Fifteen five, the competition in the auto market is just at halftime

The year 2025 marks the conclusion of the "14th Five-Year Plan". Next year, we will enter the "15th Five-Year Plan". Looking back over the past five years, the advancement of electrification, intelligence, and localization of the supply chain has led to profound changes in the Chinese automotive industry in a very short period of time.

Five years ago, new energy vehicles were merely a "supplementary item" in the market, but now they have become the mainstream choice. Chinese brands have surpassed joint venture brands to become market leaders, and new forces have moved from the "fringe" to the mainstream. All of this has laid the foundation for the integration and reshaping during the "Fifteenth Five-Year Plan" period.

The development path of the automotive industry during the "15th Five-Year Plan" period has gradually become clear, considering the current policy orientation, market performance, and corporate strategies. With the acceleration of market clearing and policy optimization, a structural adjustment from "chaotic competition" to "market clearing" is brewing.

The 14th Five-Year Plan, changing the landscape

During the 14th Five-Year Plan period, China's automotive industry landscape underwent tremendous changes.

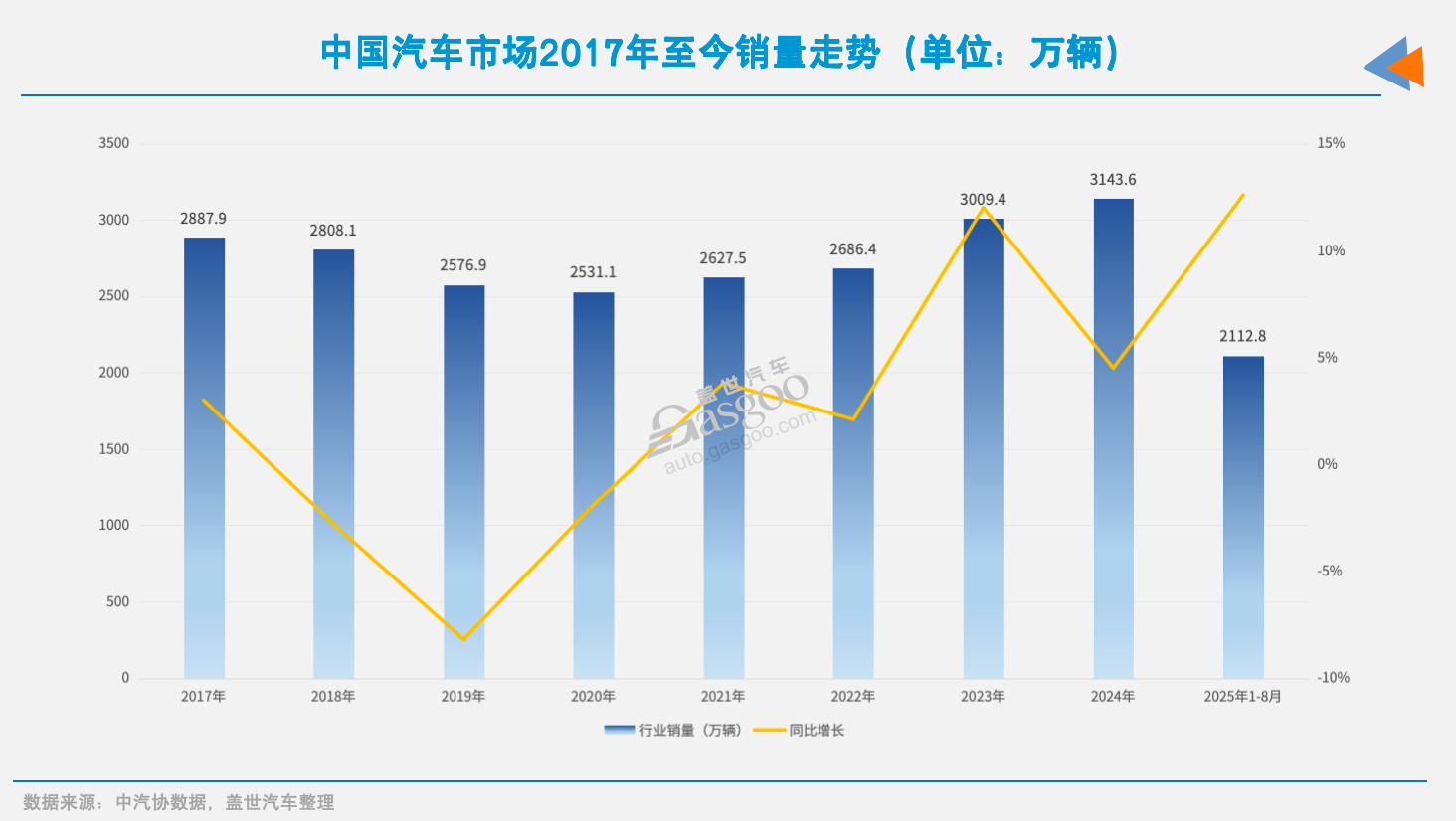

The most direct changes come from the market and the consumer side. The penetration rate of new energy vehicles increased from about 5% in 2020 to 40% in 2024, with nearly one in three new cars being a new energy vehicle. With the joint efforts of policies and car manufacturers, the overall sales volume of the automotive industry exceeded the 30 million mark in 2023.

Beyond policy promotion, the real driving force comes from the enhancement of the competitiveness of new energy products. The reduction in battery costs, increase in range, and application of fast-charging technology have gradually brought the price and user experience of electric vehicles to the level of, or even surpassing, that of gasoline vehicles. In recent years, we have already entered an era where "electricity and oil cost the same" or even "electricity is cheaper than oil." Furthermore, the accelerated construction of charging and battery swapping networks has alleviated consumers' concerns about energy replenishment.

With the cognitive restructuring of end consumers, the original brand landscape has been disrupted. New car-making forces have transitioned from "self-entertainment within the internet circle" to the mainstream market. In addition to NIO and Li Auto, tech giants like Huawei and Xiaomi have also entered the fray; traditional independent brands are responding by incubating new energy sub-brands such as Denza, Zeekr, Deepal, and Avatr.

For a time, the number of brands in the market surged, and the industry entered a state of "contention among a hundred schools of thought." According to statistics from Gasgoo Auto Research Institute, there are currently about 130 brands available in the domestic market. After several years of mental cultivation and development, domestic brands have captured 90% of the new energy market share and have made breakthroughs in several niche markets.

In the high-end market, brands such as Denza, NIO, Li Auto, and AITO have successfully broken through, while Yangwang and Zunjie have secured a position in the million-level market. In the mainstream market, independent brands like BYD and Geely have leveraged electrification to penetrate the core territory of joint venture brands. Notably, BYD sold over 4.2 million units last year, surpassing "Southern and Northern Volkswagen" for three consecutive years to become the top-selling domestic manufacturer. This year, BYD's overall sales are expected to exceed 5 million units.

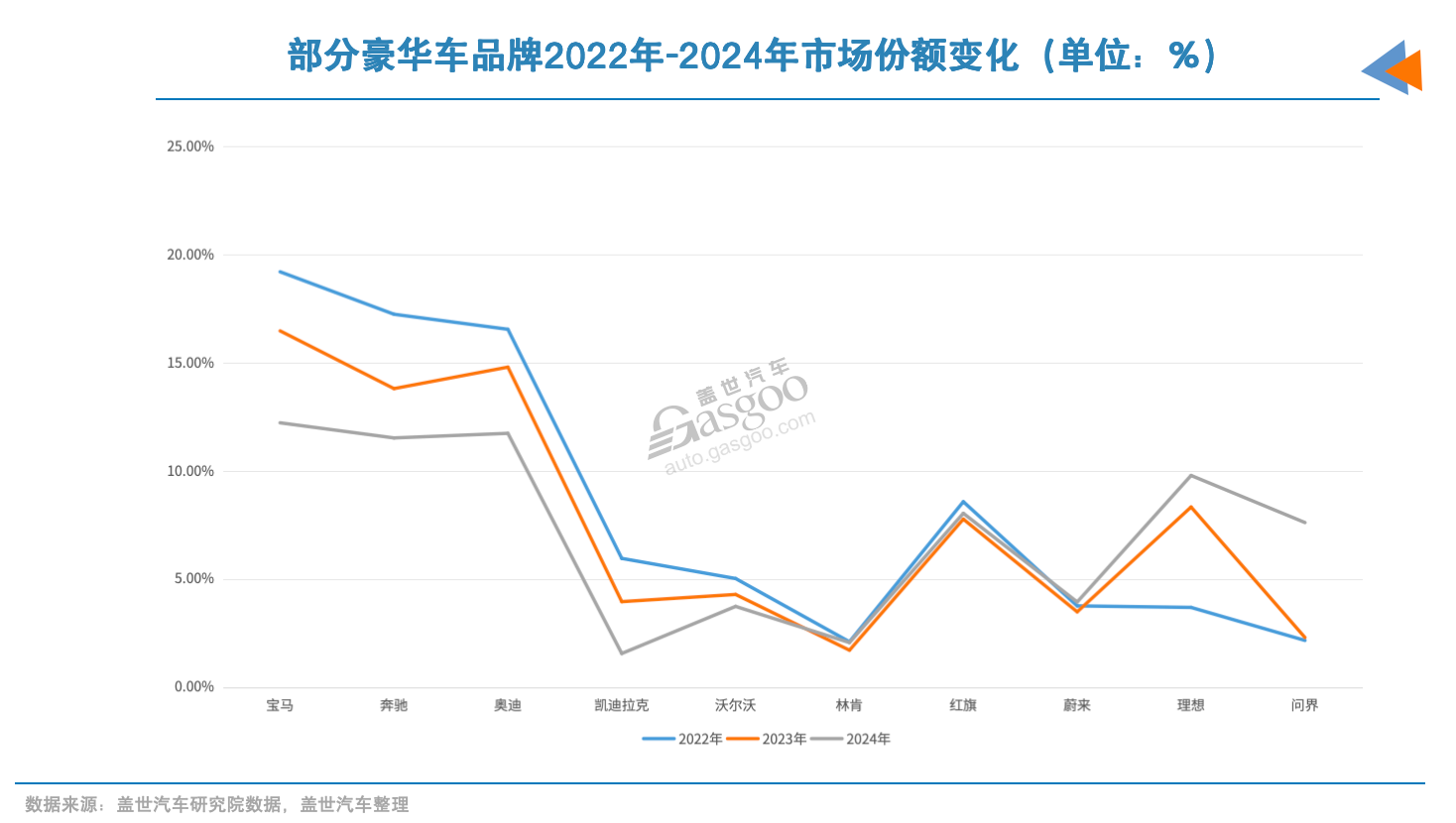

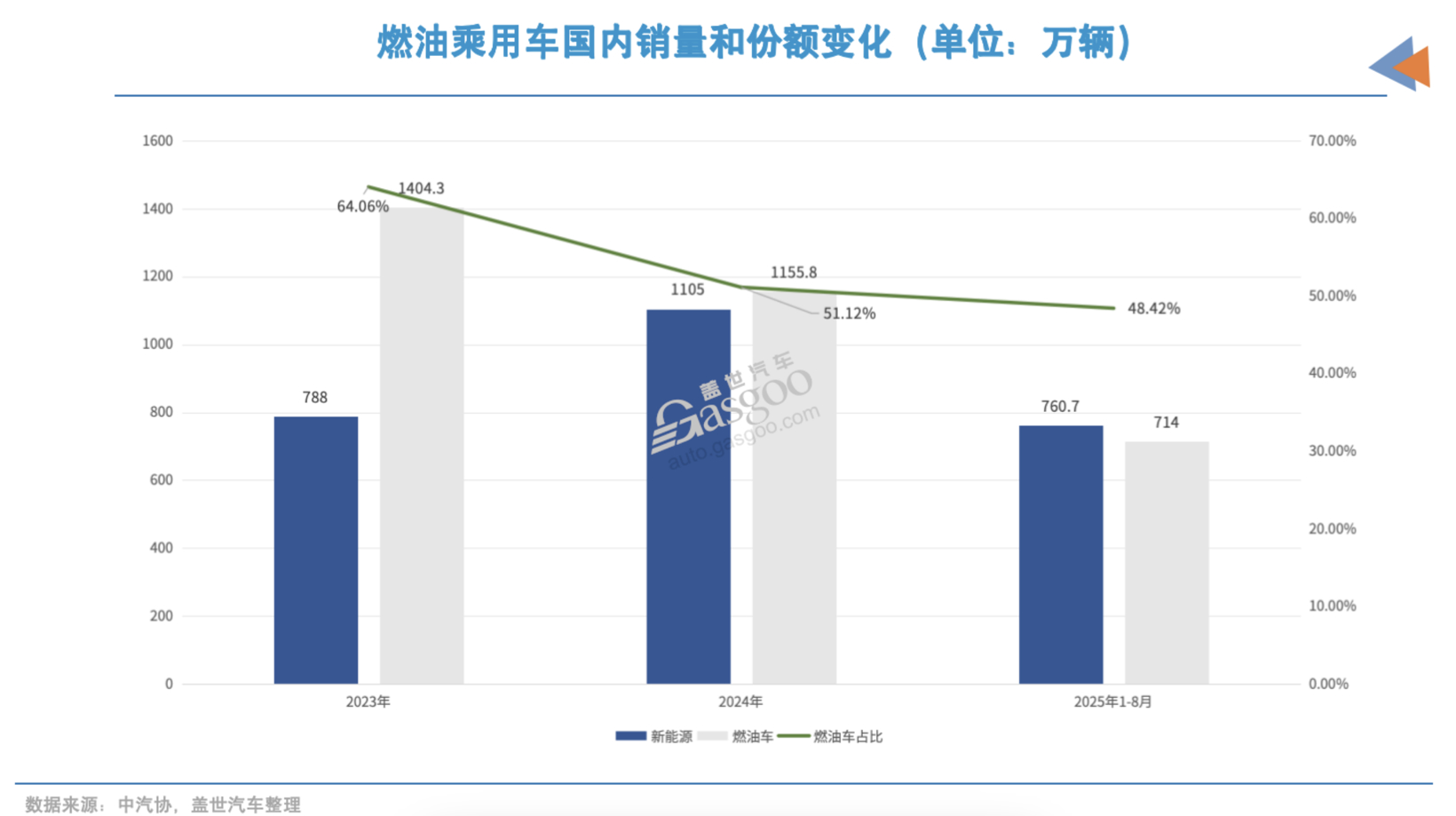

Joint venture brands, due to lagging product iterations, obvious shortcomings in intelligence, and slow transition to electrification, have seen their market share drop from 64% in 2020 to the current 36%, falling from market leaders to followers.

The reason behind this is that new energy vehicles, especially plug-in hybrids, are rapidly eating into the market share of fuel vehicles. In the 2024 passenger car market, sales of new energy vehicles have reached 11 million, almost equal to that of fuel vehicles. This trend continues in 2025, with the penetration rate of new energy passenger vehicles surpassing 50% from January to August. The structural shift of "new energy rising, fuel declining" has become irreversible.

Consumer preference shifts are an important factor in changing dynamics. Currently, users' focus on cars has shifted from traditional power performance and brand premium to intelligent experience, service ecosystem, and total cost of ownership. Features such as assisted driving and cockpit interaction experience have become key factors influencing car purchase decisions.

In terms of the supply chain, China's global position has risen. In the battery sector, globally leading battery companies such as CATL, BYD, and Gotion High-Tech have emerged. Among them, CATL and BYD together hold over 50% of the global market share for power batteries. In the fields of assisted driving and car networking, local companies like Horizon Robotics, Hesai Technology, and Suteng Innovation have been nurtured, building a supply chain system with international competitiveness.

In recent years, leading companies have accelerated their overseas expansion by establishing research and development centers, production bases, and marketing networks to advance their globalization strategies. Within just a few years, China's automobile exports have grown from one million vehicles to nearly six million last year, continuously surpassing Germany and Japan to become the largest export country.

The ultimate internal competition has set the pattern.

As the "14th Five-Year Plan" enters its final phase, China's automotive industry, after experiencing explosive growth and structural reshaping, faces intensified competition. The industry is gradually transitioning from "expansion competition" to an elimination stage centered on "survival." "Involution" is the most notable characteristic during the 14th Five-Year Plan period.

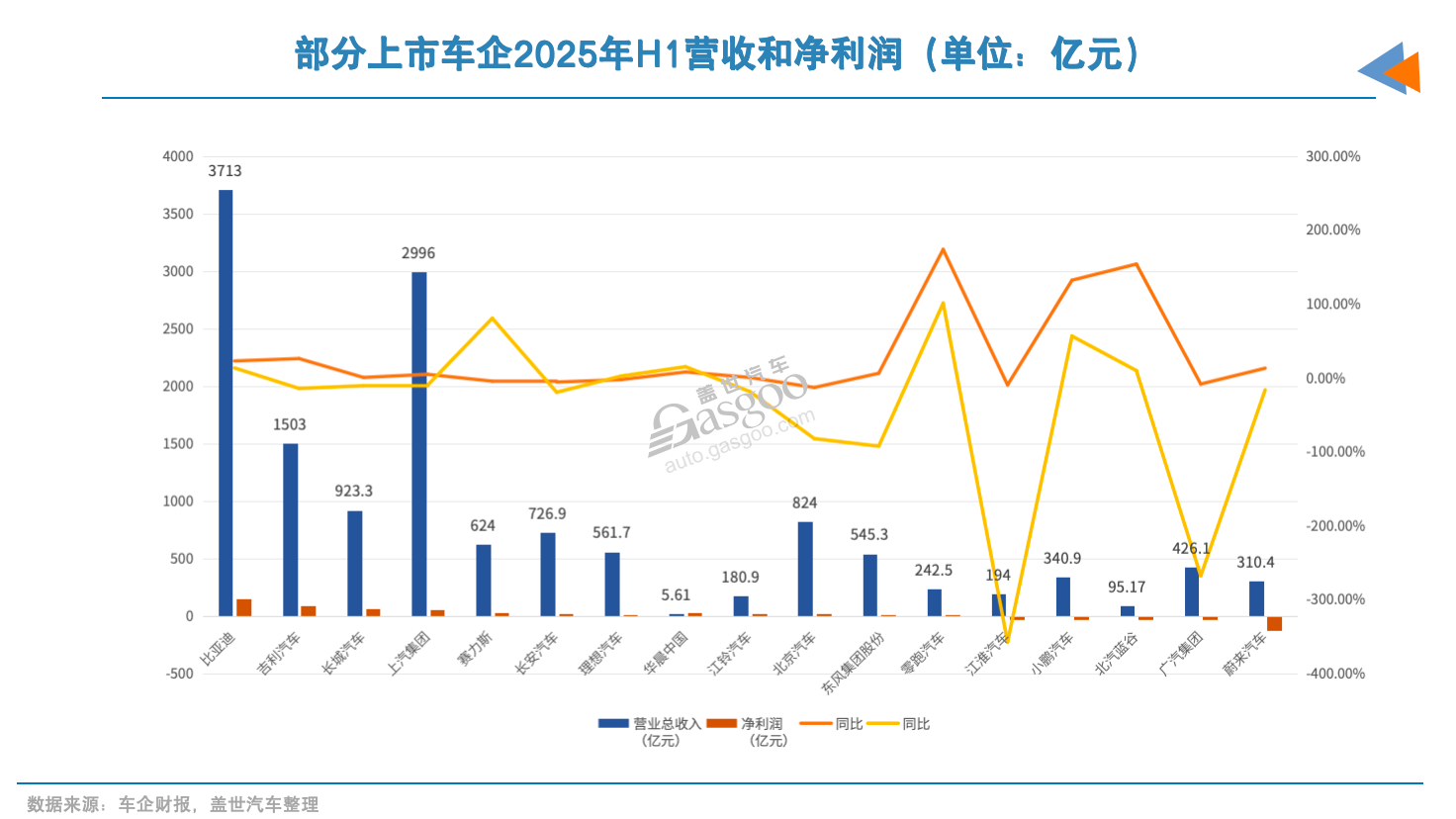

In the battle for survival, the product development cycle of car companies has shortened, the frequency of updates and replacements has accelerated, and product homogenization is severe. To compete for limited market share, "price wars" are prevalent among car companies, leading to challenges in financial health, and "increasing revenue without increasing profit" has become a common phenomenon. Statistics indicate that by July 2025, the profit margin of the automotive industry had declined to 4.6%, which is below the national industrial average. Except for a few new energy car companies like BYD and Li Auto that have achieved profitability, the vast majority of new energy brands are still deeply mired in losses.

