Improved Supply and Demand Margins Boost Confidence, Polyethylene Expected to Trend Stronger

Review

This week, the polyethylene market showed a strong trend, with an increase of 10-40 yuan/ton. Although supply remained high this week, the pressure is expected to ease as more maintenance facilities are added. Downstream demand continues to rise, with increased purchasing power, and the inventory in social sample warehouses has shifted from rising to falling. Especially now, as demand transitions from the off-season to the peak season, it has boosted market sentiment. Low prices in the market are gradually decreasing, and the price center has slightly moved up. As of August 14th, the mainstream price for linear low-density polyethylene in North China is between 7230-735. 0 CNY/ton.

Recent Focus Points in the Polyethylene Market:

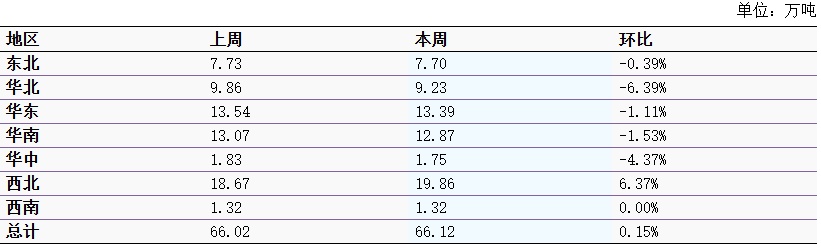

1、 This week, polyethylene production reached 661,200 tons, an increase of 1.15% compared to last week. Among them, the production in the Northwest region saw a significant rise of 6.37%, while the production in the North China region experienced a notable decline of 6.39%.

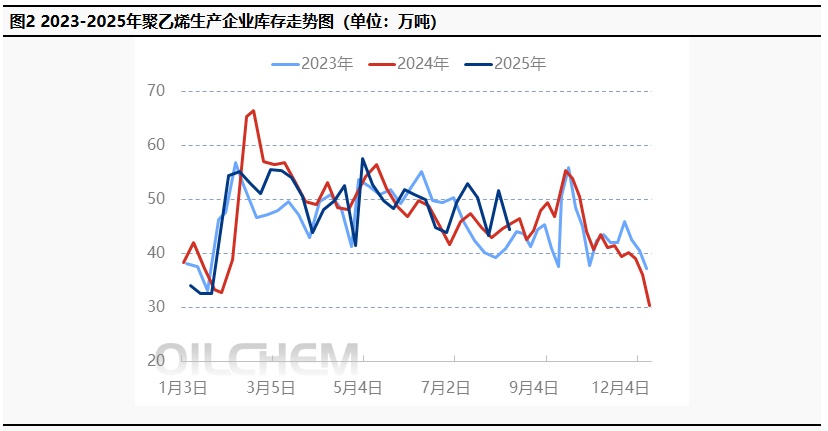

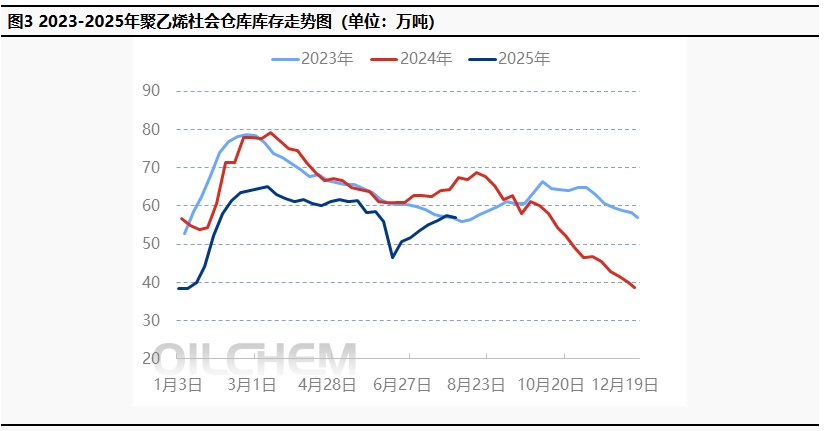

2、 This week, the sample inventory of polyethylene production enterprises in China was 444,500 tons, down 70,900 tons from the previous period; the sample inventory in social warehouses was 568,600 tons, down 7,000 tons from the previous period.

