Gasgoo Supply Chain: A Closer Look at China’s Automotive Thermal Management Industry

With the popularization of new energy vehicles, the importance of vehicle thermal management systems has become increasingly prominent. The traditional thermal management model, which focused on cooling and air conditioning, is being replaced by an integrated system encompassing the battery, drive motor, heat pump, and overall vehicle temperature control strategies. Thermal management not only affects driving comfort and vehicle safety, but also directly relates to the thermal safety of the battery system, low-temperature performance, and overall vehicle energy consumption. It is a crucial link to ensure driving range and improve overall vehicle performance. Driven by the optimization of driving range, the application of high-voltage platforms, and vehicle lightweighting, the thermal management industry chain is accelerating its upgrade towards integration, intelligence, and highly efficient cooling solutions.

In this context,Gasgoo, based on an in-depth analysis of the national automotive supply chain, selects multiple dimensions for analysis in an attempt to reflect the current situation in China.Thermal managementStructural Characteristics and Development Trends of the Industry

Gai Shi Global Automotive Industry Big DataAs of August 2025, there are 4,573 above-scale enterprises nationwide related to thermal management, covering electric compressors, radiators, condensers, thermal management controllers, and various integrated solution providers. The total registered capital amounts to 279.5 billion RMB. After years of development, the industry has evolved into the stage of "scale competition."

From the perspective of distribution areas,Thermal ManagementThe leading provinces with concentrated enterprises occupy nearly half of the territory, demonstrating a significant industrial cluster effect.Data shows that Zhejiang, Jiangsu, Guangdong, Shandong, and Shanghai rank as the top five regions in China in terms of the number of thermal management enterprises, accounting for over 50% of the national total. Zhejiang and Jiangsu, relying on the Yangtze River Delta automotive industrial belt, have benefited from the comprehensive automotive industry chain and component supply advantages radiating from Shanghai, which has led to the concentration of a large number of thermal management-related enterprises and the gradual formation of a collaborative ecosystem of "R&D—production—supporting facilities." Guangdong, driven by local automakers such as BYD and the layout of foreign car manufacturers, has seen the production and sales of new energy vehicles continuously expand, which has rapidly increased the demand for thermal management and accelerated the gathering of related enterprises.

Thermal managementThe industry is in a leading position nationwide, with the number of enterprises reaching 884.The Xiaoshan Automotive Industry Cluster in Hangzhou focuses on the research, development, and production of new energy vehicle components and thermal management modules, forming a synergistic pattern of R&D and manufacturing. The Longquan Automotive Parts Industrial Park balances the construction of air-conditioning systems and thermal management components. In August 2023, Geely Group and Longquan City signed a cooperation agreement to establish Geely Longquan Xiazhi Thermal Management Systems Co., Ltd., jointly promoting the implementation of projects related to new energy vehicle thermal management. According to data from the Longquan municipal government, as of July 2025, the total industry output value has exceeded 10 billion yuan, forming a complete R&D-production-support industrial ecosystem and establishing one of Zhejiang’s first industrial innovation service complexes—the Zhejiang Longquan Automotive Air Conditioning Industry Innovation Service Complex.

Jiangsu follows closely with 778 enterprises, forming a complete industry chain that covers multiple segments. The Wuxi Huishan Economic Development Zone relies on platforms such as the National Sensor Park and the Economic Development Intelligent Manufacturing Park to create a cluster area for new energy vehicle thermal management and related components. This includes core segments like compressors, providing integrated support for R&D, production, and ancillary services to the regional industry chain. Additionally, in May 2025, the China International Thermal Management Materials and Equipment Exhibition will be held at the Suzhou International Expo Center, bringing together industry-leading companies in thermal management materials, equipment, and solutions from both domestic and international markets.

Guangdong has 437 companies, ranking third, relying on the new energy vehicle industry in the Pearl River Delta, with rapid development in heat pump systems, electronic control, and component support. Shandong ranks fourth with 379 companies, with Qingdao and Weifang accelerating the expansion from traditional automotive parts to new energy thermal management systems. Shanghai has 314 companies, mainly concentrated in Lingang and Jiading areas, focusing on new energy vehicle thermal management solutions and integrated system research and development.

From the perspective of the nature of the enterprise,Private capital holds an absolute dominant position, accounting for as high as 81.02%.This reflects the high degree of marketization and intense competition in the sector. Foreign and joint venture enterprises together account for about 8%, indicating a certain level of international participation, but domestic companies remain the main players. State-owned enterprises account for only 1.03%, demonstrating the market-oriented nature of the sector. Leading suppliers such as Sanhua Intelligent Controls and Yinlun Co., Ltd. are all private enterprises, occupying important positions in the market.

From the perspective of the years since the establishment of the company,The industry is highly mature, with companies established for over 10 years accounting for 65.41%.The market structure is relatively stable. Among the companies, 47.02% have been established for over 15 years, indicating that there are many long-term participants in the traditional thermal management field. These include companies such as Sanhua Intelligent Controls, Yinlun Co., Aotecar, Tenglong Co., and Johnson Electric, all of which have been established for over 20 years, and Shenglong Co., which has been established for over 15 years, showcasing their deep technical expertise. Additionally, companies established for 10-15 years account for 18.39%, such as Hailida; those established for 5-10 years account for 21.67%, such as Anhui Welling and Dunan Automotive Thermal Management; and those established for 1-5 years account for 12.44%, such as Gentherm Investment, indicating that new entrants continue to join the industry, which is in a stage of steady development.

Thermal management supply chain The subfields exhibit a significant uneven distribution characteristic.

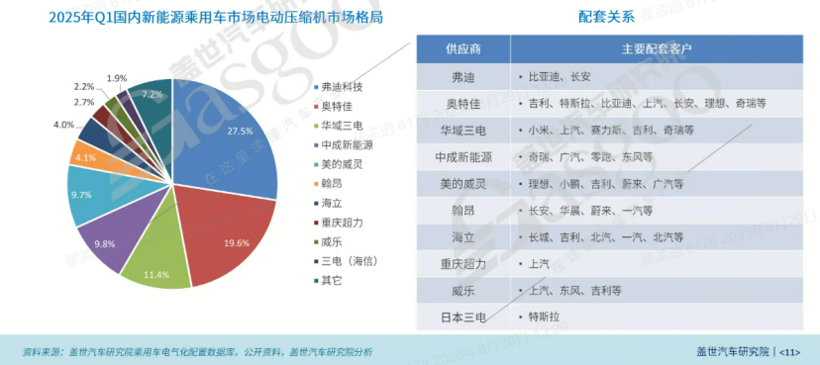

The electric compressor serves as the "heart" of the air conditioning system in new energy vehicles and is also a key executive unit in thermal management systems. There are as many as 584 companies in this field, accounting for 12.77%, making it one of the sub-sectors with a large number of enterprises. According to the supporting data for the electric compressor industry in the first quarter of 2025, the top three companies—Fudi Technology, Aotecar, and Huayu Sanden—account for 58.4% of the market share, with the top 10 companies (CR10) reaching 92.8%, indicating a very high level of industry concentration.

Image source: Gasgoo Automotive Research Institute

PTC is a core component that efficiently provides electric heating for the air conditioning and battery systems of new energy vehicles. In this field, there are only 171 companies, accounting for 3.74%. In terms of technical advantages and shortcomings, this solution is irreplaceable in the short term due to its cost and stability, but it has shortcomings in energy efficiency. On the other hand, heat pump systems, with their higher energy efficiency, have become the ideal solution for improving the low-temperature driving range of new energy vehicles.

The "Action Plan for Promoting High-Quality Development of the Heat Pump Industry" released in April this year clearly states that heat pump technology should be promoted for the intelligent thermal management of electric vehicles, to improve the energy utilization efficiency of power batteries and enhance vehicle range. Currently, mid-to-high-end pure electric models from car manufacturers such as Tesla, BYD, IM Motors, and Avatr have all adopted heat pump solutions. According to data from Gasgoo Auto Research Institute, the penetration rate of heat pump air conditioning in pure electric passenger vehicles is around 35% in 2023, and it is expected to reach approximately 50% this year.

In the short term, PTC remains mainstream, especially in low-cost models and extremely cold regions. In the medium term, a PTC + heat pump hybrid solution will be used to balance cost and energy efficiency. In the long term, heat pumps will become the mainstream solution, while PTC will continue to exist in specific areas.

Additionally, CO2The heat pump air conditioning is regarded as the "next-generation revolutionary technology" in the thermal management field of new energy vehicles. Component companies such as Sanhua, Anhui Welling, Meizhi, and OEMs such as Mercedes-Benz, Volkswagen, and Dongfeng Group are all working on CO.2Research and development related to heat pump air conditioning are underway, and currently, the domestic CO2 heat pump air conditioning industry chain has basically been established.

The electric water pump is a key actuator for precisely controlling coolant circulation, enabling intelligent and efficient cooling and heating of the battery, motor, and electronic control systems. It features low noise, low energy consumption, long lifespan, and compact size, making it the mainstream solution. There are approximately 145 companies in this field, accounting for 3.17% of the total.

Overall, Thermal managementThe supply chain is characterized by "private sector dominance, concentration in traditional fields, and great potential in emerging fields." Private capital accounts for nearly 90%, indicating a high degree of marketization and sufficient competition. The industry has a high level of maturity, with enterprises established for over 10 years accounting for more than 65%. The distribution in specific segments is uneven, with a large number of companies in traditional component fields and a very high market concentration.

Based on the above analysis, the following recommendations are proposed for professionals in the field of thermal management:

For industry participants (enterprises), traditional sector companies need to face fierce market competition by implementing automation transformations to reduce costs and increase efficiency, or by extending towards system integration to provide sub-module solutions, thus preventing being caught in low-end price wars. Emerging sector companies, on the other hand, must maintain high-intensity R&D investments to construct core technology patent barriers, actively engage in joint R&D and targeted collaborations with leading OEMs or Tier-1 suppliers to secure future vehicle projects, and simultaneously focus on technology integration trends, such as the new challenges and opportunities that CTC technology presents to water-cooled plate design.

For investors, attention should be focused on leading top-tier companies that have established technological and customer advantages in high-barrier emerging fields (such as integrated modules and electronic expansion valves). These companies possess strong moats and are expected to benefit from the high growth dividends of the industry. Additionally, investors can explore "hidden champions" or "little giant" enterprises with unique technical expertise in niche segments (such as PTC materials, special pipelines, and thermal conductive materials). Investment decisions need to closely track the evolution of new energy vehicle technology routes, the supply chain strategies of OEMs, and the policy trends in major global markets.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track