【International News】Honeywell's business spin-off makes new progress! Uncertainty around U.S. e-commerce tariffs; McDonald's plastic toys "return to the nest."

Highlights of International News:

Raw Material News - New Progress! Honeywell Announces Leadership Team and Company Name for Advanced Materials Spin-off Business

Packaging News - TOPPAN to Acquire BOPP Film Manufacturer Irplast

Medical News - Bayer Launches New PET Blister Packaging in the Pharmaceutical and Healthcare Industry for the First Time

BMW Group and Alibaba Reach AI Strategic Cooperation

News on Market Information - The Trump Administration Adds Multiple Chinese Technology Companies to the "Entity List" Again

Market price news - CFR Northeast Asia $855/ton; CFR Southeast Asia $920/ton

Here are the details of international news:

1. New Development! Honeywell Announces Leadership Team and Company Name for Advanced Materials Spin-off Business

On March 25, Honeywell officially announced key progress in its plan to spin off its Advanced Materials business. This business divestiture, conducted as a tax-free spin-off for shareholders, is expected to be completed by the end of 2025 or early 2026. The newly independent company will be named Solstice Advanced Materials and will be headquartered in Morris Plains, New Jersey.Rajeev Gautam PhD is appointed as the board chair, David Sewell as president and chief executive officer, and Tina Pierce as chief financial officer.

Concerns about Trump's tariff policy have been expressed by multiple domestic teams in the United States.

Recently, the U.S. Chamber of Commerce, in collaboration with the oil, natural gas, and clean energy organizations, expressed their "concerns" to the government regarding President Donald Trump's tariff policy. This joint action highlights the worries of relevant domestic teams about Trump's tariff policy.

At the panel discussion hosted by the American Clean Power Association on March 25, senior industry officials spoke out urging the White House and the government to pay attention to the potential volatility in the energy market, businesses, and consumers caused by their trade policies. Frank Makiyaurola, the chief advocacy officer of the American Clean Power Association who moderated the discussion, stated bluntly, "The actions taken by the Trump administration in recent weeks have created tremendous uncertainty in the business community and the markets." He further noted that regarding the direction of the government's trade policy, "There is great uncertainty, and the market clearly has not fully grasped the president's intent to use tariffs as leverage."

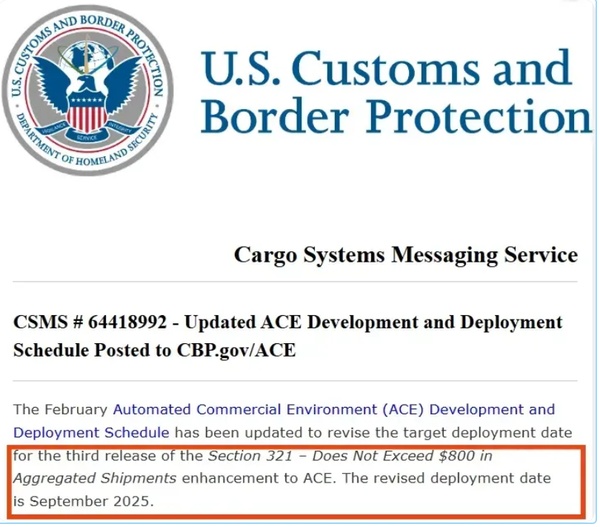

3. Enjoy tariff exemptions before September? U.S. strictly investigates under-declaration of goods and imposes heavy fines.

The U.S. Customs and Border Protection (CBP) has released a significant announcement through the Cargo Systems Messaging Service (CSMS), causing a stir in the cross-border e-commerce industry. The announcement focuses on the "Commercial Environment (ACE) Development and Deployment Plan" and clearly sets key deployment milestones for September 2025. This news has immediately attracted the attention of many industry professionals, signaling that the sector is about to undergo major changes.

4. Major Global Move in Hydrogen Economy! Saudi Aramco Completes Acquisition of 50% Equity in Blue Hydrogen Industrial Gases

As a global leader in the energy and chemical sectors, Saudi Aramco, in collaboration with Air Products Qudra (APQ), has successfully completed the acquisition of a 50% stake in Blue Hydrogen Industrial Gases Company (BHIG), headquartered in Jubail. This partnership brings together the expertise of both companies with the aim of enhancing hydrogen production in Jubail Industrial City, including large-scale supply of low-carbon hydrogen.

