How Did Trendy Toys Surge 480% Overseas, and What Makes Their Strategy Different?

Market Indicator

The craze for Chinese designer toys is becoming increasingly popular overseas. When Labubu sparked a frenzy of queues on the streets of New York, when 52TOYS' "Mythical Beasts Series" was eagerly sought after by collectors in Tokyo, and when TOPTOY's "Chinese Street Scene" Chinese-style building blocks swept across the seas—during the designer toy export boom of 2025, these three Chinese brands have achieved a breakthrough with users and explosive growth in overseas markets by using IP as the core driving force. This is not only a victory for the products but also a reflection of the globalization of China's cultural and creative industries.

How do these three brands create a global IP? How do they efficiently build a supply chain? How do they develop precise marketing strategies for different overseas markets? And how do they build core competitiveness? The underlying logic of going global is worth our in-depth exploration.

POP MART

Collaborative development at home and abroad, initiating global influence.

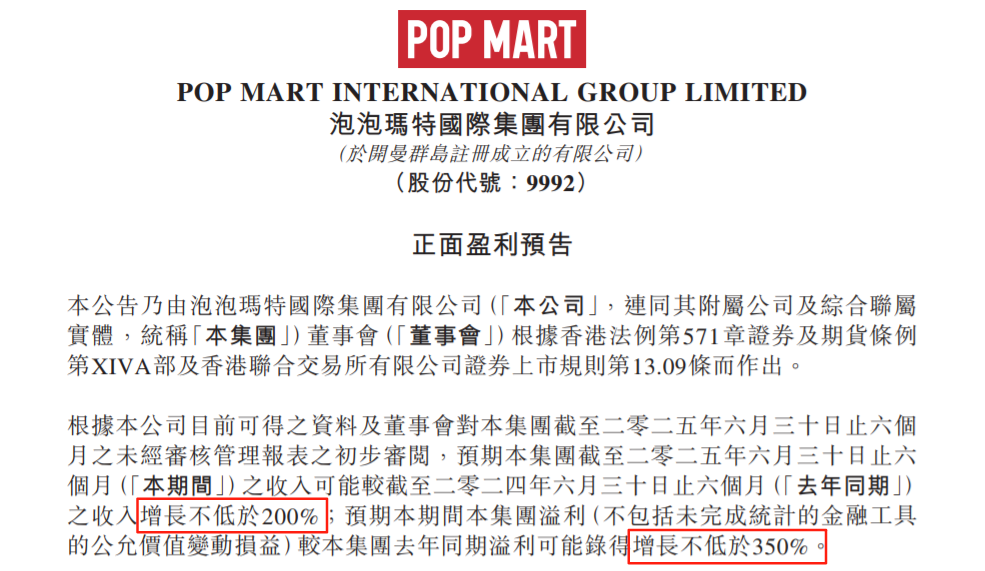

The summer of 2025 belongs to Labubu. Recently, Pop Mart released a performance forecast announcement, stating that in the first half of this year (ending June 30, 2025), the company is expected to achieve a revenue increase of no less than 200% compared to the same period last year; the group's profit for the first half of the year (excluding gains and losses from changes in the fair value of financial instruments that have not been fully accounted for) is expected to increase by no less than 350% compared to the same period last year.

