Industry Turning Point? Water Shares Suddenly Announce Postponement

Guoen Co., Ltd. has just announced its entry into PEEK and other special engineering plastics, while Water Co., Ltd. announced a project delay of two years. Why is this happening?

On August 1, Water Group issued an announcement, agreeing that under the condition that there is no change in the project implementation entity and the use of raised funds, and the total project investment and construction scale remain unchanged,The expected date for the project “Annual Production of 45,000 Tons of Special Polymer Materials Construction Project” to reach its intended usable state has been postponed from August 11, 2025 to August 11, 2027.

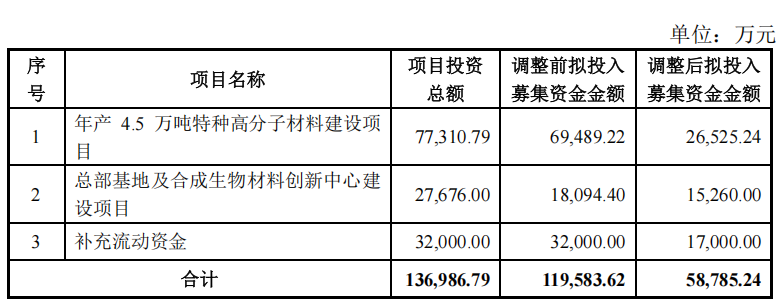

Previously, on May 22, 2023, the company issued RMB ordinary shares (A shares) to specific investors, raising a total fund of no more than RMB 1,195.8362 million, to invest in construction.The project involves the annual production of 45,000 tons of special polymer materials, as well as the headquarters base and the Synthetic Biomaterials Innovation Center project, etc. The actual fundraising for the project...The total amount approved for construction is RMB 599,999,989.68.

According to the plan, upon reaching full production, the high polymer materials project constructed by the wholly-owned subsidiary Chongqing Wat Intelligent New Materials Technology Co., Ltd. will add an annual production capacity of 20,000 tons of liquid crystal polymer (LCP) modified materials, 20,000 tons of polyphenylene sulfide (PPS) modified materials, and 5,000 tons of high-performance polyamide (PPA) resins and modified materials.

On May 22 this year, Waton Corporation announced that its Chongqing Intelligent Base had obtained the "Work Safety Permit," marking the official commencement of production for Phase I and Phase II of the company's 20,000-ton-per-year liquid crystal polymer (LCP) resin materials project, as well as Phase I of the 1,000-ton-per-year polyaryletherketone (PAEK) resin materials project.

As of the end of 2024, the company has an LCP synthetic resin production capacity of 25,000 tons (including the original 10,000 tons, the first phase of 5,000 tons and the second phase of 10,000 tons that have commenced production. Additionally, there is a third phase of 5,000 tons yet to be put into production); the specialty nylon series materials synthetic resin production capacity is 5,000 tons.The designed total production capacity is 10,000 tons.Polyaryletherketone (PAEK) synthetic resin production capacity is 1,000 tons; polysulfone (PSF) has not yet been constructed (planned capacity of 10,000 tons); polytetrafluoroethylene (PTFE) is mainly produced by two subsidiaries, Zhejiang KESAI and Shanghai Woterhua.

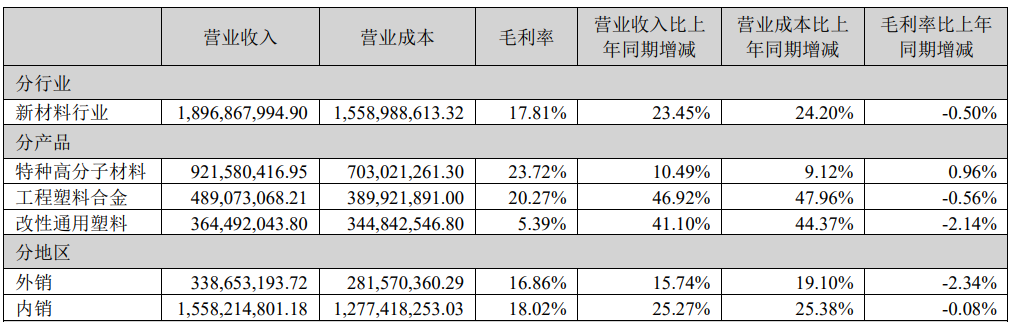

The year 2024,Watts Co., Ltd.The company achieved a total operating revenue of 1.897 billion yuan, representing a year-on-year increase of 23.45% and setting a record high. Net profit attributable to shareholders reached 37 million yuan, a significant year-on-year increase of 520.69%. Net profit excluding non-recurring gains and losses was 27.8283 million yuan, a year-on-year increase of 2,085.60%. Among these, the specialty polymer materials business achieved operating revenue of 922 million yuan, up 10.49% year-on-year, accounting for 48.58% of total operating revenue, and has become an important growth engine for the company’s performance.

The company has not specified the exact reasons for the delay, merely stating that it is due to a comprehensive consideration of changes in the external environment and actual needs. However, based on long-term development and industry trends, and after careful decision-making, the company will continue to advance the implementation of the fundraising investment project.

According to the company's report, the production of special polymer materials in 2023 and 2024 is actually similar, amounting to 15,038.44 tons and15,748.20 tons, with sales volumes of 12,537.19 tons and14,848.39 tons, with no significant growth, which is sufficient relative to the current production capacity. Additionally, the sales price of the company's specialty polymer materials continued to decline in 2023-2024 (with little change in raw material prices). A rough calculation of the average sales price for the next year shows that in 2023 and 2024, it was approximately 66,500 yuan/ton and 62,000 yuan/ton, respectively. This number reached as high as 80,000 in 2022./ton, with a significant decline.

Specialty polymer materials have significant application potential in high-end markets. For example, LCP can be used in air-cooled heat dissipation materials for AI servers, low-loss films for high-frequency and high-speed communication signals, and antennas; PTFE films are used in high-frequency and high-speed PCB circuit boards; and PEEK is used as encapsulation material for stators in rotating motors of robots.

Although the current usage of specialty polymer materials is not large, their high added value is the greatest attraction. However, the modified plastics industry has always been highly competitive, with leading competitors increasing their investments. For example, the most direct competitor, Polyplastics, currently has an annual production capacity of 4,000 tons of LCP resin polymerization, 5,000 tons of LCP blend modification, 3 million square meters of LCP film, and 1,000 tons (1000D) of LCP fiber. Recently, they also announced a new planned capacity of 400,000 tons, involving modified PEEK, PPS, LCP, and carbon fiber reinforced materials. In addition, Kingfa Sci & Tech has a planned capacity of 34,000 tons of specialty engineering plastics, with a capacity utilization rate of 68%, and is constructing 15,000 tons of LCP and 8,000 tons of specialty polyamide.

It is worth mentioning that JuJia Technology, a fellow LCP competitor, posted a loss of 46.3096 million yuan in 2024 and a loss of 6.0929 million yuan in the first quarter of this year. Recently, it sold up to 20.17% of its equity to Landi Group for a total price not exceeding 121 million yuan.

From the perspective of the overall external environment, looking at the global giants that have already released their financial reports for the first half of the year, including BASF, Dow, Covestro, Evonik, and Sinopec.、Arkema, Sumitomo Chemical......Wait, almost all are sharply declining, and almost all outlooks for 2025 believe that globally...The overall economy remains sluggish with no signs of recovery in the short term.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track