Fearful Of China’s Cars, Mexico Takes Action!

Following the EU, Mexico suddenly announced: We will raise tariffs on imported cars from China, up to 50%!

The reason for this approach is that the price of cars arriving in Mexico is lower than the reference price stated by Mexico. A more ostensible reason is to protect local employment.

Objectively speaking, if foreign products are priced too low, it will indeed affect the sale of local products. When local products struggle to sell, it impacts factory production, which in turn can lead to employment issues. The domino effect is quite frightening.

According to reports, the price of a Tiggo 4 Pro in Mexico is 399,900 Mexican Pesos, equivalent to a starting price of 154,000 RMB; an MG4 starts at 194,000 RMB in Mexico, with the top configuration reaching up to 295,000 RMB. Such pricing can only be described as too high!

Others might consider it low, but we think it's high. This situation actually also occurred in Russia, roughly because of "underpricing," and they adopted some protective policies to prevent local enterprises from suffering devastating impacts.

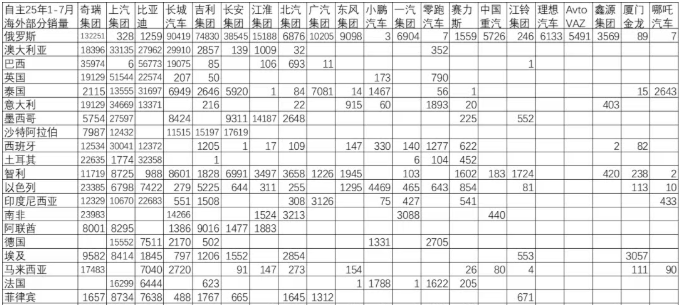

Mexico is China's second-largest trading partner in Latin America, while China is Mexico's third-largest export destination. Data shows that from January to July 2025, Mexico was among the top ten overseas markets for Chinese car exports. However, like Russia, it has shown a downward trend, while sales in Southeast Asia and Europe have increased year-on-year.

Currently, car companies that are selling well in Mexico include SAIC, JAC, Changan, Great Wall, and Chery, with sales from January to July reaching 27,597 units, 14,187 units, 9,311 units, 8,424 units, and 5,754 units respectively. In terms of new energy vehicles, BYD is also gradually entering the Mexican market.

Recently, at the Munich Auto Show in Germany, Chinese automotive brands showcased new cars and technologies, attracting the attention of foreign visitors. The three German giants—Mercedes-Benz, BMW, and Audi—have collectively faltered in the wave of new energy vehicles. However, even though executives are already aware of their backwardness and shortcomings, how can they easily achieve a "turnaround" given their established systems and structures in order to mount a counterattack?

In such circumstances, using tariffs as a weapon to retaliate and protect domestic enterprises has become the primary means.

According to data from Central European automotive trade, "the average export price of Chinese electric vehicles to Europe has risen from 18,000 euros in 2020 to 36,000 euros in 2025." Clearly, with the increase in premium pricing, Chinese cars are not relying on low prices in overseas markets; rather, the rise in premium indicates a simultaneous enhancement of brand strength. This is particularly fatal for foreign brands.

Europe is scared, and Mexico is also scared.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track