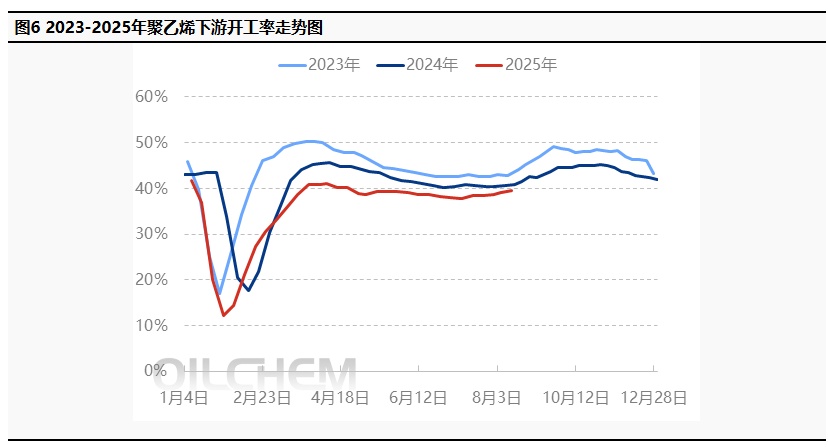

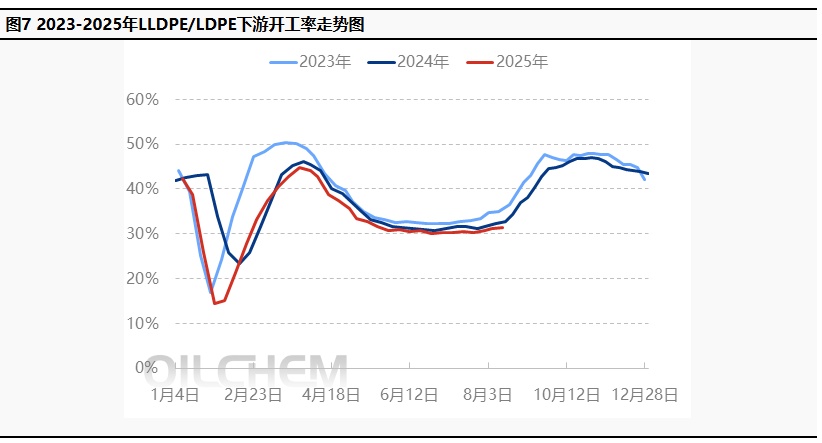

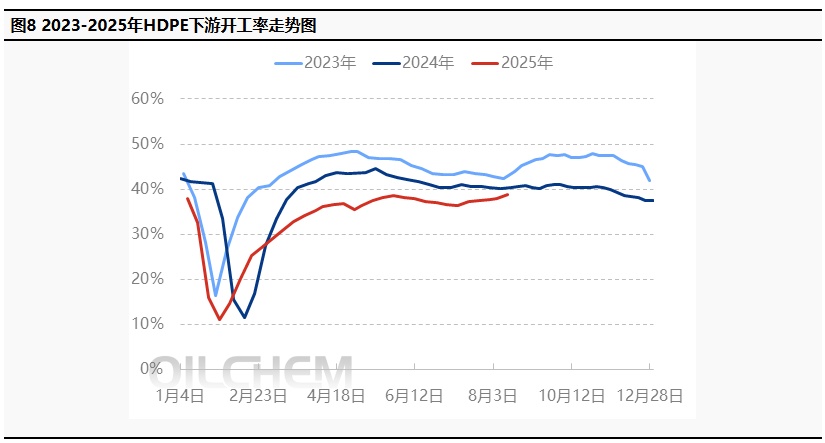

3、 The overall operating rate of downstream industries of polyethylene this week is 39.47%, up 0.35% compared to last week.

