand building, channel expansion, and product development. The brand construction work has been fully launched, with plans to officially release a new brand name by the end of 2025, and the first model is expected to be officially launched by the end of 2026.

Some industry insiders predict that Huawei Automotive's first model is expected to integrate Huawei's advanced technologies, such as assisted driving and intelligent cockpit solutions, while being equipped with GAC’s independently developed powertrain and electric drive systems, thus forming a deep technological and market collaboration between the two parties.

In terms of sales channels, Huawang Auto recently launched a nationwide city recruitment plan, with the first phase prioritizing the recruitment of 40 cities, including key markets such as Beijing, Shanghai, Shenzhen, Chengdu, Chongqing, and Wuhan. The channel model adopts a "1+N" layout (user center + experience center) and adheres to the principle of fewer partners and more stores, aiming to cover high-end user groups with more intensive touchpoints.

Image source: GAC Aion

According to the latest announcement from GAC Group, Huawang Auto may become another high-end brand under Aion. The reason GAC Group is allocating project resources of Huawang Auto to Aion is based on the latter's leading position in the group's new energy business.

As the pioneer of GAC Group’s comprehensive electrification transformation, Aion not only possesses experience in pure electric platforms, three-electric (battery, motor, and electronic control) technologies, and intelligent research and development, but also has a mature supply chain and manufacturing system. Placing the new brand under the Aion system helps leverage its existing R&D, manufacturing, and marketing capabilities, shortens the incubation period for the new brand, and reduces costs through technological sharing.

In addition, in GAC Group's three-year "Panyu Action" plan, Aion is expected to play a significant role. GAC Group plans to achieve a sales proportion of over 60% from its own brands by 2027, challenging a scale of 2 million units, with Aion potentially playing a key role in this endeavor.

A tool for Aion's upward surge?

Hua Wang Auto may be the tool for Aion to achieve a sales breakthrough and surge again.

Aion currently has two major brands: the main brand Aion and the high-end brand Hyper. Aion focuses on the mid-to-low-end pure electric market within 200,000 yuan, relying on main models such as AION Y, AION S, and AION UT to maintain sales scale in the mainstream market. However, this part of the market is highly price competitive, with significant pressure on profit margins, and the Aion brand image is more associated with being "affordable" and "ride-hailing."

