Foreign Tier 1 Firms in China Continue to Step Up Efforts

The rapid surge of China's new energy vehicle market is not only reshaping the landscape of complete vehicles, but also initiating a profound restructuring of the underlying automotive industry chain. The foreign Tier 1 giants, who once dominated the world with their technological barriers and global systems, are now feeling the unprecedented heat and pressure from this dynamic land.

From ZF establishing a joint venture, to Valeo expanding its intelligent cockpit R&D and production base, and Autoliv investing in the construction of a technology R&D center in Wuhan... A series of intensive and high-profile moves reveal an undeniable trend: in the face of the electrification and intelligent transformation wave in the Chinese market and the rapid rise of local supply chains, foreign Tier 1 suppliers’ strategies in China have shifted from “rooting” to “upgrading,” and are continuously “strengthening.”

Dense layout, full of “sincerity”

The attractiveness of the Chinese market to foreign-funded enterprises is being evidenced by a series of vivid data and intensive investment activities.

According to the 2024 National Economic and Social Development Statistical Bulletin released by the National Bureau of Statistics, in 2024, the number of newly established foreign-invested enterprises nationwide reached 59,080, an increase of 9.9% year-on-year. Additionally, data from the Ministry of Commerce shows that in the first half of 2025, this momentum continued strongly, with the number of newly established foreign-invested enterprises nationwide exceeding 30,000, representing a year-on-year growth rate of 11.7%.

In the automotive industry, this trend is even more pronounced—foreign Tier 1 suppliers are continuously increasing their stakes in the Chinese market through establishing factories, expanding production, and setting up R&D centers.