5. Plastic Toys "Return to Nest"? McDonald's UK Happy Meal Plan Sparks Debate

The UK and Ireland division of fast-food giant McDonald's is considering reintroducing plastic toys in its popular Happy Meals. Four years ago, McDonald's announced that it would reduce the use of such items in its products by 2025. However, earlier this month, McDonald's acknowledged that while these efforts have achieved some success, substitute materials for plastics have limitations. The company is currently testing other materials. McDonald's stated that when plastic remains the best option, it plans to explore the types of plastics that can be used and, if necessary, form partnerships to improve the recyclability of plastics.

Agilyx established Plastyx Ltd. to supply raw materials to the European plastic recycling industry.

Agilyx announced a partnership with Plastic Energy founder Carlos Monreal to establish Plastyx Ltd., aimed at sourcing and supplying feedstock for the advanced plastic recycling market in Europe. Agilyx stated that while advanced plastic recycling technologies are scaling up industrially and complementing mechanical recycling, the growth of the sector is constrained by a consistent supply of high-quality feedstock. Plastyx aims to bridge this gap by developing partnerships and material processing capabilities to ensure a reliable supply of high-quality polymers for food-grade and other high-performance packaging applications. The company stated its near-term goal is to procure and execute memorandums of understanding (MOU) for 200,000 metric tons of waste plastic by the end of 2025. Plastyx Ltd. is a joint venture established by Agilyx and Circular Resources in a 60:40 ratio, with Monreal serving as chairman.

7. OMV Establishes a Plastic Recycling Plant

OMV announced the expansion of its innovative ReOil technology at the Schwechat refinery near Vienna. The new plant will be able to process up to 16,000 tons of difficult-to-recycle mixed plastic waste per year, equivalent to the plastic waste produced by 160,000 Austrian households annually.

TOPPAN will acquire Irplast, a BOPP film manufacturer.

TOPPAN has reached a final agreement to acquire 80% of the issued shares of the Italian BOPP film manufacturer Irplast, which is currently held by the main shareholder Cheyne Strategic Value Credit. According to TOPPAN, Irplast manufactures BOPP films using synchronous biaxial orientation technology, which is said to provide "higher" transparency, durability, and processability; help reduce environmental impact and improve recyclability; and offer products for packaging and labeling in areas such as food, personal, and household care. The TOPPAN Group plans to integrate Irplast's high-performance BOPP film manufacturing technology to develop and provide solutions that meet various customer needs. The Group added that this acquisition aligns with its strategic goal of achieving a sustainable society.

Bayer launches a new type of PET blister packaging in the pharmaceutical healthcare industry for the first time.

Bayer announced the launch of its Aleve brand in PET blister packs in the Netherlands, a first in the healthcare industry. Bayer collaborated with packaging expert Liveo Research to develop this new packaging format, replacing traditional polyvinyl chloride (PVC) with PET, significantly reducing the environmental impact of over-the-counter (OTC) blister packaging.

BMW Group and Alibaba达成AI领域战略合作

On March 26, CAIXIN.com reported that BMW Group announced a strategic partnership with Alibaba in the AI field today, focusing on technologies such as large language models. Alibaba's Tongyi model will be applied to new-generation series vehicles of BMW in the Chinese market.

The following is information on the overseas macro market:

Trump may implement copper import tariffs in a matter of weeks. The U.S. is likely to impose tariffs on imported copper in a few weeks, months earlier than the deadline for making a decision.知情人士因讨论内容保密而要求匿名,他们称,美国总统唐纳德·特朗普2月份曾指示商务部对潜在的铜关税展开调查,并在270天内提交报告,但现在预计会更快解决。

