High Debt Yet Distributing 3.8 Billion! Founding Family Takes 3.6 Billion, AUX IPO in Hong Kong for "Capital Injection"

Recently, AUX Electric Co., Ltd. (“AUX”) submitted its prospectus to the Hong Kong Stock Exchange for the second time, standing at a crossroads in the capital market.

Zheng Jianjiang, the founder of AUX, the world’s fifth largest air conditioner supplier, has been pursuing his dream of going public for ten years. In 2015, AUX planned to list on the A-share market but failed to get approval. In 2016, the company was listed on the New Third Board for a year before delisting. In October 2018, AUX Electric launched A-share IPO counseling, completed it in June 2023 but gave up the plan, and is now turning to the Hong Kong stock market.

According to the prospectus, in recent years, AUX's business has rebounded, with both revenue and net profit achieving high growth. On the other hand, its asset-liability ratio has consistently remained above 80% for a long period. The move to distribute nearly 3.8 billion yuan in dividends before its IPO in Hong Kong in 2024 has also sparked controversy for the company.

High dividends contrast with the fundraising demand for "supplementing cash flow." Does Aux really lack money?

01、High Growth and High Risk

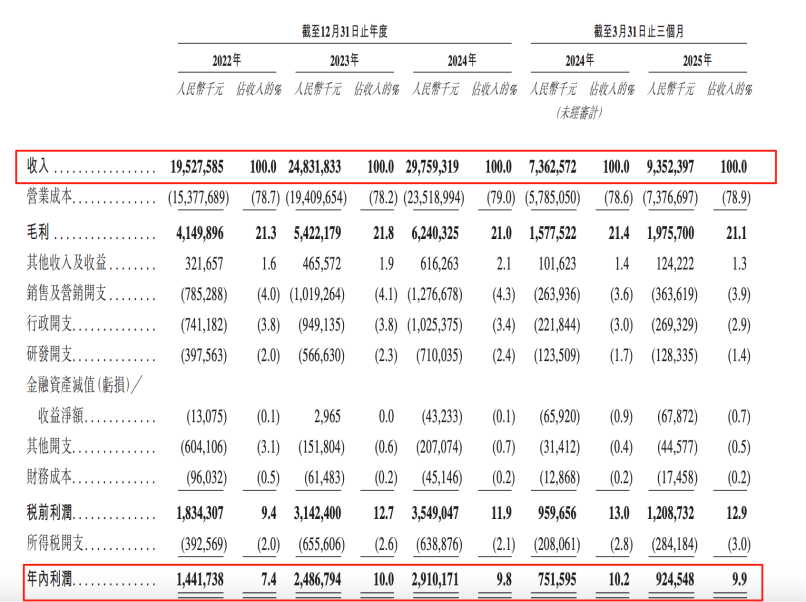

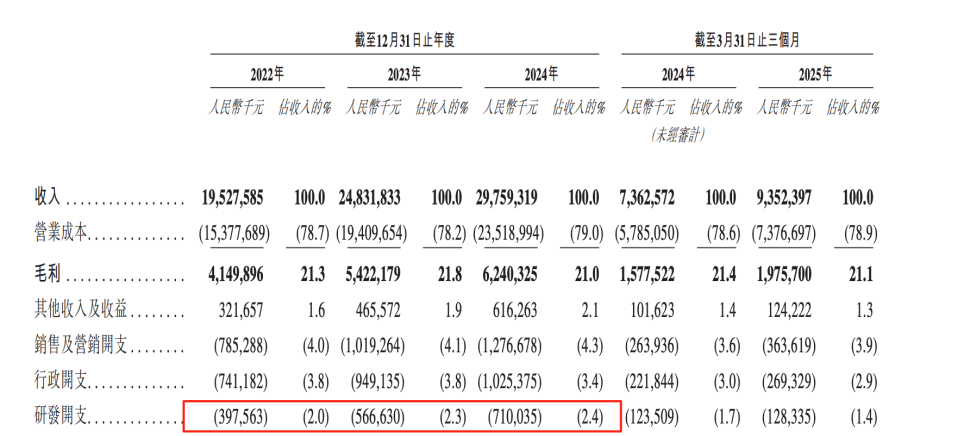

According to the prospectus, the revenue of AUX from 2022 to 2024 is 19.5 billion, 24.8 billion, and 29.8 billion, respectively, with a three-year growth of 52.8%. The net profits are 1.44 billion, 2.49 billion, and 2.91 billion, respectively, with a three-year growth of 102%. Among these, the overseas market has developed rapidly, contributing revenues of 8.39 billion, 10.41 billion, and 14.68 billion from 2022 to 2024, accounting for nearly half of the total revenue. In Q1 2025, the overseas growth trend continued, with 57% of the total revenue coming from overseas markets.