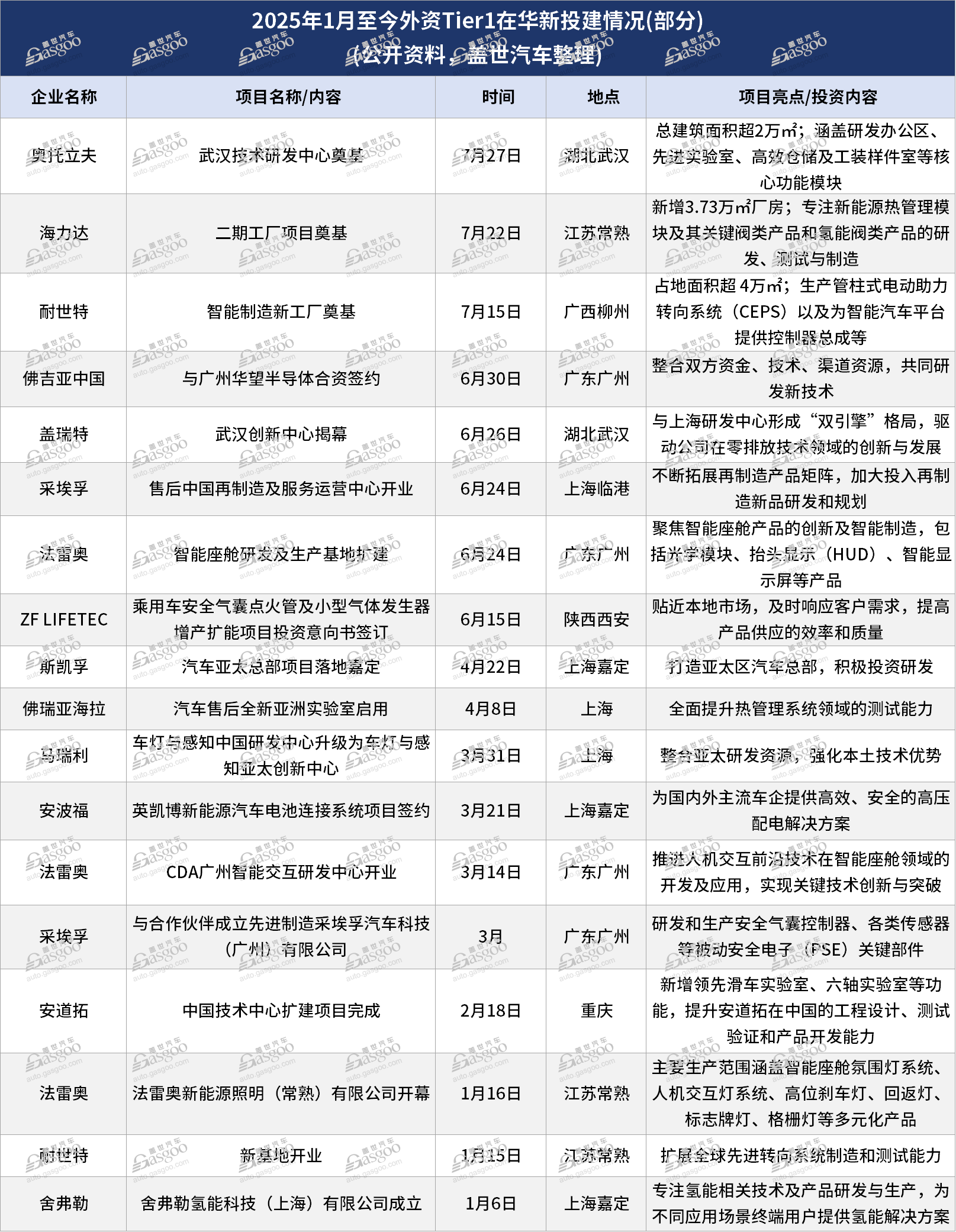

On July 27th, the Otto Wulf Wuhan Technology R&D Center was officially inaugurated. The new R&D center covers a total construction area of 21,819 square meters and is expected to be operational in the third quarter of 2026. The center will be equipped with advanced laboratory equipment and a digital R&D platform, encompassing core functional modules such as R&D office areas, advanced laboratories, efficient warehousing, and tooling and prototype rooms.

Image source: Autoliv

On July 22, the second phase project of Hailida Automotive Technology Co., Ltd. officially broke ground in the Changshu High-tech Industrial Development Zone, Jiangsu Province. The new facility, adjacent to the first-phase plant, plans to add a 37,300 square meter factory, focusing on the research, testing, and manufacturing of new energy thermal management modules, key valve products, and hydrogen energy valve products.

On July 15th, the NEXTEER Automotive Systems intelligent manufacturing new plant was officially inaugurated in Liuzhou, Guangxi, to meet the strong demand from domestic and international vehicle manufacturers for advanced steering systems and motion control technologies, including Column Electric Power Steering (CEPS), as well as controller assemblies that provide excellent safety, serviceability, and layout advantages for intelligent vehicle platforms.

Tracing back to the end of June, Faurecia China and Guangzhou Huawang Semiconductor Technology Co., Ltd., a subsidiary of GAC Components Co., Ltd., held a joint venture contract signing ceremony in Guangzhou. Through the establishment of this joint venture, both parties will fully leverage their respective strengths and integrate resources such as capital, technology, talent, and channels to achieve complementary advantages. At the same time, they will jointly develop new technologies and products, actively and rapidly respond to market demands, and address the current intense market competition.

Image source: Faurecia China

These are only some of the cases. According to incomplete statistics from Gasgoo Automotive, since the beginning of this year, many foreign Tier 1 suppliers such as ZF, Valeo, and Freudenberg have been very active in China, either laying foundations or opening new factories, or signing and upgrading new projects. From capacity expansion to technological research and development, from product innovation to market expansion, foreign Tier 1 suppliers are continuously deepening their presence in China.

Behind the intensive investments lies the foreign Tier 1 investors' firm confidence in the "long-term value" of the Chinese market.

According to the report "Multinational Corporations in China" released by the China Academy of International Trade and Economic Cooperation of the Ministry of Commerce on June 19, from 2019 to 2024, the total profits of foreign-invested enterprises and Hong Kong, Macao, and Taiwan-invested enterprises above designated size nationwide increased from 1.6 trillion RMB to 1.8 trillion RMB, with profit margin indicators continuously leading the national industrial average level.

In the automotive field, this "value" is more reflected in the explosive growth of the Chinese new energy vehicle market and the wave of intelligence.

According to data from the China Association of Automobile Manufacturers, sales of new energy vehicles in China exceeded 12 million units in 2024, maintaining the global lead for consecutive years, with a market penetration rate of over 40%. Such scale and growth rate are unparalleled worldwide. Meanwhile, the popularization of functions such as intelligent cockpits, driver assistance, and vehicle networking is driving explosive demand for core components like high-end sensors, intelligent interaction systems, and high-precision steering control. The deployment of foreign Tier 1 suppliers is precisely targeting this continuously expanding blue ocean market.

Since the beginning of this year, the new projects officially announced by foreign Tier 1 suppliers have been highly focused on two core areas: new energy and intelligent technologies. For example, Hailida's Phase II project specializes in new energy thermal management modules and valve products; Valeo's expansion project focuses on product innovation in smart cockpits; Aptiv's subsidiary InkaBo announced a project in the new energy vehicle sector; and ZF established a joint venture in Guangzhou to promote the development of automotive safety electronics.

Such investments not only cover key segments of the new energy industry chain, including the three-electric systems, hydrogen energy, and thermal management, but also deeply support intelligent fields such as domain controllers for assisted driving, sensors, and HUD interactive systems, highlighting how foreign Tier 1 suppliers are seizing the strategic high ground of China’s electrification and intelligence market through localized production capacity and R&D resource integration.

Strategic escalation, continuously "increasing intensity"

Amid the concentrated actions of foreign Tier 1 suppliers, a deeper change is taking place: the Chinese market is no longer merely the "end sales point," but rather a "testing ground" and "source" for technological innovation in the global automotive industry.

As domestic car companies rapidly advance in electrification and intelligence, they not only accelerate the pace of product iteration but also place higher demands on the responsiveness and customization capabilities of the supply chain. The era when foreign Tier 1 suppliers could rely on global unified technical standards and product systems to remain unchanged in the face of change has passed. Faced with the advantages of local suppliers in cost control, rapid development, and customer proximity, foreign giants must engage in "localization and upgrading" to maintain competitiveness.

The simultaneous advancement of technology research and development alongside production line expansion has become a significant embodiment of this "upgrading." Valeo's layout in Huadu District, Guangzhou, is highly representative—its planned expansion of the intelligent cockpit R&D and production base focuses on innovative products such as optical modules, head-up displays (HUD), and smart screens. This dual-driven approach of "R&D + production" enables technological innovation to be rapidly transformed into mass production capacity, precisely matching the iteration pace of local automakers.

Image source: Valeo

ZF’s actions also point to this logic. In March this year, together with its partners, it established Advanced Manufacturing ZF Automotive Technology (Guangzhou) Co., Ltd., which will research, develop, and produce key passive safety electronic (PSE) components such as airbag controllers and various sensors. This strategic layout aims to build a more agile and cost-competitive operating model that can quickly respond to local market demands while consolidating its leading position in the automotive safety electronics field. It is a vivid example of “R&D and production synergy” in practice.

In March, Marelli also announced the upgrade of its Marelli Automotive Lighting and Sensing China R&D Center in Shanghai to the Marelli Automotive Lighting and Sensing Asia-Pacific Innovation Center. By integrating R&D resources across the Asia-Pacific region, the Automotive Lighting and Sensing Asia-Pacific Innovation Center will further strengthen local technological advantages and build a technology innovation hub centered in China, covering the Asia-Pacific, and extending globally.

Aptiv is no exception. In February this year, Aptiv's China Technology Center expansion project in Chongqing was officially completed. The expanded technology center has added industry-leading facilities such as a pulley laboratory and a six-axis laboratory, which will further enhance Aptiv's engineering design, testing and validation, and product development capabilities in China. It will create a highly collaborative, flexible, and digital innovation platform for Aptiv China's seat R&D engineering team, providing customers with automotive seat products and solutions that better align with local trends and lead the industry.

