[in-depth analysis] can yinxi technology turn "p" into "gold"?

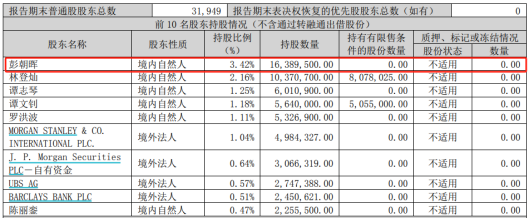

"The giant ship without a captain welcomes a 'star sailor' at the helm? A unique scene is unfolding in the shareholder register of Silver Jubilee Technology: As the label 'no actual controller' announces a dispersion and vacuum of power, prominent investor Peng Chaohui quietly becomes the most dazzling 'key figure' on this technological giant with his commanding shareholding ratio."

First Quarter Report of 2025

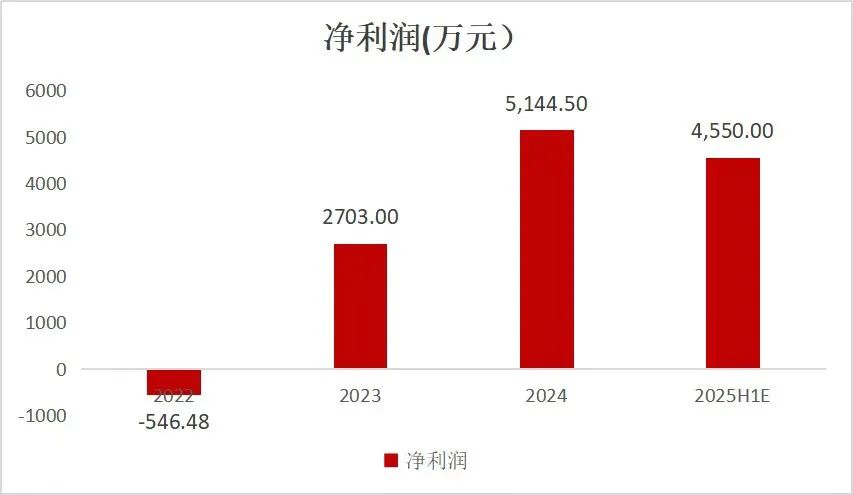

Based on the past development of the company, despite characteristics such as "shrinking revenue scale," "negative net profit," and "depleted cash flow," and not being covered by brokerage firms in the past three years, Yinxi Technology is quietly breaking this fixed pattern and emerging with an alternative model.

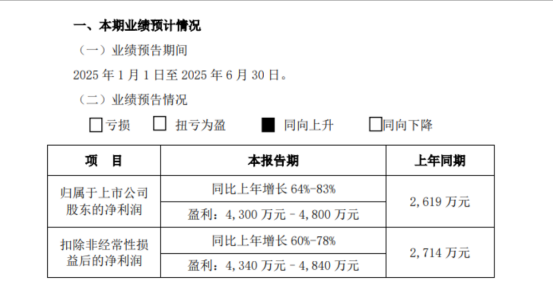

In 2024, Yinxi Technology achieved a revenue of 2.022 billion yuan, marking a year-on-year growth of 21.38%, thus ending a two-year declining trend. The net profit attributable to shareholders was 51 million yuan, up 90.33% year-on-year, while the net operating cash flow amounted to 4.0244 million yuan, a decrease of 92.97% year-on-year. The R&D expenses were 105 million yuan, an increase of 30.14% year-on-year. In the first half of 2025, the company reported a revenue of 1.085 billion yuan, a year-on-year growth of 24%, and expects to achieve a net profit attributable to shareholders between 43 million and 48 million yuan, representing a year-on-year increase of 64% to 83%.

Currently, Yinxi Technology's industrial layout focuses on high-performance polymer modified plastics, intelligent lighting, 3D printing materials, and fine chemicals.