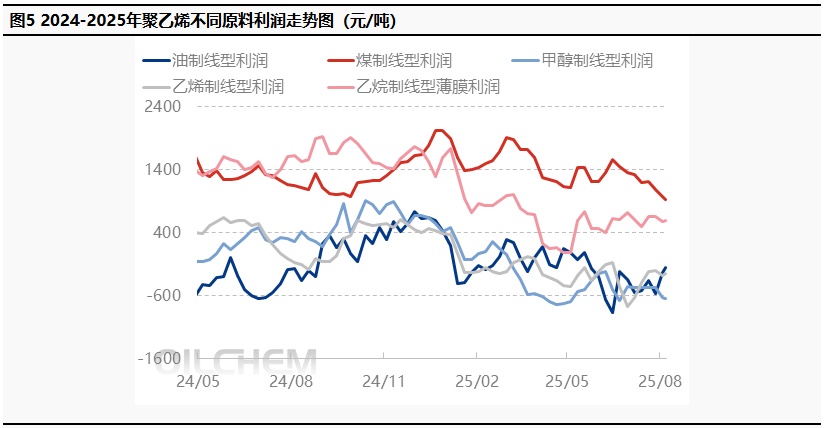

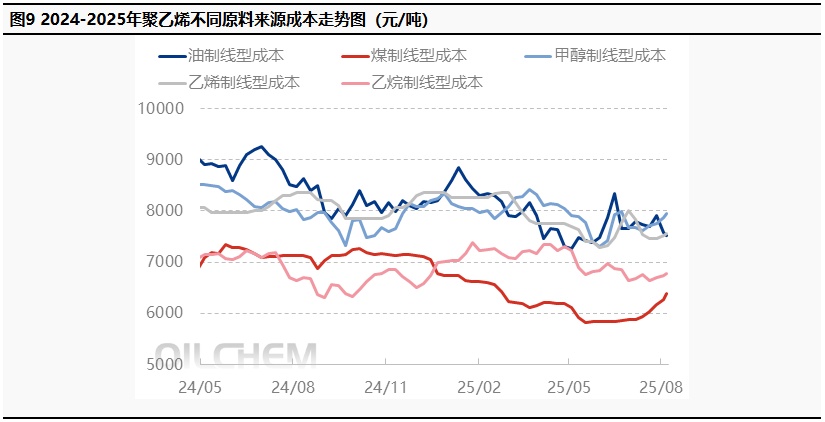

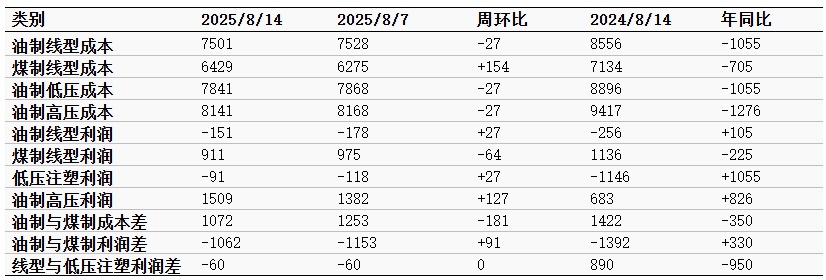

4、 Polyethylene profit adjustments: oil-based profits increased by 49.16%, while coal-based profits decreased by 6.96%.

5、 This week, the USD prices in the Chinese market showed mixed fluctuations, rising and falling between 5-12.5 USD/ton. LDPE prices are in the range of 1020-1060 USD/ton, and LLDPE prices are in the range of 820-880 USD/ton.

1. Supply pressure may ease while demand grows slowly, leading to a strong upward trend in polyethylene prices.

Prediction With the recent increase in maintenance of facilities, supply is expected to decline next week. Inventory at social sample warehouses has begun to decrease, and market sentiment is expected to remain relatively strong. Downstream demand continues to gradually improve, transitioning towards the peak season, which gives the market some confidence. Recent news signals have weakened, and costs are expected to stabilize, awaiting further guidance. Therefore, in the short term, the supply and demand margin for the polyethylene market is improving next week, confidence is strengthening, and the trend is expected to be bullish. The mainstream price range for the North China linear product is between 7,250 and 7,400 yuan per ton.