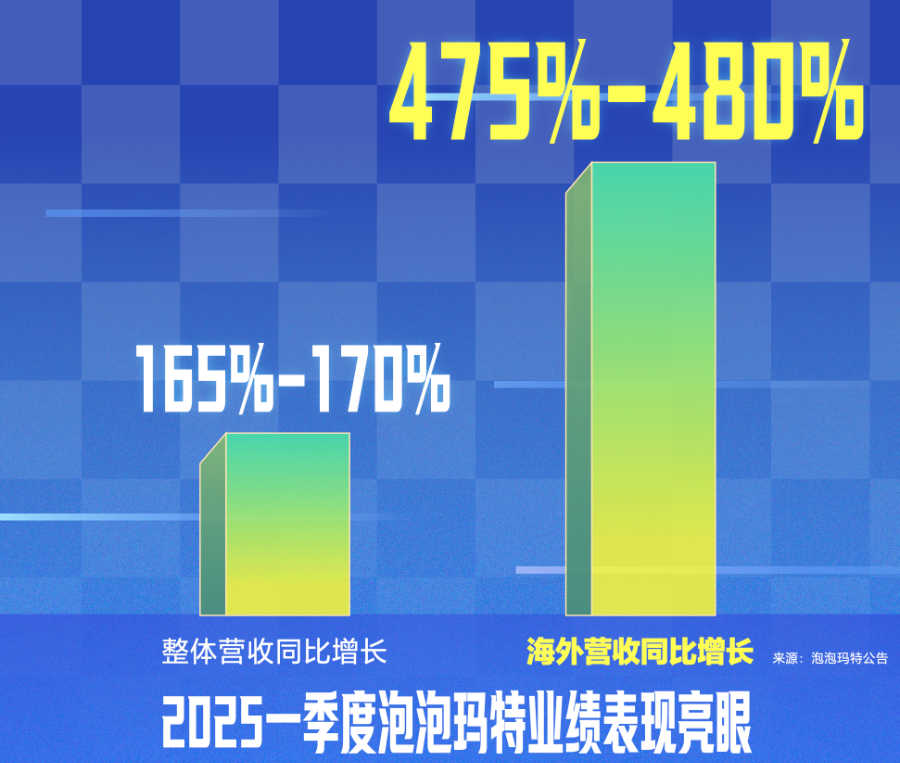

According to Pop Mart’s first quarter financial report, overall revenue in the first quarter of 2025 increased by 165%-170% year-on-year, with revenue in China growing by 95%-100% and overseas revenue surging by 475%-480% year-on-year. This dual-track development, characterized by steady progress domestically and rapid expansion overseas, fully demonstrates the effectiveness of Pop Mart’s global strategic layout.

As for why Labubu suddenly became popular, most people believe that its quirky and “ugly-cute” design caters to contemporary aesthetics, while Pop Mart’s business model and platform operations contributed to its explosive success.

But this does not seem to explain why it is Labubu, rather than other similar IPs.

In 2018, Pop Mart acquired the rights to Labubu, but from 2019 to 2022, Labubu did not achieve widespread popularity. Although it had a considerable number of niche fans, its overall performance among the general public remained relatively subdued.

Labubu’s rise to popularity was not achieved overnight; it is the result of Pop Mart’s gradual and deliberate strategy.

In product development, Pop Mart attracts global artists to design and create, ensuring that its IP characters embody both global aesthetics and local characteristics. The design of the Labubu IP, with its unique shape and rich details, has successfully captured the attention of toy enthusiasts worldwide.

At the entrance of the POP MART store in Milan, you can even spot Italian grandmothers dressed in haute couture in the queue at 3 a.m. The Labubu craze has swept not only the European and American markets but is also booming in Southeast Asia. In Thailand, the authorities have even awarded it the title of "Amazing Thailand Experience Officer," and local tattoo parlors have launched special Labubu-themed tattoos, which are very popular among young people.

Deeply aware that product quality is the foundation of brand establishment, POP MART, as a globally renowned designer toy company, insists on selecting world-class supply chain partners. Strict quality control is implemented from the very beginning of raw material procurement to ensure that all materials used meet international environmental standards and are of premium quality. In terms of production processes, POP MART collaborates with manufacturers who possess advanced technology and extensive experience. During product assembly, operations are carried out in strict accordance with meticulous craftsmanship standards to ensure that every component is firmly and precisely assembled. A New York toy review blogger dropped Labubu from a height of 1.5 meters ten times, and the shell remained intact. The blogger exclaimed “China Quality” on camera. This pursuit of ultimate product quality has enabled POP MART to earn widespread recognition from consumers in the designer toy market.

With the strong support of China's supply chain, Pop Mart has established an efficient cross-city division of labor system. Domestically, Dongguan in Guangdong serves as the core, being the world’s largest hub for the designer toy industry, with over 4,000 toy enterprises and nearly 1,500 supporting upstream and downstream companies. Internationally, Pop Mart has set up a production base in Vietnam, completing the first batch of products from its overseas factory, thus building a global supply chain system to ensure the supply for international markets.

Through strict management of the entire supply chain and quality control, Pop Mart ensures that every product launched into the market is of high quality, maintaining the brand's good image in the minds of consumers.

Global expansion is not uncommon for designer toy brands, but most brands grow domestically before venturing abroad. However, Labubu has taken a different approach—expanding overseas first and then feeding back into the domestic market.

Southeast Asian market boom: In September 2023, POP MART opened its first store in Thailand, gaining increasing popularity among Thais. In April 2024, after Thai celebrity Lisa posted about Labubu on social media, its Google search popularity in Thailand soared by 300%.

Fission in the European and American markets: From April to June 2025, Labubu reached over 1 billion users through platforms such as Instagram and TikTok. Following spontaneous posts by celebrities like Rihanna and the Kardashian family, a craze erupted in the European and American markets. This year, the growth rate in the North American market is expected to surpass that of Southeast Asia.

Domestic Market: In May 2025, the topic "Labubu Overseas Explosion" on domestic social media garnered over 5 billion views. The semi-annual performance forecast shows that Pop Mart's overall revenue increased by no less than 200% year-on-year. So far, Pop Mart's stock price has surged nearly 200% year-to-date. Looking at domestic stores, a large number of foreign tourists regard Pop Mart stores as must-visit spots, and Pop Mart's products have become "Chinese local specialties."

This unique path and precise execution enabled Labubu to transform into a top-tier IP.

The core of its success lies in a threefold precise strategy: accurately targeting overseas markets by leveraging the high acceptance of novel IP among Southeast Asian and Western consumers to cultivate the market—first building a foundational fanbase in Southeast Asia, then expanding global influence through the Western market; breaking through boundaries with the help of international celebrities—rapidly increasing exposure and endowing trendy attributes through spontaneous promotion by stars like Lisa and Rihanna; and establishing a cycle between international and domestic markets—using the "overseas viral" phenomenon to drive domestic social media discussions, generating a feedback loop of popularity that ultimately results in a dual explosion of both popularity and sales.

52TOYS

Diverse categories with trendy IPs, sci-fi IPs, and cultural IPs advancing side by side.

Since launching its globalization strategy in 2017, 52TOYS has entered key markets such as Southeast Asia, Japan and South Korea, and North America, with rapid growth in overseas markets. According to its prospectus, from 2022 to 2024, its revenue increased from 460 million yuan to 630 million yuan, while overseas revenue jumped from 35 million yuan to 147 million yuan, with a compound annual growth rate of over 100%. By the end of 2024, 52TOYS had 16 overseas authorized stores and was fully present on major e-commerce platforms such as Amazon, Shopee, and TikTok.

52TOYS' outstanding performance in the overseas market is closely related to its strong IP operation and localization capabilities.

