Global Smartphone Shipments in Q3 Increase 3% Year-On-Year, Apple Sets Record for Best Performance in History for Same Period

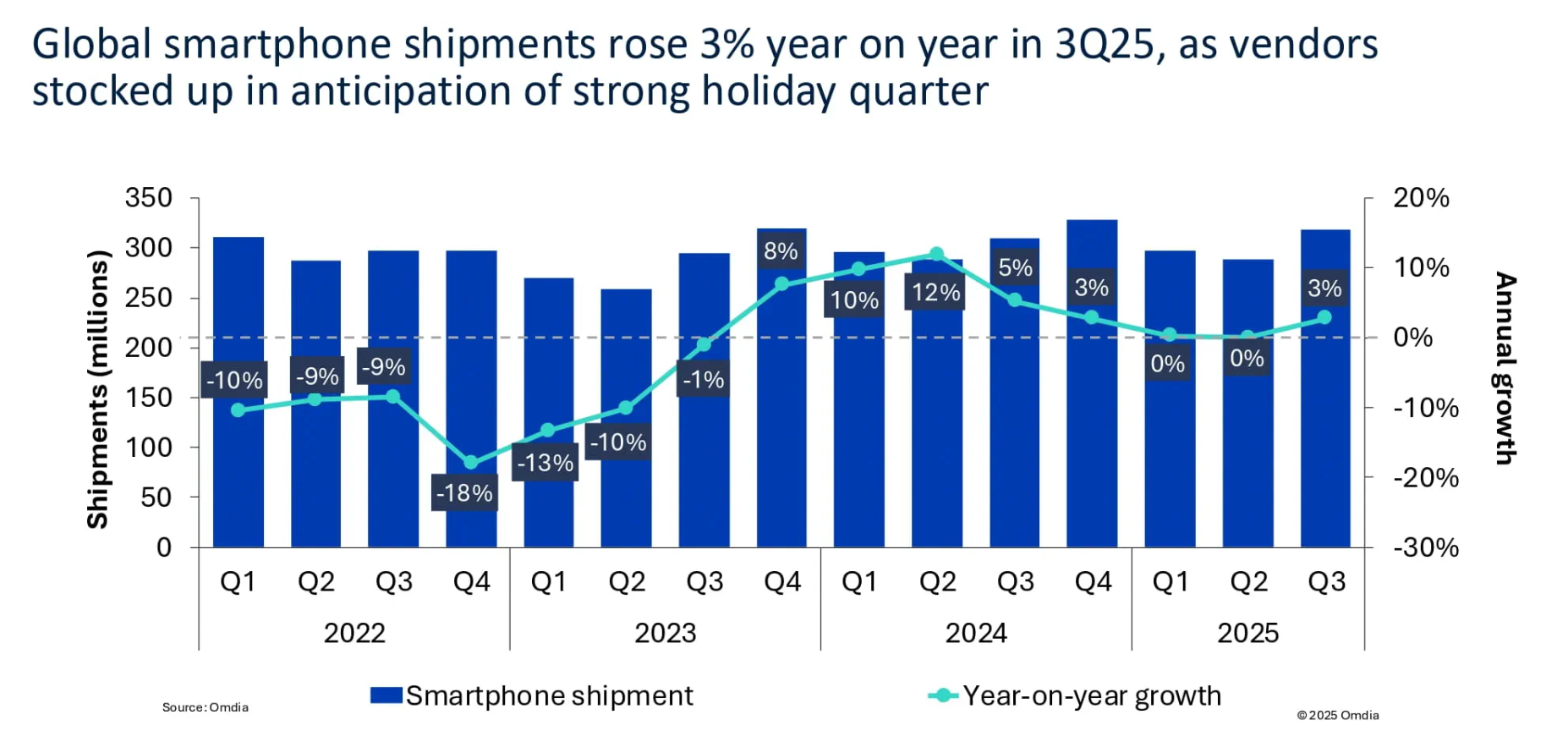

On Tuesday, Eastern Time, the latest research from Omdia, a leading global technology research and consulting company, showed that the global smartphone market grew by 3% year-on-year in the third quarter of 2025. This indicates that driven by strong product renewal demand fueled by major product launches during this quarter, the mobile phone market has regained growth momentum.

Global smartphone shipments grow strongly.

In the third quarter of this year, the global smartphone market showed strong replacement demand, with several suppliers preparing inventory in advance across various channels before the busy sales period of the fourth quarter. Driven by these factors, global smartphone shipments experienced robust growth.

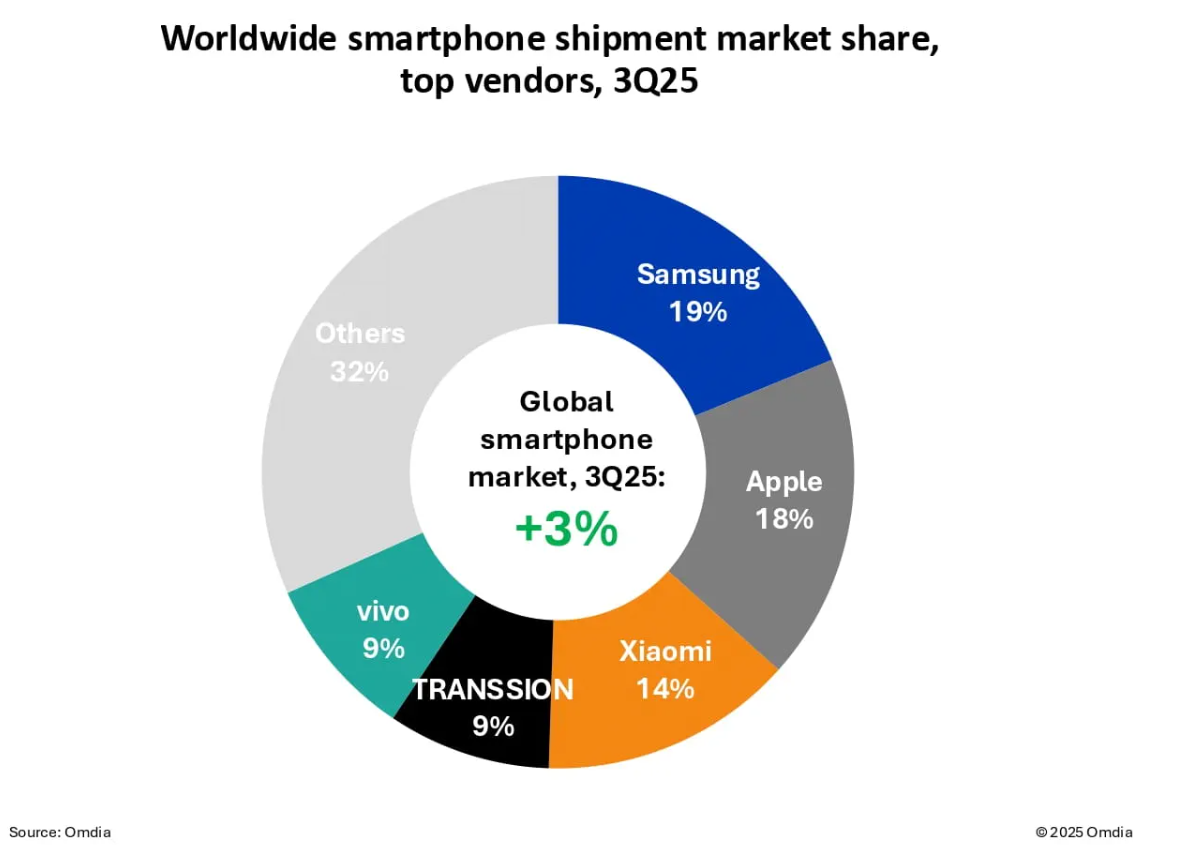

Maintaining the lead for the third consecutive quarter, its global market share reached 19%, thanks to the continued sales advantage of its Galaxy A series and the upgraded seventh-generation foldable product lineup.

Apple Inc.iPhone shipments increased by 4% year-on-year, achieving the strongest third-quarter sales performance in history. Due to the strong initial demand after the launch of the iPhone 17 series, Apple successfully captured an 18% share of the global market.

Another smooth quarter has arrived, with the market share reaching 14%.Transsion HoldingsVivo each held a 9% market share, and these five companies together constituted the top five suppliers for the quarter.

Global Smartphone Market Share Distribution

The demand for mobile phone consumption is rebounding.

Le Xuan Chiew, Research Manager at Omdia, stated: "As the market's instability at the beginning of this year gradually subsides, consumer demand for upgrading and replacing smartphones is recovering, thereby driving market growth. From the data of the top five suppliers, compared to the third quarter of last year, their businesses have all experienced growth."

The industry's largest-scale launch event received positive feedback because leading suppliers struck a reasonable balance between hardware and software. This season's hardware highlights—foldable phones, ultra-thin phones, vibrant colors, and rear display screens—captured attention. Compared to previous quarters, some suppliers have increased production targets as initial demand exceeded expectations.

Le Xuan Chiew pointed out that the resurgence of consumer demand highlights the importance of effective product categorization, and the iPhone 17 series stands out particularly in this regard.

In the third quarter of this year, the iPhone 17 base model upgraded its storage capacity while keeping the price unchanged, exceeding expectations in first-tier markets. The iPhone 17 Pro and Pro Max continued to attract consumers globally. Although the shipment volume of the iPhone Air remains low, its marketing performance is strong, serving as an important platform for Apple to test core technologies, which may lead to further developments. Lay the foundation for future device form innovation.

"Many suppliers took advantage of the off-season in the first half of 2025 to adjust inventory, optimize operations, and strategically optimize their market launch cycles, and now they are benefiting from the reinvigorated consumer demand," added Le Xuan Chiew.

“Transsion HoldingsThe company performed particularly well in this regard, achieving double-digit growth compared to the third quarter of last year, reaching the highest third-quarter sales ever. This growth was attributed to cautious inventory management at the beginning of the year, the recovery of demand in the Middle East and Africa, and the launch of updated model series such as Hot 60 and Smart 10 series.

However, concerns and uncertainties regarding the global economy continue to impact suppliers' strategic planning, forcing many to cautiously balance scale, profitability, and revenue targets.

"In the face of upcoming adverse factors, suppliers remain cautious, but short-term success will depend on the ability to clearly identify opportunities with effective market promotion and marketing strategies."

The pressure of competition and cost remains immense.

Runar Bjørhovde, a senior analyst at Omdia, stated: "The competitive pressure in the current market is very intense, and the profitability of many suppliers is facing significant challenges."

"The continuous rise in material costs is exacerbating the balance issue between competitive pricing and profit. Semiconductor products, including storage and memory, are under significant pressure (rising), as smartphone manufacturers are competing for capacity against the backdrop of rapid growth in data center and artificial intelligence investments."

The fact is that competitive pressure and brand management costs cannot be alleviated in the short term, so major smartphone suppliers must seize more opportunities to increase revenue and enhance their competitiveness in the market. Subscription services, accessories, bundled products, and add-on sales within the ecosystem have all become key focus areas for strengthening consumer propositions and planning profitable paths.

Omdia points out that implementing the above strategies in emerging markets will be particularly challenging, as entry-level devices dominate these markets. In this context, offering financing options to avoid price wars can make the operating model more sustainable while maintaining device accessibility for consumers.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track