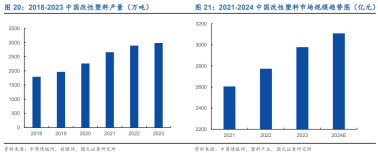

Modified plastics, as one of the "Seven Strategic Emerging Industries" and a key focus area of "Made in China 2025," have received clear expressions of support for their development from a series of policy documents such as the "Industrial Structure Adjustment Guidance Catalog" and the "14th Five-Year Plan." Furthermore, the successive promulgation and implementation of "plastic restriction and ban orders" globally signal the gradual phase-out of traditional plastics, ushering in a golden development period for bio-based modified plastics like PPC.

According to data from China Research & Intelligence, the market size of modified plastics in China is expected to reach 310.7 billion yuan in 2024, representing a year-on-year growth of 6.44% and accounting for 28% of the global market share. It is projected that the market size will exceed 400 billion yuan in 2025, with a compound annual growth rate of 8%-10%. The industry is in an expansion phase, with major growth driven by new energy vehicles, wind and solar energy storage industries, and humanoid robots.

The automotive and home appliance sectors are the most extensive downstream markets for modified plastics. However, affected by the sluggish real estate market, the home appliance industry continues to decline in prosperity. Related companies are actively seeking transformation opportunities by entering emerging sectors such as robotics, new energy, and the low-altitude economy to seek development opportunities.

Faced with intensified industry competition and the increasing demand from downstream manufacturers for high-end products, Yinxi Technology is upgrading and tackling challenges in areas such as halogen-free, lightweight, green, and functional modifications of plastics. The company is vigorously researching materials that are PFAS-free and compliant with the latest national standard S2 flame retardant test. Currently, material solutions like PP, ABS, and PPO that meet these requirements have passed client application verification. Meanwhile, products for special application scenarios, such as high CTI 800V flame retardant PA and ceramic-like plastics, have also been put into mass production.

In addition to upgrading and iterating product technology, Yinxi Technology is simultaneously optimizing its downstream customer structure and actively expanding its business layout. The company is focusing on highly promising fields such as electronics and electrical appliances, low-altitude aircraft, and new types of household service robots (such as drones, swimming pool cleaning robots, automatic lawn mowers, etc.). It has also deeply established stable customer bases with companies like DJI and Xpeng Huitian. Emerging fields generally have high technical barriers and product added value, with profit margins significantly higher than traditional industries. This undoubtedly injects strong and lasting momentum into the company's performance growth.

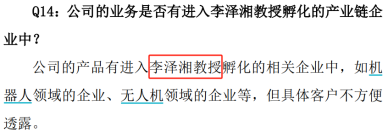

It is worth mentioning that Yinxi Technology's robots and drones have been integrated into companies incubated by Professor Li Zexiang. The strong background of this prominent figure naturally evokes much speculation about the future.

Company Investor Relations Record Table

Source: Baidu Encyclopedia

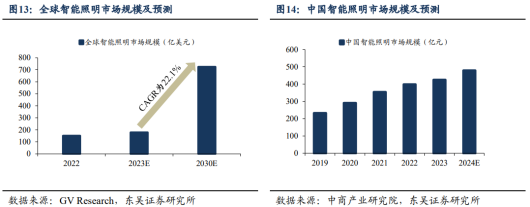

According to data from Guanyan Research, in 2022, the market size of China's smart lighting industry was approximately 42.5 billion yuan, representing a year-on-year growth of 6.78%. It is expected that by 2025, the market size will be 51.2 billion yuan, with a compound annual growth rate of 16.34%.

As a provider of comprehensive smart lighting solutions across the entire industry chain, subsidiary Yinxii Optoelectronics has established an integrated capability system encompassing material research and development, optical design, SMT precision manufacturing, and IoT cloud platform development. Its manufacturing capabilities cover the entire process, including SMT mounting, silicone extrusion, automated assembly, and surface treatment. Core patents such as its independently developed smart dimming algorithm and flexible lighting technology have been applied on a large scale.

