Global second! China first! This spandex company earned 2.22 billion yuan.

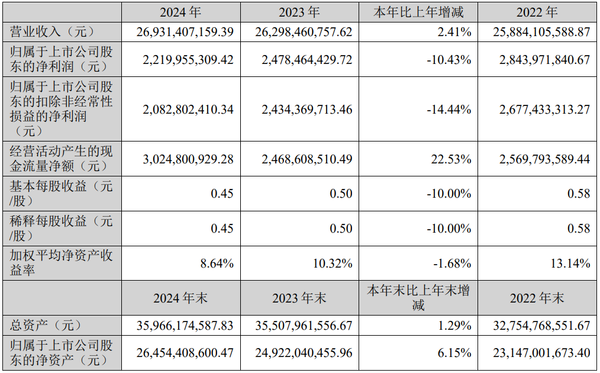

On March 29, Huafeng Chemical released its 2024 annual report. In 2024, Huafeng Chemical achieved operating revenue of 26.931 billion yuan, an increase of 2.41% year-on-year; the net profit attributable to shareholders of the listed company was 2.22 billion yuan. During the reporting period, the net cash flow generated from the company's operating activities reached 3.025 billion yuan, an increase of 22.53% year-on-year.

2024年华峰化学主要会计数据和财务指标 Translation: 2024 Major Accounting Data and Financial Indicators of Huafeng Chemical

During the reporting period, the company achieved stable growth in performance by optimizing the industrial chain layout, increasing R&D investment, and expanding the global market, laying a solid foundation for future development. As the leading company in the global spandex industry, Huafon Chemical's spandex production capacity and output rank second globally and first in China. The company's market share in the polyurethane original liquid field continues to expand, with products widely used in various industries such as footwear materials, furniture, and automotive parts. With the development of emerging fields such as 3D printing and new energy battery materials, the market demand for polyurethane original liquid is expected to grow further. Adipic acid is another core product of Huafon Chemical, widely used in nylon 66 fiber and polyurethane fields. In 2024, the company's adipic acid production capacity reached 1.355 million tons, with a capacity utilization rate as high as 94.96%, maintaining its global leading position.

1. Spandex Industry: Leading Position is Stable, Cost Advantages Await Release

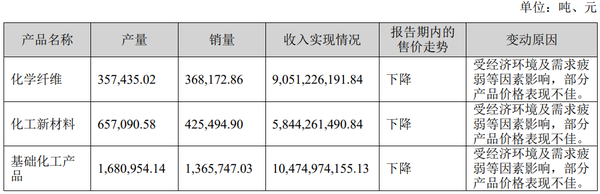

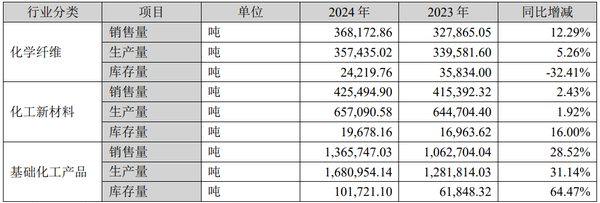

As the world's second-largest spandex producer, Huafon Chemical currently has a capacity of 325,000 tons, with a capacity utilization rate of 109.98% in 2024, and an additional 150,000 tons of capacity under construction. In 2024, the company produced 357,000 tons of chemical fibers, sold 368,000 tons, and generated revenue of 9.05 billion yuan. However, due to industry-wide capacity expansion and weak demand, spandex prices declined throughout the year, leaving most companies in the sector at a loss. The company plans to leverage its 150,000 tons of capacity under construction and upstream integrated projects (including a 1.1 million-ton natural gas integration project and a 240,000-ton PTMEG project) to build a full industrial chain advantage from raw materials to finished products, which is expected to significantly reduce production costs.