However, behind the impressive figures, the company also faces significant challenges.

From 2022 to 2024, trade receivables and notes receivable were 1.428 billion, 1.945 billion, and 3 billion respectively, representing a three-year growth of 110%. By Q1 2025, they further increased to 4.765 billion, a 58% growth compared to the end of 2024. The turnover days extended from 25.2 days in 2022 to 37.4 days, indicating a deterioration in sales collection efficiency.

Meanwhile, from 2022 to 2024, its trade payables and notes payable were 5.436 billion, 6.436 billion, and 10.395 billion respectively, expanding by 91.2% over three years. In Q1 2025, this figure further increased to 11.948 billion.

02、A surprise dividend of nearly 3.8 billion yuan, with the founding family alone taking over 3.6 billion yuan.

What is even more noteworthy is that, according to the prospectus, Aux's asset-liability ratio is as high as 84.1% by the end of 2024, which is a very high level of financial leverage. In comparison, among its peers, the asset-liability ratio of the brand Midea is 62.33% by the end of 2024, while Gree's ratio is 61.55% during the same period.

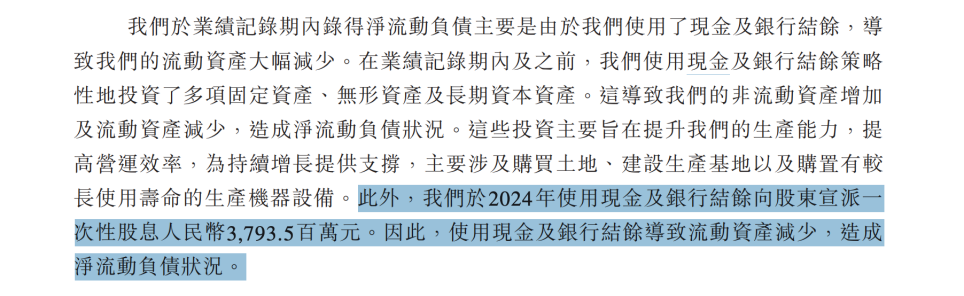

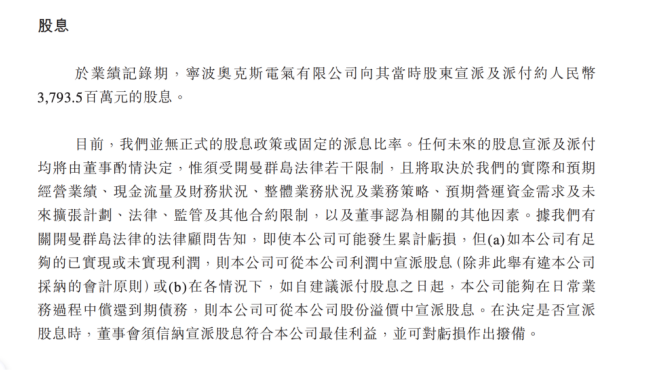

What is perplexing is that, according to the prospectus, in 2024 when the asset-liability ratio was high, AUX made a special dividend payout of 3.794 billion yuan, which exceeded the net profit of 2.91 billion yuan for the entire year by more than 880 million yuan, amounting to 55% of the total net profit from 2022 to 2024.

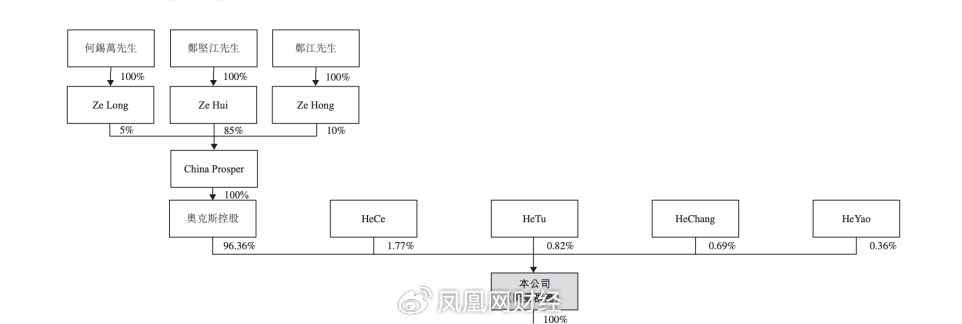

In this dividend distribution, the actual controller Zheng Jianjiang and his family, with a 96.36% controlling stake, can receive 3.656 billion yuan.

