Fire retardants surge again, China's fire retardant industry trapped in a double bind with 77% import reliance.

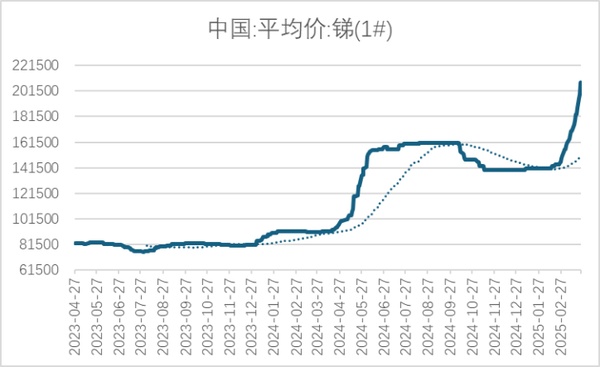

According to PliXuS Insight,On March 24, Kanghui, a major domestic flame retardant producer, initiated a price increase, announcing a raise of 6,000 yuan per ton for the modified PBT brominated flame-retardant series specifications. Previously, Kingfa Sci. & Tech. also announced price increases for all series of brominated flame-retardant products in PP, HIPS, ABS, PA, etc. The main reason is the sharp rise in the price of antimony, a key raw material for brominated flame retardants, due to low inventory levels and the country's increased export controls on antimony and related products.

A review of historical occurrences shows that the prices of brominated flame retardant products have experienced significant fluctuations, and such frequent surges are not uncommon. What are the underlying reasons behind these frequent price spikes?

Zhuansu Vision Research has found that the upstream raw material for brominated flame retardant products is bromine, which has a low degree of domestic production and a high reliance on imports. It is also classified in China as a category.Class 8 hazardous chemicals, classified as primary inorganic acidic corrosive substances, are also toxic, thus their production is subject to environmental protection standards.

The unstable international situation has a greater impact on high-import varieties.

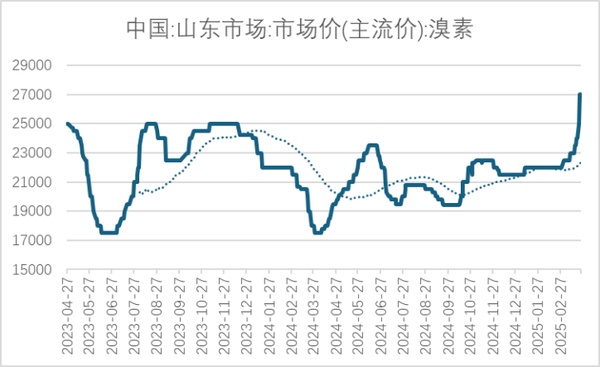

The data shows that,In February 2025, the national bromine production reached 16.39 million tons, with imports totaling 53.8 million tons, resulting in a high import dependence of 77%. However, overseas bromine production also relies on importing antimony raw materials from China. In 2024, China implemented export controls on antimony, causing prices to soar.请提供需要翻译的内容或下图的描述。This year,In early February, to safeguard national security and interests and fulfill international obligations such as non-proliferation, the Ministry of Commerce and the General Administration of Customs announced export control measures on bismuth, tungsten, tellurium, molybdenum, and indium-related items. Coupled with low inventory levels, this ignited market sentiment for antimony, causing prices to surge. The increased costs were passed down through the supply chain, leading to a sharp increase in the price of bromine and downstream flame retardant products in the domestic market.

Environmental factors have also been significant drivers of historical price fluctuations.

The production of bromine often involves substantial energy consumption and environmental pollution, making it a high-energy-consuming and highly polluting industry.Ninety-nine percent of the world's bromine is stored in seawater. Bromine production enterprises in China are mainly concentrated along the Bohai Sea, with Shandong Province being the most centralized, accounting for 81% of the country's capacity. In recent years, due to the promotion of dual carbon and environmental protection policies in Shandong, bromine production is often affected.(The figure below), prices have also experienced significant fluctuations.

Author: Zhou Yongle,资深行情分析专家 at Zhoushu Vision

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics