Foreign Enterprises vs. China Players: Polyurethane Elastomer Market Analysis

Polyurethane (PU) elastomers are synthetic materials with elastomeric properties, formed by the reaction of diisocyanates, polyols, and, in some cases, chain extenders. Common polyurethane elastomers include thermoplastic polyurethane elastomers (TPU) and casting polyurethane elastomers (CPU).

TPU has a wide range of applications, including pipes, films, shoe materials, and mobile phone cases. Each application field contains many sub-markets. For example, film materials can be divided into low-permeability blown film, medium-permeability film, high-permeability film, ordinary cast film, easy-to-cut cast film, hot-melt adhesive film, and so on. CPU has excellent wear resistance and oil resistance, making it difficult to replace in special-purpose fields. In the mining and metallurgical industries, CPU is one of the most suitable non-metallic materials and can replace some metal materials. Its main applications include screen panels, liners, and liner blocks.

In the context of differentiated growth in consumption, major manufacturing enterprises are actively seeking differentiated development strategies to adapt to market changes. Leading companies in the polyurethane elastomer industry are taking frequent actions. International giants like BASF and Covestro are continuously expanding their presence in the Chinese market, while domestic leaders such as Wanhua Chemical and Miracle New Materials are also accelerating the advancement of their polyurethane elastomer business layouts, collectively driving the rapid growth of the domestic polyurethane elastomer market.

The global supply of polyurethane elastomers is shifting toward the Asia-Pacific region.

The main manufacturers of global polyurethane elastomers include BASF, C.O.I.M, Covestro, DIC Corporation, Lubrizol, and TOSOH, with a high concentration of production. Among them, Lubrizol has successively acquired polyurethane elastomer-related departments and companies such as the American companies Noveon and Dow Chemical, becoming the supplier with the most comprehensive product line and the largest supply volume of medical-grade polyurethane elastomers worldwide.

As economic growth in Europe slows, the global supply of polyurethane elastomers is shifting toward the Asia-Pacific region. In January 2024, BASF’s second TPU unit at its Zhanjiang base commenced operations. In September, Covestro began construction of its largest TPU plant in Zhuhai, which, upon full completion in 2033, will have a maximum annual production capacity of 120,000 tons. At the same time, Covestro also announced the establishment of a new Thermoplastic Polyurethane (TPU) Asia-Pacific Application Development Center in Guangzhou, China, which was originally planned to start construction by the end of 2024 and begin operations in 2025 (current progress is unclear). In October, LANXESS sold its polyurethane business to Japan’s UBE Corporation. In November, Yantai Wanhua commissioned the world’s largest single-line TPU production facility.

02 It is expected that in the coming years, the supply of TPU in the Chinese market will be sufficient, demand will slow down, and competition will intensify.

TPU is usually produced by a one-step or two-step reaction of pure MDI (or MDI variants) with polyols, and the different properties of the polyols used determine the main differences in TPU grades. The polyols mainly include polyether polyols, polyester polyols, and polycaprolactone, with global market shares of 25%, 65%, and 10% respectively.

To meet the needs of different market applications, there are over a hundred conventional formulations of TPU. In the actual production process of enterprises, to ensure product quality, some types (of the same series) of TPU materials can be produced on the same line. A special type of TPU is made by reacting p-phenylene diisocyanate (PPDI) with polycaprolactone-based polyol; other specialty TPUs can be used to bridge the gap between rigid plastics and rubber elastomers. For example, TPU/PC blends can improve the toughness, stress cracking resistance, notch sensitivity, solvent resistance, and chemical resistance of PC, while reducing the molding processing temperature of PC.

China's TPU production capacity and output have been growing rapidly, with new capacities expected to come on stream in the future, leading to a more relaxed supply situation. The growth rate of TPU consumption is slowing down, while the film and medical sectors will continue to drive demand. Overall, it is expected that in the coming years, China's TPU market will have ample supply, slowing demand, and increasingly fierce market competition.