The cash flow pressure on car companies is intensifying—high R&D and marketing expenditures continue to deplete corporate capital, while a tightening external financing environment is pushing a number of companies with insufficient self-sustaining capabilities closer to the survival threshold. The bankruptcy or market exit of companies like WM Motor, HiPhi, NETA, Aiways, and Enovate serves as evidence.

The normalization of price wars further weakens the profit margins. Tesla took the lead in 2023 by significantly reducing prices, followed by BYD, triggering a chain reaction of price cuts across the entire industry. The logic of competition has shifted: previously, companies determined pricing primarily through cost control, but now they focus more on survival, even if it means exchanging sales for minimal profits or even losses.

Simultaneously, the threshold for technological investment has risen significantly. What once required only the capability to mass-produce "three-electric" systems has now evolved into a comprehensive competition. High-voltage fast-charging platforms, assisted driving algorithms, vehicle operating systems, and in-car artificial intelligence applications have become key factors for car manufacturers to maintain competitiveness.

Data shows that from 2024 to the first half of this year, the R&D expenses of major car companies have increased by more than 20% year-on-year. BYD's R&D investment reached 29.6 billion yuan in the first half of this year, a year-on-year increase of 51%. The R&D investment of some car companies such as Geely and XPeng also increased by more than 20% during the same period.

After multiple rounds of competition, the initial signs of increased industry concentration have become apparent. Market share is gradually concentrating towards a few leading companies. From January to August 2025, the top ten car manufacturers in retail sales collectively hold 60% of the market share, while the remaining share is divided among hundreds of other brands.

Image source: BYD

BYD, with its leading technology, scale, and brand, holds a 30% share of the new energy market. Traditional independent car manufacturers' new energy sub-brands and some leading new forces are gradually establishing themselves in niche markets. The pattern of "two giants + multiple strong players + long tail" is taking shape among independent brands.

Joint venture brands are experiencing increased internal differentiation. Brands like Volkswagen, Toyota, and General Motors are using their brand strength and "price-for-volume" strategies to gain a brief respite. Meanwhile, Nissan and Honda are seeing their market share continuously shrink due to weak product competitiveness. Korean and French brands are becoming increasingly marginalized, with their market share now below 2%.

In the luxury car market, under the impact of domestic high-end brands such as AITO and Li Auto, the market share of BBA has shrunk from a peak of 60% to the current 35%. Among the second-tier traditional luxury brands, most have performed poorly, with the exception of some companies like Volvo and Lexus.

In the latter part of the "14th Five-Year Plan," the car market has shifted from rapid expansion to intense stock competition. The combination of financial pressure, price wars, and technological arms races creates undercurrents beneath the surface of the industry's apparent prosperity.

The policies under the 15th Five-Year Plan provide support.

By the end of the "14th Five-Year Plan" period, intense competition has led to signs of differentiation in the industry, with some car companies being eliminated and the overall structure beginning to converge. However, relying solely on market mechanisms is not enough to complete a thorough clearing out. Influenced by non-market factors, many enterprises, even if lacking profitability, may still depend on local protection or capital infusions to struggle for survival. This not only slows down the efficiency of resource reallocation but also keeps the industrial structure in a long-term inefficient state.

According to available information, after entering the "15th Five-Year Plan" period, policy orientation may gradually shift from early encouragement of market entry to optimization and integration, accelerating the clearance process. Experts point out that the "15th Five-Year Plan" period is an important transitional phase, as China's economic growth has entered the second half of the "new normal." The contribution of population and capital to economic growth will continue to decline, while improving total factor productivity is the core of high-quality development.

This means that the integration of the automotive industry is not merely an adjustment within the industry but an inevitable choice serving the overall industrial upgrade of the country. New energy vehicles and intelligentization are at the intersection of a new round of technological revolution and industrial transformation. Their clearing and restructuring process is essentially an important step for China's manufacturing industry to cultivate new quality productivity through "reducing capacity and improving efficiency."

Image Source: BYD

This transformation is first reflected in the entry phase. In recent years, many companies have relied on capital-driven approaches to enter the new energy vehicle sector, resulting in a proliferation of projects in a short period of time, but many of these lacked core technological accumulation. Entering the "15th Five-Year Plan" period, the approval of new production capacity will become more stringent, with a greater emphasis on the company's core technological strengths, long-term financial security, and sustainable development capabilities.