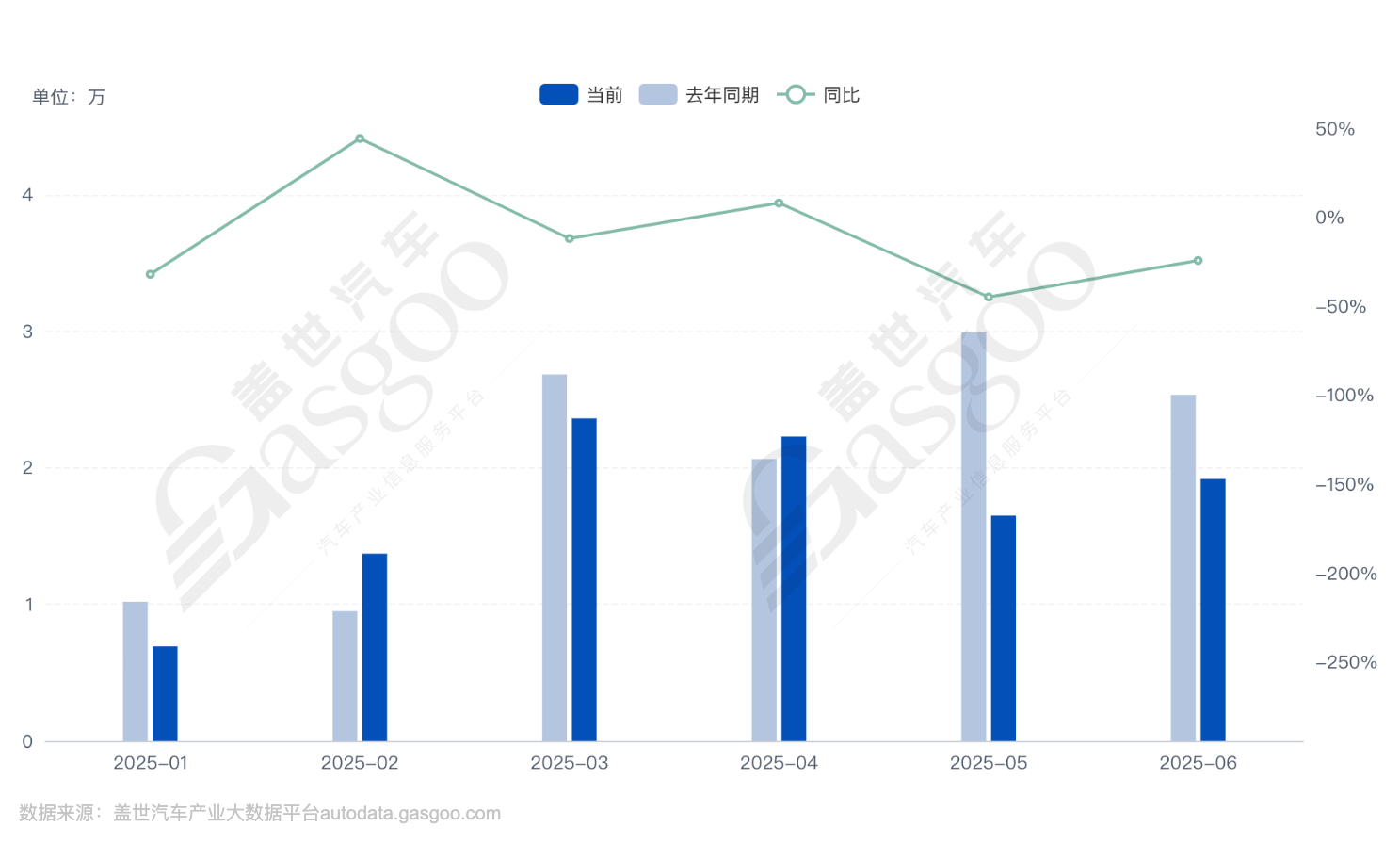

Sales of the Aion brand in the first half of 2025

Due to the increasingly competitive market for new energy vehicles in the 150,000 RMB price range, Aion has faced significant challenges in the past two years. According to the Gasgoo Auto Industry Database, in the first half of 2025, Aion's cumulative sales exceeded 100,000 units, a 16.5% decline compared to the same period last year and more than halved from its peak sales figures.

