Half-Year Revenue of 14 Billion, Profit Exceeds Expectations! How the Asian Packaging Leader Maintains Its Strong Position?

SCG Packaging Public Company Limited (SCGP) is a Thailand-based integrated packaging solutions provider and a leader in the industry within the ASEAN region. The company is committed to offering a wide range of innovative products and services, aiming to become a leading multinational consumer packaging solutions provider.

SCGP Group was established in 1975. Since its inception, the company has continuously developed steadily and grown, and it has now become the largest manufacturer of packaging paper and corrugated cartons in the ASEAN region. In pursuit of high-quality growth and striving to become the preferred packaging solutions provider for customers, SCGP continuously engages in mergers and acquisitions, deepens collaborations, and actively expands its own business.

SCGP's business is mainly divided into three major sectors: integrated packaging, fiber, and recycling. Among them, the integrated packaging sector is SCGP's largest division, offering a diversified product portfolio of over 120,000 stock keeping units. The product range includes corrugated boxes, retail display packaging, flexible packaging, rigid packaging, medical consumables, laboratory supplies, and packaging paper. The integrated packaging sector primarily serves high-growth areas such as the fast-moving consumer goods industry and e-commerce, fully meeting consumers' increasingly diverse needs.

The fiber business focuses on providing food service products, including "Fest" branded food packaging, offering comprehensive catering packaging solutions for the fast food and takeaway industries. At the same time, the fiber business also covers pulp and paper products, mainly including printing and writing paper, pulp, plantations, and bio-based solutions. The recycling and other businesses mainly involve the recycling of packaging materials, such as the recycling of paper and plastic materials in Europe and the United States.

In terms of factory layout, the packaging paper business has 8 factories in 4 countries, the paper packaging business has 32 factories in 3 countries, the pulp and paper & food service packaging business has 8 factories in 4 countries, the consumer goods and performance packaging business has 13 factories in 3 countries, and the recycling business has 86 factories in 4 countries.