It is worth noting that during the "15th Five-Year Plan" period, we cannot simply repeat the "shutdown and merger" model of the previous round in the steel and coal industries. Instead, we should promote industrial clearance through reform, optimization, and technological innovation. For "new three" industries such as new energy vehicles and photovoltaics, policies may place more emphasis on reducing inefficient and excess capacity, while supporting leading companies to enhance competitiveness through technological innovation and supply chain integration.

Corresponding to the tightening of access is the improvement of the exit mechanism. The country is gradually establishing and perfecting systems related to corporate bankruptcy restructuring and capacity merger integration, promoting the orderly exit of enterprises that have long been in operational difficulties and lack market competitiveness, to avoid the continuous waste of social resources.

The subsidy policy should also be narrowed, shifting from "general support" to "targeted support." Some experts suggest that the subsidy plan for trade-in programs and the exit timetable should be announced as soon as possible to provide clear expectations for businesses and consumers. At the same time, subsidies should gradually shift from the car purchasing phase to the consumption and service phases, such as credit insurance, financial leasing, charging services, etc.

Wang Qing, Deputy Director and Researcher at the Institute of Market Economy of the Development Research Center of the State Council, also stated that after the monthly penetration rate of new energy vehicles exceeded 50%, the subsidy gap between them and fuel vehicles should gradually be narrowed to create a fair competitive environment. He suggested implementing a more phased withdrawal of the purchase tax incentives for new energy vehicles, to avoid a simultaneous decline in subsidies and purchase tax incentives, which could lead to a sudden market downturn.

In the long run, experts believe that "expanding domestic demand" should be combined with "supply-side reform" to avoid industries falling into "involution competition." It is necessary to unleash effective demand by improving product quality, strengthening innovation chains, and enhancing the industrial ecosystem, thereby promoting a positive interaction between consumption and investment.

In the view of experts, advancing the construction of a unified national market is one of the keys to solving "involution-style competition." Future policies will further eliminate market entry barriers, break down local protectionism and market fragmentation, and promote the concentration of resources towards competitive enterprises. This will accelerate the exit of less competitive enterprises.

Another major focus of the policy is on standards and regulation. As the level of intelligence increases, data security, driving safety, battery recycling, and carbon emissions have become new constraints for industry development. Strengthening relevant standards will force companies to not only focus on product sales but also meet strict compliance requirements.

Changes in the macro environment can also have a significant impact on industry consolidation. As economic growth slows, consumers are making more rational car purchasing decisions, tending to choose products that are technologically reliable, have stable brands, and high resale value. This is expected to further strengthen the advantages of leading companies.

Under the pressure of domestic demand, going abroad is also highly anticipated. In the latter part of the "14th Five-Year Plan," the export of new energy vehicles has shown rapid growth, but during the "15th Five-Year Plan," the international environment is becoming more complex. Trade protection policies in Europe and the United States, subsidy tilts, and geopolitical risks pose significant challenges to Chinese car companies.

Therefore, support at the national level is crucial. On one hand, measures such as signing bilateral or multilateral free trade agreements, providing export credit support, and establishing overseas marketing service platforms create more favorable conditions for enterprises to go global. On the other hand, in the face of challenges such as trade barriers, differences in technical standards, and geopolitical risks, automotive companies need more support from policies in areas such as compliance guidance, risk warnings, and alignment with international rules.

Cui Dongshu, Secretary-General of the China Passenger Car Association, believes that looking towards the 15th Five-Year Plan, the total output of automobile manufacturers may reach 40 million units, stating "I feel the potential is enormous." In his view, there are three driving forces for growth: firstly, the increase in automobile penetration rates in the central, western, and county-level markets; secondly, the shortened vehicle ownership cycle brought about by electrification; and thirdly, the gradual increase in overseas market share.

Entering the Era of Oligopolistic Competition

As policies gradually take effect and market clearing accelerates, the trend of concentration in the automotive industry becomes increasingly apparent.In the next five years, the industry will enter a critical stage of transitioning from "diverse competition" to an "oligopoly structure."

The Gasgoo Auto Research Institute predicts that the future automotive industry will consist of three main types of players.