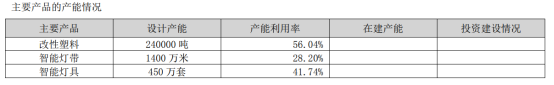

As early as 2018, Yinxi Optoelectronics shifted its focus to the smart home and festive ambience lighting markets. Its product portfolio includes smart light strips, lamps, and light strings, with an annual design capacity of 14 million meters for light strips and 4.5 million sets for lamps. To expand its overseas market footprint, Yinxi Technology established a lighting division in Vietnam, forming a global layout with dual manufacturing bases in China and Vietnam, accelerating capacity release and catalyzing performance growth.

Regular report

According to projections by Huajing Industry Research Institute, the global 3D printing market is expected to reach $29.8 billion by 2025 and $85.3 billion by 2030, with a compound annual growth rate of approximately 23.4%. The industry is in a period of rapid expansion and may form a trillion-dollar materials market in the future.

In 2024, Yingxi Technology's proprietary brand of 3D printing materials will expand its product categories and continue to grow in North America, Europe, and retail platforms, with an enhanced brand effect in the industrial application field. The demand in the B2B market is steadily increasing, and the industrial 3D printing materials have passed customer testing and are gradually being industrialized. Meanwhile, the industrial 3D printing powder materials are entering the market, with collaborations on materials such as TPU and PA12 powder with several open-source SLS equipment manufacturers and application service providers.

The company has introduced high-speed PLA and fast printing materials in material development, gaining recognition and orders from domestic and international customers. In 2024, it will participate in the Formnext exhibition in Frankfurt, Germany, where its industrial 3D printing materials and industry standards have been recognized by professional customers.

3D Printed Products from the CompanySource: Company Website

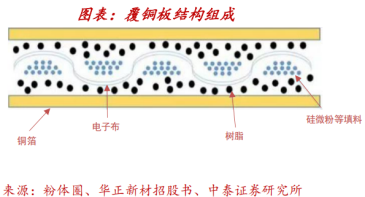

Copper Clad Laminate (CCL) is an essential component of electronic devices, primarily composed of copper foil, resin, electronic cloth, silicon micropowder, and other fillers, with resin accounting for 26% of the CCL cost. The key properties of CCL, such as flame resistance, heat resistance, moisture and heat resistance, dimensional stability, dielectric properties, and environmental characteristics, are fundamentally determined by the electronic resin.

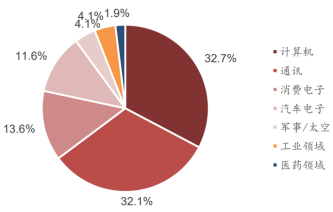

The primary substrate of a PCB (Printed Circuit Board) is the copper-clad laminate, which integrates the three major functions of conduction, insulation, and support. It enables the interconnection between electronic components and is widely used in terminal fields such as communications, computers, automobiles, and industrial control. It is known as the "mother of the electronics industry."

Huatai Securities

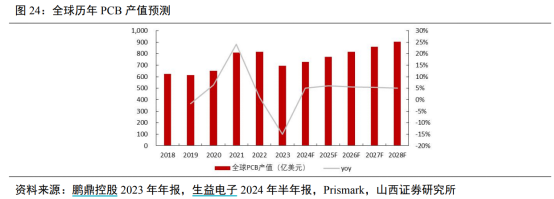

According to Prismark data, the global PCB output value in 2024 is USD 73.565 billion, representing a year-on-year growth of 5.8%. It is expected to reach USD 94.661 billion by 2029, with a compound annual growth rate of 5.2%. As the destocking phase comes to an end and the demand from AI services, consumer electronics, and other downstream sectors is stimulated, PCBs may usher in a new growth cycle.

In recent years, with the advancement of AI servers and communication technology, the bandwidth and capacity of data transmission have increased exponentially. This has significantly raised the requirements for the signal transmission rate and transmission loss of copper-clad laminates, driving their development towards high frequency and high speed.

