Half Tax Reduction on Vehicle Purchase, 5% Price Increase, How to Reduce Costs for New Energy Logistics Vehicles?

In three months, that is, in 100 days, buying a new energy vehicle may become 5% more expensive! This is not alarmist talk, but a predetermined policy announced two years ago.

"From January 1, 2026, to December 31, 2027, vehicle purchase tax for new energy vehicles will be halved," and "Under the battery swap model, the purchase tax will be calculated based on the price of the vehicle excluding the battery." This presents a significant opportunity for swap-enabled models and battery separation modes. However, some industry insiders believe that most swap-enabled vehicles are concentrated in the heavy truck sector, while new energy logistics vehicles have more diverse application scenarios and demand. They argue that technology cost reduction is key for users to spend the least money to get the most suitable vehicle. In their view, the battery swap model is not the optimal solution.

"Purchase tax halved, how much more will it cost?"

On December 31, 2022, the national subsidies officially completed their historical mission of "helping new energy vehicles get on the horse and giving them a ride," and thus withdrew from the historical stage. The new energy vehicle industry, including new energy logistics vehicles, has entered a new development phase, transitioning from policy-driven to market-driven.

In the same year, the price of core raw material lithium carbonate for power batteries plummeted from a peak of 600,000 yuan per ton to a reasonable range below 200,000 yuan per ton. The price of power batteries also dropped significantly, accelerating the arrival of the "oil-electricity parity" era. Driven by the policy of (full electrification) for public domain vehicles, new energy vehicle companies rushed to compete for market share, but found themselves mired in intense internal competition.

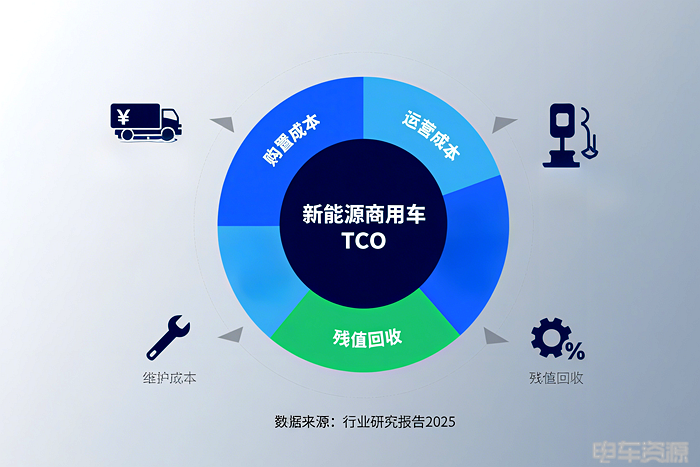

In the first half of 2025, the penetration rate of new energy vehicles in China surpassed 50% for the first time, marking a shift in the industry from "incremental expansion" to "stock competition." New energy logistics vehicles, being the most economical in terms of Total Cost of Ownership (TCO) in the road transport market and the most aligned with the "dual-carbon" strategy, have a penetration rate of around 25%, indicating a vast market space in the stock market. Whether new energy logistics vehicle companies can succeed in the stock market competition depends crucially on their ability to reduce the initial vehicle ownership cost and the total lifecycle TCO cost for users.

The implementation of the new policy to halve the purchase tax on new energy vehicles will increase the vehicle purchase cost by 5%. Taking the best-selling mid-sized car as an example, assuming a price of 80,000 yuan, the purchase price on January 1, 2026, including the halved purchase tax, will be: 80,000 yuan + 80,000 yuan * 10% / 2 = 84,000 yuan. For the new energy logistics vehicle market, where insurance premiums are high and freight rates continue to decline, a price increase of 4,000 yuan is a significant burden for freight drivers.

Therefore, many industry insiders say that purchasing a vehicle before December 31, 2025, means saving money.

The optimal solution is to reduce costs and increase efficiency through total cost of ownership (TCO) over the entire lifecycle.

To alleviate the cost pressure of purchasing new energy vehicles caused by the vehicle purchase tax, the only viable strategy is to reduce costs and increase efficiency throughout the entire lifecycle, as the trend clearly indicates a phased implementation of the purchase tax for new energy vehicles.

Of course, this does not affect the market's optimism about the cost reduction in technology. The main reasons include but are not limited to: the leapfrog development of technology, the high integration of intelligent, modular, and platform-based components in new energy vehicles, which can achieve process cost reduction and efficiency improvement; manufacturers can significantly optimize production processes and yield rates through intelligent and fully automated production lines, thereby reducing production costs; intelligent configurations enhance the active safety performance of vehicles, greatly reducing collisions and lowering insurance and maintenance costs.

However, the true realization of cost reduction in technology relies on the large-scale application of vehicles. It is imperative to reduce the total cost of ownership (TCO) over the entire lifecycle of the vehicle.

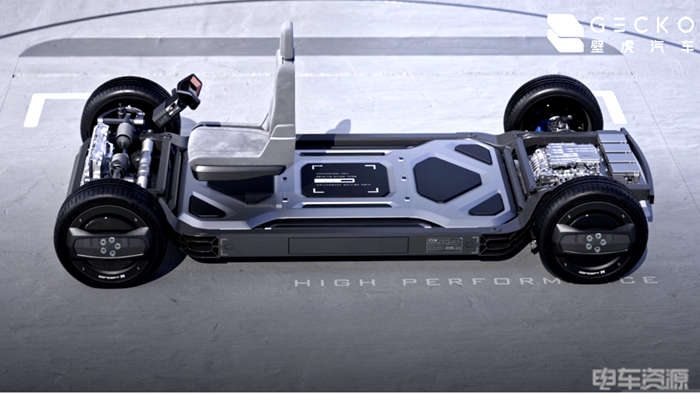

Taking Gecko Auto as an example, the company uses an advanced digital chassis as its core, based on a strategic platform technology that is modular, digital, and ecological, leading the industry towards a more efficient, intelligent, and sustainable future. At the same time, through the technological leadership and resource advantages brought by its ecological layout, it continuously creates value, thereby achieving cost reduction and efficiency improvement throughout the entire vehicle lifecycle.

On one hand, a series of intelligent driving functions tailored for commercial vehicles significantly enhance the driving experience and active safety coefficient, greatly reducing the probability of vehicle collisions and thereby lowering insurance and maintenance costs. On the other hand, Geckor Auto's shareholders include leading enterprises from the upstream and downstream of the industrial ecosystem, enabling the maximization of cost reduction throughout the vehicle's entire lifecycle.

It should be noted that achieving cost reduction throughout the entire life cycle of new energy commercial vehicles is not an easy task, nor can it be accomplished by automotive companies alone. This requires the coordinated development of the upstream and downstream of the industry chain. Currently, OEMs hold a favorable position, and those who seize the initiative are likely to gain market dominance.

"From January 1, 2026, to December 31, 2027, vehicle purchase tax on new energy vehicles will be halved," the most direct impact of which is the increase in the purchase cost of new energy vehicles. In the current era of comprehensive competition, price reduction is the more pressing trend. For the new energy logistics vehicle industry, which is more sensitive to price, cost reduction and efficiency improvement are common needs across the entire industrial ecosystem. The battery swapping model may see short-term benefits due to relatively smaller price increases, but in the long run, technology-driven cost reduction is considered a better solution due to its potential for significant cost reduction over the entire lifecycle. Do you agree with this? Feel free to share and discuss in the comments section.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track