01 China's TPU supply is rapidly developing, with future expansion slowing down, but supply remains ample.

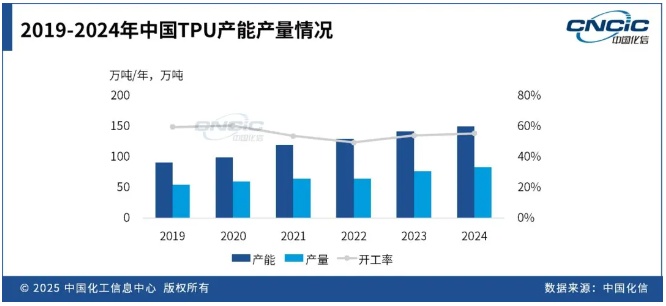

Over the past five years, China's TPU industry has rapidly expanded its production capacity, but the operating rate has not been high. From 2019 to 2024, the compound annual growth rates of China's TPU capacity and output are 10.5% and 12.2%, respectively. By 2024, China's TPU production capacity will reach 1.5 million tons per year, with new capacities including BASF's 32,000 tons per year (commissioned in June) and Wanhua Chemical's 50,000 tons per year (completed in November); China's TPU output will increase to 830,000 tons.

There are approximately 35 domestic TPU manufacturing companies, with production capacity relatively dispersed. The top five companies account for 50% of the total capacity, namely Wanhua Chemical, Huafeng Chemical, Merry Material, INOV, and Baoding Bangtai. Leading companies are continuously enhancing their production capabilities and technology, while small and micro enterprises lack competitiveness, making the industry competition relatively intense. China's TPU production is concentrated on low to mid-end products, with high-end products mainly coming from foreign companies like Lubrizol and BASF. In recent years, the quality of TPU film products from Merry Material and Wanhua Chemical has begun to rival those of foreign companies.

02 China is a net exporter of TPU, and its export volume is expected to further increase.

From 2019 to 2024, China's TPU import volume has shown an overall downward trend, while export volume has increased year by year. In terms of imports, the main importing enterprises are foreign-invested, and domestic TPU is currently unable to fully replace certain imported sources. However, the decline in import volume also reflects the gradually increasing competitiveness of domestic TPU companies in the high-end market. On the export side, rapidly rising inflation in Europe and the United States has driven up overseas processing costs and increased outsourcing demand. However, under the combined impact of India’s protectionist policies, the China-US trade war, and the EU’s carbon tariffs, cross-border shipping costs have risen sharply, resulting in a relatively limited increase in China’s TPU export volume. In the future, as the competitiveness of domestic enterprises' products continues to strengthen, net exports are expected to increase further.

03 The downstream consumption growth of Chinese TPU has slowed down, but the film and pharmaceutical sectors will continue to make efforts.

From 2019 to 2024, the compound annual growth rate of TPU consumption in China is 10%. Footwear and TPU films have been the main drivers of the rapid development of TPU consumption over the past five years.

TPU is mainly used as a material for footwear, films, hoses, etc., and is applied in industries such as footwear, automotive, textiles, and medical. In 2024, China's TPU consumption increased to 720,000 tons, up 8.1% year-on-year. This growth was mainly driven by the rising demand for TPU in automotive films and the popularity of expanded TPU in high-end sports shoes. The footwear industry remains the largest source of TPU consumption, accounting for 29%; consumption in films, sealing materials, hoses, and automotive sectors accounts for 20%, 17%, 15%, and 10% respectively.

Although China is no longer the largest shoe manufacturer, the consumption of TPU continues to grow as elastomer materials such as ethylene-vinyl acetate copolymer (EVA) and polyvinyl chloride (PVC) are gradually being replaced by TPU in shoe production. TPU can be used for shoe outsoles, offering excellent wear resistance, flex resistance, and fatigue resistance; it can also be used for the air cushion part of the midsole, providing good rebound and shock absorption.

Due to its excellent waterproof, breathable, and mechanical properties, TPU is widely used as a film material in textiles and inflatable materials. In textiles, representative products include fabrics such as Breathtex from Boryszew and Dintex from DingZing. In terms of inflatable materials, they include inflatable life jackets, diving BC jackets, life rafts, inflatable boats, inflatable tents, military inflatable self-inflating mattresses, massage airbags, medical anti-decubitus mattresses, and specialized waterproof backpacks. In recent years, there have been technological breakthroughs in automotive TPU films, and their usage is increasing year by year. The technical threshold for TPU films is relatively high, with stringent requirements for the thickness, uniformity, and strength of the films.