The prospectus states that this amount will be used in 2024 with cash and “Surplus” was distributed to shareholders, resulting in a decrease in current assets and causing a net current liability position.

Note: Zheng Jiang refers to the brothers Zheng Jianjiang, and Mr. He Xiwan is the elder brother of Mr. Zheng Jianjiang.

The explanation also mentions that, as advised by its legal counsel on Cayman Islands law, even if the company may incur accumulated losses, (a) if the company has sufficient realized or unrealized profits, it may declare dividends from its profits (unless this is contrary to the accounting principles adopted by the company), or (b) in each case, if from the date of the proposed dividend payment, the company is able to pay its debts as they fall due in the ordinary course of business, the company may declare dividends from its share premium.

The general meaning is that the distribution of this dividend is legal and compliant. However, while issuing large amounts of dividends to themselves and simultaneously raising substantial funds, this approach is likely to affect investor trust.

According to the 2024 Hurun Rich List, Zheng Jianjiang ranked 213th with a wealth of 22.5 billion yuan.

03、Consumers complain about products catching fire and "exploding"—the dilemma of low-priced products.

Zheng Jianjiang, the founder of AUX, was born in Ningbo, Zhejiang in 1961. After dropping out of junior high school, he became an auto mechanic. In 1986, he and some friends took over a watch parts factory, and in 1994, he set his sights on the air conditioning industry, leading to the birth of AUX Air Conditioners. By adopting a disruptive low-price strategy, he carved out a space in the market. In 2002, he released the "Air Conditioner Cost White Paper," exposing the industry's profit margins and slashed prices on more than 40 AUX air conditioner models by 30%. His reputation as a "price butcher" thus sent shockwaves through the industry.

This results in a relatively low gross profit margin within the industry, with its overall gross profit margin maintaining around 20%, which is lower than its peers.

At the same time, compared to leading brands, its investment in research and development is relatively lower. According to the prospectus, in 2022-2024, AUX's R&D expenses were 400 million, 570 million, and 710 million yuan respectively. In contrast, Gree's R&D expenses for 2024 are 6.9 billion yuan, and Midea's R&D expenses for 2024 are 16.2 billion yuan. AUX's total R&D investment over the three years amounts to 1.675 billion yuan.

It is worth noting that on relevant complaint platforms, there have been a total of 6,383 complaint entries related to "AUX," with many mentioning product quality issues.

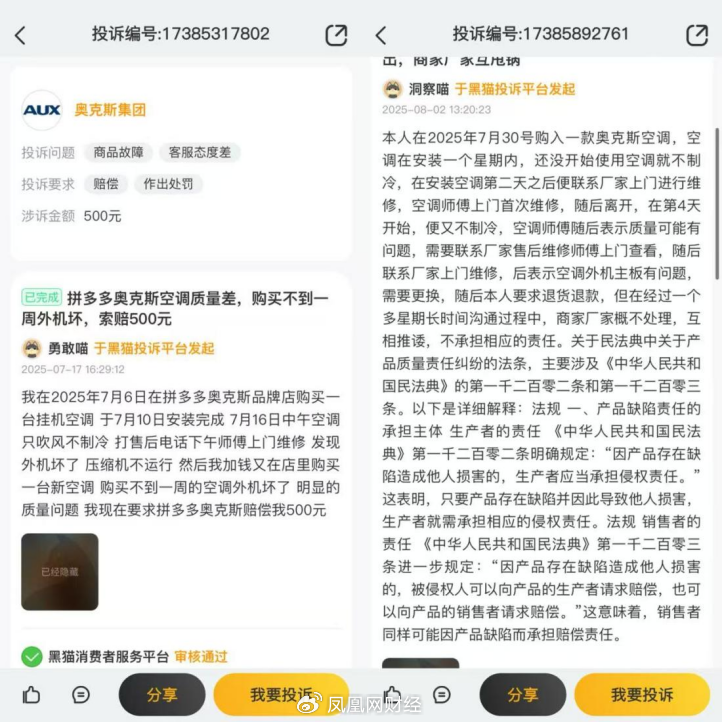

A variety of issues are involved. Regarding air conditioner products, for example, some consumers reported that after purchasing a wall-mounted air conditioner on an e-commerce platform in early July, the unit stopped cooling just a few days after installation, and it was later found that the outdoor unit was already damaged. Another consumer complained that an AUX air conditioner purchased at the end of July stopped cooling less than a week after installation. After the manufacturer came to repair it, the unit worked for only four more days before the problem recurred. During the subsequent process of requesting a return and refund, the consumer encountered the manufacturer and the seller shirking responsibility and blaming each other.

