From 24.2% to 17.3% EU Anti-Dumping Final Ruling Loosens But China Epoxy Resin Exports Still Under Pressure

On July 28, 2025, the European Commission officially announced the final anti-dumping ruling on epoxy resin from mainland China, Taiwan region of China, and Thailand, marking the end of a trade dispute that had lasted for more than a year. Although the EU ultimately maintained the imposition of anti-dumping duties, Chinese companies, through active responses to the investigation, succeeded in securing a final duty rate significantly lower than the provisional rate.

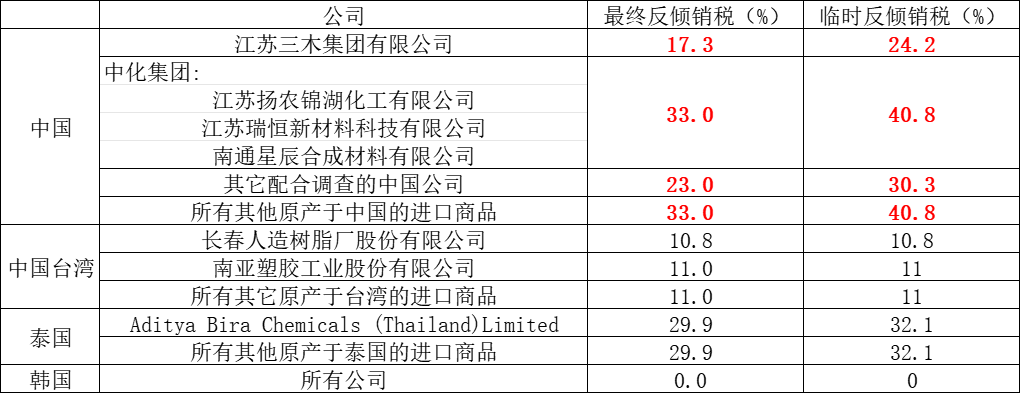

According to the final determination, the EU's final ruling presents three major changes.

Corporate tax rates in China are generally being reduced.Jiangsu The group's provisional tariff was reduced from 24.2% to a final tariff of 17.3%; companies under Sinochem Group saw their rate drop from 40.8% to 33.0%; other cooperating companies had their rate reduced from 30.3% to 23.0%; and the rate for all other Chinese exporters was lowered from 40.8% to 33.0%. This adjustment has directly reduced the export cost pressures on enterprises.

Differentiated adjudicationThe EU imposes differentiated tax rates on companies that cooperate with investigations (23.0%) and those that do not (33.0%), highlighting the substantive value of responding to investigations.

South Korea ExemptionThe EU has terminated its anti-dumping investigation into epoxy resin from South Korea, determining that there was no dumping or that it did not cause material injury to the EU industry.

The EU's final anti-dumping ruling "eases restrictions"

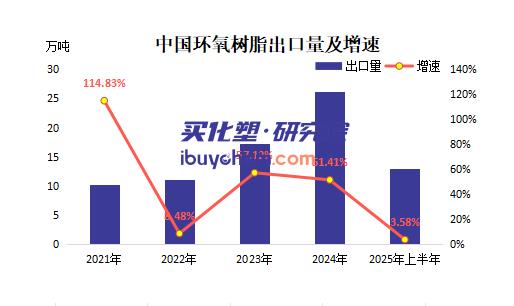

The anti-dumping investigation began on July 1, 2024, during which the EU imposed provisional anti-dumping duties on epoxy resin exports from mainland China, Taiwan, and Thailand.MaihuaSuAccording to the research institute's monitoring, the average monthly export volume of epoxy resin from China to Europe in 2024 was about 25,000 tons. However, since the temporary tariff was imposed in February 2025, the export volume has declined month by month, dropping to 20,800 tons in June, a decrease of 23.5%.

The investigated enterprises mainly include Jiangsu Sanmu and Sinochem Group from mainland China, Nan Ya Plastics from Taiwan, and Aditya Birla from Thailand. Among them, the mainland Chinese enterprises actively defended themselves by submitting complete cost data and justifying the reasonableness of their pricing, ultimately achieving a reduction in the tax rate.

The New Landscape under Capacity Expansion and Demand Differentiation

As of the first half of 2025, the growth rate of epoxy resin supply in China has exceeded the growth rate of demand, with capacity expansion continuing. China's epoxy resin capacity has reached 3.56 million tons, an increase of 3.18% compared to the end of 2024. However, downstream demand varies significantly, with the wind power industry showing strong demand. Essential restocking has driven prices up, while demand in coatings, electronics, and other downstream sectors remains subdued. The European Union and the United States have initiated anti-dumping and countervailing investigations against Chinese epoxy resin, affecting some export orders, leading to a decrease in exports to the U.S. and the EU. In the first half of 2025, the main export trading partners for epoxy resin also changed, with exports to the Middle East increasing.

Although the reduction in tariff rates has alleviated some pressure, the remaining tariffs of 17.3%-33.0% will still significantly undermine the price competitiveness of Chinese epoxy resin in the European market. In the short term, exporting companies may face two options: shifting to emerging markets, with regions such as the Middle East and Southeast Asia potentially becoming alternative export destinations; or some companies may bypass trade barriers by establishing overseas factories, as exemplified by Sinochem Group's epoxy resin project in Saudi Arabia.

The EU's ruling this time is not an isolated incident. In recent years, Europe and the United States have frequently launched anti-dumping investigations into Chinese chemical products, such as the United States on polyvinyl chloride (PVC).PVCHigh tariffs are imposed on titanium dioxide and other products. This trend indicates that with the restructuring of global industrial chains, trade protectionism is becoming the norm.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track