TPU, due to its characteristics of oil resistance, high temperature resistance, high pressure resistance, and compliance with food-grade requirements, can be used as seals in the automotive industry, hydraulic and pneumatic systems, food industry, and medical devices.

Medical materials such as trachea, catheters, and infusion tubes made from TPU have good blood compatibility and do not affect blood components, and are widely used in the medical field. TPU does not face the issue of plasticizer migration that PVC materials encounter, thus its use in medical applications has been steadily increasing.

TPU's outstanding wear resistance, flexural fatigue resistance, and high elasticity make it suitable for various automotive components, such as gear shift lever handles, coupler bushings and washers, connectors for wire harnesses, spiral retractable wires, cable sheaths, etc. It can also be compounded with other plastics or rubber for use in automotive bumpers, airbags, dust covers, and other components.

From 2024 to 2028, the consumption growth rate of TPU downstream demand is expected to remain around 4%, mainly driven by films and medical tubing. With the increasing demand for outdoor sports equipment, the consumption growth rate of TPU films will reach approximately 8%. As medical standards improve, the demand growth rate for TPU in medical tubing will be around 6%. The consumption growth rate in other application areas will be relatively low.

Product prices continue to decline, and the industry's gross profit margin is gradually narrowing.

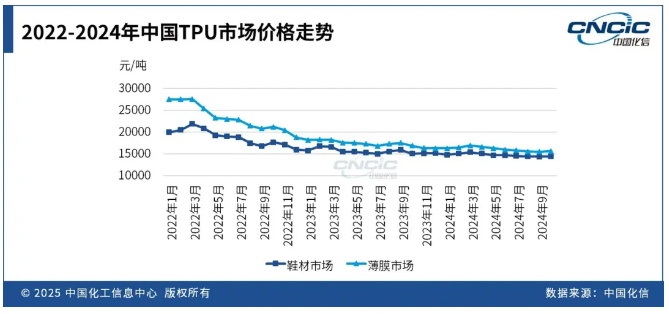

According to the market prices of TPU subdivided products in China, TPU film has the highest price, while the prices for TPU used in shoe materials, pneumatic tubes, and phone cases are relatively similar. In 2022, the average market price for TPU film in China was 23,000 RMB/ton, whereas the average market price for TPU used in shoe materials, pneumatic tubes, and phone cases was 18,800 RMB/ton, with a price difference of 4,200 RMB/ton. In 2023, TPU market prices declined steadily, with the average price for TPU film at 17,400 RMB/ton and the average price for TPU used in shoe materials, pneumatic tubes, and phone cases at 15,800 RMB/ton, reducing the price difference to 1,600 RMB/ton. In 2024, prices further dropped, with the average prices for TPU film and TPU used in phone cases at 16,100 RMB/ton and 14,700 RMB/ton, respectively, representing year-on-year declines of 7.1% and 6.3%.

Currently, domestic manufacturers mainly produce low to mid-range TPU products, while mid to high-end TPU products need to be imported from overseas at relatively high prices. The downstream applications of low to mid-range products are quite extensive and the customer base is fragmented, generally exhibiting characteristics of a large market capacity and intense competition. In 2024, the average gross profit margin of China's TPU industry is around 15%, with low-end products having a gross profit margin between 10% and 15%, and high-end products having a gross profit margin of approximately 25% to 35%.

Huaxin's Perspective

The future demand for polyurethane elastomers is generally stable but exhibits structural differentiation. Mid-to-low-end products have broad applications and a dispersed customer base, resulting in a large market capacity but with adequate supply and intense competition. The mid-to-high-end market participants are primarily foreign industry leaders. Domestic companies, such as Wanhua Chemical and Miracll New Materials, have initially established a foothold in the high-end market. In specific segments, such as cable protection, automotive anti-lock systems, wind power cables, medical catheters, implantable products, automotive films, and injection-molded TPU products, high-performance products continue to be dominated by multinational companies like BASF, Covestro, and Lubrizol.

The domestic automotive TPU films are mainly imported from companies such as BASF, Covestro, and Lubrizol. Products from local enterprises Wanhua Chemical and Meray New Materials are gradually gaining market recognition. Wanhua Chemical has rapidly captured the TPU film market by leveraging cost advantages to lower product prices, simultaneously driving the vigorous development of downstream applications. For example, in the automotive sector, the installation rate of TPU car paint protection films has significantly increased.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track