Fake hair tycoon harvests 900 million market value, csrc fine reveals billion-dollar blue ocean of plastic wigs

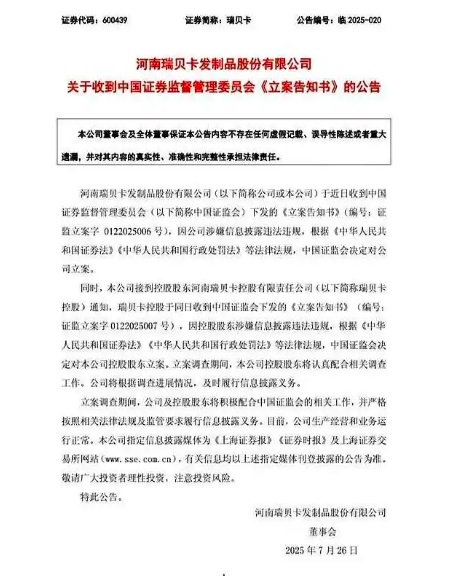

Special VisionOn July 28, it was observed that over the past weekend evening, an announcement pushed "Wig King" Rebecca (SH600439) into the spotlight. This wig giant, with a total market value of 4.188 billion yuan, is under investigation by the China Securities Regulatory Commission for suspected violations of information disclosure laws and regulations.

The announcement shows that Rebecca and its controlling shareholder, Henan Rebecca Holding Co., Ltd., failed to disclose non-operating fund transactions with related parties as required, inadequately provided for inventory write-downs, and had non-standard insider information management, among five major issues, exposing deep-seated risks in corporate governance. Just two months ago, Rebecca had failed to disclose in a timely manner.In 2024, the performance forecast was warned by the Henan Securities Regulatory Bureau, and the annual net profit attributable to the parent company showed a loss of 118 million yuan, further exacerbating its predicament of experiencing a loss for the first time in 25 years.

Source: Rebecca

From synthetic fiber wig to"Plastic Financial Report": The Ultimate Fate of a "Fraudulent" Company

Rebecca's dilemma reflects the synthetic fiber wig industry.The "high profit margin, low transparency" gray area. As the world's largest synthetic wig manufacturer, Rebecca's main composition in 2024 includes over 40% synthetic wigs. However, its financial report has been repeatedly questioned due to issues such as "insufficient provision for inventory write-downs" and "undisclosed related-party transactions." For example, at the end of 2023, the company's inventory reached as high as 1.23 billion yuan, but it did not adequately provide for the inventory write-downs, resulting in a 62% surge in marketing expenses through cross-border e-commerce channels in the fourth quarter of 2024, directly eroding profits by 128 million yuan.

Behind the "plastic financial reports" is the deep dependence of the synthetic fiber wig industry on plastic materials.From high-temperature wire to polyvinyl chloride (PVC)Rebecca's product line covers all mainstream plasticized wig materials, from PVC-based fibers to PAN-based fibers to PP-based fibers.Among them,PVC-based fibers are widely used in high-end wigs due to their "good styling effect and strong flame retardancy," but the large number of chlorine atoms in their molecules can easily release toxic gases at high temperatures. Although PAN-based fibers have a soft feel, they require graft modification to meet flame retardant standards. These material characteristics provide synthetic wigs with the selling points of "heat resistance and easy styling," but also pose quality risks. Rebecca was once reported by the EU for non-compliance with wig combustion performance standards, exposing the industry's neglect of the safety of plastic materials.

However, it is precisely thisThe characteristics of "low technical threshold and high profit margin" have made synthetic fiber wigs a blue ocean pursued by capital. According to the Yiwu Index, it is predicted that China's wig product exports will exceed 37.5 billion yuan in 2024, accounting for 80% of the global market share. The global market size for wigs and hair extension products is expected to reach $10.06 billion, and it is anticipated to grow to $13.28 billion by 2026, with a compound annual growth rate of approximately 15%. Despite Rebecca being investigated for violations, its stock price only slightly declined by 0.5% after the announcement, and its market value remains above 4.1 billion yuan. The market's tolerance for the "wig tycoon" indirectly confirms the industry's logic of high profitability.

Unveiling China's Synthetic Fiber Market: The Wig Industry"Invisible Hand"

Rebecca's rise and fall is closely linked to the ups and downs of the Chinese chemical fiber industry.In 2024, China's chemical fiber production reached 74.75 million tons, an increase of 8.8% year-on-year, with the production of polyester filament and spandex both growing by more than 10%. Behind the high operating rate (averaging over 90%) and high capacity utilization rate (a 7.8 percentage point increase for polyester direct spinning filament compared to 2023) is the deep penetration of chemical fiber enterprises into niche markets such as wigs.

For example, modified fibers of polyester, such as flame-retardant polyester and antibacterial polyester, are widely used in wig substrates, which not only reduce costs but also enhance product functionality.In 2024, although the export volume of polyester filament decreased by 2.5% due to India's BIS certification policy, exports to emerging markets such as Vietnam and Pakistan grew significantly. This demonstrates that under the global industrial chain restructuring, Chinese chemical fiber companies are capturing market share through the dual advantages of "technology + cost."

What is more noteworthy is the connection between the chemical fiber industry and the wig industry.The "symbiotic relationship" is deepening. On one hand, wig companies are driving innovation in synthetic fiber materials through customized demands (such as developing protein fibers that more closely resemble real human hair); on the other hand, synthetic fiber companies are reducing wig costs through large-scale production (for example, the price of polypropylene fiber is only 1/10 that of real human hair), forming a virtuous cycle of "material upgrade-cost reduction-market expansion." Although Rebecca was fined for violations, its R&D investment in 2024 will still reach 120 million yuan, accounting for more than 3% of its revenue, mainly directed towards the field of "new plastic materials wigs," which confirms the industry's consensus on technology-driven growth.

From Constraints to Boosts, the Wig IndustryPlastic materials

The core competitiveness of synthetic fiber wigs lies in the precise control of plastic materials. Currently, the main plastic wig materials on the market include:

High temperature wireHigh temperature resistance (approximatelySupports heat styling up to 160℃, with a realism close to human hair, but the price is relatively high.

Ordinary synthetic fibersPrimarily composed of polyester or acrylic fibers, it is low-cost and rich in color, but prone to static electricity and lacks a natural luster.

Protein filamentThe texture is closest to real hair, but it cannot be permed or dyed, and the production technology is monopolized by a few companies.

PVC-based fiberHigh strength and good shape retention, but prone to shrinkage when heated, requires the addition of flame retardants.

PAN-based fiberHigh softness, but flammable; needs modification to improve safety.

PP-based fiberCost-effective, but flammable, must undergo flame-retardant treatment.

The characteristics of these materials determine the product positioning and price range of synthetic wigs. For example, Rebecca's high-end product line mostly uses high-temperature fibers and protein fibers, with prices exceeding...High-end products are priced at 2,000 yuan per unit, while mid to low-end products primarily use ordinary synthetic fibers, with prices dropping below 200 yuan. This "stratified competition" strategy allows synthetic wigs to cover the entire market channel from street stalls to high-end malls.

However, the safety issues of plasticized materials have always been a pain point in the industry.In 2024, 60% of the Chinese wig products reported by the EU's Rapid Alert System for Non-Food Consumer Products (RAPEX) involved "non-compliance with flammability standards," primarily due to companies reducing the use of flame retardants to cut costs. Although Rebecca declared in its financial report that "products comply with EU CE certification," the company's "quality compensation expenses" in its 2024 sales expenses increased by 40% year-on-year, exposing the contradiction between material safety and cost control.

Epilogue: CSRC Penalty Unveils the Trillion-Yuan Blue Ocean of Plasticized Wigs

Rebecca was filed for investigation, which seems to be a governance crisis of a single company, but in reality, it pertains to the synthetic fiber wig industry.The shift from "barbaric growth" to "regulated development" is epitomized here. The intervention by the China Securities Regulatory Commission not only targets information disclosure violations but also implicitly warns against the industry's tendency towards "heavy marketing, light R&D" and "heavy scale, light quality."

The potential of the synthetic wig market has not yet been fully realized.In 2024, the global wig consumer population exceeded 300 million, with the African market becoming the fastest-growing region due to the "wig necessity" (African women own an average of six wigs) and increased e-commerce penetration (a 50% year-on-year growth in African wig e-commerce sales in 2024). In contrast, the European and American markets are driven by "fashion consumption" and the "hair loss economy," with a continuous rise in demand for high-end wigs. Although Rebecca was fined for violations, its cross-border e-commerce revenue accounted for 30% in 2024, demonstrating the industry's reliance on emerging channels.

The more far-reaching impact is that the supervision by the China Securities Regulatory Commission will force enterprises to enhance their technological barriers. For example, developing safer plasticizing materials (such as chlorine-free flame retardants).Improving the comfort of wigs (such as breathable base design) and expanding application scenarios (such as medical wigs and AR try-on) will become key competitive factors for companies. In its 2024 annual report, Rebecca explicitly stated "increasing the proportion of R&D investment to 5%" and plans to collaborate with universities to establish a "wig materials laboratory," which reflects this trend.

From high-temperature fibers to protein fibers, from African street stalls to high-end European and American markets, the future of synthetic fiber wigs will ultimately belong to those companies that can both master the use of plastic materials and adhere to compliance standards.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track