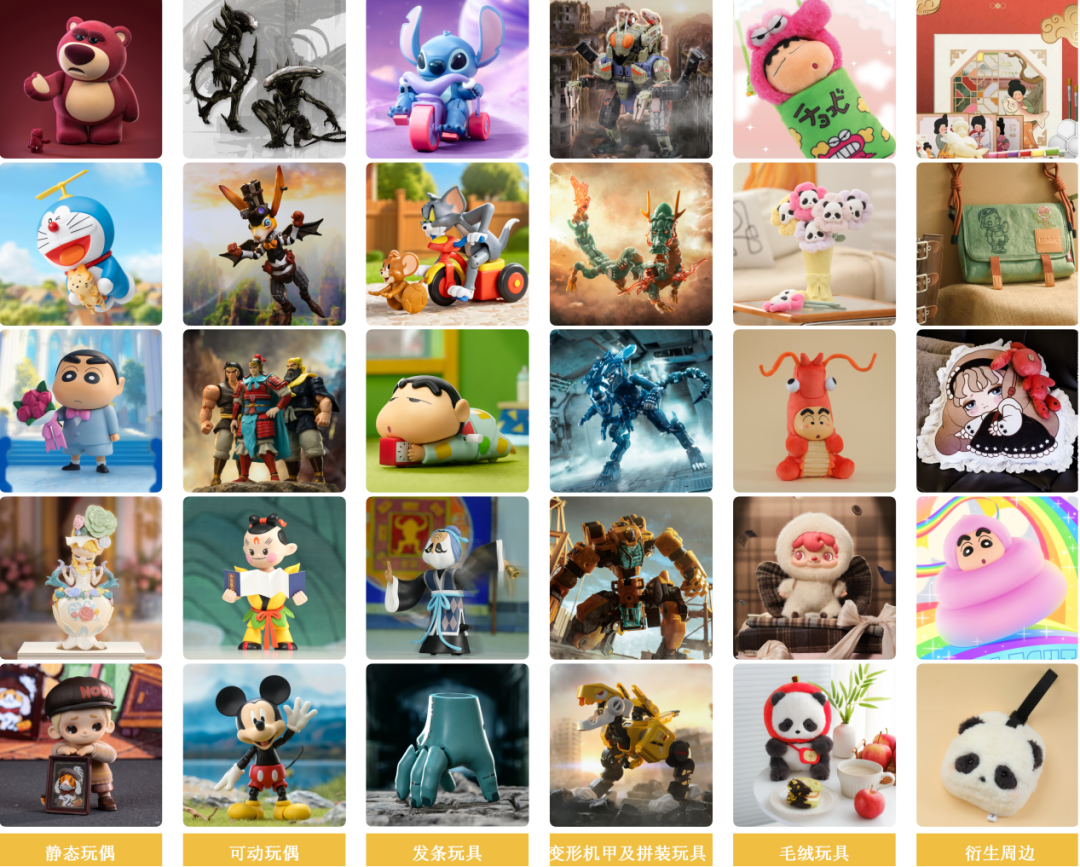

52TOYS has a "multi-category toolkit" covering static figures, articulated figures, transforming mecha & assembly models, wind-up toys, plush toys, and derivative peripherals. Each product category corresponds to distinctly different designs and craftsmanship. Among them, the "Beast Box" series, with its high-precision craftsmanship and high playability, ranks first in sales within the same category of toys in China. The "Beast Box" is an original transforming mecha series launched by 52TOYS in 2016. The classic "Beast Box" series reimagines prehistoric giant beasts, various animals, insects, and more into complex mecha forms that can transform into cubes of different sizes, full of infinite imagination.

Leveraging global trends to create market-competitive products is a major advantage of 52TOYS in its design and development process. In June 2025, DreamWorks' film "How to Train Your Dragon 2" was released worldwide. During the film's release period, 52TOYS launched limited edition collaborative products featuring its own trendy IPs NOOK and NINNIC in partnership with the movie, selling nearly 3,500 units on the first day.

52TOYS utilizes flexible supply chain management to maintain an efficient and scalable operational structure. By collaborating with specialized third-party factories, it establishes an integrated production network to ensure robust capacity. It also has a dedicated supply chain management team to guarantee a smooth transition from product design to manufacturing. Throughout the production process, strict quality control measures are implemented to ensure excellent product quality.

In terms of warehousing and logistics, 52TOYS has established a hybrid model combining overseas warehouses with Amazon FBA. This model has proven highly effective, achieving a high next-day delivery coverage rate in Japan and the United States, significantly enhancing logistics efficiency and providing consumers with a better shopping experience.