The first category consists of all-around giants with core platform mastery and vertical integration capabilities, with annual sales expected to reach a scale of 3 million units. BYD has already demonstrated these characteristics, and Chery, Geely, etc., also have the opportunity to join their ranks.

The second category consists of eco-friendly or technology-based giants that complement all-round car manufacturers through their ecosystems or leading technologies. Huawei's HarmonyOS has an advantage in the field of assisted driving, while Xiaomi Auto leverages its user ecosystem to quickly penetrate the market. Both are expected to achieve annual sales volumes of up to one million vehicles.

The third category consists of leaders in niche markets, with a stable consumer base and high profit margins in specific areas such as off-road vehicles, sports cars, luxury cars, and MPVs. For example, Audi, BMW, and Mercedes continue to maintain influence in the mainstream luxury car market, while some new forces like Xpeng and Leapmotor have developed distinct characteristics in niche markets. The market share of leading joint venture companies will continue to be compressed, and they may seek breakthroughs in the high-end and specialized fields.

This means that in the future, fewer car companies will divide the "40 million vehicles" market share. Whether a car company can join the ranks of oligopolies is driven by multiple factors. First is the capability to win with technology. As cars transition from mechanical to intelligent electric drives, software service subscriptions and electronic and electrical architecture will become the true profit core. Only companies that have mastered core R&D capabilities will be able to maintain an advantage in the next round of technological iteration.

"Improving total factor productivity is the core of high-quality development." For the automotive industry, future competition will not only be a contest of vehicle integration capabilities but also a battle for self-controlled capabilities in underlying technologies, chips, operating systems, and other "intermediate goods." Some experts have pointed out that the innovation path should shift from "end product innovation" to "intermediate goods innovation," particularly achieving breakthroughs in key components, high-end chips, and basic software.

Secondly, there is the ability for vertical integration of the supply chain and cost control. Batteries, motors, and electronic controls remain core components, but in the context of a highly mature industrial chain, the ability to convert technological advantages into cost advantages will also influence market share.

Capital and scalability are emphasized once again. Without economies of scale, it is difficult to amortize the high costs of research and infrastructure. Moreover, a tightening financing environment further highlights the importance of cash flow.

Finally, it's about brand and globalization capability. In the context of the domestic market demand nearing saturation, the real growth potential for automakers comes from overseas. In the competition of overseas markets, brand premium and channel layout will determine success or failure.

Image source: Chery Automobile

It is noteworthy that the formation of this competitive landscape did not happen overnight. Ouyang Minggao, an academician of the Chinese Academy of Engineering, pointed out that the "15th Five-Year Plan is merely the mid-term competition in intelligent electrification." He believes that China's new energy vehicle industry has taken the lead in the electrification stage, but the long-term outcome still depends on deep breakthroughs in intelligence and global strategic layout. This means that even if an oligopolistic pattern may form during the "15th Five-Year Plan," it cannot be regarded as the final outcome but rather as the starting point for a new round of competition. The speed of technological iteration, the initiative in setting standards, and the uncertainties of the international market might once again alter the landscape.

Looking at the global market, this trend is also evident. The automotive industry in the European and American markets has long entered an oligopoly pattern, but the competition in the Chinese market is more complex. On one hand, the large capacity of the domestic market and the diverse consumer demands provide space for niche markets to survive; on the other hand, the regulatory role of policies is more pronounced, making the process of enterprise exit faster and more concentrated.

For car companies, this transformation is more like a protracted battle. On the surface, short-term factors such as price wars, product homogenization, and financing difficulties are testing companies, but the deeper challenge is whether they can maintain sustainable technological iteration and capital operation over the next decade. Once they fall behind in areas like assisted driving, computing power platforms, and battery systems, it will be difficult to make up the gap through "price wars" or marketing.

For the industry, an oligopoly structure means that resources can be concentrated in a few car companies with core competitiveness, significantly improving industrial efficiency. The redundant capacity and inefficient competition of the past will gradually disappear, and the remaining companies are more likely to compete directly with traditional automotive powerhouses on the global stage.

In short, what China needs is not just "champions" in the single field of new energy vehicles, but "all-around champions" that can represent the overall level of Chinese manufacturing. This is precisely the fundamental logic behind the policies promoting clearance and standardized development during the "15th Five-Year Plan" period.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track