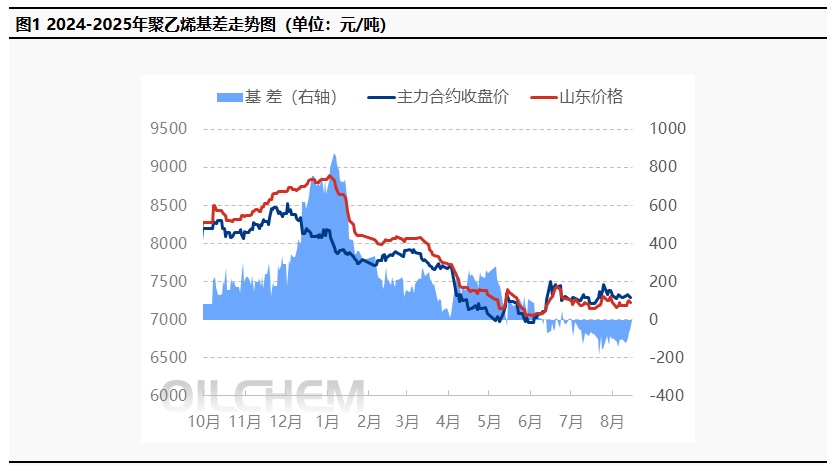

This week, the plastic basis slightly strengthened. The fundamentals gradually improved, and the spot market showed firm performance. Futures were more influenced by macro factors, experiencing a slight downward correction, while the basis slightly strengthened.

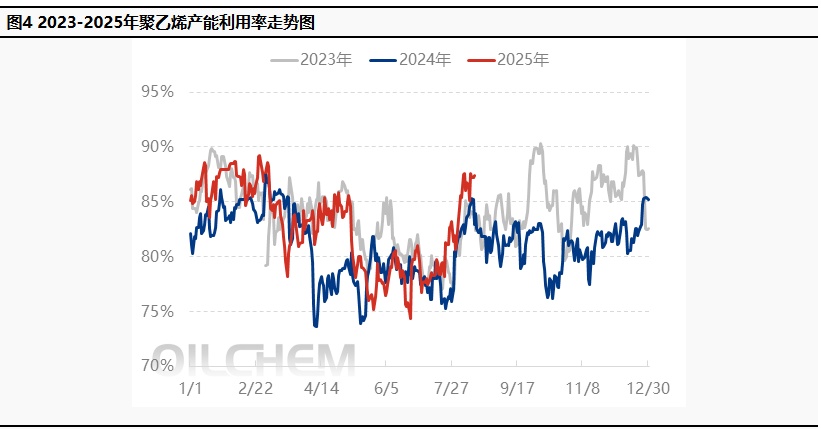

This week, domestic polyethylene production saw a slight increase, with a rise of 0.14%. The shutdown and maintenance at Fushun Petrochemical were brought forward, resulting in supply not increasing as expected. In terms of raw material sources, coal-based polyethylene production increased significantly by 2.49%, while oil-based polyethylene production decreased by 0.99%. With more plants shutting down recently, supply is expected to decrease next week.

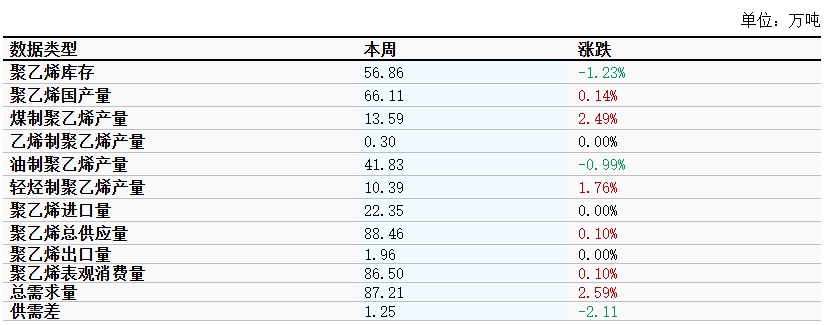

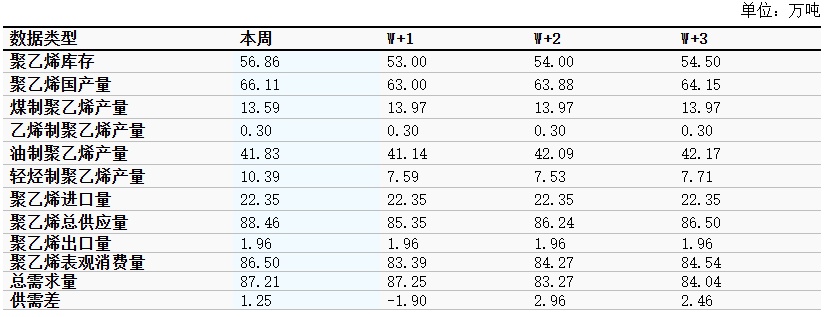

Table 1 Weekly Supply and Demand Balance Sheet of Domestic Polyethylene

Data period: Thursday last week to Wednesday this week

2. The shift from rising to falling inventory in the social sample warehouse boosts sentiment.

Prediction The sample inventory of polyethylene production enterprises in China is expected to be around 420,000 tons next week, with inventory anticipated to continue declining. The main reasons are that downstream factories are expected to maintain an upward trend in operating rates, and intermediaries' confidence has strengthened, leading to increased purchasing expectations. Additionally, due to recent shutdowns and planned maintenance of multiple units, supply is expected to decrease. With demand increasing and supply decreasing, the inventory of production enterprises is expected to decline.

