Goldhair Technology Stock Soars, Operating Quality Gradually Improves

On September 12, Kingfa Technology's stock performed excellently, closing at 19.14 yuan per share, with a total market capitalization reaching 50.5 billion yuan, surpassing the 50 billion mark in one go. As of the closing price on September 15, at 19.85 yuan per share, the market capitalization reached 52.34 billion yuan. Against the backdrop of the chemical industry's triple pressures of overcapacity, weak demand, and trade frictions, the company still delivered impressive performance, and this achievement is by no means accidental.

The main products of Kingfa Sci. & Tech. include nine major categories: modified plastics, environmentally friendly high-performance recycled plastics, biodegradable plastics, specialty engineering plastics, carbon fiber and composite materials, light hydrocarbons and hydrogen energy, polypropylene resins, styrene resins, and high-performance polymers for medical and healthcare applications. In the first half of 2025, the company achieved a revenue of 31.636 billion yuan, representing a year-on-year increase of 35.50%; net profit attributable to shareholders reached 585 million yuan, a year-on-year increase of 54.12%.

Modified plastics: Steady increase in product market share

In the first half of 2025, the modified plastics segment of Kingfa Sci & Tech achieved a sales volume of 1.3088 million tons, representing a year-on-year increase of 19.74%, setting a new historical high. Revenue reached 16.473 billion yuan, an increase of 18.62% year-on-year. Specifically:

In the automotive industry, the development of low-carbon and environmentally friendly PP materials has led to the creation of the first global standard formulated in China by a leading global company in automotive cooling systems, achieving a carbon reduction rate of up to 40%. Transparent PP materials are widely used in automotive components such as headlights, bumpers, and ambient lights for new energy vehicles, significantly enhancing the aesthetic quality and product appeal, earning recognition from multiple mainstream automotive manufacturers. In the first half of 2025, global sales of automotive materials reached 560,300 tons, a year-on-year increase of 21.54%, with overseas sales growing by over 50% compared to the previous year.

In the field of new energy, the introduction of environmentally friendly flame-retardant special reinforced polyolefin materials has successfully addressed the molding process challenges of large-size PACK structural components in the energy storage sector. The high refrigerant-resistant long carbon chain polyamide products exhibit excellent performance, breaking the monopoly of foreign companies on material technology for energy storage thermal management piping systems, and have now achieved domestic mass application. In the first half of the year, global sales of new energy materials reached 45,000 tons, a year-on-year increase of 30.06%.

In addition, modified plastics used in household appliances, electronic and electrical engineering, and consumer electronics all achieved sales growth, with growth rates of 19.55%, 17.54%, and 23.59%, respectively.

At the same time, Jinfat Technology is accelerating its global layout. In the first half of the year, the sales volume of finished products in overseas regions reached 161,000 tons, continuing to grow by 33.17% on the basis of nearly 30% growth last year, significantly increasing its share in the overseas market. By the end of June 2025, the Vietnam factory has achieved large-scale production, the Spain factory has successfully commenced operations, and the Indonesia factory has been built and is set to begin operations soon. Overseas bases such as Jinfat USA, Jinfat Europe, Jinfat India, Jinfat Vietnam, and Jinfat Malaysia are working in synergy.

Green Petrochemical: Operating Quality Gradually Improving

Goldwind Technology's green petrochemical sector achieves cost reduction and efficiency improvement through continuous technological transformation upgrades and process optimization.In the first half of 2025, Jinfat Technology's green petrochemical business achieved revenue of 5.962 billion yuan, a year-on-year increase of nearly 50%, and its proportion of total revenue rose to 18.8%. The improvement in operational quality has significantly contributed to the overall profit growth of the company.

In the first half of the year, Ningbo Jinfang achieved operating revenue of 3.761 billion yuan, a year-on-year increase of 43.17%. It owns a 1.2 million tons/year PDH unit and an 800,000 tons/year polypropylene unit, and has developed nearly 20 grades of homopolymer PP and copolymer PP products. It is constructing an integrated project for 1.2 million tons/year polypropylene thermoplastic elastomers (PTPE) and modified new materials.

