Ideal, a fight to the death

On September 26th, the Li Auto i6 was officially launched. This is the last model released by Li Auto this year, thus completing their lineup for the year.

This year, Li Auto still had quite a few achievements: not only completing the renewal of the L series and Li MEGA, but also launching two all-electric SUV models, accelerating the steps towards establishing the second growth curve in electric vehicles. However, upon closer examination, it is not difficult to find that what Li Auto gained the most may be an indescribable bitterness.

From the ambitious goal of 700,000 annual sales announced at the beginning of the year, to the mid-year pressure on the range-extended series sales and declining profits that forced a downward revision of sales targets, and a shift to a greater focus on the pure electric track; then the setbacks faced by the Ideal i8 at its debut, with August sales falling below 30,000 units, looking back from the perspective of Ideal, the development trajectory in the first three quarters of 2025 is clearly not sweet.

The underlying reasons for this situation can be explored from two aspects. On one hand, it stems from the intensifying competition in the external market: more and more car manufacturers are focusing on the range-extended vehicle sector, and Li Auto's comfort zone is being increasingly squeezed, facing severe challenges to its market share. On the other hand, Li Auto's own issues cannot be ignored: although the Li Auto MEGA has entered a sales ramp-up period, the full refresh of the L series failed to make a splash in the market. Coupled with the impact of the Li Auto i8's unsuccessful debut, these multiple factors intertwine, putting Li Auto in a particularly passive development situation.

Fortunately, after making timely adjustments, the recent market terminal responses indicate that the final card played by Ideal has produced a fairly good effect, injecting a glimmer of hope into the somewhat sluggish first three quarters.

01

Competitive products encircle, extended-range loses ground.

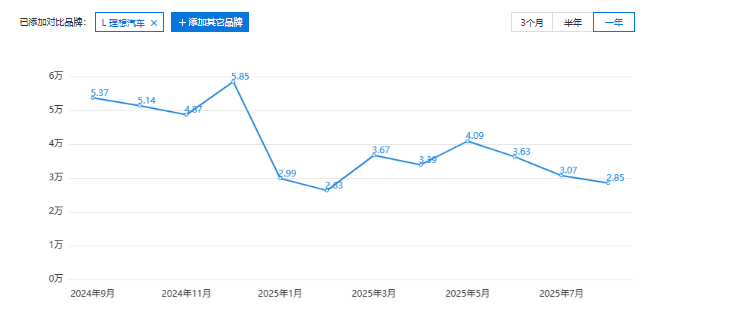

In terms of sales, Li Auto's performance this year has not been satisfactory.

After experiencing a market lull in January and February, Li Auto's sales slightly rebounded in March and April, with monthly sales returning to 30,000 vehicles. Against this backdrop, Li Auto is confident and has set an annual sales target of 700,000 units, considering the full update of the L series and the launch of two electric vehicles.

However, the subsequent developments seemed to deviate from the ideal projected trajectory. In May, driven by the refreshed models, ideal sales rebounded to over 40,000 units. It was initially thought that this would mark the beginning of a sales climb, but unexpectedly, it turned out to be the peak. After June, ideal sales continued to decline, and in August, they even failed to surpass 30,000 units.

The core issue at the heart of all this is closely related to the decline of the range-extended series. As one of the first automakers to take the plunge, Li Auto initially leveraged its first-mover advantage to successfully open up the blue ocean market for range-extended vehicles, capturing consumer mindshare and building a strong brand barrier. However, as market competition intensifies, the blue ocean has gradually turned into a red ocean, with competitors quickly filling any market gaps. Li Auto, once feeling its way forward, is now being squeezed from all sides by rivals who are learning from its example.

Ideal faces competitive pressure, primarily from AITO. From the AITO M5 to the new AITO M7, AITO M8, and AITO M9, AITO's product lineup is becoming clearer, with each model precisely targeting Ideal's core products: the AITO M5 is eating into the market share of the Ideal L6, the AITO M7 is aimed at the Ideal L7 and L8, and the AITO M8 and M9 directly target the Ideal L8 and L9, forming a comprehensive "encirclement" strategy.

Taking the Wanjie M8, which was launched in April, as an example, its market performance can be described as "phenomenal": after starting deliveries, it surpassed 20,000 units in just 45 days, and the cumulative delivery exceeded 80,000 units within four months of its launch. In contrast, Li Auto has seen a continuous decline in sales since June, highlighting a stark contrast in market performance, with Wanjie's strong rise directly siphoning off Li Auto's core user base.

Apart from the direct confrontation with AITO, a number of models marketed as "half-price Li Auto" have also entered the market, using low-price strategies to capture the low-end extended-range market. This impact directly affected the performance of Li Auto's sales pillar, the L6, with its sales dropping to 11,000 units in August, further exacerbating Li Auto's sales pressure.

It is worth noting that while sales were declining, the average selling price of Li Auto also showed a certain degree of decrease. However, thanks to the phased growth in deliveries in the second quarter and effective control of the average sales cost, Li Auto's net profit in the first half of the year still maintained a growth trend, reaching 1.744 billion yuan. The vehicle gross margin also slightly increased to 20.3%, providing a short-term profitability "buffer" amidst the pressure on sales.