National Spandex Industry Overview in 2024: Domestic spandex prices continued to bottom out, maintaining a unilateral downward trend and repeatedly hitting historic lows, with the majority of companies in the industry still struggling to turn losses into profits. In 2024, China's spandex production capacity reached 1.3545 million tons, a year-on-year increase of 9.3%, while spandex output was 1.045 million tons, up 11.3% year-on-year. Exports totaled 69,600 tons, a 13.2% year-on-year increase, while imports fell 4.8% to 47,900 tons. Apparent demand reached 1.012 million tons, up 10.3% year-on-year.

Global spandex industry situation: By the end of 2024, global spandex production capacity will increase to 1.75 million tons, with a year-on-year growth rate of 7%. The incremental contribution is concentrated in the Chinese mainland market, where new spandex production capacity totals 115,000 tons. Domestic spandex production capacity in China is 1.3545 million tons, a year-on-year increase of 9.3%, with the growth rate slightly narrowing compared to the previous year. Under the influence of multiple factors, some newly installed facilities have experienced delays and reduced investments.

Polyurethane raw materials: Industry integration accelerates, leading players gain higher market share

The subsidiary Huafeng New Materials is the largest polyurethane raw material production enterprise in China, with a current production capacity of 520,000 tons and a capacity utilization rate of 68.17% in 2024. In 2024, the company's production volume of chemical new materials is 657,000 tons, sales volume is 425,000 tons, and revenue is 5.84 billion yuan.

The national polyurethane raw material industry is showing a polarized situation: small and medium-sized sole raw material enterprises are being squeezed in their survival space due to insufficient demand and cost pressure, while leading companies are continuously consolidating their market position relying on technological and scale advantages, and the industry's concentration is expected to further increase.

3. Adipic Acid: Supply-Demand Imbalance Intensifies, Long-Term Potential Awaits Exploration

The subsidiary Chongqing Chemical is the largest adipic acid production enterprise in China, with a current production capacity of 1.355 million tons and a capacity utilization rate of 94.96% in 2024. In 2024, the company's basic chemical production volume is 1.68 million tons, sales volume is 1.366 million tons, and revenue is 10.47 billion yuan.

National Adipic Acid Industry Overview in 2024: Domestic adipic acid capacity remained at 4.1 million tons, an increase of 9.63% compared to the previous year; production reached 2.56 million tons, a year-on-year increase of 10.82%. However, downstream consumption of adipic acid was 1.92 million tons, up 9.71% year-on-year. The supply growth rate of adipic acid exceeded the downstream consumption growth rate, leading to a temporary supply-demand imbalance that exacerbated the downward price trend, resulting in continuously narrowing production profits. According to BaiChuan data, the industry's gross profit per ton in 2024 was -1,303 CNY/ton, a significant decline compared to -222 CNY/ton in 2023.

Currently, the adipic acid industry is in a phase of survival of the fittest, with further concentration of production capacity and an increasing degree of integration within the industry chain. In the future, with the gradual recovery of the economic environment and the introduction of industry-related support policies, downstream demand will be unleashed, and capacities in nylon, TPU, and PBAT will expand. Particularly, breakthroughs in domestic hexamethylenediamine (HMD) technology will bring a new growth point for nylon 66. Meanwhile, driven by national policies such as the plastic restriction order and environmental protection initiatives, there will still be significant capacity investments in PBAT. These two sectors will become the biggest drivers for the future growth of adipic acid product consumption.

Huafeng Chemical has always regarded technological innovation as its core competitiveness, with R&D investment reaching 809 million yuan in 2024, accounting for 3.01% of its operating revenue. The company has made significant progress in the research and development of high-end products such as bio-based spandex and ultra-low-temperature easy-to-set spandex, further consolidating its market share in the mid-to-high-end segment.

During the reporting period, Huafeng Chemical continued to advance its internationalization strategy by establishing subsidiaries in South Korea, Pakistan, India, and other places, further expanding its overseas markets. The export volume of the company's spandex products increased by 13.2% year-on-year. At the same time, the company also reduced the risks brought by the fluctuation of raw material prices through optimizing the layout of the global supply chain.

Major accounting data and financial indicators of Huafon Chemical in 2024

Production, sales, and inventory status of Huafon Chemical by product category in 2024

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics