Impact of adjustments to "old equipment" standards in the petrochemical industry on the chemical products market

Last Friday, the market began to focus on the Ministry of Industry and Information Technology's potential redefinition of the concept of "old facilities" in the petrochemical industry. The original standard was "facilities running for over 30 years are classified as 'old facilities'," and it is proposed to adjust this standard to "main equipment reaching its design service life or actually running for over 20 years will be considered old facilities," covering subfields such as refining, coal chemicals, chlor-alkali, fertilizers, and fine chemicals.

Industry Capacity Statistics and Analysis

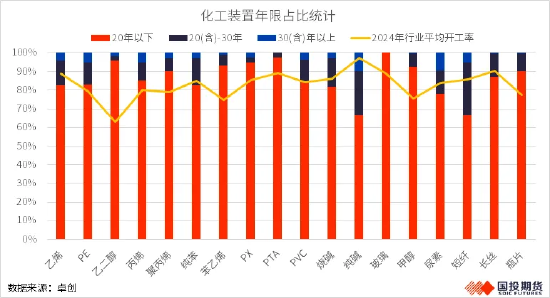

We conducted a preliminary statistics on the relevant installations currently in operation in the country, using the end of 1995 and the end of 2005 as dividing lines. The installations were categorized based on their commissioning dates into three groups: those in operation for 30 years and above, those between 20 and 30 years, and those under 20 years. Additionally, we overlapped the analysis with the capacity utilization rate for the industry in 2024.

Based on the statistical results, the following conclusions can be drawn:

In the domestic petrochemical sector, facilities with a production capacity of less than 20 years account for a high proportion, indicating that the industry equipment is relatively new and is expected to be less affected. Among them, those with this indicator exceeding 90% include... (1439, -10.00, -0.69%)(100%)、Ethylene glycol(4641, -57.00, -1.21%)PolypropyleneStyrene、PX、PTA(5834, -4.00, -0.07%)、 (2529, -33.00, -1.29%)The share of PTA facilities in this indicator is the highest at over 97%. The low proportion of facilities with less than 20 years of operation indicates a high share of outdated capacity in the industry. The proportion of production capacity under 20 years is only 66%, followed by A 78% impact is expected to be significant. In other industries, this proportion of capacity accounts for 80%-90%.

In the domestic petrochemical sector, production capacities for facilities that have been in operation for 20 to 30 years may be classified as obsolete under the new standards. The portion of these older capacities is expected to have a significant impact, particularly for segments with a high proportion, such as short fibers at 28% and soda ash at 23.5%. The operational capacities for ethylene glycol, PX, and PTA with 20 to 30 years of age have the lowest proportions.

The domestic petrochemical facilities that have been in operation for over 30 years are considered "obsolete capacity" under current standards. Currently, a significant portion of these facilities consists of soda ash and urea, each accounting for over 9%. Short fiber, propylene, and polyethylene are above 5%, while others are below 5%. All facilities in the PTA and glass industries that have been in operation for over 30 years will be phased out, while those in the long fiber and bottle-grade PET sectors have a relatively low share of facilities over 30 years old. Following the adjustment of standards, facilities in operation for over 30 years will be combined with those over 20 years, becoming subject to policies requiring either exit or upgrade of capacity. Industries with a high proportion of merged old capacity are expected to be significantly affected if the elimination and upgrade policy for obsolete capacity is implemented.

The term "aged equipment" is redefined in connection with "the elimination and renovation of outdated equipment." If equipment that has been in operation for 20 to 30 years is defined as "aged equipment," it may face mandatory retirement or technological upgrades alongside equipment that has been in operation for over 30 years, significantly impacting the industry as a whole. Overall, this affects soda ash, short fibers, and urea.PVC(5886, 65.00, 1.12%)、 Benzene and other affected substances may be significantly impacted; the upstream raw materials of the polyester industry chain are minimally affected.

Involved industries related to supply security, national strategic planning, national energy supply assurance, and "neck-choking" technologies may apply for a temporary non-exit. Considering that urea is essential for agricultural supplies with significant supply stability requirements, and the release of new production capacity for short fibers has significantly slowed in recent years, "old facilities" are more likely to be phased out through upgrades or capacity replacement, resulting in limited long-term impact. The capacity share of facilities in the ethylene- polyethylene and propylene- polypropylene industrial chains that are over 20 years old is also relatively high. However, as future domestic oil reduction and chemical increase will primarily focus on the investment in ethylene cracking facilities supporting refining and chemical integration, planned future capacity investments in the industry are expected to be high, and the exit of outdated capacity will help alleviate excess pressure.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track