First Results of FAW and Leapmotor Cooperation?

On the evening of July 24th, Leapmotor officially launched the second product in its B series, the B01, an A-class compact pure electric sedan.

The launch of the B01 has attracted considerable attention in the industry for two main reasons. First, its starting price of 89,800 yuan once again sets a new low for pure electric vehicles priced under 100,000 yuan. Second, this model can be equipped with lidar for just 113,800 yuan, breaking the record of 119,800 yuan set four months ago by its sibling model, the Leapmotor B10.

Overall, these can only be said to have sparked external "interest." After all, "price competition" and "configuration competition" are the two main themes in the current domestic automobile market. Although the Leapmotor B01 has temporarily set several records, for the parties who have been caught up in intense competition over the past few years, this seems to be just a routine small-scale event that leads a brief "three to five days of glory."

I thought the same until a rumor appeared online that very night—

FAW plans to develop new models based on the B platform of Leapmotor and sell them in overseas markets. The two parties will adopt a cooperation model similar to that of Leapmotor and the Stellantis Group. In addition, FAW-Volkswagen will also collaborate with Leapmotor, emulating the cooperation model of Volkswagen and XPeng, to develop and sell new models in the domestic market based on Leapmotor's technical architecture.

Although it may not be as popular as companies that are good at hype, the industry is well aware of the significance of the Memorandum of Understanding signed between FAW and Leapmotor in early March this year.

In particular, there were reports at the time that the first jointly developed model, the C-NOVA—a mid-to-large pure electric SUV priced around 250,000 RMB—would be equipped with Leapmotor’s advanced intelligent cockpit and FAW’s independently developed electric drive system. The project had already reached the clay model stage, with plans for mass production at FAW Bestune’s Changchun plant in 2026.

However, since the two parties signed the contract on March 3, it has been four and a half months without any further news being disclosed. This seems to be noticeably out of sync with the current wave of vigorous internal and external reforms faced by FAW.

Finally, new revelations have arrived. Moreover, what they reveal is a prospect far broader and deeper than the mere joint development of a vehicle—what appears to be a cooperation in technology and interests is, in fact, a challenge and disruption to existing frameworks.

01FAW and Leapmotor

"Strategic cooperation has two dimensions: First, both parties will fully leverage their respective technological accumulations in the field of research and development to jointly develop new energy passenger vehicles and cooperate on components, thereby enhancing product competitiveness through the integration of their technologies. Second, both parties will further explore the feasibility of deepening capital cooperation, enabling them to achieve full industry chain resource synergy through capital collaboration."

In early March this year, the signing between FAW Group and Leapmotor caused a great stir. In terms of its model, the innovation lies in taking the lead in launching a new round of collaboration between state-owned and private enterprises. After all, state-owned automobile groups had not previously entered into cooperation agreements with private companies, and there had never been such a degree of "capital cooperation enabling both parties to achieve full industry chain resource synergy."

Cooperation between enterprises is inevitably driven by the pursuit of interests, especially for a company with a special status like China FAW Group, which is willing to humble itself to engage in technical joint development with a new car-making force whose annual sales are just a fraction of its own. So, what value can Leapmotor provide to FAW?

First and foremost, it is the experience and channels for going global.

The collaboration with Stellantis enabled Leapmotor to successfully enter international markets and dramatically turn around its situation.

On May 13th this year, Zhu Jiangming, Chairman and CEO of Leapmotor, announced on social media that in the first four months of this year, Leapmotor International's cumulative export sales reached 13,600 units, achieving breakthroughs in ten European markets including Germany and the UK. For FAW, which has been seeking to expand its Hongqi brand overseas, this undoubtedly presents a ready-made path.

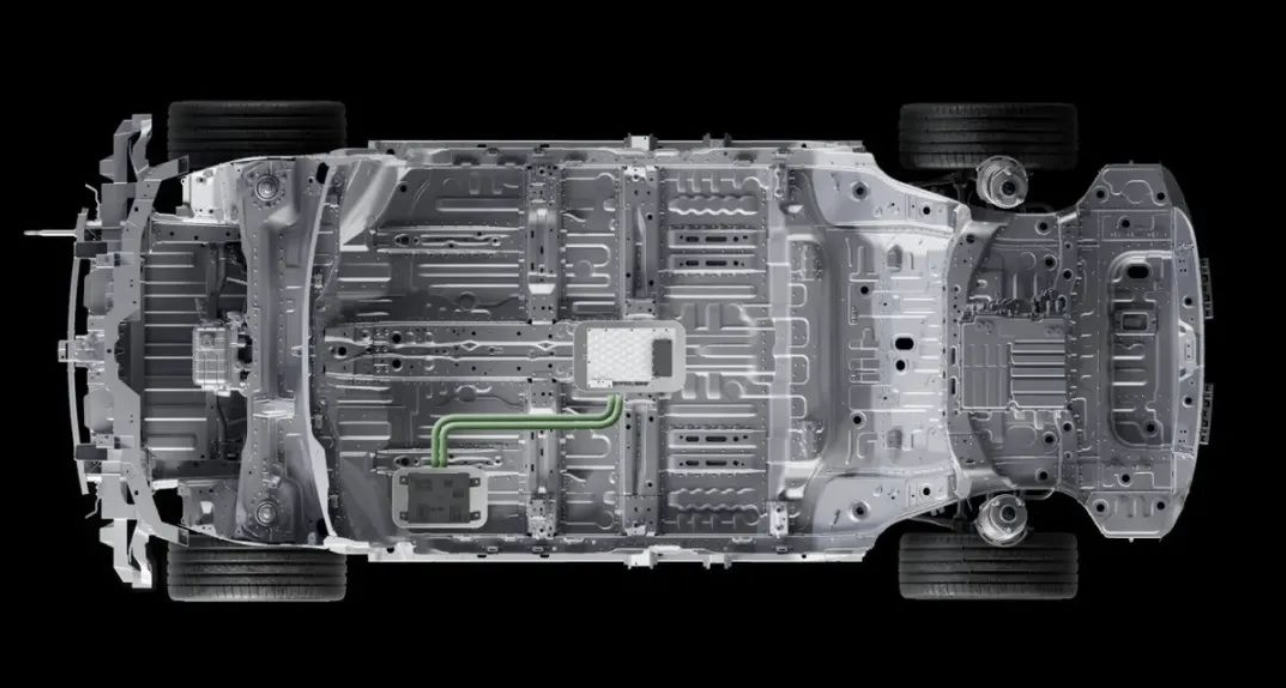

Secondly, the Leapmotor B platform mentioned in this disclosure of information.

Details about C-NOVA have previously been scarce. What the public knew were only its code name, dimensions, price range, and a few technical details. This time, it can be almost confirmed that it will be based on the B platform, meaning it will feature Leapmotor's latest LEAP 3.5 central domain control electronic and electrical architecture, while also integrating an L2-level driver assistance system. Undoubtedly, Leapmotor has put forth its best platform and latest technology in this collaboration.

With the sharing of platform technology, FAW can shorten the development and testing cycle to as little as 18 months. If we consider the statement made in early March that the C-NOVA has already entered the clay model stage, then the claim that this model can complete testing, finalize its design, and enter mass production next year is clearly not an exaggeration.

It is particularly noteworthy that Platform B currently has two models on the market, among which the compact pure electric SUV model B10 obtained the EU WVTA certification in early March this year. Additionally, the Leapmotor factory being constructed in Zaragoza, Spain, is scheduled to start production after 2026.

Once the models developed by FAW Hongqi based on this platform are launched in the European market, they can quickly gain technical endorsement through Leapmotor's existing products, making it easier for local consumers to recognize and accept them.

02Leapmotor and FAW-Volkswagen

In the first half of 2025, FAW-Volkswagen strives to move forward despite facing headwinds.

In the first half of the year, the Volkswagen brand sold a total of 436,000 vehicles, achieving a year-on-year increase of 3.5%, with its market share in the fuel vehicle segment rising against the trend by 0.7 percentage points. As for the Audi brand, its year-on-year growth in June reached 15.7%, with total deliveries exceeding 61,000 units (including imported vehicles). Regarding the Jetta brand, deliveries exceeded 12,000 units, marking a year-on-year increase of 33.4%.

In terms of actual achievements, it would not be an exaggeration to define it as "still maintaining dominance in the traditional fuel vehicle sector." The reason for this situation is also very clear—FAW-Volkswagen has done a good job of solving the problem of "how to make fuel vehicles intelligent."

From the second half of last year to the first half of this year, major models such as Sagitar, Magotan, and Tayron have successively completed intelligent upgrades. While ensuring the adoption of Volkswagen’s new-generation intelligent cockpit, they are also equipped with a driver assistance system jointly developed with Zhoyoo.

These measures have reflected in the market segment, with the Sagitar, Magotan, and Tayron models achieving sales of nearly 120,000, over 100,000, and over 82,000 units respectively in the first half of this year, each firmly securing a top-three position in their respective vehicle categories.

Picture | A high-scoring answer to how traditional fuel vehicles can become intelligent is not enough to solve the problems of new energy products.

Although it is commendable that the mass-market brand has achieved this phased success through a pure internal combustion engine product lineup in the current adverse market conditions, precisely because of this situation, it highlights the urgency for the brand to quickly introduce new energy products. Especially after entering July, the FAW Audi Q6L e-tron series has finally been completed and begun to make frequent appearances in front of the media, which is particularly urgent.

After all, FAW Group's self-owned new energy growth rate reached 95.5% in the first half of this year. In contrast, although FAW-Volkswagen has a large-scale new energy product matrix in planning and development, the earliest it can begin to launch them successively is in 2026.

It is worth noting that the Volkswagen brand has already begun exploring cooperation in the field of intelligent technology—the all-new Magotan is equipped with Zhuoyu Technology’s L2 driver assistance system, and the Audi Q6L e-tron uses Huawei Qian Kun intelligent driving system. The deep integration with Leapmotor will accelerate its transition from supplier collaboration to platform-level technology integration.

Image | Leapmotor B platform has its own unique features

In short, as the most important joint venture brand within the group, FAW-Volkswagen clearly cannot wait for the original timeline and urgently needs to achieve a "technology leapfrog" in new energy products as soon as possible.

From the perspective of product portfolio, the two existing models on Leapmotor’s B platform are both targeted at the low-price, high-volume segment. Products developed by FAW-Volkswagen based on this platform will undoubtedly enhance its entry-level new energy product lineup. Furthermore, from a technical standpoint, in addition to the current in-depth partnerships with Horizon Robotics and ZuoYu, the further introduction of Leapmotor will clearly be of great value in ensuring technological diversity.

Given the current situation faced by FAW-Volkswagen, adopting a "two-pronged approach" clearly provides an additional layer of security.

For Leapmotor, being able to achieve such in-depth cooperation with the "firstborn of the Republic's automotive industry," which has a profound heritage, will also bring substantial benefits.

The boost to profitability brought by collecting intellectual property licensing fees and technical service fees is self-evident. Even more significant is the inclusion of various high value-added self-developed components into FAW's supply chain system over the past several years.

Photo | Leapmotor Hangzhou Factory

The financing endorsement and policy dividends obtained through reliance on super partners, as well as the breakthrough opportunities achieved in the domestic lower-tier markets through FAW channels, are more than enough to make most peers envious.

And we must not forget those parts that are of even greater strategic value—

As the first emerging force to simultaneously bind with international giants and domestic central enterprises, Leapmotor's technical credibility and industry status are set to soar. It not only has the potential to attract more partners but also, to some extent, qualifies to participate in the formulation of industry standards.

Certainly, since this is an unprecedented collaboration, there will naturally be challenges and risks. Given the current stance of both parties, the future tests can still be described as severe.

First, FAW-Volkswagen needs to balance the profit pillar of fuel vehicles with the investment in electric transformation, as the R&D costs of launching 10 new energy models by 2026 are enormous. Meanwhile, Leapmotor faces the challenge of balancing technology open-sourcing with its own product development, in order to avoid repeating the internal friction seen in the "Android camp" of the mobile communications sector.

Of course, there are significant differences between companies. Such cross-domain cooperation between central state-owned giants and emerging car manufacturers cannot be expected to be smooth sailing. After all, there are considerable differences between FAW and Leapmotor.

From a technical perspective, the LEAP series architecture of Leapmotor is characterized by highly integrated electronic and electrical systems as well as CTC battery chassis integration, which fundamentally differs from FAW's platforms based on traditional fuel vehicles. The integration of their supply chains faces the issue of restructuring the standards of systems (such as component companies like FAW Fuwei and Fuao Co., Ltd.). If not handled properly, it may lead to a surge in production line modification costs and component compatibility conflicts in the short term.

In addition, at the technical concept level, FAW prefers a gradual approach to intelligentization, such as basing intelligent driving functions on the realization of L2-level assisted driving features and adopting a step-by-step development strategy. In contrast, Leapmotor has consistently adhered to the L4 standard and pre-installed hardware. There are even reports that the first jointly developed model, C-NOVA, has encountered disagreements over the sensor configuration plan: FAW demands a reduction in the number of LiDAR units to control costs, while Leapmotor believes that "hardware redundancy" is the core of technical competitiveness.

These conceptual differences must be reconciled as soon as possible. If the differences are amplified, it will inevitably lead to vague product positioning, resulting in the loss of traditional users and difficulty in attracting tech enthusiasts.

In addition to major technological aspects, there are many differences between the two companies in terms of approval models and incentive mechanisms, as well as differences in their attitudes towards problems. State-owned automobile groups adopt a cautious approach, aiming to avoid mistakes rather than seeking achievements, while new forces have adopted a rapid trial-and-error attitude since their inception.

Despite such huge differences, this is nevertheless a cooperation that must be carried out. For FAW, the essence of cooperating with Leapmotor is a major decision of "trading space for time": by opening up technology, they gain a window of opportunity for transformation, but must also endure the multiple tensions between institutional legacy and market dynamics. This also means that from the very beginning, this cooperation could never be limited to the superficial level.

This largest "hybrid experiment" in the history of China's automotive industry, if it successfully bridges the gap, could reshape the transformation paradigm of state-owned car enterprises; if it becomes trapped in the crevice between the system and the market, it may turn into a sunk cost of trillions of yuan. FAW's choice is no longer just about the rise and fall of an enterprise, but also carries the exemplary significance of China's automotive industry shifting from “scale dominance” to “technological supremacy.”

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track