Forex Market in China Remains Stable in August! Oil Prices End with Long Upper Shadows for Four Consecutive Weeks, Main Plastic Futures Mostly Down

Overnight crude oil market dynamics

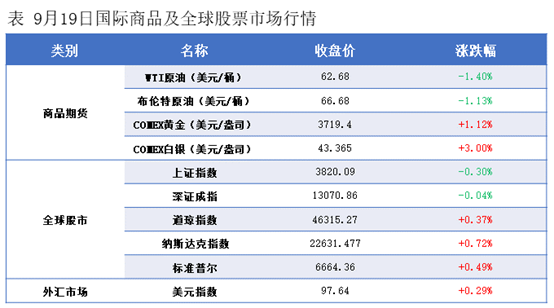

OPEC+ remains firm on increasing production, and the market is still concerned about a poor demand outlook, leading to a decline in international oil prices. NYMEX.Crude oil futuresThe October contract fell by $0.89 per barrel to $62.68, a month-on-month decrease of -1.40%; ICE Brent crude futures for the November contract fell by $0.76 per barrel to $66.68, a month-on-month decrease of -1.13%. China's INE crude oil futures for the 2511 contract fell by 5.1 to 491.2 yuan per barrel, and dropped by 7.6 to 483.6 yuan per barrel in the night session.

Market Forecast

Overall, the market's focus will remain on whether the pressure of oversupply will materialize, while geopolitical factors will continue to cause disruptions from time to time. The divergence in expectations for oil prices among investors will take some time to resolve. After a period of minor fluctuations and consolidation in the third quarter, we can see that the short, medium, and long-term focal points of the crude oil market are once again converging. This suggests that the balance between bullish and bearish positions has reached its peak, and the market is nearing a breakthrough moment. In the face of the massive paper oversupply pressure in the crude oil market, oil prices need to decline to release risk. In terms of seizing opportunities, we still prefer to focus on taking advantage of rebounds to short at high levels, while paying attention to timing.

II. Macroeconomic Dynamics

Premier Li Qiang of the State Council presided over a State Council executive meeting to discuss the implementation of domestic product standards and related policies in government procurement. The meeting emphasized the need to treat all types of business entities equally and ensure fair competition. The meeting also discussed and preliminarily approved the "Banking Supervision Law of the People's Republic of China (Revised Draft)" and decided to submit the draft to the Standing Committee of the National People's Congress for review.

The State Council Information Office will hold a series of thematic press conferences on "Successfully Accomplishing the 14th Five-Year Plan" at 3:00 PM on September 22 (Monday). Governor of the People's Bank of China Pan Gongsheng, Director of the Financial Regulatory Commission Li Yunze, Chairman of the China Securities Regulatory Commission Wu Qing, and Director of the State Administration of Foreign Exchange Zhu Hexin will introduce the achievements of the financial industry during the 14th Five-Year Plan period and answer questions from the press.

The State Administration of Foreign Exchange introduced that in August, China's foreign exchange market operated smoothly, with cross-border receipts and payments by non-bank sectors such as enterprises and individuals reaching USD 1.3 trillion, a year-on-year increase of 8%. The net inflow of cross-border funds was USD 3.2 billion, and the banks' settlement and sale of foreign exchange recorded a surplus of USD 14.6 billion. Overall, foreign investment net purchased domestic stocks and bonds.

The Ministry of Commerce disclosed that from January to August, the actual use of foreign capital nationwide amounted to 506.58 billion yuan, a year-on-year decrease of 12.7%. The actual use of foreign capital in the e-commerce service industry, aerospace equipment and manufacturing industry, chemical pharmaceuticals manufacturing industry, and medical instruments and equipment manufacturing industry increased by 169.2%, 37.5%, 23.2%, and 19.2%, respectively.

The Bank of Japan has decided to maintain the benchmark interest rate at 0.5%, marking the fifth consecutive time it has held steady. Deliberation committee members Hajime Takata and Naoki Tamura dissented, believing that a 25 basis point increase to 0.75% should be implemented. The Bank of Japan also announced the start of reducing its holdings in ETFs and real estate investment trusts. BOJ Governor Kazuo Ueda stated that if economic and inflation forecasts are realized, further interest rate hikes will be pursued in the future.

In August, the UK's budget deficit reached £18 billion, setting the highest borrowing record for the same period in five years, far exceeding economists' expectations. This indicates that the UK's public finances are in a precarious state ahead of the November fiscal budget announcement.

3. Early Morning Update on the Plastic Market

Oil prices have formed long upper shadows for four consecutive weeks! Overnight, the main domestic plastic futures contracts mostly declined with few gains.

The plastic 2601 contract is quoted at 7,158 yuan/ton, down 0.32% from the previous trading day.

The PP2601 contract is quoted at 6,911 yuan/ton, down 0.09% from the previous trading day.

The PVC2601 contract is reported at 4963 yuan/ton, up 0.28% from the previous trading day.

Styrene contract 2510 was reported at 6,971 yuan/ton, down 0.75% from the previous trading day.

4. Market Forecast

In the current PE market, the supply side remains stable, with no changes in plant shutdowns or restarts, indicating an overall steady supply situation. On the market sentiment front, the "anti-involution" sentiment and the Federal Reserve's interest rate cut expectations have provided some short-term boost to the market, but the positive impact is limited and lacks sustainability, failing to effectively drive a trend in the market. On the demand side, with the National Day holiday approaching, some factories have initiated pre-holiday stocking plans, leading to a temporary improvement in demand. However, the overall pace of demand growth remains slow and has not formed strong support. Meanwhile, some suppliers, to avoid the risk of inventory backlog during the holiday period, are currently inclined to promote sales through discount strategies to maintain reasonable inventory levels. In the short term, the polyethylene market is expected to maintain a narrow range of fluctuations.

PP: On the supply side, the Shaoxing Sanyuan's 200,000-ton PP plant is scheduled to restart today, leading to an expected marginal increase in market supply. Coupled with the current high industry inventory levels and a continuously slowing destocking pace, market concerns about the pressure of oversupply are intensifying. On the demand side, although the traditional peak season has arrived, its effects are significantly below expectations. The capability of downstream enterprises to take on new orders is weak, and overall demand appears sluggish. However, the upcoming Mid-Autumn Festival and National Day holidays present a temporary positive influence. In the terminal sectors, the order volume for holiday gift packaging, such as mooncakes, has increased significantly, providing some support for the demand for packaging PP products due to rigid demand release. In the short term, the polypropylene market is expected to maintain a volatile and slightly weak trend.

PVC: In the spot market, after the futures prices rose, transactions weakened. The high prices relatively suppressed the enthusiasm of downstream enterprises to purchase. Additionally, at the current time point, there is no extra speculative demand, and intermediaries are purchasing in a step-by-step manner, making it difficult for transactions to stimulate price changes. On the external side, crude oil futures continue to decline, with traders still concerned about the US economic outlook. On Wednesday, the Federal Reserve cut interest rates by 25 basis points and indicated that it would steadily lower borrowing costs for the rest of the year to address signs of a weakening job market. Overall, in the short term, the PVC spot market prices may continue to undergo narrow adjustments.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track