In terms of performance in the third quarter, Li Auto's short-term pressure has not been alleviated. Previously, Li Auto estimated in its financial report that vehicle deliveries for the third quarter would be between 90,000 and 95,000 units, representing a year-on-year decline of 37.8% to 41.1%; the corresponding quarterly revenue is expected to decrease by 38.8% to 42.1% year-on-year, dropping to 24.8 billion to 26.2 billion yuan. From the actual delivery situation, Li Auto basically met expectations, but this data also clearly indicates that the pressure on the sales end is still ongoing, and no obvious signs of recovery have appeared.

02

The start is unfavorable, and the growth curve of pure electric has yet to arrive.

The bigger issue, beyond external competition, comes from internal wavering and dilemmas.

Originally intended to expand the second growth curve through the series of pure electric SUVs, the start of Li Auto's pure electric segment has been fraught with challenges.

As the first model of Li Auto's ideal pure electric SUV series, the i8's market response after its launch can be described as another setback for Li Auto. The unexpected pricing for consumers, the complex and confusing version configurations, and the long gap before delivery have become obstacles for users to place orders.

After the launch of the Ideal i8, market reactions doused Ideal with a cold splash of water. The unexpectedly high price, complicated version configurations, and a lengthy gap before delivery became obstacles for consumers placing orders. Seeing the poor market feedback, Ideal urgently adjusted its strategy, not only reverting to a single configuration but also implementing price cuts. However, the impact of the initial failure had already taken its toll.

The setbacks of the ideal i8 reflect the difficulties and dilemmas faced by Ideal at present: the range-extended segment is under pressure, and there is an urgent need for a pure electric boost to lift the morale of the beleaguered Ideal. However, it is also constrained by the pricing red line of the L series, making it hesitant in pricing its pure electric models. On one hand, there is concern that pure electric vehicles will overtake range extenders, and on the other hand, there is a pressing need to explore growth avenues for pure electric vehicles. Caught in this agonizing dichotomy, Ideal finds itself empty-handed on both ends.

After learning from past painful experiences, for the launch of the i6, Li Auto abandoned illusions and completely unleashed its potential.

After the launch of the new car, only one version was released, and in terms of price, it was directly aligned with the Li Xiang L6 Pro, at just 249,800 yuan. If you include the 10,000 yuan initial sales period cash discount, the price of the Li Xiang i6 is reduced to 239,800 yuan. Moreover, the i6 offers initial sales benefits valued at 35,000 yuan, which are not available with the L6, including dual-chamber air suspension, a climate-controlled compartment, and soft-close doors.

More importantly, aside from power and initial sales rights, the Li Auto i6 also has performance in other configurations that is not inferior to the L6.

In terms of space, the Li Auto i6 has a length of 4.95 meters and a wheelbase of 3 meters, both of which surpass the Li Auto L6. Compared to competitors in the same class, the space performance of the Li Auto i6 is also fully capable of competing with popular models such as the Xiaomi YU7 and Model Y.

In terms of intelligent experience, the AD MAX intelligent driving with LiDAR is consistent with the L6. Perhaps due to the discontinuation of the Li Auto i7, Li Auto has even made available the rear-seat large TV and streaming rearview mirror, which are high-end configurations only available in the L7, on the i6.

Of course, the i6 also made some compromises. To simplify the configuration, the i6 from Li Auto does not include all-wheel drive as standard like the L6; instead, it is offered as an optional feature for an additional 20,000 yuan.

However, in the face of highly competitive pricing and rich configurations, this choice seems innocuous. During the live broadcast after the launch, Li Xinyang revealed that five minutes after the launch of the Li Xiang i6, the number of orders exceeded ten thousand. Subsequently, an employee from the Li Xiang sales department claimed that the sales of the Li Xiang i6 had already surpassed the initial launch performance of the L9 that year.

However, behind the initial success of the Li Auto i6 lies a new crisis. As Li Auto shifts its focus towards pure electric vehicles, the extended-range segment, which has been a sales pillar, may feel increasingly neglected. Sharing the same sales track, the Li Auto i6, with its more advantageous pricing and configuration, is likely to draw away the user base of the Li Auto L6. As the undisputed sales champion, any market share erosion of the latter will directly impact the foundational stability of the extended-range segment.

Opting for pure electric may lead to losing the extended-range option, while maintaining the extended-range makes it difficult to advance the transition to pure electric. Li Auto seems to be caught in a dilemma of prioritizing one over the other. Finding a balance between the pure electric and extended-range segments, leveraging the popularity of the i6 to penetrate the pure electric market while stabilizing the sales base of the extended-range segment, is the core challenge that Li Auto needs to address next.

This conundrum has yet to be perfectly solved by any car manufacturer. As the new energy vehicle market shifts from incremental competition to stock game, the challenges faced by Li Auto may also be the growing pains that the entire industry must endure during the transition of technological routes and adjustments in product layout. For Li Auto, finding the optimal solution in this battle of trade-offs in the remaining time of 2025 is not only crucial to achieving its annual goals but will also impact its long-term position in the new energy race.

The ideal has already played its last card of the year, but the game will continue.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track