Exports to the United States Continue to Decrease, Polyolefins Still Depend on Fundamentals

Introduction:

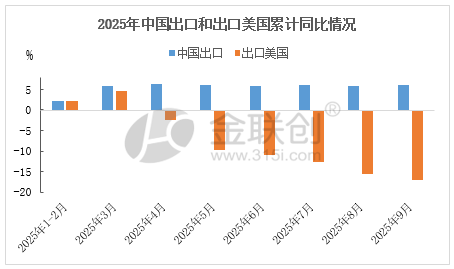

According to customs statistics, in September 2025, China's total import and export value was 566.68 billion USD, an increase of 4.7% compared to the previous month and a year-on-year increase of 7.9%. In September, the year-on-year growth rate of China's export value increased, but the growth rate of exports to the United States continued to decline, and the growth rate of imports of American goods also continued to decline.

According to customs statistics, the total value of imports and exports in China for September 2025 was 566.68 billion USD, representing a month-on-month increase of 4.7% and a year-on-year increase of 7.9%. Among these, exports amounted to 328.57 billion USD, with a year-on-year increase of 8.3% and a month-on-month increase of 2.2%; imports were 238.12 billion USD, with a year-on-year increase of 7.4% and a month-on-month increase of 8.5%; the trade surplus was 90.45 billion USD, compared to the previous value of 102.33 billion USD. The export growth rate for the first nine months of 2025 was 6.1%. For the entire year of 2024, the export growth rate was 5.9%, the import growth rate was 1.1%, and the trade surplus was 992.16 billion USD. Overall, despite the high tariff policies from Trump, which have affected trade, the year-on-year growth rate of China's total exports in September increased, but the growth rate of exports to the United States continued to decline, as did the growth rate of imports of American goods.

In terms of polyolefin-related products, in September 2025, the import volume of primary shape plastic raw materials decreased. The export value of plastic products saw a slight increase. In September, international oil prices fell, causing polyolefin prices to decline in sync; the domestic import arbitrage window closed, leading to a reduction in raw material imports. The export growth of plastic products remained low, significantly impacted by U.S. tariff policies, resulting in a notable decrease in exports to the U.S. In July, due to "anti-involution" and supply concerns, polyolefin prices rebounded temporarily but ultimately returned to fundamentals. In August, with the decline in oil prices, domestic polyolefin prices also fell, and the domestic import arbitrage window closed, reducing imported raw materials. In September, polyolefin prices weakened further, continuing their downward trend into October, and in November, prices will still be under pressure from strong supply and weak demand, continuing to oscillate at the bottom.

China's total exports to the United States have continued to see a decline in year-on-year growth rate.

Data source: General Administration of Customs of China, JLC

In terms of the total value of goods exported by China calculated in U.S. dollars, the year-on-year growth rate remains positive, while the total value of goods exported to the United States maintained positive growth in the first three months, but decreased year-on-year from April to June, with the decline continuing to widen. This indicates that Trump's tariff policy has indeed had a tangible impact on China's exports to the United States. In the first nine months, China's total export value increased by 6.1% year-on-year, while the total value of exports to the United States decreased by 16.9%, with the decline in exports to the U.S. continuing to expand.

The import volume of basic plastic shapes has increased despite a price drop.

Data Source: General Administration of Customs of China, JLC Network Technology Co., Ltd.

In September 2025, the quantity of imported primary shape plastic raw materials was 2.155 million tons, a decrease of 7.4% compared to the same period last year; the import value was 23.31 billion yuan, a decrease of 8.0%. From January to September 2025, the quantity of imported primary shape plastic raw materials was 20.07 million tons, a decrease of 6.8%; the import value was 215.54 billion yuan, a decrease of 7.3%. In the year 2024, from January to December, the quantity of imported primary shape plastic raw materials was 28.981 million tons, a decrease of 2.1% compared to the same period in 2023; the import value was 311.67 billion yuan, a decrease of 2.0%. From the perspective of cost support, international crude oil prices have shown a downward trend since mid-January, with oil prices falling in August. Domestic polyolefin prices have also fallen, the domestic import arbitrage window has closed, and imports of raw materials have decreased. As international oil prices continue to decline and the cost of foreign polyolefin raw materials decreases, it is expected that imports will increase appropriately.

Data Source: General Administration of Customs of China, JLC Network Technology Co., Ltd.

From the perspective of the monthly average prices of imported primary plastic raw materials, after reaching a new high in June 2022, the monthly average price began to decline and has since maintained a continuous downward trend. As shown in the chart, the cumulative average price from January to December 2023 continued to decline. In 2024, prices generally maintained a fluctuating downward trend, with little variation. In the first two months of 2025, the cumulative average price significantly dropped due to the continuous decline in international oil prices. The average price slightly increased in March, then declined again in April, saw some improvement in May, continued to rise in June, and significantly decreased in July. The average price rose slightly in August, before declining again in September.

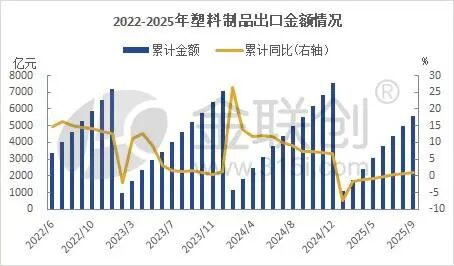

The export value of plastic products increased year-on-year.

Data source: General Administration of Customs of China, Jin Lian Chuang

In September 2025, the export value of plastic products was 59.19 billion yuan, a year-on-year increase of 3.9%. From January to September 2025, the export value of plastic products was 559.54 billion yuan, a year-on-year increase of 0.9%. When measured in U.S. dollars, the export value of plastic products for the period of January to September decreased by 0.5% year-on-year. In the first nine months of this year, the total export value of China's goods trade was 77.9641 billion U.S. dollars, remaining flat compared to the same period last year. The growth rate of export value for plastic products was lower than the national goods export growth rate. When measured in U.S. dollars, in the first nine months, the export value growth rates for automobiles, home appliances, and integrated circuits maintained a high pace, with year-on-year increases of 10.8%, -2.2%, and 23.3% respectively. The export quantities also maintained high growth rates, with year-on-year increases of 21%, 0.8%, and 20.3% respectively.

The polyolefin market is bottoming out amid weak fundamentals.

In the first nine months, data shows that exports to the U.S. decreased by 16.9% year-on-year, with the decline expanding by 1.4 percentage points compared to August. Imports from the U.S. fell by 11.6% year-on-year, with the decline widening by 0.6 percentage points from August. Despite the extension of the suspension of additional tariffs for 90 days, under the existing high tariff level of nearly 41.3%, China's export momentum to the U.S. continues to weaken, while import activity remains weak as well.

In terms of the domestic polyolefin fundamentals, the expansion of production capacity will be concentrated in the first half of 2025, with supply growth significantly outpacing demand growth, maintaining a scenario of strong supply and weak demand. Polyolefin prices will continue to be constrained by the reality of weak fundamentals. In June, geopolitical factors gradually faded, returning to a weak fundamental situation. In July, prices rebounded somewhat due to the domestic macro "anti-involution" effect, while in August, prices declined weakly without clear positive guidance. In September, the downtrend continued, probing lower, and in October, the weak probing downward persisted. It is expected that November will still see fluctuations at the bottom.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track