Regarding the inventory of the social sample warehouse in the next cycle, Currently, there is little change in the fundamentals, and the market is mostly waiting for changes in demand in late August. In the absence of directional guidance, the market continues to fluctuate, and inventory may continue to slightly increase or decrease.

This week The sample inventory of polyethylene production enterprises in China is 444,500 tons, a decrease of 70,900 tons from the previous period, representing a month-on-month decline of 13.76%. The inventory trend has shifted from rising to falling. This is partly due to a slight increase in the operating rate of downstream factories, which has strengthened purchasing efforts, and partly due to production enterprises actively reducing inventory with cautious price increases. Additionally, traders have increased confidence in the market outlook, leading to greater enthusiasm in placing orders, thereby facilitating the smooth transfer of inventory from production enterprises.

up to 2025 Year 8 Moon 8 On the day, the polyethylene social sample warehouse inventory was 56.86 Ten thousand tons, down compared to the previous period 0.70 Ten thousand tons, month-on-month decrease 1.22% Compared to the same period last year -11.66% China Polyethylene Import Warehouse Inventory Month-on-Month Comparison -1.87% Year-on-year decrease 20.70% By product category, HDPE Month-on-month change of social sample warehouse inventory -4.31% Compared to the same period last year, it is lower. 60.48% ; LLDPE Month-on-month change of social sample warehouse inventory 2.27% ...year-on-year increase 63.58% ; LDPE Social sample warehouse inventory month-on-month -2.09% Compared to the same period last year, it is higher. 109.52% The market supply and demand situation has not changed significantly, and end users continue to purchase according to their needs, with inventory showing slight fluctuations.

During the current period (August 8th to August 14th), polyethylene production reached 661,200 tons, an increase of 1.15% compared to the previous week. Among them, production in the Northwest region saw a significant rise of 6.37%, while the North China region experienced a notable decline of 6.39%. There were fewer unplanned shutdowns in August, with maintenance loss estimated at 413,600 tons, a week-on-week decrease of 18.38% and a year-on-year increase of 13.28%.

Table 2 Weekly Polyethylene Production by Region in China

Data period: from last Friday to this Thursday

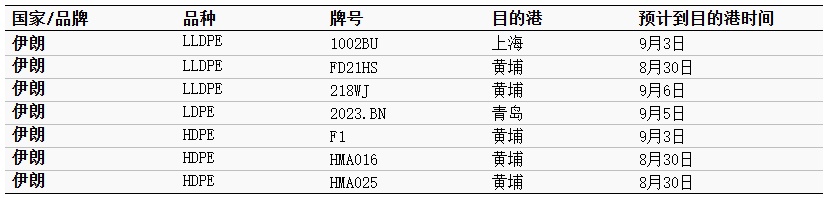

This week, the US dollar in the Chinese market showed mixed fluctuations, with a range of 5-12.5 USD/ton. As of now, LDPE prices are between 1020-1060 USD/ton, and LLDPE prices are between 820-880 USD/ton.

Overall, market offers during the week remained limited, with sporadic offers from the US and India. However, due to expectations of an increase in domestic supply in the future, importers remained cautious in accepting offers. Continued attention should be paid to overseas regional price differences, new offers, and demand conditions. It is expected that China's USD prices will mainly fluctuate within a narrow range.

Table 3 Comparison of Price Differences Between Imported and Domestic Polyethylene Resources

Table 4 Polyethylene Import Shipping Schedule Details

3. The downstream agricultural film is entering a phase of seasonal demand transition, and the continuity of packaging film orders is relatively poor.

Prediction Next week, the operating rate of downstream industries is expected to slightly decline, with a decrease of about 0.57%. Specifically, the operating rate for agricultural film and injection molding industries is expected to rise by less than 1%, the pipe industry is expected to remain stable, the operating rate for the packaging film hollow industry is expected to decrease by 1%, and the operating rate for the wire drawing industry is expected to decline by 2.5%. The agricultural film industry is entering a phase of seasonal demand transition, and the continuity of orders for the packaging film is relatively poor.