Image source: AndoTrade

Behind these changes lies a fundamental transformation in the ecosystem of China's automotive industry. As the local supply chain gains advantages in cost, responsiveness, and customization, foreign Tier 1 suppliers who still rely on a "globally standardized" product system find it difficult to adapt to the fast-paced competition of the Chinese market. Therefore, "localization upgrading" is not only an expansion of production capacity, but also a deep localization of the entire value chain, including R&D, manufacturing, and services. It marks a strategic shift from "selling products to China" to "creating products in China."

Developed in China, serving the world

In the wave of accelerated "going global" in China's automotive industry, the layout of foreign Tier 1 suppliers in China is forming a new closed loop: centered on Chinese R&D, it serves both the local market and supports the global supply chain. This strategy of "in China, for China; in China, for the world" enables Chinese innovation to radiate worldwide through the global supply chain.

The planning of the Hailida Phase II plant clearly demonstrates this. The plant is expected to be completed within two years, and by 2030, its thermal management product capacity will be able to meet the supporting needs of tens of millions of new energy vehicles. The products will not only serve the Chinese market, but will also be exported to overseas markets such as Europe and the United States.

Aptiv’s strategy is similar. During this year’s Shanghai Auto Show, Yang Xiaoming, President of Aptiv China and Asia Pacific, stated that by 2027, Aptiv China is expected to achieve global coverage of its domestic supply chain to support local customers’ overseas expansion.

Bosch’s actions demonstrate a highly globalized vision. As Chinese automobiles accelerate their “going global” process, Bosch leverages its technical expertise, global resources, and market insights to actively support Chinese OEMs in expanding into overseas markets. Bosch offers a wide range of export vehicle products, covering e-axles, control units, smart cockpits, advanced driver assistance systems, and electronic air brake control systems, meeting both functional and regulatory requirements of global markets. Meanwhile, Bosch Intelligent Mobility Aftermarket and X-Motors are exploring a model that combines 4S dealerships with comprehensive repair centers to assist Chinese OEMs in their global expansion. They also plan to open 120 Bosch Car Service outlets in Indonesia.

Image source: Bosch

Garrett's practice is a vivid illustration of "R&D in China, serving the world." It has established two world-class advanced manufacturing plants in Shanghai and Wuhan, as well as an in-house R&D center. The Wuhan Zero Emission Innovation Center, newly established last year, is also under construction. Notably, innovative products such as Garrett's fifth-generation exhaust gas bypass turbocharger and hydrogen fuel cell electric air compressor are led by Chinese teams in R&D, achieving a technological feedback loop "from the East to the world."

Olivier Rabiller, the President and CEO of Garrett, previously stated in an interview with Gasgoo and other media that the Chinese market is the largest automotive market in the world and serves as a "bridgehead" for Garrett’s new technology initiatives. "We have been promoting the 'East for East' strategy in China for a long time. We started doing this ten years ago, and five years ago, we began offering some products globally because our customers in China are already leading the pace of global automotive development. In the future, we will continue to do so."

Behind this transformation is the rise of China's global influence in the automotive ecosystem. Nakul Duggal, Senior Vice President and General Manager of Automotive, Industrial & IoT at Qualcomm Technologies, pointed out in an interview with Gasgoo and other media that in the past five years, China has evolved from a market primarily importing overseas technologies to one driven by local innovation and differentiated development. "We are witnessing China becoming a global center for automotive technology innovation, with a large number of technological changes emerging."

In summary, from "Made in China" to "R&D in China," and from "serving the local market" to "radiating globally," foreign Tier 1 suppliers are continuously intensifying their presence in China. This not only enables foreign enterprises to integrate more deeply into the Chinese industrial chain but also allows Chinese innovation to reach the world through the global supply chain system, consolidating China's position as a global automotive industry innovation hub.