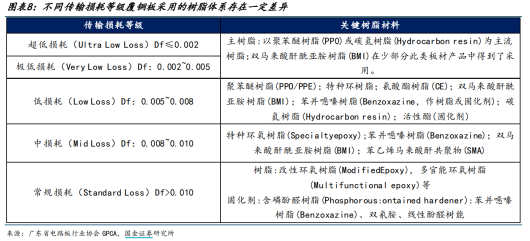

In high-frequency and high-speed environments, signal attenuation is severe, and the characteristics of copper-clad laminate materials can also affect and limit signal transmission, leading to signal distortion or loss. Signal transmission loss mainly stems from conductor loss and dielectric loss, where dielectric loss is proportional to the dielectric constant (Dk) and dielectric loss factor (Df) of the dielectric material. Meanwhile, signal transmission delay is proportional to the Dk of the dielectric material. To reduce signal transmission loss and delay, high-frequency and high-speed copper-clad laminates require the substrate materials to have lower Dk and Df values.

Traditional epoxy resin is a widely used substrate material for copper-clad laminates, but due to technological advancements, its dielectric performance disadvantages have become apparent (Dk>4). Consequently, various resins such as cyanate ester resin (CE), bismaleimide resin (BMI), polyphenylene oxide (PPO), and polytetrafluoroethylene (PTFE) have gradually replaced it. Among them, PPO and PTFE have excellent dielectric properties, making them popular choices for resin substrates in the current copper-clad laminate industry. However, PTFE is difficult to process and has high processing costs, which makes it challenging for large-scale application in copper-clad laminates.

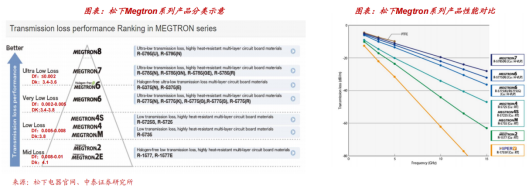

The Panasonic "MEGTRON" series is a benchmark in the high-speed copper-clad laminate field, with a product system ranging from MEGTRON 2 (M2) to MEGTRON 8/8S (M8/8S). By reducing Dk and Df, the goal of lowering transmission loss is ultimately achieved. The Df values of M6/7 are between 0.002-0.005 and less than 0.002, respectively, with Dk values ranging from 3.4-3.6, achieving Very Low Loss and Ultra Low Loss levels. These can be used in 5G and other communication infrastructure equipment and supercomputers. The Df of M8/8S is between 0.0012-0.0016, with Dk values ranging from 3.08-3.22, achieving an Ultra Low Loss level. These can be used in AI servers, switches, optical transmission equipment, etc., but have not yet reached mass production.

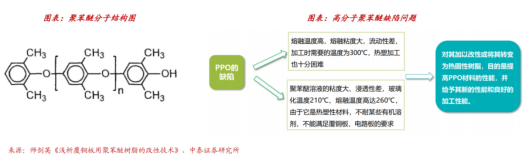

The molecular structure of PPO is symmetrical, containing a large number of rigid benzene rings and numerous side methyl groups, which makes the molecular chain rigid and free of strong polar groups. These structural characteristics confer PPO resin with a high glass transition temperature and high thermal decomposition temperature, as well as low dielectric constant and low dielectric loss. Moreover, its dielectric properties are almost unaffected over a wide range of temperature and frequency variations. These characteristics make PPO resin one of the highly compatible matrix resins for copper-clad laminates.

However, PPO resin is a high molecular weight thermoplastic resin with poor flowability and cannot cure by itself. It also has poor resistance to chlorinated hydrocarbons and aromatic solvents. When mixed with epoxy resin for use as a PCB substrate, phase separation can occur, leading to a decline in material performance. Therefore, it is necessary to adjust its molecular weight (reduce the molecular weight to enhance processability) and modify it to be curable (introduce non-polar cross-linking groups) to better apply it in the preparation of high-frequency high-speed copper clad laminates.

