Global EV Landscape Reshaped: BYD Takes the Crown, Geely Surges, Tesla Stumbles

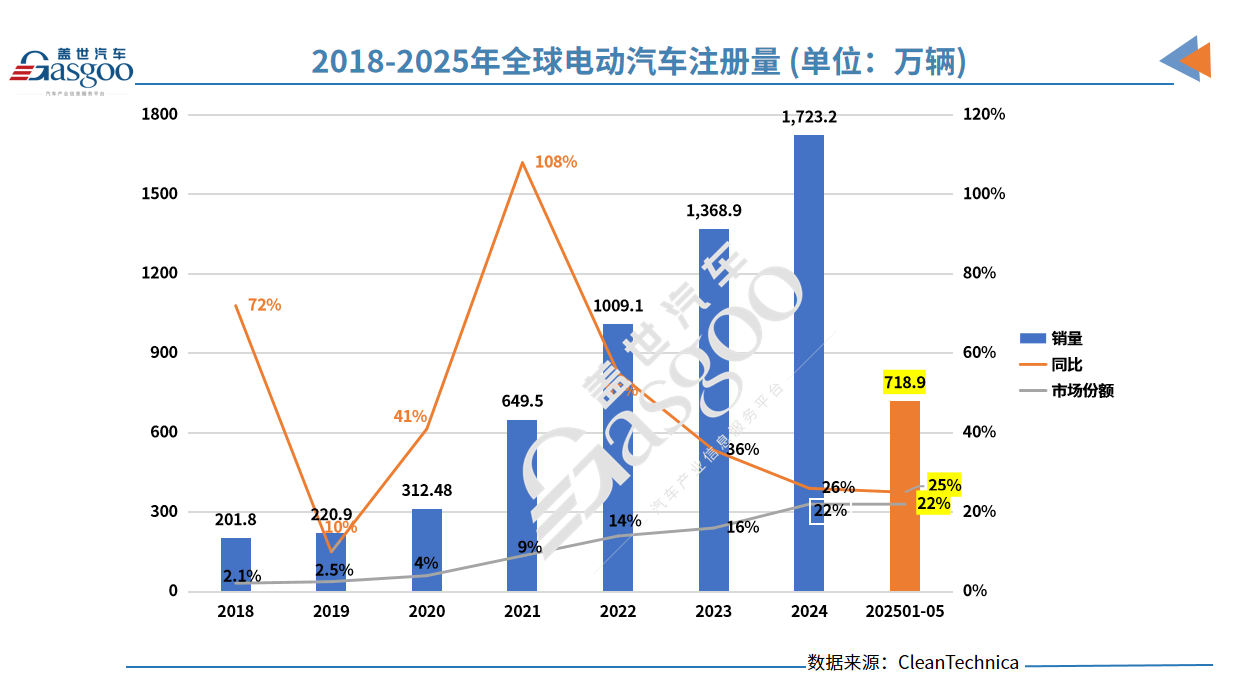

In 2025, the global electric vehicle market continues to heat up compared to 2024, but the growth rate has significantly slowed down compared to previous years.

According to data from CleanTechnica, the cumulative registrations of electric vehicles (including battery electric vehicles and plug-in hybrid electric vehicles) worldwide reached 7.189 million in the first five months of this year, a year-on-year increase of 25%.

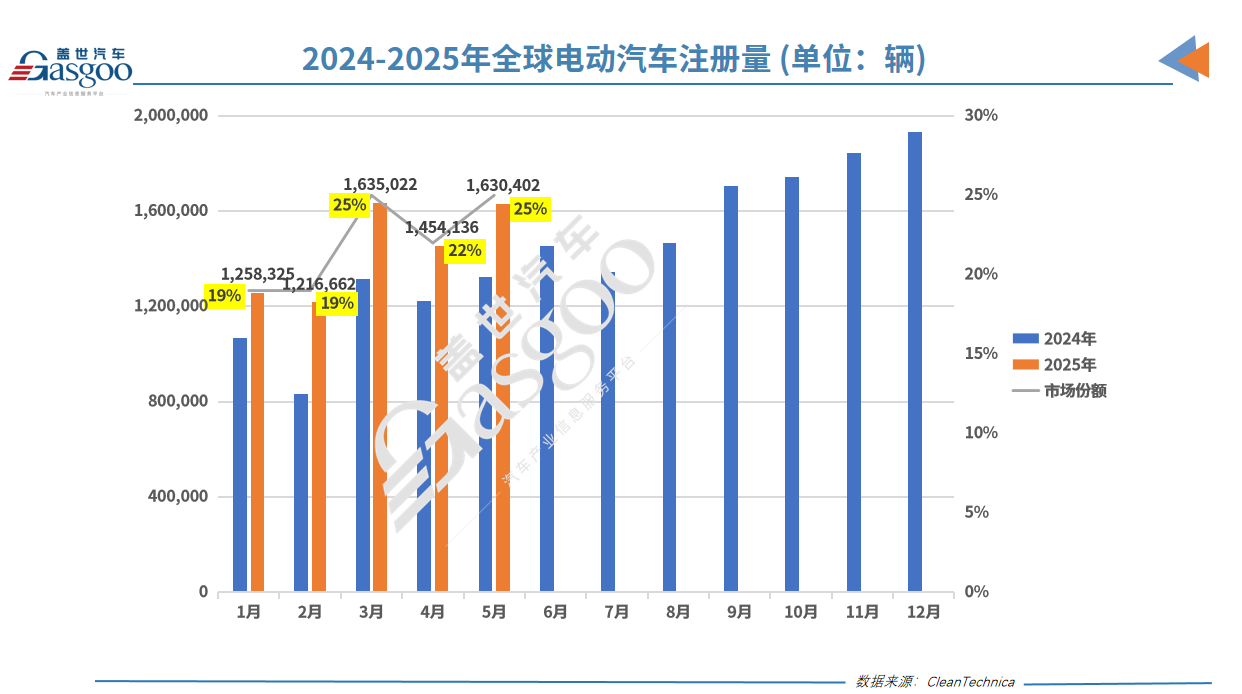

In terms of registrations in May alone, the global electric vehicle market saw 1,630,402 new car registrations, a year-on-year increase of 22%. Among these, pure electric vehicles grew by 19% year-on-year, with registrations exceeding 1 million, accounting for 65%. Plug-in hybrid vehicles grew even faster, with registrations increasing by 28% year-on-year to over 500,000.

Overall, electric vehicles accounted for 25% of the global automotive market this month, an increase of 5 percentage points compared to the same period last year and a rise of 3 percentage points compared to April. With the arrival of the traditional sales peak season in June, the market share of electric vehicles worldwide is expected to further increase.

TeslaModel YBack to the top of the list, but sales are still declining.

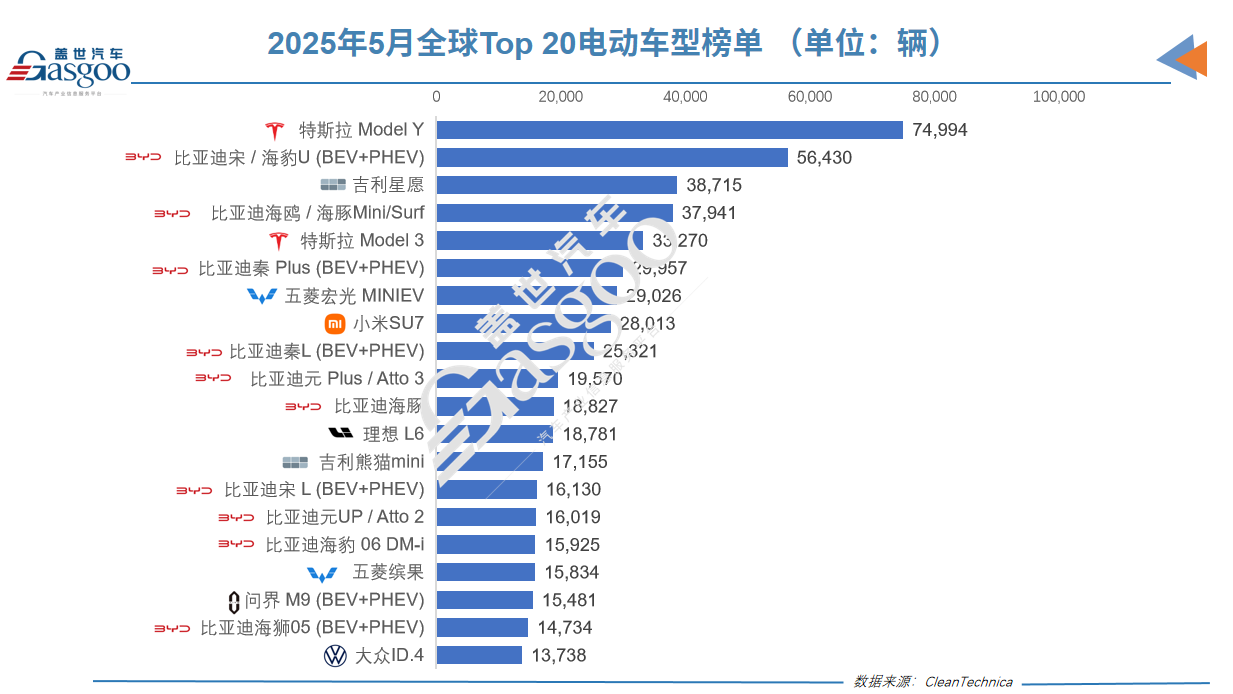

Despite a 19% year-on-year decline in registrations, the Tesla Model Y still reclaimed the global electric vehicle sales crown in May with approximately 75,000 units sold, replacing the BYD Song (also known as Seal U in overseas markets), whose registrations fell 11% year-on-year to about 56,000 units.

These two “veterans” still maintain a strong presence in the electric vehicle market, but both are facing significant growth pressure. If it weren’t for the sales of the BYD Song in overseas markets (such as Europe, Brazil, etc.) providing some support, its ranking might have declined even further.

It is worth noting that after Tesla launched the refreshed Model Y in March, the market response was limited. In April, registrations still plummeted by 29%. Although there was a slight recovery in May, registrations were still down by 19%. If this downward trend cannot be reversed in June, Tesla’s dominance in the global electric vehicle market will be in jeopardy.

More severe is TeslaModel 3In May, the global registration volume of this model plummeted by 29% year-on-year, with only about 33,000 units. In the context of slow model updates and the continuous emergence of new competitors, this model is facing increasingly intense competitive pressure, including some consumers switching to the newer Model Y.

Geely's Xingyue ranks third, Chinese electric vehicles dominate the list.

In May, Geely Xingyuan achieved a record-breaking 38,715 registrations, securing third place. It is noteworthy that this model has set a new monthly sales record for the fifth consecutive month. This also allowed it to successfully surpass its direct competitor, BYD. (The overseas market is also known as Dolphin Mini/Surf), the latter ranks fourth with a slight sales gap of about 800 units.

It is worth noting that Geely Xingyuan is currently focused primarily on the domestic market and continues to increase delivery volumes. If it accelerates its pace of exports in the future, it might even challenge the top position.

The BYD Seagull is also not standing still. As this model gradually enters the European market, its overseas sales are expected to increase steadily. These two Chinese micro electric vehicles will compete for the top three positions during Tesla's "stall."

In addition, the registration volume of BYD's Seagull 05 rose to 15,000 units, making it onto the global top 20 list for the first time. This also allowed BYD to have 10 models in the global electric vehicle registration TOP 20 list in May, occupying "half of the market."

Outside the top 20, the Leapmotor C10 ranks 21st with a registration volume of 13,567 units, just one step away from making the list. The 20th place on the list is occupied by the Volkswagen ID.4, which is the only model from an international traditional automaker to make the list. The second best-selling electric vehicle from a traditional automaker is the Volkswagen ID.3, with a registration volume of 10,976 units in May, lagging far behind new models from China, such as the AITO M8 (with a registration volume of 12,116 units) and the BYD Sealion 07 (with a registration volume of 11,866 units).

Notably, among the top 20 global electric vehicle registrations in May, apart from two Tesla models and the Volkswagen ID.4, all others are Chinese models. Considering that the Chinese auto market typically strengthens in the second half of the year and Volkswagen's business in China remains sluggish, even the Volkswagen ID.4 may be pushed out of the list, resulting in the top 20 rankings being entirely occupied by Chinese models and Tesla.

January-May Rankings: The "Iron Triangle" structure remains unchanged, but variables are becoming apparent.

In terms of cumulative registrations for the first five months of this year, the top three are still occupied by Tesla Model Y, BYD Song, and Tesla Model 3, continuing the "iron triangle" pattern since 2022. Given that there is still a sales gap of 25,000 vehicles between the Tesla Model 3 and the fourth-ranked BYD Seagull, it is expected that the top three will remain unchanged by the end of the year.

With the continued efforts of new Chinese forces, subtle changes have occurred beyond the top three. Both the BYD Seagull and the Geely Xingyuan have demonstrated strong growth momentum, posing a potential threat to the Tesla Model 3. Additionally, the Li Auto L6 and the Geely Panda Mini have climbed to the 11th and 12th positions, respectively. Moreover, many models in BYD's product lineup have also seen their rankings rise, with the Dolphin jumping 3 places to 15th, the Yuan UP climbing to 18th, and the BYD Song L joining the list at 19th.

The trend of small cars is also reflected in the rise of the Wuling Bingo, which has ranked 17th globally, further proving that micro pure electric models are gaining popularity worldwide.

Brand Battle: Geely Continues to Rise, Tesla’s Market Share Halved

In terms of brands, in May, the top three global sales were BYD, Tesla, and Geely. BYD maintained its leading position with nearly 350,000 units sold, approximately three times that of Tesla. However, despite its overall lead, BYD's growth in the domestic Chinese market is slowing down. Its ability to continue rapid development in the future will depend on the pace of its expansion in overseas markets.

Tesla's May sales dropped 24% year-on-year to 111,500 units, but it still narrowly reclaimed the second place from Geely. However, Geely's performance remains impressive. With a strong lineup of models in the Chinese market and its initial steps into the export market, Geely once again achieved a record-breaking result in May, with registrations reaching 104,120 units. It continues to charge ahead on the path of challenging BYD's dominance and surpassing Tesla.

Geely's progress is also notable in terms of market share. A year ago, Geely ranked third with a market share of 7.9%, but now it has increased by 3.4 percentage points to 11.3%, moving up to second place. This is almost the opposite of Tesla's situation, as Tesla's market share decreased by 3.6 percentage points during the same period.

Besides Geely, Leapmotor's registration volume has also continuously hit new records. In May, the brand's delivery volume surged by 148% year-on-year, exceeding 45,000 units, making it currently the best-selling new electric vehicle force in China. AITO, with the impressive performance of its M8 model, climbed to ninth place in the brand rankings with over 36,000 units sold; Xiaomi is also highly anticipated, with an expected monthly production capacity of 50,000 units by the end of the year, which will put pressure on Leapmotor.

In the latter part of the ranking, we see Deep Blue and Ford re-enter the list. Ford has benefited from increased sales in its European operations and is also expected to see strong demand in the US market, as American consumers are eager to purchase electric vehicles before tariffs rise and EV subsidies are removed.

Summary: Reshaping the New Energy Landscape, More Domestic Brands Rise

As of data from May 2025, the global electric vehicle market is undergoing a profound transformation. Tesla is no longer an unattainable myth, as domestic brands are rapidly rising, particularly with the surge of micro electric vehicles and new forces reshaping the global electric vehicle market landscape. BYD continues to lead, Geely is striving to catch up, and emerging brands like Leapmotor and AITO are making a strong entrance, while traditional powerhouses such as Tesla and Volkswagen are forced into a defensive position.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track