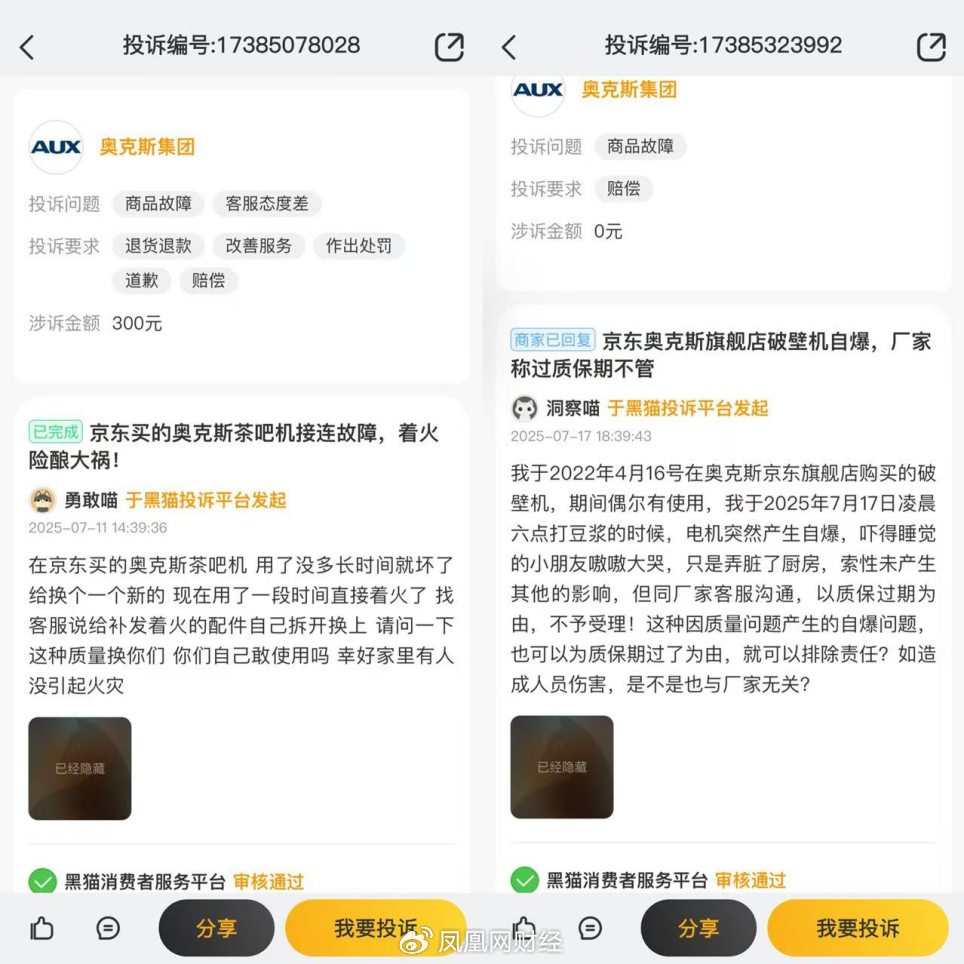

The problem is not limited to air conditioners. Some consumers mentioned that after purchasing an AUX tea bar machine, it malfunctioned after a short period of use. After replacing it with a new one, it caught fire after some time, fortunately avoiding a fire as someone was at home. Other consumers reported that AUX water dispensers have issues with electric leakage.

Small household appliancesSimilarly, there are issues, such as a consumer mentioning that the AUX blender they purchased was used to make soy milk at 6 a.m. Suddenly experienced a "self-explosion." However, when communicating with the manufacturer, they refused to handle it on the grounds that the product was beyond the warranty period.

In addition, according to media reports, since 2013,Gree Electric AppliancesA total of 27 lawsuits were filed against AUX for infringement, and all were won. In its prospectus, AUX disclosed that its subsidiary, Ningbo Aoshen, had paid the plaintiff a total of approximately 116 million yuan in compensation. Although AUX stated that it had updated the designs of certain products to avoid further infringement and had comprehensively improved them,Intellectual Property ProtectionThe system cannot guarantee that such measures will effectively protect the company from the risk of intellectual property litigation.

Low pricing is AUX's magic weapon, but the industry environment has now undergone drastic changes. The growth in the domestic air conditioner market has peaked, and brands like Midea and Gree are accelerating channel penetration, squeezing AUX's survival space. In the wave of the home appliance industry's transition towards quality and intelligence, AUX's low-price gene is also facing unprecedented scrutiny.

Listing in Hong Kong is not the end goal, and what AUX needs is not just fundraising through the listing.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track