Global Trade Friction Index High At Run! Oil Price Weekly Surge 5%, Plastic Futures Main Contract Rise More Than Fall

I. Overnight Crude Oil Market Dynamics

The intensity of the Russia-Ukraine conflict has recently increased, raising market concerns about potential supply risks, leading to a rise in international oil prices.Crude oil futuresThe 11th contract for WTI crude oil is $65.72, up $0.74 per barrel, a week-on-week increase of 1.14%; the 11th contract for ICE Brent crude oil is $70.13, up $0.71 per barrel, a week-on-week increase of 1.02%.

Future Market Forecast

Geopolitical factors have been the absolute driving force behind this year's oil price rebound. However, it can be seen that their short-term impact significantly amplifies oil price volatility but does not determine the overall trend of oil prices. Since September, geopolitical disturbances have been continuously introduced to the market, including the stability of Russian oil supply, Israel's confrontation with the entire Islamic world in the Middle East, and friction between Venezuela and the United States in South America. In the past week, geopolitical disturbances have reached a peak. Meanwhile, on the macroeconomic front, the Federal Reserve's entry into an interest rate cut cycle is a relatively positive factor for global risk assets. It can be said that geopolitical and macroeconomic factors have caused considerable disturbance to oil prices this year, overall serving as a bullish factor for oil prices. On the other hand, the accelerated production increase by OPEC+ is undoubtedly a bearish factor for oil prices and the most critical driving force. There is currently significant disagreement in the market regarding the impact of OPEC+ production increases on the oil market's supply-demand balance, and the answers to these questions will gradually be revealed in the upcoming October and the fourth quarter. Based on a comprehensive assessment of various influencing factors, it is recommended to focus on seizing shorting opportunities after the rebound peaks. The Friday night session's peak offers a rare shorting opportunity, so be cautious with timing and participate carefully.

II. Macroeconomic Dynamics

The National Bureau of Statistics released a statistical report on social and livelihood developments since the "14th Five-Year Plan," showing that by the end of 2024, the total population of the country was 1,408.28 million, with 857.98 million people of working age (16-59 years old), accounting for 60.9% of the total population. The advantages of scale and demographic dividend still exist.

During this year's National Day and Mid-Autumn Festival holiday, small passenger cars will be allowed to pass through toll roads nationwide for free. The free passage period is from 0:00 on October 1 to 24:00 on October 8. The Ministry of Transport expects that during the 8-day holiday, the total inter-regional mobility of the population will reach 2.36 billion person-times, averaging about 295 million person-times per day, an increase of approximately 3.2% compared to the same period last year.

According to CCTV Finance, starting from the 29th of this month until June 30 next year, South Korea will implement a visa-free entry policy for Chinese group tourists. China has long been the largest source of inbound tourists to South Korea, with Chinese tourists accounting for 28.6% of foreign visitors to South Korea in the first half of this year. With the visa exemption in effect, it is expected that the number of Chinese tourists visiting South Korea this year will surpass 5 million.

Goldman Sachs analysts stated in their latest report that the risk of the U.S. economy reaccelerating is on the rise. This expectation is based on multiple favorable factors such as the resilience of the labor market, anticipated fiscal stimulus, and a loose financial environment. This prospect of economic reacceleration will have a significant impact on the Federal Reserve's monetary policy path, especially in the context of the Fed selecting a new chairperson.

According to the China Council for the Promotion of International Trade, global economic and trade frictions have intensified again due to the repeated adjustments of U.S. tariff policies. In July, the global economic and trade friction index was 110, remaining at a high level. The amount involved in global economic and trade friction measures increased by 6.6% year-on-year and 27.6% month-on-month. The U.S. has the highest amount involved in global economic and trade friction measures, ranking first for 13 consecutive months.

According to informed sources, as the risk of a government shutdown in the United States looms closer, President Trump is scheduled to meet with the four congressional leaders on Monday. This will be Trump's first formal consultation with Democratic leaders ahead of the funding deadline. Federal government funding will run out at midnight on September 30, and if the two parties cannot reach an agreement by then, some government agencies will face a "shutdown." The White House has previously instructed agencies to prepare large-scale layoff plans, indicating that the risk of a government closure is rising.

3. Plastic Market Morning Dynamics

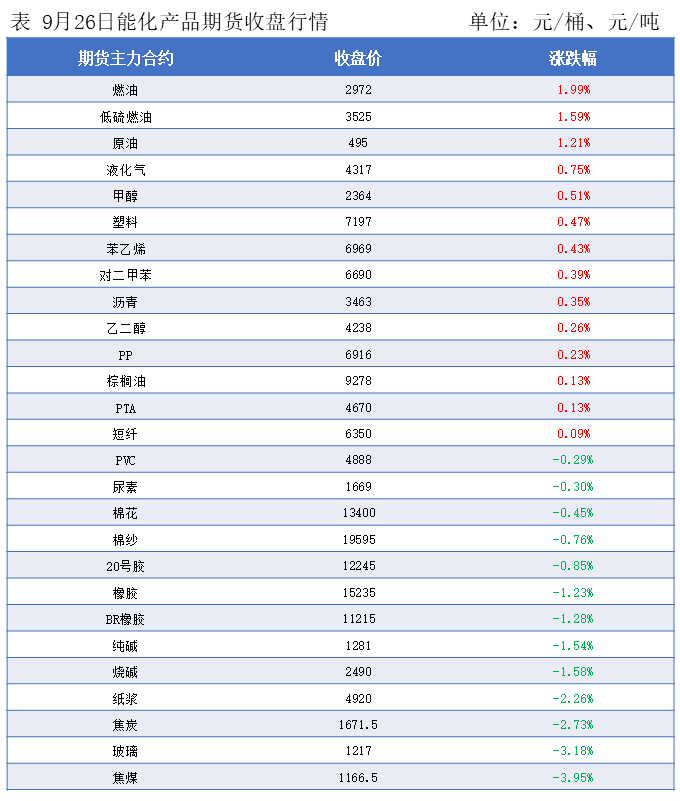

Oil prices surged 5% in a week! Overnight, the main contracts of domestic plastic futures mostly rose with few declines.

The plastic 2601 contract is quoted at 7,197 yuan/ton, an increase of 0.47% compared to the previous trading day.

The PP2601 contract is reported at 6916 yuan/ton, up 0.23% from the previous trading day.

The PVC2601 contract is quoted at 4888 yuan/ton, down 0.29% from the previous trading day.

The styrene contract for 2510 is priced at 6,969 yuan/ton, up 0.43% from the previous trading day.

IV. Market Forecast

PE: In the short term, the cost side has weakened, leading production enterprises to reduce the number of shutdowns due to profit concerns. The supply volume is expected to continue to increase. On the demand side, there is still a lack of purchasing motivation. Recently, overseas offers have also increased due to Brazil's counter-tariffs against the U.S. and the return of Middle Eastern facilities. Overall, the pressure from the supply side will become the main issue, and market prices are expected to fluctuate with a slight decline.

PP: Recently, international oil prices have been trending strong, but the guidance from the cost side to the spot market is limited. From a fundamental perspective, many production enterprises have shut down for maintenance, yet pressure on the supply side remains. During the week, downstream operations have been slowly increasing but are below expectations. With the upcoming festivals, traders are offering discounts to boost sales, and it is expected that the polypropylene market will mainly maintain a volatile consolidation.

PVC: With the completion of maintenance and the addition of new production capacity, the output is expected to reach a new weekly high by the end of the month. Downstream stocking ahead of the festival is relatively weak, leading to a significant increase in industry inventory. Export uncertainties in October due to policy disruptions, coupled with weakening costs of calcium carbide, are affecting the market. The expected policy impact before the festival is diminishing. It is anticipated that the spot prices in East China will fluctuate within a weak range ahead of the festival, with the cash price for calcium carbide-based PVC expected to be between 4600-4780 RMB/ton.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track