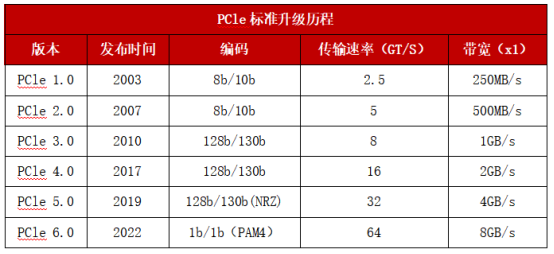

PCIe (Peripheral Component Interconnect Express) is a high-speed serial computer expansion bus standard that serves as the data transmission channel between different components of a computer system, such as data transfer between the CPU and GPU or other accelerator processors. Its core performance depends on the transfer rate and bandwidth. The upgrade and iteration in fields such as AI servers, smart driving, and data centers demand higher transmission rates from PCIe, driving its evolution and upgrade.

Currently, PCIe 3.0 and PCIe 4.0 still occupy the majority of the market share, but PCIe 5.0 has become a focal point for competition and development among major manufacturers, with a transmission rate of 32 GT/s. As product costs are optimized and demand for high-end terminal devices increases, the mainstream value of PCIe 5.0 is becoming more prominent. The final version of PCIe 7.0 is expected to be released in 2025.

Brokerage Research Report

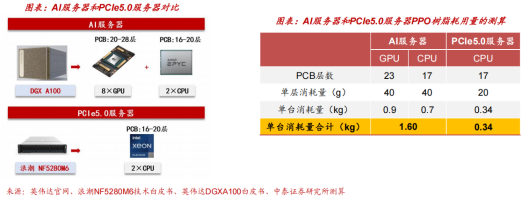

The improvement in PCIe transmission speed drives the usage and dielectric performance of PCBs. Layers: Compared to regular servers, AI servers have added GPU acceleration cards. AI servers use PCBs with 20-28 layers, PCIe 5.0 servers have 16-20 layers, and regular servers have 12-16 layers. Area: The GPU module requires a larger PCB for the module board, driving an overall increase in size. According to the patent documentation of Nord New Material, manufacturing one piece of prepreg requires approximately 15-50g of PPO resin. The PCB single-layer consumption for AI server GPU, CPU motherboard, and PCIe 5.0 server CPU motherboard is approximately 40g, 40g, and 20g respectively. Therefore, the PPO consumption for a single AI server and a PCIe 5.0 regular server is approximately 1.60kg and 0.34kg respectively.

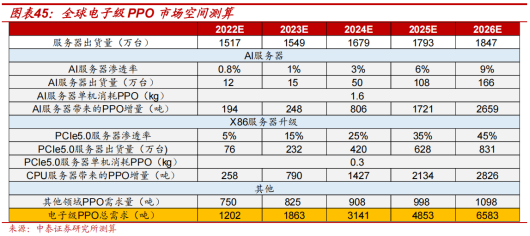

According to the research report by CITIC Securities, the global server shipments for 2023-2025 are expected to be 15.49 million, 16.79 million, and 17.93 million units, with a CAGR of 5.7%. Among them, the penetration rate of AI servers will gradually increase from 0.8% in 2022 to 3% in 2025, reaching 540,000 units. The penetration rate of PCIe 5.0 servers will increase from 5% in 2022 to 65% in 2025, reaching 11.65 million units.

The PPO consumption for a single AI server and a PCIe 5.0 standard server is 1.60 kg and 0.34 kg, respectively. As a result, it is anticipated that the global demand increase for PPO resin due to the upgrade of AI servers and PCIe 5.0 servers will reach 2,659 tons and 2,826 tons, respectively, by 2025.

According to a report by Caixin, in 2022, SABIC, as the world's only mainstream supplier of electronic-grade PPO, had sales of only about 1,000 tons. After excluding the demand from the server sector, it is estimated that the demand from other sectors (such as optical modules and switches) in 2022 was approximately 500-1,000 tons, with an average demand of about 750 tons. Since the demand for PPO from other sectors is relatively limited, it is assumed that the demand in these sectors will maintain a growth rate of about 10% over the next three years. In summary, it is predicted that the global demand for electronic-grade PPO resin will increase to 4,853 tons by 2025.