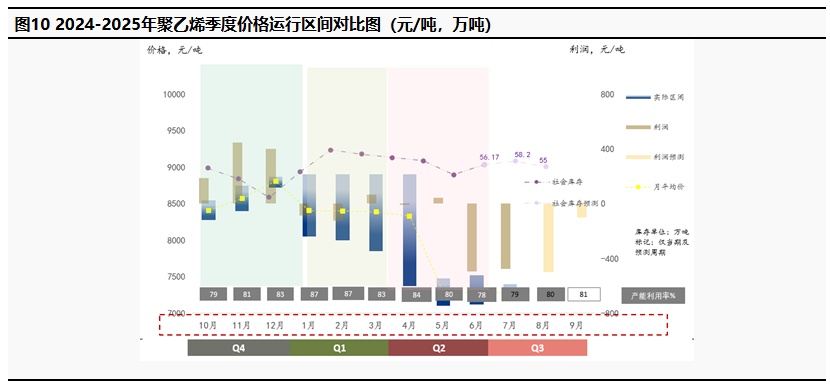

1 Both supply and demand have slightly increased, with prices making narrow adjustments.

![[聚乙烯]:供需边际好转信心增强 聚乙烯预计走势偏强 [聚乙烯]:供需边际好转信心增强 聚乙烯预计走势偏强](https://oss.plastmatch.com/zx/image/678cff66be724034b8c2cbcf53c8ade5.png)

Instructions: Translate the above content into English, directly output the translation without any explanations.

Price unit: RMB/ton

Price Cycle: Weekly Average Price (from last Friday to this Thursday)

Product Pricing Area: Mainstream Prices in the Domestic Market

From the perspective of upstream and downstream transmission, cost-side support was below expectations, with international crude oil maintaining a downward trend. Both polyethylene capacity utilization and downstream operating rates saw a slight increase, transactions began to improve, and inventory slightly decreased, leading to a narrow adjustment in polyethylene prices. Among them, HDPE prices fell by 0.30%, LDPE prices rose by 0.69%, and LLDPE prices increased by 0.33%. Polyethylene profit adjustments showed that oil-based profits rose by 49.16%, while coal-based profits decreased by 6.96%.

2 Although the operating rate downstream has slightly rebounded, it still remains relatively weak compared to the same period in previous years.

This week, the overall operating rate of downstream industries for polyethylene is 39.47%, up by 0.35% compared to last week. It is expected to decrease by 0.57% next week.

In the agricultural film industry, the operating rate is 13.82%, an increase of 0.75% compared to the previous period. The order follow-up speed in the greenhouse film market remains slow. Although there has been a slight increase in the operating rate of enterprises, it still appears weaker compared to the same period in previous years. In terms of mulch film, some companies have recently received tender orders, which has slightly improved operating conditions and boosted the average production level of mulch film.

PE In the packaging film industry, the operating rate is 49.07%, a decrease of 0.22% compared to the previous period. Some rigid demand orders are executed with cyclical delivery, while supplementary short-term agreements for daily chemical packaging products are limited. Industrial packaging consumption remains relatively weak, terminal inventory levels are low, and the number of order scheduling days has decreased, resulting in insufficient momentum to support an increase in the operating rate, which has slightly declined on a month-on-month basis.

4. The expectation of easing geopolitical tensions has weakened support for oil prices.

Predict OPEC+ maintains increased production, major oil-producing countries see output growth, and the U.S. summer travel peak boosts end-user demand. Geopolitical tensions have eased compared to previous periods. The Federal Reserve is not expected to cut interest rates in August, and the U.S. dollar has weakened. International oil prices are expected to decline next week, with WTI likely to fluctuate between $59-62 per barrel and Brent between $62-65 per barrel. The anticipated easing of geopolitical tensions has weakened support for oil prices.

This week, the cost difference between oil-based and coal-based polyethylene narrowed by 514 yuan/ton, and the profit difference widened by 524 yuan/ton, with profits mainly increasing. Only the coal-based linear profit decreased, with a decline of 55 yuan/ton. (Point value comparison)

Table 5 Domestic Polyethylene Market Cost and Gross Profit Analysis Table

5. Marginal improvement in supply and demand boosts confidence, polyethylene is expected to have a strong trend.

Recent key focuses: the strength of inventory reduction at social warehouses, the intensity of restocking in downstream sectors, the extent of supply reduction, cost-side support, and macro-level guidance.