Emerging results, symbiosis and win-win.

The strategic upgrade of foreign Tier 1 suppliers is rapidly translating into tangible market results. Since 2025, a series of new orders and the mass production of new products have demonstrated the effectiveness of their deployment in China, while also highlighting the strong symbiotic and mutually beneficial ties between the Chinese market and foreign enterprises.

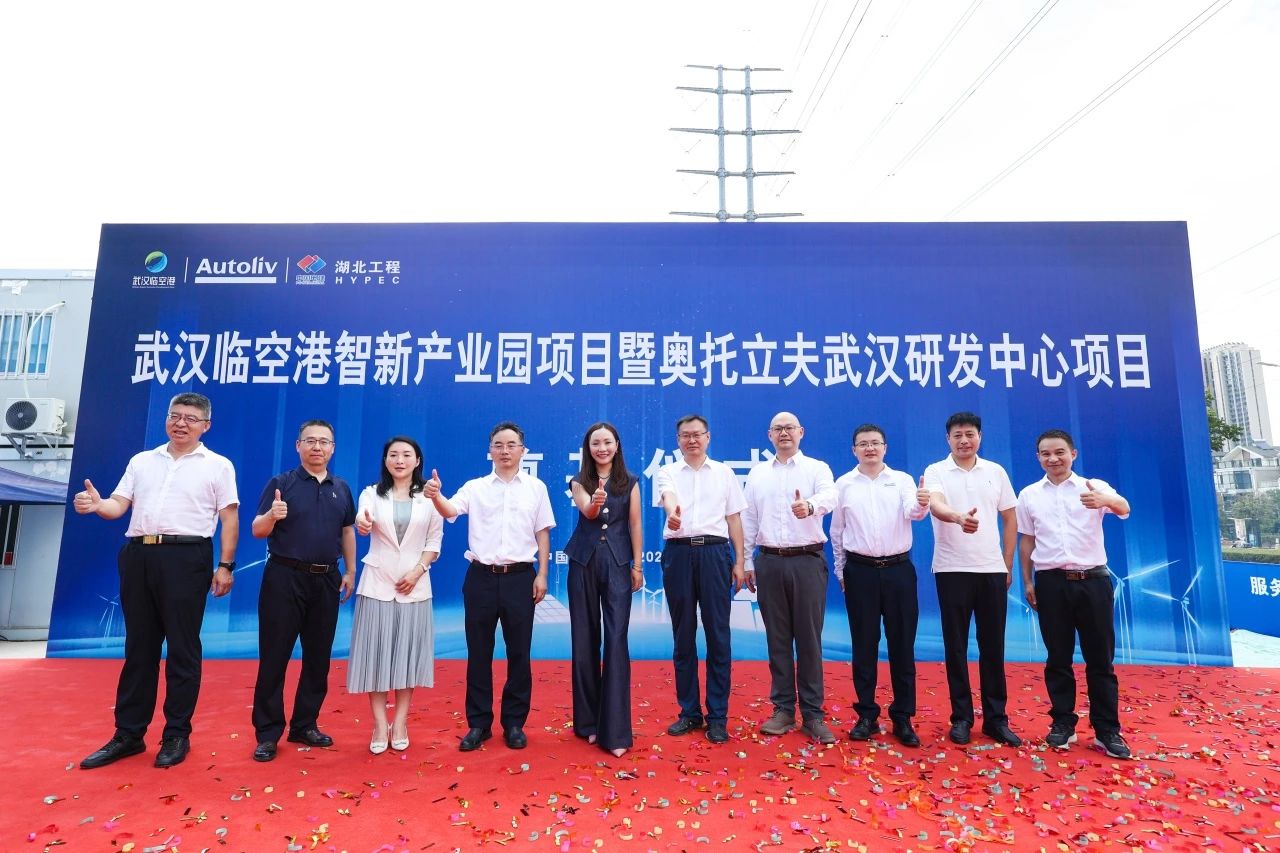

In July this year, Valeo announced that a leading Chinese new energy vehicle manufacturer has selected Valeo's five-in-one deeply integrated electric drive module for its electric drive powertrain system. To shorten the development cycle and meet the growing customer and market demands, Valeo adopted a flexible development process based on an advanced pre-research technology stack, enabling the entire project to progress from the concept stage to mass production in less than one year. Mass production is planned to officially begin in 2026.

Valeo 5-in-1 Deeply Integrated Electric Drive Module; Image Source: Valeo

In July, ZF Transmissions (Shanghai) Co., Ltd. announced the official rollout of its first reducer product for the new energy vehicle market. This product will be delivered to a leading domestic automobile manufacturer, marking a key breakthrough for ZF in localized new energy powertrain solutions and further deepening its electrification layout in China.

Madi Mo, Senior Vice President of the E-Drive Technology Division at ZF Group Asia-Pacific, defined this project as a model of autonomous management by the Asia-Pacific team: "From customer localization and project initiation to the successful product launch, the entire process was independently driven by the Asia-Pacific team, fully demonstrating the regional team's outstanding capabilities in localized R&D, project management, procurement, and manufacturing. The successful product launch not only reflects ZF Asia-Pacific's technical strength in core components for new energy vehicles but also once again validates our ability to respond quickly and execute efficiently in the local market."

Notably, at the Shanghai Auto Show held in April this year, ZF announced that the new generation of assemblies and components products launched to meet the demands of the Chinese market have achieved mass production in China and have already secured orders from Chinese automakers, amounting to over 1 billion euros.

In the first half of this year, the planetary gear coaxial reducer developed by ZF's Chinese team achieved mass production in China for the first time. The electric drive factory in Hangzhou will begin mass production of the next-generation 800-volt motor in June this year, which will be used by domestic and international car manufacturers. Additionally, ZF's electric drive factory in Shenyang will start mass production of the next-generation electric drive system in the third quarter of this year, which will be used in the electric drive platforms of international luxury cars.