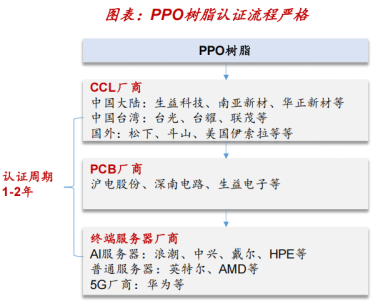

As an ideal structural material, PPO has undergone several generations of technological innovation since its inception, but globally, only five companies have truly mastered the technology for industrial production of ten thousand tons of PPO. This is closely related to the two major barriers of PPO resin development and certification.

Product development barriersElectronic resins need to match the process characteristics and operational window of copper-clad laminates, such as the reactivity and rheological properties of epoxy resin during the impregnation and lamination stages of copper-clad laminate production.

Customer Authentication BarriersCustomer certification is rigorous and the certification cycle is long. The certification cycle for copper-clad laminate customers usually takes 3-6 months, while materials certification for terminal equipment manufacturers typically requires 1-2 years. After passing the certification, customers also need to conduct small batch trial production before proceeding to large-scale use. Due to considerations of product quality stability, conversion costs, and other factors, customers are unlikely to change suppliers easily.

China-Thailand Securities Research Report

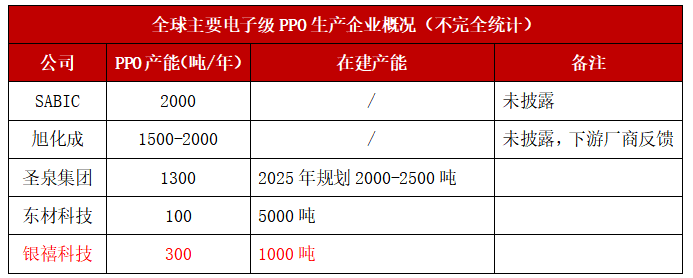

General Electric (GE) in the United States was the first to industrialize PPO, and in 2008, SABIC (Saudi Basic Industries Corporation) acquired GE's engineering plastics division, becoming the world's largest PPO producer. Currently, the main global PPO suppliers include SABIC, Asahi Kasei, Mitsubishi Gas Chemical, Shengquan Group, and Nantong Xingchen. In terms of production capacity, SABIC has an annual electronic-grade PPO capacity of about 2,000 tons, Asahi Kasei 1,500-2,000 tons, and Shengquan Group about 1,300 tons.

Periodic report, Zhongtai, Guojin Securities

Research and DevelopmentZhaoqing Yinxi Juchuang, a subsidiary, has mastered the complete synthesis process of PPO. By utilizing PPO raw powder as a base material and employing a melt blending technique with PS, they have developed high-flow, halogen-free flame-retardant PPO materials for injection molding. The performance is comparable to SABIC, yet at half the price. The batch stability (Dk fluctuation < 0.02) reaches international standards, meeting the stringent consistency requirements of AI servers. Currently, the product technology has been certified by Shengyi Technology and Linkchem, with Shengyi Technology's monthly supply reaching approximately 15 tons.

Production capacity layoutThe Zhaoqing base's PPO production capacity is restricted by the Class A workshop to 300 tons per year and is still in the ramp-up phase. Meanwhile, Yinxi Technology plans to launch a PPO project in Zhongshan, with the site already confirmed and a planned production capacity in the kiloton range. Industry insiders expect that after the expansion, the PPO business will contribute more than 700 million yuan in gross profit.

Supply chainYinxi Technology's PPO resin has been integrated into Taiguang Electronics' supply chain by Shengyi Technology, with the end application being Nvidia GPU substrates. The electromagnetic shielding materials from its Vietnamese subsidiary are directly supplied to Amphenol (a core supplier of Nvidia high-speed connectors), indirectly supplying Nvidia.

According to the company's report, it seems that the company may be emerging from its deep quagmire. From the company's semi-annual report forecast, the profit for the half-year has increased by 64% to 83% year-on-year. The gross profit margin also shows an upward trend from the first quarter, as the company gradually transitions its products towards high-end customization, coupled with the gradual release of new materials. Perhaps the company's downward trend is expected to continually alleviate.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics