Iphone 17 released! indian manufacturing fully launched; can china maintain its core supply chain position?

In the early hours of September 10th, Beijing time, the iPhone 17 series was officially released, marking the most significant design upgrade for Apple in nearly six years. Equally noteworthy as the product itself is the major shift in its production layout: all US versions of the iPhone 17 series will be manufactured in India.

Source: Apple

This marks a new phase in Apple's supply chain diversification strategy. Market data shows that nearly 80% of iPhones in the U.S. market will be imported from India in the first half of 2025, with a total volume of 18.6 million units, a significant increase from 53% a year earlier.

01 India's Manufacturing Rise: The American Version of iPhoneThe shift of production focus

Since taking on the role of Apple's CEO, Tim Cook, who is well-versed in management, has consistently worked to reduce risks from the supply chain. The geopolitical risks triggered by Trump's presidency have also accelerated Apple's steps to shift its supply chain. Under this strategy, India, Vietnam, and Brazil have begun to take on the manufacturing of some product lines.

Apple's manufacturing plan in India is accelerating. From early 2025 to April, the proportion of U.S. version iPhones assembled in India increased from 53% to 80%. Currently, there are five factories in India manufacturing the entire iPhone 17 series for the U.S. market, marking the first time Apple has entrusted India with the complete new product line at the time of a global launch.

These factories include Tata Group's Hosur factory, the former Wistron factory (now acquired by Tata), Foxconn's Tamil Nadu factory, the Devanahalli factory, and Pegatron's Chennai factory.

The Tata Hosur factory is newly constructed, characterized by a high level of automation and high yield, and is primarily responsible for producing the iPhone 17 Pro model. Bloomberg states that in the next two years, this factory, controlled by a local Indian company, will contribute to half of the iPhone production in India.

The Tata Group has a huge influence in its home country of India. Image from the official website.

02 India's total capacity is still unable to meet global demand.

Despite rapid progress in Indian manufacturing, India's capacity is still insufficient to meet global iPhone demand. According to data from market research firm Omdia, the global shipment of Apple's iPhone in 2024 is 225.9 million units.

According to a Canalys report, in the first half of 2025, the number of iPhones produced in India reached 23.9 million units, representing a significant year-on-year increase of 53%. However, this still shows a clear gap compared to Apple's global shipment of 226 million phones last year.

Wang Duo, a supply chain industry expert close to Apple's manufacturing business, clearly stated: "India's entire production capacity is still unable to meet global demand."

This means that "Make in India" can currently only meet part of the market demand, not all of it.

03 Indian-made iPhoneCompared to China, the cost is 10% higher.

In addition to production capacity, production costs are also a key factor restricting India's ability to supply iPhones to the global market. "India Today" states: "The cost of manufacturing phones in India is still 5%-8%, and sometimes even 10% higher than in China. Labor may be cheaper here, but many key components still have to be imported."

This is not because Indian manufacturing is too unreliable; on the contrary, the level of iPhone production in India has indeed been improving in recent years: from an early yield rate of only 50% to now surpassing 80%. The production timeline for Apple's new products has also progressed from being later than China's before 2023 to now keeping pace with China.

Compared to the generally over 95% yield rate of Chinese factories, there is still a significant gap. It can only be said that Chinese manufacturing is very powerful.

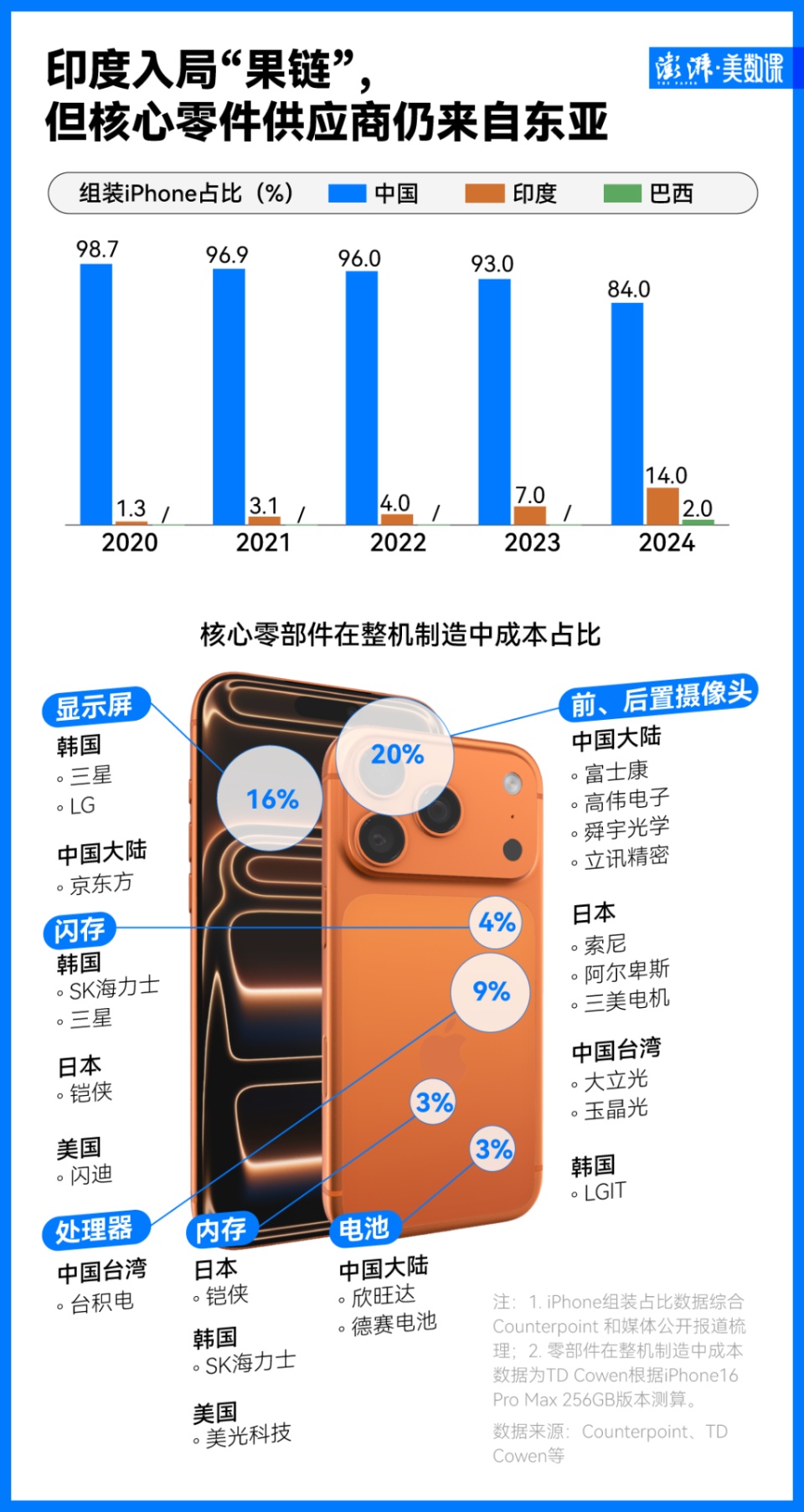

The shortage of high-end components continues to persist in India, with most of these components being imported from China, Japan, and South Korea. This not only leads to production delays but also increases manufacturing costs by about 10%-20%.

These key components refer to chips, camera modules, etc., most of which come from China, Japan, and South Korea. A senior person responsible for manufacturing management within Apple's supply chain stated that the shortage of high-end components (in India) persists, and most of these components are imported from East Asia.

04 Nearly a hundred Chinese companies control Apple's core components.

Chinese companies hold a crucial position in Apple's supply chain. The supply chain list released by Apple in April 2024 shows that...Out of 187 supply chain companies, 92 are from China (including 51 manufacturers from mainland China), accounting for more than 50%, firmly ranking first.

Although Apple has shifted some assembly processes to Southeast Asia, China still holds a leading position in high value-added segments such as chip packaging, optical components, OLED panels, and precision machinery. The overall supply chain advantage is very significant.

Considering that Apple still requires a large number of Chinese suppliers (such as GoerTek and BYD Electronics) to provide core components, in the long run, China may reduce its role as an "assembly workshop" and take on more of a role as a "core components and high-end manufacturing center."

On the other hand, domestic enterprises are also going global, changing from "passive transfer" to "proactive planning."

Both Luxshare Precision and Lens Technology, along with many other companies in Apple's supply chain, have already established their own factory campuses in Southeast Asia, striving to achieve localized supply.

Taking Luxshare Precision, one of the "three giants of the fruit chain," as an example, it established a factory in Vietnam in 2018. As of 2023, two of its factories in Vietnam have been included in Apple's supplier list. Goertek set up its factory in Vietnam as early as 2015. Lens Technology, which has long supplied glass touch screens for Apple products, opened its first factory in Vietnam in 2020.

Chinese fruit chain suppliers establishing factories in Southeast Asia has become the new norm. Image from official website.

China's manufacturing industry holds an overall advantage that is difficult to be quickly replaced. China's manufacturing value-added accounts for nearly 30% of the global share, and its overall scale has ranked first in the world for 15 consecutive years. This scale advantage brings a comprehensive industrial chain supporting capability.

5 Future Outlook: Formation of a Multi-Center Supply Chain Pattern

Apple is forming a "multi-hub manufacturing" model: China (high-end components and partial assembly), India (partial phone assembly), Vietnam/Thailand (earphones, tablets, and accessories assembly).

This model appeared in the 20th-century automotive industry, where Japan, the United States, and Germany leveraged their respective advantages to divide labor within the industry chain.

India faces significant challenges in achieving supply chain localization. Industry analysts estimate that a sustained investment of approximately $15-20 billion will be required over the next 5-7 years, focusing on the construction of semiconductor plants, precision manufacturing, and quality testing capabilities.

The Indian industry estimates the localization of the supply chain to take 5-7 years, but externally it was generally believed to take as long as 10 years. This is also the key reason why Apple has been unable to fully achieve "Made in America" for iPhones.

Trump has asked Apple CEO Cook to stop building factories in India and instead "increase production in the United States." However, Apple's latest choice may still not meet Trump's expectations—starting this year, Apple has begun producing the new iPhone 16e model in Brazil for the first time, establishing a third iPhone production base outside of China and India.

The migration of the Apple supply chain is far more difficult than imagined, and the advantages of the Chinese supply chain continue to persist.

Edited by: Lily

Source: The Paper, Gonglianchuang Morning 8 o'clock, Tencent News, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track