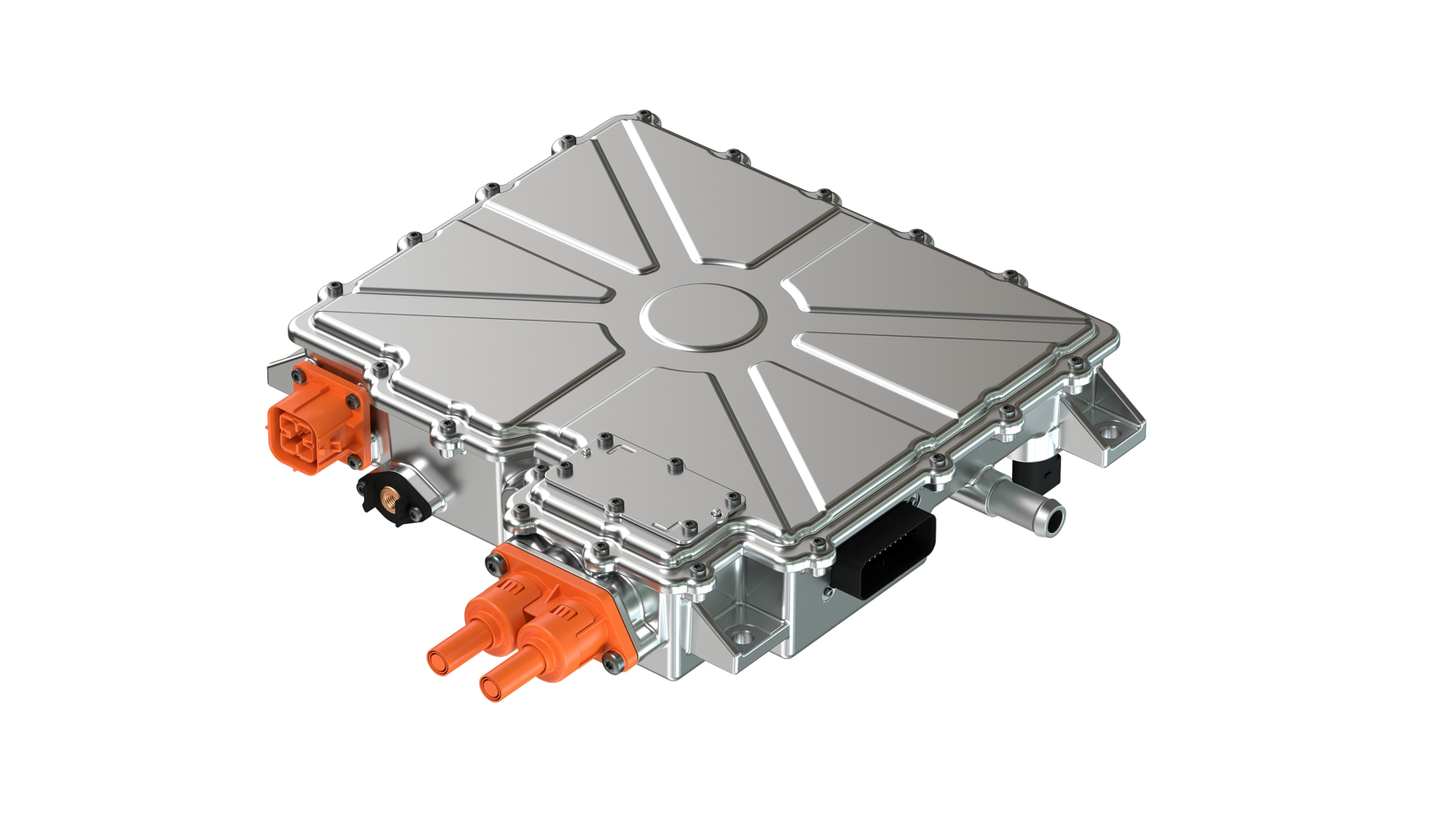

The progress of Continental Group and Mahle is equally noteworthy. In April this year, Continental Group's first domestically produced sixth-generation millimeter-wave radar ARS620 successfully entered mass production. Meanwhile, Mahle China secured an order worth 200 million euros to supply DC/DC converters for a luxury brand automaker's future electric vehicle model, with plans to start mass production at its Changshu plant in 2028.

MAHLE DC/DC converter; Image source: MAHLE

"China is at the forefront of automotive electrification, and winning this order will undoubtedly help us further expand our influence in the world's largest automotive market, which is truly exciting. The pace of innovation in China is astonishing. We see potential for further growth, especially in the fields of electrification and thermal management," remarked Roger Busch, a member of the Management Board of Mahle Group, reflecting the continued confidence of foreign Tier 1 suppliers in the Chinese market.

BorgWarner has also made significant breakthroughs in the new energy sector. In February this year, BorgWarner secured four major electric motor business projects, delivering an impressive “report card” for the Chinese market. Specifically, in response to the strong global demand for new energy vehicles, BorgWarner has continuously strengthened its technological innovation and localized strategies. As a result, BorgWarner successfully expanded its new energy motor business in the Chinese market and established partnerships with leading automotive brands, providing them with products such as 400V high-voltage hairpin (HVH) motors. These products are expected to achieve mass production in August 2025, October 2025, and March 2026.

The emergence of the aforementioned achievements not only validates the effectiveness of foreign Tier 1 suppliers' strategic upgrades in China but also highlights the vitality and potential of the Chinese automotive market. As China evolves from being the "world's largest market" to a "global innovation center," the path of "dimensional upgrade" for foreign Tier 1 suppliers is not only a proactive adaptation to market changes but also an inevitable choice for deep integration with China's industrial ecosystem. In this industry transformation led by electrification and intelligence, the story of foreign top-tier suppliers and the Chinese market is advancing towards a deeper symbiotic win-win relationship, jointly promoting innovation and development in the global automotive industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track