A rich SKU matrix meets the selection needs of overseas users. 52TOYS has nearly 2,800 SKUs, with more than 500 new SKUs launched annually. This speed of product launches enables 52TOYS to quickly respond to market trends and release products around IPs that are adapted to different scenarios, allowing IPs to permeate multiple aspects of consumers’ lives. This “IP + multi-category” collaborative model not only extends the lifecycle and monetization potential of individual IPs, but also builds a product network that covers a wide range of consumer groups, laying a solid foundation for rapid expansion in overseas markets.

The combination of licensed and original IP aligns with the mindset of overseas users. Leveraging the global reach of classic licensed IPs, 52TOYS has rapidly increased its brand awareness in major overseas markets. Meanwhile, its own trendy, sci-fi, and cultural IPs enable it to emphasize unique cultural narratives and visual styles, maintaining a differentiated advantage in terms of product personality and market positioning.

In terms of authorized IP operations, 52TOYS selects classic IPs with global influence such as Crayon Shin-chan, Tom and Jerry, Lotso, Alien, and How to Train Your Dragon, leveraging their existing large fan bases to reduce market education costs. At the same time, it's not simply about replicating the IP images, but rather combining them with their own product matrix advantages to match each authorized IP with the most suitable presentation form. For example, developing static dolls and other products for Lotso to meet public consumption needs; launching wind-up toys for Crayon Shin-chan and Tom and Jerry to highlight the dynamic fun of the characters; and introducing transforming toys and action figures for Alien, fully integrating the character traits of the IP with the advantages of the product category to satisfy diverse consumer needs. This "precise matching" operation logic not only amplifies the commercial value of the authorized IPs but also strengthens consumers' emotional connection to the IPs through diversified products.

From the perspective of proprietary IP, 52TOYS accurately grasps the cultural preferences and consumer psychology of different markets, creating original images with differentiated competitiveness. Under 52TOYS, there are 35 proprietary IPs, including Beast Box, Fat Panda Cub, Sleep, and others. Among them, the "Beast Box" series stands out and distinguishes itself from other trendy toys, especially favored by veteran toy enthusiasts in mature overseas markets like Japan and the United States. According to the prospectus, there are 288 SKUs of Beast Box available, with a cumulative GMV reaching 190 million RMB. The "Mythical Creatures Series" delves into the essence of traditional Chinese culture, incorporating mythological creatures such as Azure Dragon, Qilin, White Tiger, and Black Tortoise into toy designs. With its unique recognition of Eastern culture, it has carved out a niche in overseas markets, satisfying global consumers' curiosity about diverse cultures. These proprietary IPs are not only products but also cultural symbols that convey the brand's philosophy, forming unique memory points.

52TOYS demonstrates strong operational capabilities in specific markets, being able to develop and implement localized expansion strategies to enter key overseas markets. By deeply collaborating with local distributors, it has entered Japan, a global hub for IP toy culture. In 2024, 52TOYS' GMV in Japan tripled year-on-year. Additionally, 52TOYS partnered with local distributors to open its first licensed brand store in Bangkok, Thailand, a Southeast Asian hub and vibrant creative culture center. 52TOYS quickly replicated this model and opened multiple new stores. Official data shows that in 2024, 52TOYS' GMV in Thailand quadrupled year-on-year.

TOPTOY

With the support of 7,000 stores, achieving complementary business formats and mutual benefits

Miniso's latest financial report shows that it has more than 7,000 stores worldwide, including over 2,700 stores in overseas markets. In 2024, its overseas revenue exceeded 4.5 billion RMB, accounting for more than 40% of the group's total revenue. Among them, TOPTOY, its trendy toy subsidiary, has also contributed significantly to the group's growth in overseas markets. In its performance report, Miniso pointed out that TOPTOY's revenue in 2024 reached 984 million RMB, a year-on-year increase of 44.71%. Using Southeast Asia as a strategic breakthrough point and leveraging deep insights into overseas markets, it successfully entered high-end shopping malls in countries such as Thailand, Indonesia, and Malaysia, receiving enthusiastic support from local consumers and achieving sales far exceeding expectations. TOPTOY’s rapid establishment and performance breakthrough in the Southeast Asian market are the result of multiple successful factors working in synergy.