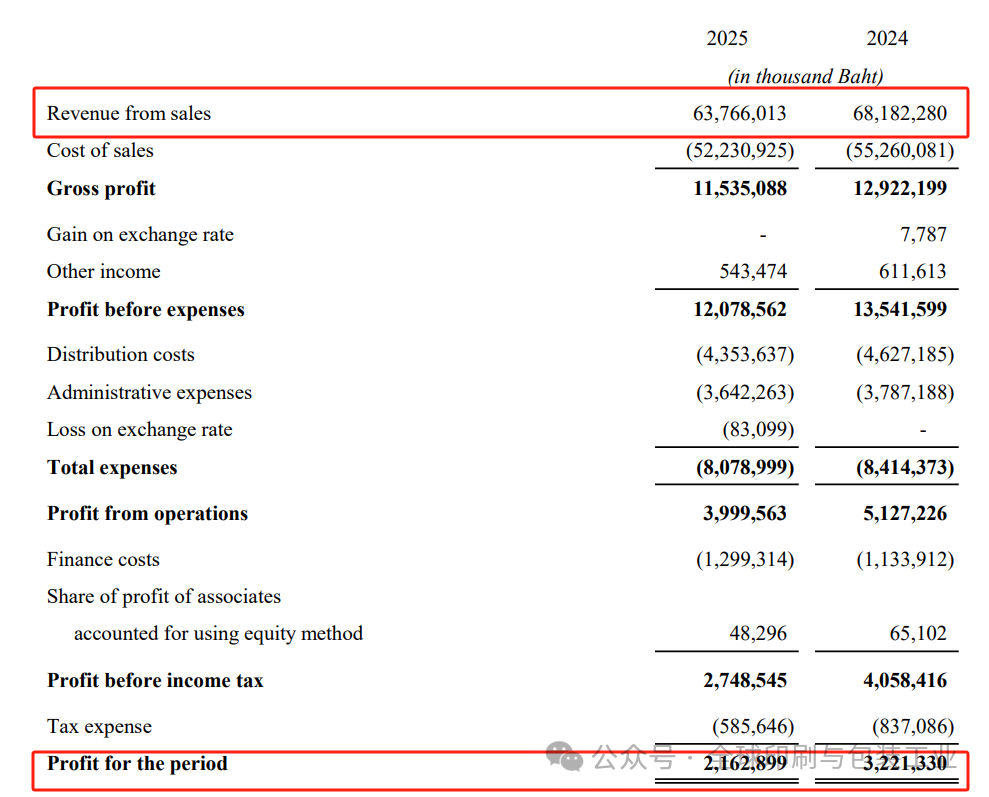

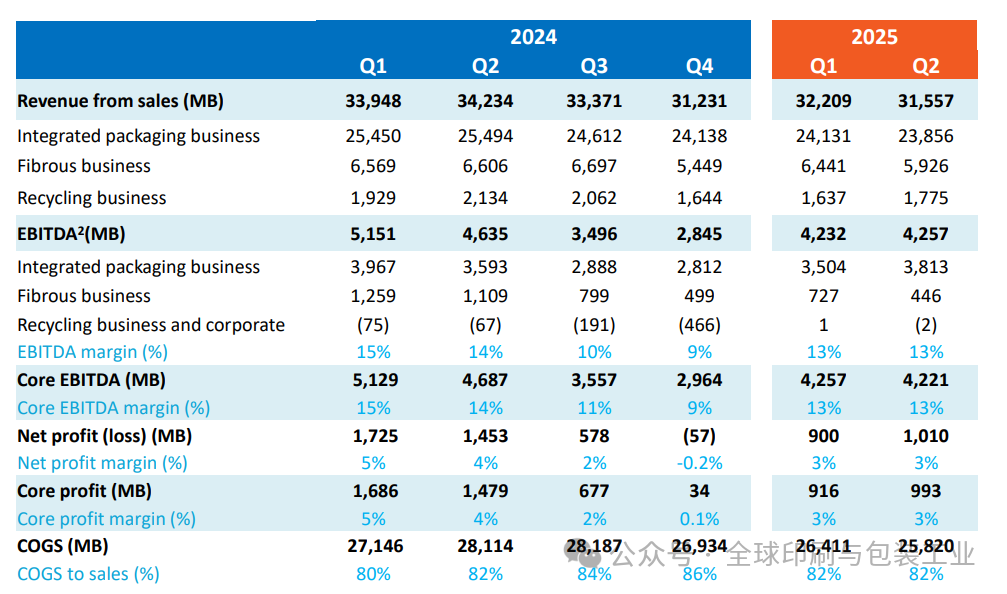

Recently, SCG Packaging released its business results for the first half of 2025 and the second quarter. Despite facing global economic uncertainty, SCGP demonstrated strong operational resilience in the first half of the year. Total sales revenue reached 63.766 billion baht (approximately 14 billion RMB), and achieved 2.163 billion baht.(Equivalent to approximately 476 million RMB)During the second quarter, the company also performed remarkably well, with total sales revenue reaching 31.557 billion Thai Baht and a reported profit of 1.01 billion Thai Baht for the period.

SCGP CEO Wichan Jitpukdee stated that the development momentum of the ASEAN packaging industry remains strong in the second quarter of 2025, mainly due to the robust growth in domestic consumption across various countries. Government measures to stimulate consumer spending have further reinforced this growth trend. He pointed out that the economic growth rates of most ASEAN countries are still higher than those of other regions. In addition, the accelerated growth of exports to the United States—especially in consumer goods and food and beverage products—prior to import tariff adjustments has also provided strong support for the overall growth of the industry.

Looking ahead to the second half of the year, Wei Chang·Jipu Kedi predicts that domestic packaging demand in ASEAN will continue to rise, especially in the food, beverage, and consumer goods sectors. This growth will be driven by various factors, including economic stimulus measures in different countries, a projected GDP growth rate higher than other regions (notably in Vietnam, Indonesia, and the Philippines), as well as year-end inventory replenishment activities. However, he also cautions that the costs of waste paper and logistics are expected to increase as regional demand improves, and close attention must still be paid to the potential impact of unresolved reciprocal tariff policies.

SCGP continues to implement its growth strategy in the ASEAN region, focusing on proactive marketing through packaging solutions that meet consumer needs. This strategy has led to steady growth in the company's integrated packaging business sales, with outstanding performance in the Vietnamese market, despite most product prices remaining stable.

In the pulp and paper business, sales volumes declined due to weakened demand in the textile and apparel industries. However, the company focused on achieving cost efficiency and sustainable operations by leveraging artificial intelligence and machine learning throughout the value chain, which was particularly evident in its Indonesian operations. SCGP has begun applying AI to energy optimization, increasing the utilization rate of domestic wastepaper, and effectively managing financial costs. These initiatives have enabled the Indonesian business to reach the EBITDA break-even point, having a positive impact on the company’s overall performance.

To address the economic situation in the second half of the year, SCGP will continue to expand its packaging business while strengthening packaging solutions to enhance customer experience and provide added value, thereby meeting the growing regional demand. The company also announced its proactive strategy of "value chain flexibility and agility" to tackle reciprocal tariff issues and achieve rapid adjustments through regional management.

SCGP is actively advancing its strategy of expanding into high-potential sectors. Recently, the company increased its stake in Vietnam’s Duy Tan Plastics Manufacturing Company. This investment aims to leverage Duy Tan Plastics’ comprehensive solutions and diverse product portfolio to meet the needs of the rapidly growing ASEAN market. This move will accelerate SCGP’s growth in the consumer packaging business, aligns with the company’s strategy to strengthen its operational base in Vietnam—a key high-potential market in the region—and is expected to enhance long-term profitability and competitiveness.

Regarding reciprocal tariff measures, SCGP stated that currently, revenue from the United States accounts for approximately 4% of its total revenue, with this income primarily derived from consumer goods exports, thus the impact is limited. Nevertheless, the company is actively implementing a strategy to increase its domestic packaging sales in ASEAN and expand exports to new potential markets such as India, Bangladesh, and Australia. The company is fully leveraging its flexible value chain, diversified production bases across ASEAN, and comprehensive integrated packaging solution portfolio. Through this approach, SCGP can integrate production and raw materials, engage in joint planning with customers, and consider contract manufacturing schemes, thereby achieving cost competitiveness in each market.

SCGP has also achieved remarkable accomplishments in sustainable development. The company continuously improves its Environmental, Social, and Governance (ESG) and circular economy principles in accordance with international sustainability guidelines. SCGP has been awarded the EcoVadis Platinum Medal for the second consecutive year, fully recognizing its outstanding performance in the field of sustainability. In addition, the company has developed over 169 products and 16 processes and has obtained product carbon footprint certification. Currently, it has completed 50% of its target to have all products certified by the fourth quarter of 2025.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track