Industry Turning Point? Water Co. Suddenly Announces Postponement

Just as Guoen Co., Ltd. announced its entry into PEEK and other special engineering plastics, Water Co., Ltd. announced a project delay—and for two years. Why is that?

[DT New Materials] has learned that on August 1, Water Group Co., Ltd. issued an announcement stating that, under the premise that the project implementation entity and the intended use of the raised funds remain unchanged, and the total project investment and construction scale remain the same, the company has agreed to extend the expected date for the “Annual Production of 45,000 Tons of Special Polymer Materials Construction Project” to reach its intended usable state from August 11, 2025 to August 11, 2027.

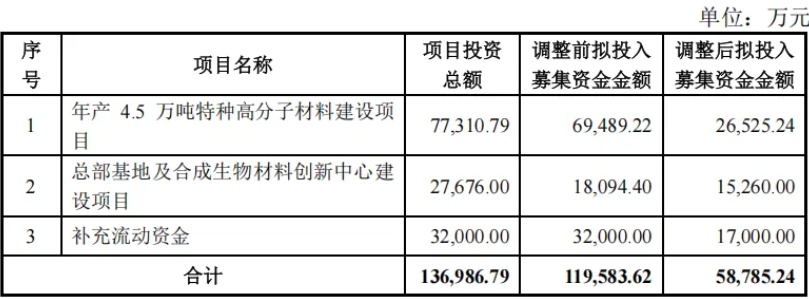

On May 22, 2023, the company issued RMB ordinary shares (A shares) to specific investors, raising a total amount not exceeding RMB 1,195,836,200. The funds were invested in the construction of a special high polymer materials project with an annual output of 45,000 tons, as well as the headquarters base and synthetic biological materials innovation center projects. The actual total raised funds amounted to RMB 599,999,989.68 for the approved construction.

According to the plan, after reaching full production capacity, the polymer materials project constructed by the wholly-owned subsidiary Chongqing Water Intelligence New Material Technology Co., Ltd. will add a production capacity of 20,000 tons per year of liquid crystal polymer (LCP) modified materials, 20,000 tons per year of polyphenylene sulfide (PPS) modified materials, and 5,000 tons per year of high-performance polyamide (PPA) resins and modified materials.

On May 22nd of this year, Water Corporation announced that its Chongqing Intelligent Base had obtained the "Safety Production License," marking the official commencement of production for the first and second phases of the company's project to produce 20,000 tons of liquid crystal polymer (LCP) resin materials annually, as well as the first phase of the project to produce 1,000 tons of polyaryletherketone resin materials annually.

Based on the company’s data as of the end of 2024, the current built production capacity for LCP synthetic resin is 25,000 tons (including the original 10,000 tons, the newly commissioned Phase I with 5,000 tons, and Phase II with 10,000 tons; in addition, there is a planned but not yet commissioned Phase III with 5,000 tons). The built production capacity for specialty nylon series synthetic resins is 5,000 tons (with a designed total capacity of 10,000 tons). The production capacity for polyaryletherketone (PAEK) synthetic resin is 1,000 tons. Polyethersulfone (PSF) has not yet been built (with a planned capacity of 10,000 tons). The production of polytetrafluoroethylene (PTFE) mainly takes place in the subsidiaries Zhejiang Kosei and Shanghai Water Hua Ben.

The company did not specify the reasons for the delay, only stating that it was due to a comprehensive consideration of changes in the external environment and actual needs. However, based on long-term development and industry trends, the company has prudently decided to continue advancing the implementation of the fundraising project.

Currently, modified companies such as Kingfa Sci & Tech (+72%), Pret (+66.65%), Silver Jubilee Tech (+83%), NHU (+70%), and Dawn Polymer (+48%) have all released their first-half forecasts, and overall they are quite positive. As for Water, it still needs to wait for specific data to come out to confirm what has happened or adjust its pace in a timely manner to be prepared, as there are rarely many exceptions in the current trend.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track