In the second quarter, many polypropylene maintenance shutdowns are coming. Which company has the longest downtime?

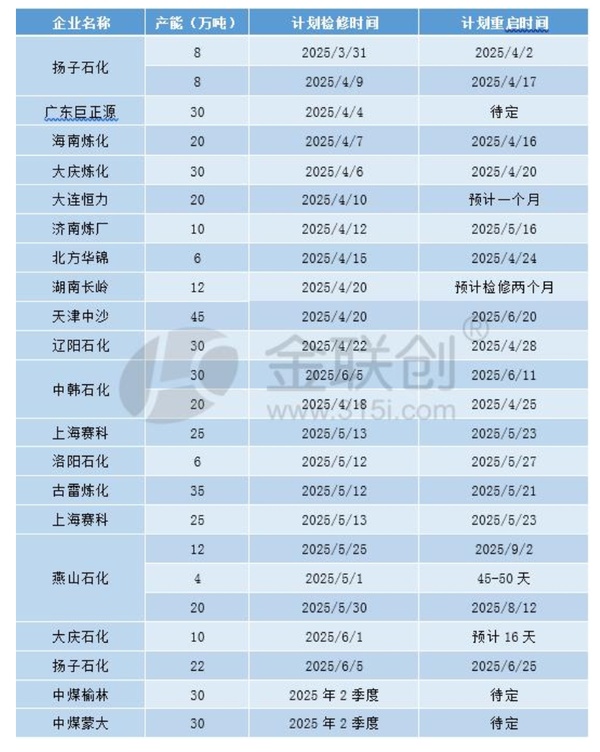

In the second quarter, the overall domestic polypropylene maintenance plans are concentrated, with the total capacity of the facilities reaching 5.02 million tons. Companies such as Yanshan Petrochemical, Tianjin Zhongsha, Zhongmei Yulin, and Zhonghan Petrochemical have maintenance plans, and the maintenance duration is relatively long, which somewhat offsets the supply pressure.

In the second quarter, new maintenance facilities concentrated in Northeast China, accounting for 19.67% of the national total, followed by North China and Northeast China, which accounted for 18.65% and 18.03%, respectively. In the Northeast region, this is mainly due to maintenance plans for facilities such as Daqing Refining & Chemical and Liaoyang Petrochemical, with a total maintenance capacity reaching 960,000 tons; in North China, facilities such as Yanshan Petrochemical, Tianjin Zhongsha, and Jinan Refinery also have maintenance plans, totaling 910,000 tons. Overall, the differences in proportions among regions are not significant, and the overall number of maintenance facilities in the second quarter is relatively high, indicating that supply pressure is expected to ease.

In the second quarter, with the expected commissioning of facilities such as Yulong Petrochemical and ExxonMobil's Huizhou project, production capacity will reach 3.3 million tons, leading to increased supply pressure. However, concentrated maintenance by enterprises in the second quarter may somewhat offset this supply pressure. On the demand side, the traditional operating rates for plastic weaving and plastic film are rising, and favorable policies for the home appliance and automotive industries in the second quarter will further boost demand. Additionally, macroeconomic favorable policies, including continuous easing of monetary policy with expected reserve requirement cuts and interest rate reductions of 1-2 percentage points for the year, will support demand. However, in the second quarter, OPEC+ will gradually restore 2.2 million barrels per day of voluntary production cuts (originally scheduled to expire at the end of March), coupled with rapid increases in crude oil production from South American countries like Brazil and Guyana. The supply and demand situation is expected to tighten first and then loosen in the second quarter, which may lead to a short-term rebound, but the overall outlook remains bearish. The destocking speed in the second quarter is constrained by the slow recovery of terminal demand, and some enterprises may resort to price reductions and promotions to alleviate pressure. Market participants are generally cautious about the overall recovery of demand and are pessimistic about future market trends. Overall, it is expected that the PP market will have limited upward momentum in the second quarter, primarily operating in a weak manner.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track