The "Chinese Street View" series of building blocks exemplifies TOPTOY's exquisite craftsmanship, with particle precision strictly controlled within ±0.02mm, reaching the leading level in the building block category. In the Malaysia limited edition product, locally characteristic "Nyonya tiles" printed pieces were added, precisely catering to the cultural and emotional needs of local Chinese consumers, with Chinese consumers accounting for as much as 47% of this product.

The efficient collaboration of the supply chain ensures the stability of supply in overseas markets. Relying on MINISO's global supply chain system, TOPTOY has achieved a flexible model of "domestic design + localized production in Southeast Asia." In Indonesia, the production line established in cooperation with local toy OEMs has shortened the cycle from product design to shelf placement to 30 days, reducing the time by 50% compared to the full import model. Meanwhile, core IP products are delivered through MINISO's existing cross-border logistics network, reducing logistics costs by 25% and increasing inventory turnover rate to 1.5 times the industry average. This supply chain advantage gives TOPTOY more flexibility in responding to seasonal consumer fluctuations in the Southeast Asian market.

The deep empowerment of group resources is the core strength of TOPTOY's overseas expansion. MINISO's extensive network of over 7,000 stores worldwide, especially more than 2,700 overseas stores, provides a natural "springboard" for TOPTOY's international ventures. In high-end shopping malls in Bangkok, Thailand, TOPTOY's first store complements the business format of MINISO stores, sharing the mall's customer flow resources and membership system. In Indonesia, TOPTOY initially entered MINISO's Jakarta flagship store as a "store-in-store," leveraging MINISO's brand recognition built over five years in the area. Within just three months, it achieved initial reach of its target customer base, and the first day sales of the subsequently opened independent store broke local opening day records for similar trendy toy stores. This "initial reliance followed by independence" expansion model significantly reduces TOPTOY's store opening costs and risks in overseas markets.

The precise localization strategy has hit the consumption pain points of the Southeast Asian market. Southeast Asian Gen Z consumers pursue both the design and collectible value of trendy toys and have a high sensitivity to price. TOPTOY, targeting this characteristic, has created a differentiated pricing ladder: blind box products co-branded with international IPs such as Disney and Sanrio maintain mid-range pricing, with single-unit prices ranging from 39 to 99 RMB, aligning with general consumer affordability. Meanwhile, high-end products like limited edition mech figurines target core collector groups, maintaining premium pricing through limited releases. In Thailand, their "Siamese Cat Blind Box" series, which combines local iconic animal imagery with trendy toy design, sold 50,000 units in the first month of launch, becoming a hot topic on social media. In Malaysia, the building block set infused with elements of the Petronas Towers sold out within two weeks of launch, necessitating multiple urgent restocks.

The globalization journey of Chinese trendy toy brands is accelerating under the dual drive of IP development and localization. The commonality among three Chinese brands going overseas lies in building global cultural resonance through IP strategies, while relying on the strong foundation of China’s supply chain to achieve deep adaptation from product design to marketing reach through localized operations.

Beyond their commonalities, the differentiated paths of the three brands highlight the diverse possibilities for Chinese trendy toys going global. Whether it's POP MART's "overseas-domestic" cycle breakthrough, 52TOYS' combination of "trendy IP + sci-fi IP + cultural IP," or TOPTOY's shortcut breakthrough leveraging group resources, this ecosystem with "distinct core capabilities" is driving Chinese trendy toys from single product exports to a creative ecosystem of global competition.

We believe that in the near future, more Chinese trendy toy brands and enterprises will combine their unique characteristics with the demands of the global consumer market to find suitable development paths for their businesses. "Made in China" will surely continue to shine brightly on the world stage.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track