H1 2025: Haier Refrigerator Tops The List Without Contest, Who Sees The Highest Growth?

In the first half of 2025, driven by consumption upgrade and policy benefits, the Chinese refrigerator market steadily grew. According to GfK Zhongyikang H1 data, the offline market retail sales reached 9.93 billion yuan, a year-on-year increase of 7.4%; the retail volume was approximately 1.392 million units, a year-on-year increase of 3.7%.

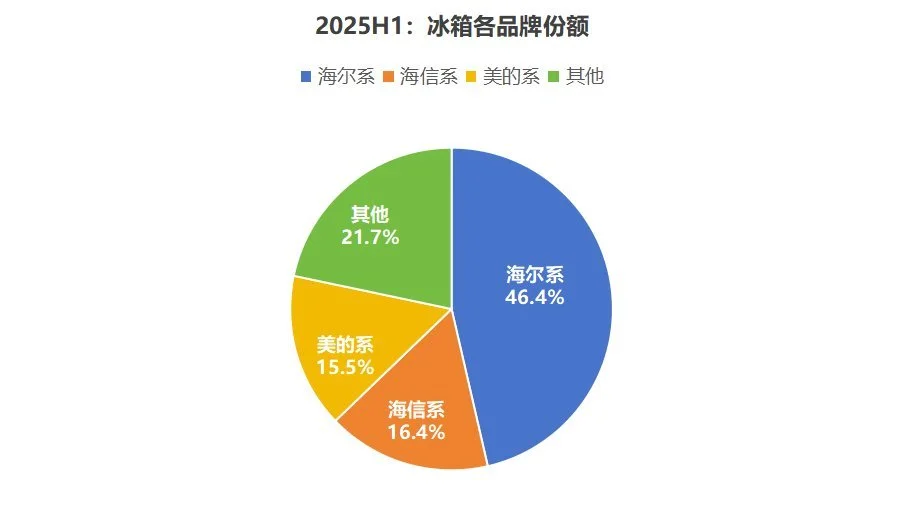

From the perspective of brand competition landscape, market concentration continues to increase. According to GfK Zhongyikang H1 data, the TOP3 brand pattern remains stable, with Haier Group, Hisense Group, and Midea Group occupying the top three positions with market shares of 46.4%, 16.4%, and 15.5% respectively, totaling 78.3%. The industry's Matthew effect is further highlighted.

In the context of intensified stock competition, incremental performance better reflects a brand’s growth momentum.Data shows that in the first half of the year, the growth among leading brands varied significantly: Haier saw a net increase of 2.3 percentage points year-on-year, Midea increased by 0.6 percentage points, while Hisense declined by 0.2 percentage points. This means that, despite having the highest base, Haier refrigerators still achieved the largest market share expansion, demonstrating strong competitiveness in both maintaining its core market and seizing growth opportunities.

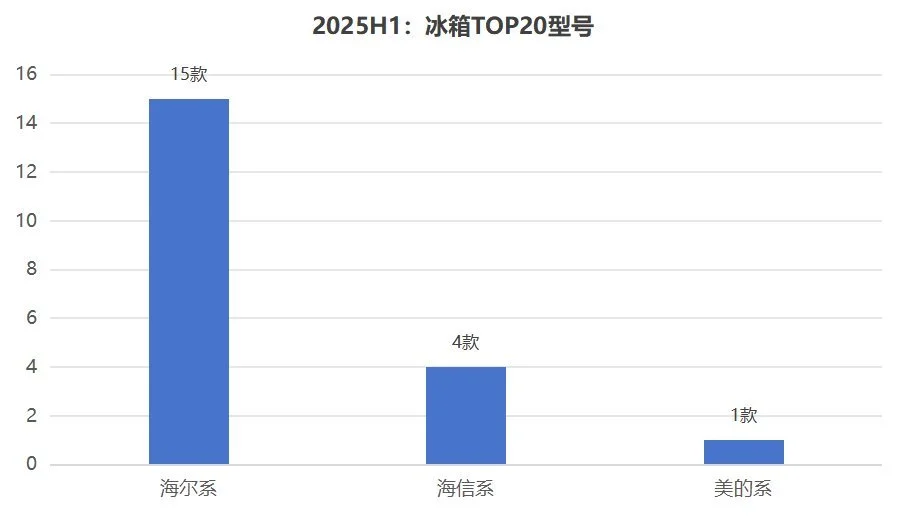

Carefully analyzing, there are two major differences in the refrigerator market in the first half of the year. On one hand, the product release speed is increasing.Compared to last year, this year’s TOP20 best-selling list features mostly “new faces,” with 13 refrigerator models making the list for the first time, including the Haier Heyue 625 at TOP1 and several Haier Mailang models. At the same time, the number of listed products is proportional to brand share: Haier series, Hisense series, and Midea series have 15, 4, and 1 products on the list respectively, demonstrating the strong pull of popular models.

On the other hand, thanks to national subsidy policies, users' sensitivity to price has decreased, making technology and experience the decisive factors for upgrades.From a macro perspective, the average price in the refrigerator industry increased by 1.9% year-on-year. Specifically, the Haier series saw a 3.1% year-on-year price increase, the Midea series a 1.2% decrease, and the Hisense series a 3.7% increase. Among them, the Haier series is the only refrigerator brand in the industry to achieve simultaneous growth in both market share and price. This corresponds to an enhancement in user experience, as seen with the TOP1 model Haier Yue 625, which features the latest magnetic control full-space freshness technology, allowing deep-sea fish and shrimp to remain fresh and flavorful after 60 days of freezing. This nationally award-winning technology is also applied to the new Mai Lang refrigerator model, which will be launched in August.

In the first half of the year, the competition in the refrigerator industry has entered a new stage of "technology defines value, users define products." Leading brands must continue to make efforts in core technology breakthroughs, responding to user needs, and optimizing product structures to consolidate their market position. How the industry landscape will evolve in the second half of the year is a dynamic worth continuous attention.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track