Impact of the Shutdown of EU and Japan TDI on the Industry

Background Brief

In July 2025, Covestro's Dormagen plant, a German chemical giant, was forced to suspend its 300,000-ton-per-year TDI production due to a chlorine supply disruption caused by a substation fire. This event not only instantly crippled 55% of Europe's TDI supply but also triggered a chain reaction.

Starting in mid-July, two key TDI units in Northwest China underwent emergency maintenance for 35 days; Wanhua Chemical's plant in Fujian also halted production for maintenance. On July 27, a chlorine gas leak occurred at Mitsui Chemicals' plant in Omuta, Japan, leading to the emergency shutdown of its TDI unit. Earlier, in May, after a planned two-month shutdown for maintenance, its TDI capacity was permanently reduced from 120,000 tons/year to 50,000 tons/year. The capacity reductions of these important facilities have created significant ripples in the global TDI market, profoundly impacting the supply-demand structure and the industrial chain.

01

The consecutive shutdowns of overseas facilities have led to a supply gap, causing significant price fluctuations.

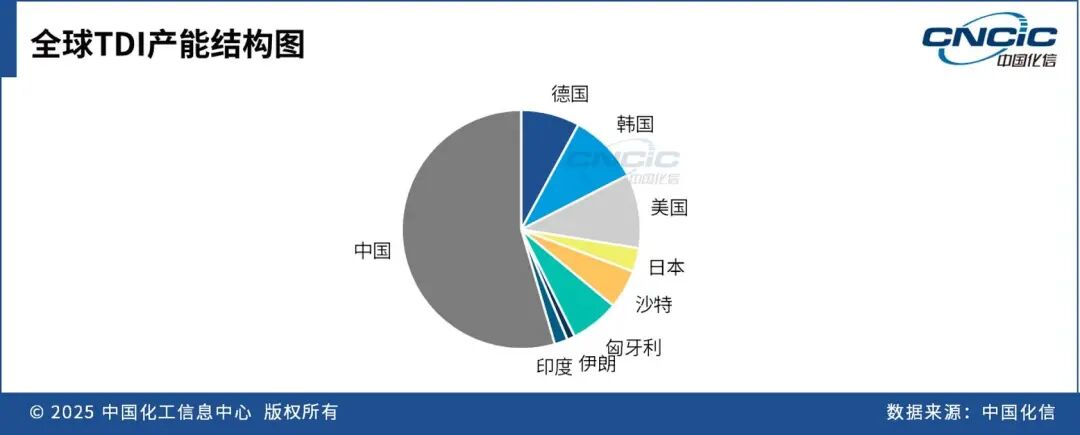

As of the end of August 2025, the global TDI production capacity is 3.777 million tons per year, with the European region having a total TDI capacity of 550,000 tons per year, accounting for 16% of the global capacity. Covestro's German plant has a capacity of 300,000 tons per year. As an important supplier to the European market, the shutdown of Covestro's German plant leaves only Wanhua BC's Hungarian plant with a capacity of 250,000 tons per year in Europe, severely impacting Europe's supply capability. Before the fire, the global TDI inventory was approximately 140,000 tons, which plummeted to 90,000 tons after the fire, a decrease of 35%, enough to meet global demand for only 15 days. The inventory gap is most severe in Europe, dropping from 50,000 tons to 18,000 tons, a gap of 64%; Southeast Asia's inventory halved to 6,000 tons, prompting manufacturers to implement quota-based supply. The inventory in domestic East China warehouses is only 25,000 tons, down 30% from early July, with some factories even experiencing "zero inventory queues."

The production capacity of Japan's Mitsui Chemicals Omuta plant has been reduced from 120,000 tons per year to 50,000 tons per year, which has also affected the supply structure in the Asia region to a certain extent.

After Covestro announced a production halt, TDI prices quickly surged. The domestic TDI price rose from 11,500 yuan/ton at the beginning of July to 15,500 yuan/ton by July 31, marking a 29% increase compared to June. Since the end of 2022, domestic TDI prices have been continuously fluctuating downward, reaching a low of around 10,000 yuan/ton. However, this year, as supply-side tensions intensified, the price rebound has exceeded 40%. Overseas, due to the overall weak demand in a sluggish economy, the supply-side tightened after the Covestro plant incident, leading to a slight increase in European TDI prices, rising from 1,900 euros/ton at the beginning of July to around 2,000 euros/ton. Other Asian markets also experienced price increases due to supply constraints.

02

Supply shortages trigger a chain reaction, putting pressure on downstream industries.

The long-term shutdown (reduction) of two overseas plants has led to the shutdown and maintenance of multiple domestic and international facilities, causing prices to soar. This has resulted in TDI manufacturers and traders being generally reluctant to sell, leading to a global shortage of TDI supplies. Downstream industries, in order to ensure a stable supply of raw materials, are forced to accept high-priced purchases.

Overseas, the procurement volume of sponge factories in Vietnam has surged, with clients required to pay a 30% deposit in advance to place orders. Clients in Saudi Arabia are securing ten thousand tons of goods at three times the usual price. Domestically, downstream furniture and automotive manufacturers are forced to accept "cash on delivery" terms. Sofa sponge manufacturers are passing on costs to furniture brands. Whole vehicle manufacturers refuse to adjust prices, leading to a significant squeeze on profit margins for automotive seat manufacturers. Some companies are considering redesigning formulas to replace part of TDI with modified MDI. Coating companies are raising product prices, affecting end markets like construction and furniture, putting companies in a dilemma. Some small enterprises, lacking the ability to pass on costs, face the risk of reducing production or even halting operations.

