Fill The Domestic Gap! Wanhua Chemical Supplier, Juhua's Chemical New Materials Leader, Is Set To Go Public; Most Plastics Fell Today

1. Filling the domestic gap! Wanhua Chemical supplier, Juhua's chemical new materials leader, will be listed.

It is reported that Jinhua New Materials will be listed on the Beijing Stock Exchange this week, with an issue price of 18.15 yuan per share.

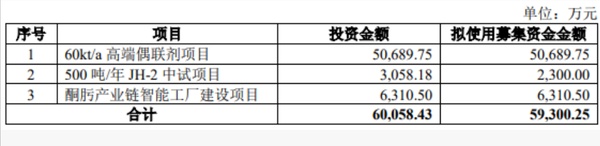

The company's IPO intends to raise RMB 63.105 million for the construction of the ketoxime industry chain smart factory project, RMB 23 million for the 500 tons/year JH-2 pilot project, and RMB 506.8975 million for the 60kt/a high-end coupling agent project.

The high-end coupling agent project will be constructed in three phases. Once fully operational, the company will add an annual production capacity of 30,000 tons of silane coupling agents and 30,000 tons of functional silane intermediates.The JH-2 pilot project plans to construct a hydroxylamine aqueous solution.Pilot research and development device for liquids.Can be used as a cleaning agent in the chip manufacturing process and as a stabilizer in the production process of special fibers.Currently, this product is mainly monopolized by BASF. If the project is successfully implemented, it will fill the domestic gap.

Jinhua New Material was established in December 2007, located in the High-tech Park of Quzhou City, Zhejiang Province. The legal representative is Lei Jun, and it is a domestic silane cross-linking company.Leading companies in niche areas such as agents and hydroxylamine salts, national-level specialized and innovative "little giant" enterprises.

Jinhua New Materials is a state-owned enterprise, and the chemical giant Juhua Group is the largest shareholder of the company, holding 82.49% of the shares, and is also the company's largest raw material supplier. Another chemical giant, Hengshen Holding Group, has a wholly-owned subsidiary involved in this context.Fujian Shenyuan New Materials Co., Ltd. holds 3.57% of the shares.

The company's main clients include large multinational enterprises such as Bayer and Bruntag, as well as listed companies like Wanhua Chemical, Sinochem International, Xanda Co., and Lianhua Technology, and Hunan Haili. The end customers of major traders include Silbond Technology, Jitai Co., Huitian New Materials, Oriental Yuhong, Lansi Technology, Science, and CompoChem.

From 2022 to 2024, Jinhua New Material's operating revenue was 994 million yuan, 1.115 billion yuan, and 1.239 billion yuan, respectively, while the net profit attributable to shareholders was 79.5922 million yuan, 173 million yuan, and 211 million yuan, respectively. It is estimated that in 2025, the annual operating revenue will be 1.063 billion yuan, a year-on-year decrease of 14.25%; the net profit attributable to shareholders will be 199 million yuan, a year-on-year decrease of 5.47%. This is mainly due to the low prosperity of room temperature silicone rubber, a downstream product of silane crosslinking agents, in the construction materials and energy power industries.

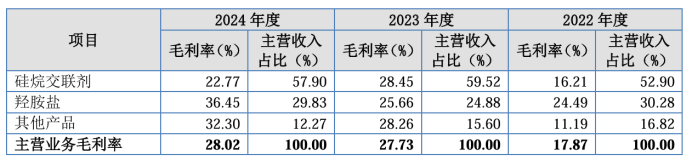

Among them,In 2024, revenue from silane crosslinking agents is expected to be 714 million RMB (accounting for 57.9%), with a domestic market share of 38.16%. These agents are primarily used in fields such as silicone sealants and photovoltaic module encapsulation (mainly for producing room temperature silicone rubber). Major global manufacturers include Wacker and Shin-Etsu Chemical, with product lines ranging from silicone monomers to silicone oils, silicone rubber, and silicone resins, where silane crosslinking agents account for a relatively small portion of their main business revenue. The domestic market has a high concentration, with key companies including Huajin New Material (58,300 tons/year), New Bluestar (28,000 tons/year), and Aikewei (16,500 tons/year).

In 2024, the revenue from hydroxylamine salts is projected to be 368 million yuan (accounting for 30% of the total), with a domestic market share of 42.37%. Hydroxylamine salts are primarily used as intermediates in pesticides and pharmaceutical synthesis. Major international companies include BASF and Ube Industries of Japan, which mainly produce hydroxylamine sulfate and primarily export to India. China is a major producer and exporter of hydroxylamine salts globally. Key domestic companies include Jinhua New Materials (35,000 tons/year), Aicowei (22,000 tons/year), Shandong Jin'an Chemical (30,000 tons/year), Sheng'an Chemical (8,000 tons/year), and Baoyuan Co., Ltd. (10,000 tons/year).

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track