Liaoning Jinfeng achieved a revenue of 3.722 billion yuan in the first half of the year, a year-on-year increase of 46.48%. The company has an ABS production facility with an annual capacity of 600,000 tons, a PDH facility with an annual capacity of 600,000 tons, an acrylonitrile facility with an annual capacity of 260,000 tons, and an MMA facility with an annual capacity of 100,000 tons.

At the same time, Liaoning Jinfang actively develops high-end specialty materials. The ABS unit has established a research and development chain from laboratory scale to pilot scale to industrial scale. In the first half of the year, a total of 243,600 tons of ABS were sold (+40.65%). The "200,000-ton ABS modification project" was handed over and put into operation, successfully completing the full industrial chain from basic synthesis to high-end modification of ABS. In addition, the development of the R&D chains for AN, MMA, and public utilities engineering units is progressing as planned. Nearly 30 new grades of ABS and SAN have been successfully developed to meet various special application scenarios such as electroplating, heat resistance, painting, oil resistance, and low noise.

Sales and gross profit of specialty engineering plastic products rapidly increased

Benefiting from the increasing demand for domestic industrial chain autonomy, Kingfa Sci. & Tech.’s specialty engineering plastics business is accelerating innovative application development in fields such as high-frequency communications and AI equipment, leveraging its technological advantages. The company's newly developed generation of low dielectric constant and low dielectric loss LCP materials has been mass-applied in high-speed connectors for AI servers, setting a new industry benchmark. Its ultra heat-resistant, fatigue-resistant, and wear-resistant PPA and PEEK materials have successfully addressed the long-term use challenges of key components in embodied intelligent robots.

Driven by product innovation, customer penetration has significantly increased. In the first half of 2025, the sales volume of specialty engineering plastics reached 14,800 tons, a year-on-year increase of 60.87%. Among these, high-performance LCP materials achieved a leap in growth, with a year-on-year increase of 98.94%, nearly doubling. The rapid growth in sales volume has led to an increase in gross profit, making this business segment another important engine for the company's profit growth.

Recently, the environmental impact report for the 1,000-ton annual production of polyimide resin project by Kingfa Sci. & Tech. Co., Ltd.'s subsidiary, Zhuhai Wantong Special Engineering Plastics Co., Ltd., has been accepted for public notice, as well as the environmental assessment information for the first phase of the 40,000-ton annual production of bio-based high-temperature nylon project. This marks a significant breakthrough for Kingfa Sci. & Tech. Co., Ltd., breaking the monopoly of two major giants.

In terms of biodegradable plastics, the main product sales reached 102,700 tons, representing a year-on-year increase of 38.41%, with an annual production...50,000 tons of bio-based succinic acid stable production, with an annual output of 10,000 tons of bio-based BDO successfully put into production; in the field of high-performance carbon fibers and composite materials, main products achieved revenue of 211 million yuan, a year-on-year increase of 15.93%; medical health products achieved sales revenue of 468 million yuan, a year-on-year increase of 185.37%. The developed nitrocellulose microporous membrane product has entered mass production, and the supercritical electrostatic spraying (SEJ) non-woven fabric is in the trial equipment debugging stage. In terms of R&D investment,Kingfa Sci. & Tech. Co., Ltd., leveraging its strong R&D system, has established the "13551" R&D framework, which consists of 1 central research institute, 3 international R&D centers, 5 branch technology centers, 5 chemical new materials incubation bases, and 1 national industrial innovation center. The company continuously increases its efforts in new product development, with R&D investment reaching 1.293 billion yuan in the first half of the year, representing a year-on-year increase of 34.56%.

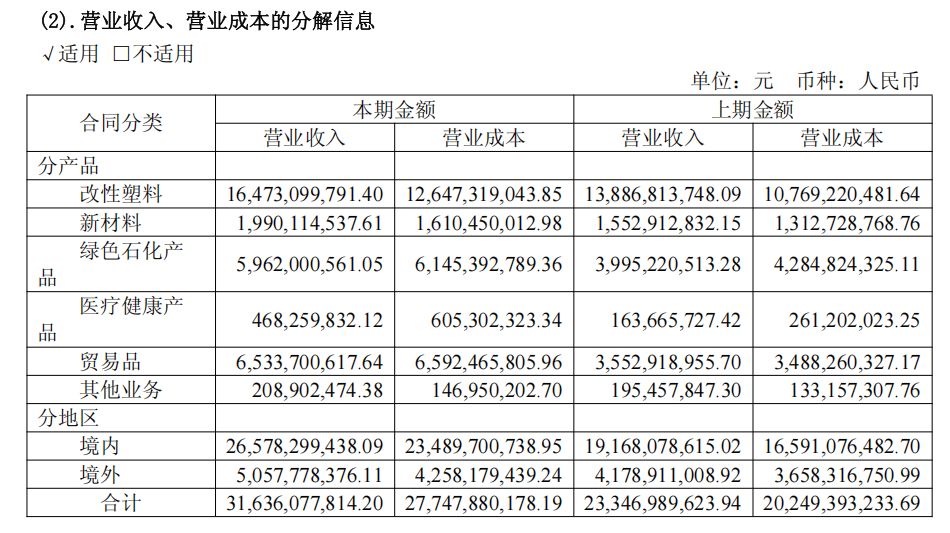

Income and Cost Comparison by Segment

A new chairman has taken office and indirectly holds shares in Unitree Robotics.

It is worth mentioning that on May 21, 2024, Yuan Zhimin, who had led Kingfa Sci. & Tech. for more than thirty years, stepped down as chairman, and Li Nanjing resigned from the position of general manager. Subsequently, the eighth board of directors elected Chen Pingxu as chairman and Wu Di as general manager. Most members of the new board of directors and board of supervisors are from the post-1980 generation. The infusion of young blood has brought a brand-new way of thinking and innovative vitality to the company. A new chairman takes office! Targeting a trillion-yuan output value! Understand the leading modified plastics company Kingfa Sci. & Tech. in one infographic!

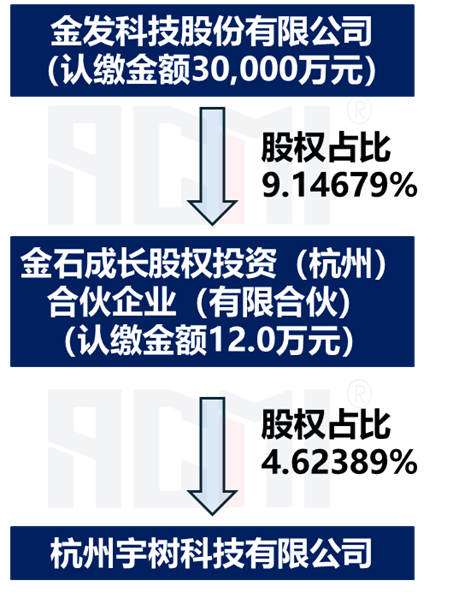

In the field of robotics, Kingfa Technology indirectly holds shares in Unisound Technology through the Jinshi Growth Fund. The shareholding structure of Jinshi Growth Equity Investment (Hangzhou) Partnership is shown in the figure below, holding 4.62% of the shares in Unisound Technology.

Recently, Yushu Technology announced that it expects to submit its listing application documents to the stock exchange between October and December 2025, at which time the company's relevant operational data will be officially disclosed. Yushu Technology stated that, for the year 2024, the sales of quadruped robots, humanoid robots, and component products will account for approximately 65%, 30%, and 5%, respectively. Among these, about 80% of the quadruped robots are used in research, education, and consumer fields, while the remaining 20% are applied in industrial sectors, such as inspection and firefighting. Humanoid robots are fully utilized in research, education, and consumer areas. (Source: Eastmoney, Jinfat Technology, Chemical New Materials)

According to industry operation data, in recent years (2020–2024), the production capacity of special engineering plastics in China has maintained a double-digit annual growth rate, with output increasing by 14.3% and consumption growing by 5.7%. Despite an overall decline in the profitability of general engineering plastics, the profit level of special engineering plastics remains high. The self-sufficiency rate has also increased from 30% to 47%, with substantial breakthroughs achieved in high performance, multifunctionality, process innovation, and industrial application.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track