03

Under the restructuring of the supply pattern and the backdrop of unexpected events, China has become a cornerstone for ensuring the stability of the supply chain.

In recent years, due to energy costs and environmental policies, overseas TDI production capacity has been continuously shrinking, and there is a significant trend of global TDI production capacity shifting to low-cost regions. China's production capacity has been steadily increasing, making it the most concentrated area for TDI production in the world. In this year's sudden crisis, Chinese companies have demonstrated extraordinary resilience and remarkable adaptability. Wanhua Chemical's share of European orders surged from 20% to 60%, with profit per ton from distribution channels exceeding 8,000 yuan; Cangzhou Dahua's export order schedule is also quite full.

In May this year, China's TDI export volume surged to 51,600 tons, a year-on-year increase of 98.4%, setting a new monthly record. The export boom was partly due to Southeast Asian companies rushing to export during the window period before the U.S. tariff policy took effect, leading to a significant increase in TDI demand. On the other hand, domestic TDI prices continued to run at low levels, consistently below export prices. From an economic efficiency perspective, factories also intensified their export efforts. In June, TDI export volume remained at 48,000 tons, a year-on-year increase of 81.6%. The growth in export orders reflects the increasingly important position of Chinese companies in the global supply chain.

04

The possibility of a short-term restart of the discontinued production facilities is relatively low, and the TDI market is expected to continue high-level fluctuations in the second half of the year.

The direct cause of the shutdown at Covestro's Dormagen plant is a fire at the substation, which has led to a disruption in the supply of chlorine. The missing chlorine cannot be fully compensated for in a short time through supply from other plants or external purchases. As a result, the TDI unit, as well as the polyurethane dispersions (PUD) and polyether polyol units at this plant, have been affected and must undergo a safety shutdown. The duration of the force majeure is currently undetermined.

It is worth mentioning that in March this year, Covestro just completed the modernization and official commissioning of the Dormagen TDI plant, which is Covestro's largest TDI production facility in Europe. Despite Covestro's proactive response and efforts to assess the damage and formulate a repair plan, the restoration of chlorine gas supply is not a quick process. It involves not only the repair of fire-damaged facilities but also a comprehensive assessment and rectification of the entire chlorine gas supply system to ensure compliance with safety and environmental standards. In the short term, the repair of the substation is expected to take 7-10 days, while the restoration of the chlorine gas pipeline will take 15-20 days. In the medium term, safety inspections and process adjustments are still needed, and production has not yet resumed. The long-term risk is that the chlorine gas pipeline may corrode, leading to secondary shutdowns, and the German government's environmental review may further delay progress. This means that the global TDI shortage cannot be filled in the short term.

Mitsui Chemicals' capacity reduction at its Omuta plant is primarily due to changes in the long-term market competition landscape. In recent years, TDI capacity in Asia has continued to expand, leading to a decline in product prices and compressing profit margins. In the face of fierce global market competition, the Omuta plant lacks advantages in cost control and capacity scale. The plant's facilities are outdated, and the processes are lagging behind, and with increasing environmental requirements, the significant investment in environmental upgrades has further weakened its profitability. Following this maintenance, the capacity will be permanently reduced to 50,000 tons per year, indicating a major adjustment in Mitsui Chemicals' future positioning for this plant, with minimal likelihood of returning to the original capacity scale. In the future, the plant may focus on producing high value-added products or operate with refined management under limited capacity to adapt to market changes.

In summary, in the short term, the possibility of overseas production facilities resuming operations is low. Domestically, Wanhua Xinjiang Juli shut down for maintenance on July 16, with an estimated maintenance period of about 35 days. Gansu Yingguang halted operations on July 27 for maintenance lasting about 10-15 days. The 720,000-ton facility of Fujian Wanhua began normal production in late July, with the first phase operating at full capacity and the second phase at 80%-90% capacity. As several domestic facilities gradually resume production, the domestic supply gap is expected to rapidly close. However, downstream is still in the off-season for sponge consumption, with orders at small and medium-sized sponge factories decreasing by 20%-30%, while only leading enterprises maintain stable procurement. In the fields of coatings and adhesives, demand has slightly increased by 3%-5% year-on-year due to policies encouraging the replacement of old home appliances and furnishings, but the contribution to TDI consumption is limited. Downstream demand remains weak, and customers are turning to a "low inventory, just-in-time replenishment" purchasing model. The market price has risen too quickly, increasing resistance from downstream buyers, and demand transaction volumes have significantly decreased. The reduction in export volume has weakened support for the domestic market. Under the imbalance of supply and demand, market prices are gradually returning to a rational state amid fluctuations, with TDI prices expected to be around 13,000-14,000 RMB/ton in the fourth quarter.

Huaxin's Perspective

1

Enterprises can strengthen market expansion and customer relationship management.

(1) Expand overseas markets: Take advantage of the current supply constraints in Europe and Japan to further expand into overseas markets, especially in regions such as Southeast Asia and the Middle East.

(2) Deepen customer cooperation: Strengthen communication and cooperation with downstream customers, establish long-term stable cooperative relationships, and ensure stable supply when market prices fluctuate.

2

Seizing Market Opportunities and Risk Management

(1) Short-term market opportunities: Take advantage of current supply shortages and price increases to optimize product sales strategies and enhance profitability.

Medium to long-term risk management: In the medium to long term, overcapacity and the threat of substitutes remain challenges that businesses must face. Companies need to proactively invest in technology research and development and product upgrades.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track