Table 6 Forecast of Domestic Polyethylene Market Supply-Demand Balance

Supply: In the next 1-3 weeks, domestic polyethylene supply is expected to decrease first and then increase. The low point will be 630,000 tons in the first week, and the high point will reach 641,500 tons in the third week. Recently, there are more shutdown and planned shutdown units, so a slight decrease in supply is expected.

Demand: Next week, the downstream operating rate is expected to slightly decline, with a decrease of 0.57%. By product category, the operating rates of agricultural film and injection molding industries are expected to increase by less than 1%, the pipe industry operating rate is expected to remain stable, the packaging film and hollow film industry operating rate is expected to decline by 1%, and the drawing industry operating rate is expected to decline by 2.5%. Agricultural film is entering a seasonal demand transition phase, and packaging film orders have poor continuity.

Agricultural Film: The average operating rate of agricultural film enterprises has increased by about 1%. As the agricultural film market enters a seasonal transition in demand, the follow-up of market orders is insufficient, and the increase in operating rates at production enterprises has not met expectations. Most PE raw materials are purchased based on orders, and it is expected that the operating rates of enterprises may fluctuate slightly in the short term.

PE Packaging Film: The average operating rate of PE packaging film enterprises has slightly declined by about 1%. Most packaging orders show poor continuity, with many accumulated orders delivered in batches. Additionally, the profit margin of some products is currently low. Enterprises maintain low levels of finished product inventory and produce according to orders. The operating rate is expected to remain stable or slightly decrease in the short term.

Cost aspect:

Crude Oil: OPEC+ maintains production increase, with major oil-producing countries seeing production growth. The US summer travel peak season drives end-user demand. The geopolitical situation has eased compared to the previous period. The Federal Reserve will not cut interest rates in August, and the US dollar is weakening. It is expected that international oil prices may decline next week, with WTI likely trading in the range of $59-62 per barrel and Brent in the range of $62-65 per barrel. The easing geopolitical situation reduces support for oil prices.

Ethylene: There will be no new circulation volume released next week, and the market will continue to maintain a tight supply balance. Meanwhile, downstream production demand will continue to support the willingness to purchase externally. Overall, ethylene prices may be relatively strong in the upcoming cycle. In the dollar market, downstream buying interest remains driven by just-in-time needs, and the strength of dollar price increases is limited.

Conclusion (Short-term)With the recent increase in maintenance of production units, supply is expected to show a downward trend next week. Inventory in social sample warehouses has started to decrease, and market sentiment is likely to remain relatively strong. Downstream demand continues to rise slowly as the market transitions to the peak season, giving the market a certain level of confidence. Recently, news-based guidance has weakened, and costs are expected to stabilize, awaiting further direction. In the short term, the supply and demand situation in the polyethylene market is expected to improve marginally next week, with increased confidence. The market is expected to be relatively strong, with mainstream linear prices in North China ranging from 7,250 to 7,400 yuan per ton.

Conclusion (Medium to Long Term)In September, only Tarim Petrochemical, Zhenhai Refining & Chemical, and Shanghai SECCO will shut down HDPE units for maintenance, with no plans to commission new units. Import volumes are expected to show a decreasing trend, and supply is gradually returning. There is an expectation of improvement in downstream demand, with a quicker transition to the peak season, providing some support. Social sample warehouse inventories are also in a seasonal decline, while the macroeconomic outlook awaits further guidance. Therefore, in the medium to long term, the polyethylene market is expected to fluctuate and rise in September.

Risk Warning:

Upside risks: 1. Downstream factories replenish inventory more aggressively than expected. 2. Increase in shutdown devices leads to a larger-than-expected reduction in supply. 3. Inventory in sample warehouses across society continues to decline. 4. Continuous release of positive macroeconomic signals boosts sentiment. 5. Strengthening support from the cost side.

Downside risks: 1. Downstream factories' restocking efforts fall short of expectations. 2. Accumulation of inventory in social sample warehouses. 3. Delays in the shutdown of production enterprises. 4. No guidance from macroeconomic data. 5. Weakening support from the cost side.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track