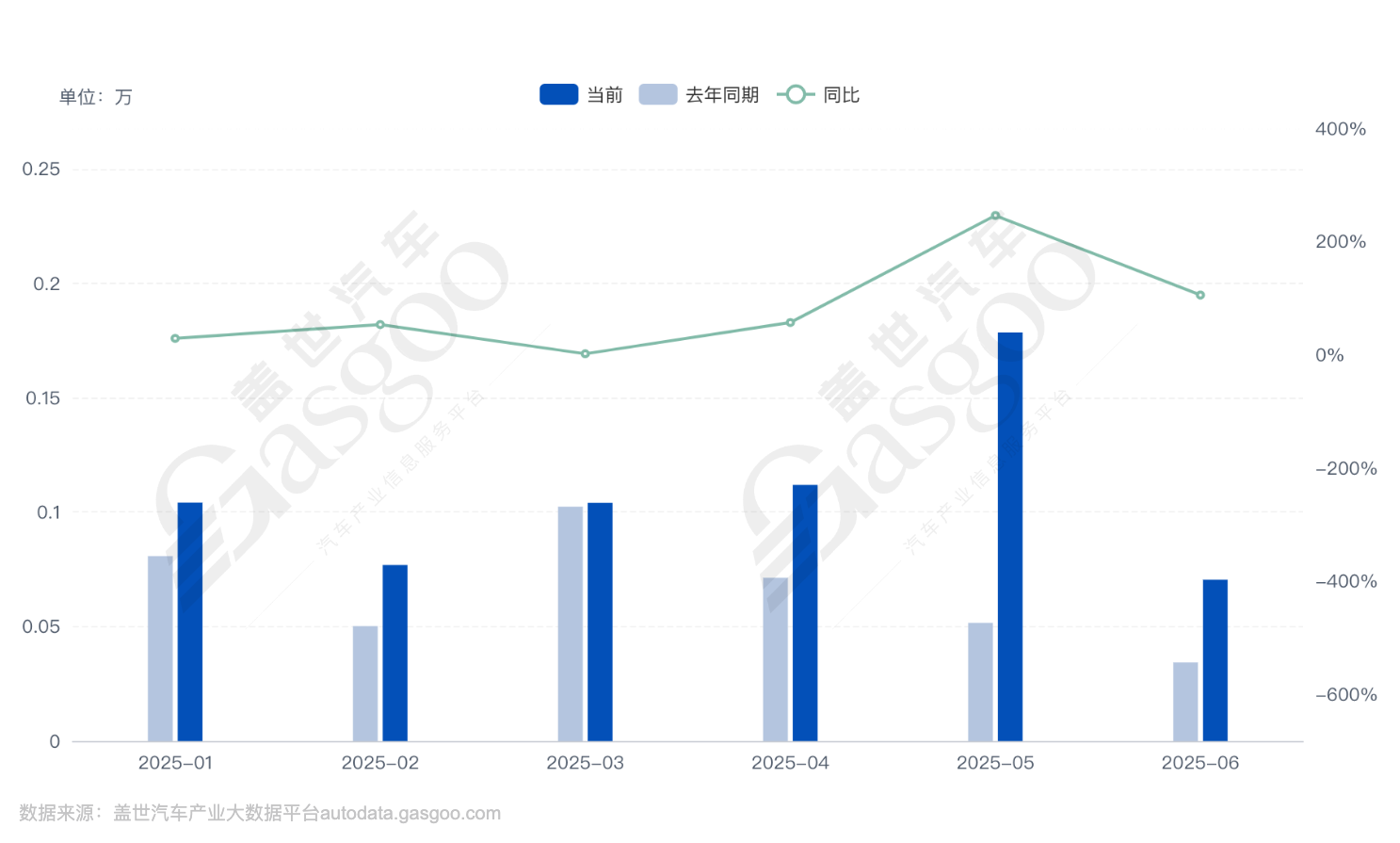

The Haobo brand is positioned as AION's path to penetrate the high-end market. The first model, Hyper SSR, is priced at over a million yuan, but serves more as a symbol of brand image. The truly mass-produced models, such as Hyper GT and Hyper HT, are mainly priced in the 200,000 to 300,000 yuan range. In the first half of this year, Haobo's cumulative sales were only slightly over 6,000 units, failing to make a significant breakthrough in the mid-to-high-end market.

Sales of Haobo from January to June 2025

Some industry insiders believe that the reason Haobo is facing resistance after its peak is due to its high association with Aion in terms of channels and brand image. The "King of Ride-hailing Cars" label creates a psychological barrier for some consumers. Additionally, its product positioning and design still have room for improvement and have not formed a differentiated advantage. In the increasingly competitive 200,000 to 300,000 yuan segment, the presence of models from Xiaomi, Wenjie, Ideal, and others further compresses the market space.

To better develop Haobo, its marketing system was separated from Aion. Earlier this year, GAC Group adjusted its organizational structure, integrating the marketing sectors of Trumpchi and Aion, and established three major brand marketing divisions: Trumpchi, Aion, and Haobo. In March, GAC Group Chairman Feng Xingya emphasized that in the next three years, there will be no upper limit on support for the development of the Haobo brand, and the group's top human, material, and financial resources will be invested in Haobo.

Hua Wang Auto's integration into AION is more beneficial for AION's advancement into the 300,000+ market. Currently, Huawei has established a strong market presence in areas such as assisted driving, intelligent cockpits, and vehicle-cloud services. The sales performance of the AITO series, in particular, validates the market potential of its technological empowerment.

If GAC Group operates Huawang Automobile under the Aion system, on one hand, it can leverage Aion's R&D and manufacturing resources to quickly advance product launch; on the other hand, it can penetrate the high-end market at the 300,000 yuan level through the dual endorsement of "Huawei + GAC" at the brand level, creating differentiation from existing brands.

The Aion brand matrix may also form a three-tier structure: Aion targets the mid to low-end mass market, Haobo caters to the mid-to-high-end models in the 200,000 to 300,000 yuan range, and Huawang Auto aims for the high-end market above 300,000 yuan. This multi-brand layout helps in creating a more segmented coverage of price and consumer demographics in the new energy market, enhancing overall competitiveness.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track