The Trump administration has added several Chinese technology companies to the "entity list." The U.S. Department of Commerce's Bureau of Industry and Security published two documents in the Federal Register on Tuesday local time, listing over 50 Chinese tech enterprises and institutions on the so-called "entity list," which is expected to take effect on March 28. In one of the documents, the Department of Commerce included a series of 12 companies involved in China's AI large model development, server, and supercomputer industries, including Beijing Zhiyuan Artificial Intelligence Research Institute, Ningchang Information Industry, the server brand Suma under the China Electronics Technology Group, and several subsidiaries of Inspur Information in mainland China and the Hong Kong and Taiwan regions. In another document, 42 Chinese companies, 19 Pakistani companies, and multiple companies from Iran, South Africa, and the UAE were added to the "entity list." The Department of Commerce imposed unreasonable sanctions on a series of companies, including SAIHONG Instruments, Anhui Kehua Trading, and Chongqing Southwest Integrated Circuit Design Co., Ltd., under the pretext of "supporting China's quantum technology development." Additionally, dozens of Chinese companies were added to the export control list by the U.S. side on the grounds of "military involvement."

India's largest oil producer plans diversification to cope with supply glut. According to oilprice, the state-owned Oil and Natural Gas Corporation (ONGC) of India is planning to diversify into refining, petrochemicals, liquefied natural gas (LNG) trading, and renewable energy in response to anticipated crude oil oversupply leading to lower oil prices. ONGC's strategic director, Arunangshu Sarkar, stated in an interview with Bloomberg that the global oil supply is trending towards oversupply, leading to a drop in oil prices, making survival in a low-price environment difficult for the company. New business ventures can provide solutions to this challenge. Currently, ONGC is looking for LNG regasification capacity along the west coast of India and is negotiating natural gas procurement agreements with city distributors. The company also plans to build a refinery, although the project is still in its early stages. Reports from last year indicated that ONGC was evaluating the establishment of an $8.3 billion refining and petrochemical project in the most populous state of India to meet the growing fuel demand. Additionally, ONGC revealed that it plans to invest $11.66 billion in clean energy by 2030, aiming for a renewable energy installed capacity of 10 GW.

The UK released the CPI data for February: the Harmonized CPI year-on-year for February is 3.7%, expected to be 3.8%, and the previous value was 3.9%.

UK Core Retail Price Index YoY in February was 3%, compared to the previous 3.2%. MoM it was 0.6%, with expectations at 0.7%, and the previous figure was -0.1%.

UK February CPI YoY 2.8%, expected 3%, previous 3%. MoM 0.4%, expected 0.5%, previous -0.1%.

UK core CPI year-on-year in February was 3.5%, expected was 3.6%, and the previous value was 3.7%.

Price information:

The central parity rate of the RMB against the US dollar is 7.1754, up 34 points; the previous trading day's central parity rate was 7.1788, the official closing price of the previous trading day was 7.2640, and the night session closing price was 7.2593.

Upstream raw material USD market price

Ethylene Asia: CFR Northeast Asia 855 USD/ton; CFR Southeast Asia 920 USD/ton.

Propylene Northeast Asia: FOB Korea average price 800 USD/ton; CFR China average price 820 USD/ton, down 5 USD/ton.

North Asia frozen cargo prices, propane at $615-$617 per ton; butane at $601-$603 per ton.

The CIF price for South China frozen goods in April is as follows: Propane $620-622/ton; Butane $605-607/ton.

The frozen cargo arrival price in the Taiwan region, propane is $615-$617 per ton; butane is $601-$603 per ton.

【LDPE USD Market Price】

Film: $960/ton (CFR Huangpu)

Injection molding: $1,010/ton (spot in Dongguan Bonded Zone);

【HDPE US Dollar Market Price】

Film: $935-950/ton (CFR Huangpu);

Hollow: $900-$965 per ton (CFR Huangpu);

Injection molding: $830 per ton (CFR Huangpu).

LDPE USD Market Price

Film: $1130-1135/ton (CFR Huangpu), down $5/ton;

Coating: $1360 per ton (CFR Huangpu).

PP USD Market Price

Homopolymer: $935-$970/ton (spot), down $30/ton;

Co-polymer: $995-1060/ton (CFR Huangpu spot).

Film material: $1105/ton (CFR Huangpu).

Transparent: $1040/ton (CFR Huangpu spot), up $20/ton;

Tubing: $1,160 per ton (CFR Shanghai).

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track