Evonik's full-year 2024 performance shows a significant improvement compared to the previous year, committed to achieving sustained growth.

Briefing

Briefing

Briefing

Briefing

Briefing

Briefing

Briefing

Briefing

Briefing

Briefing

Briefing-

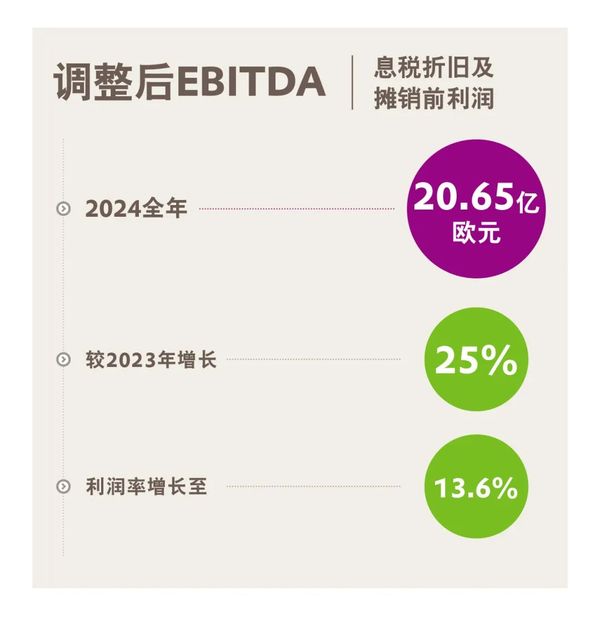

25% growth in adjusted EBITDA for 2024 -

Adjusted EBITDA for 2025 is expected to be between 2 billion and 2.3 billion euros -

Restructuring and cost control measures have been significantly effective

-

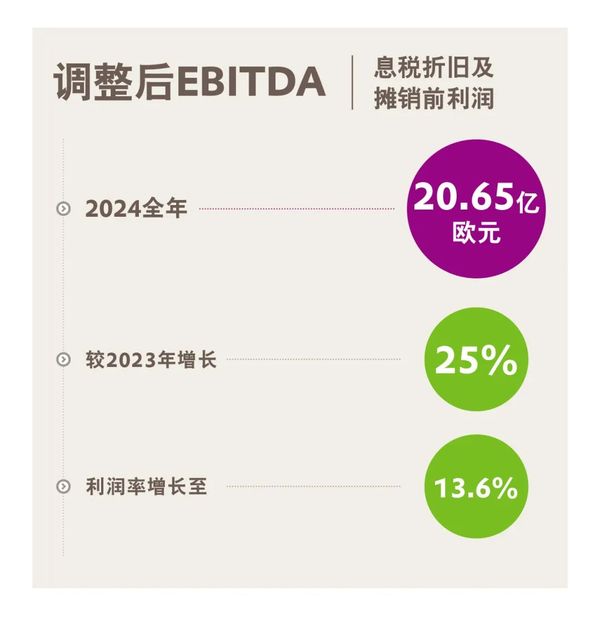

25% growth in adjusted EBITDA for 2024 -

Adjusted EBITDA for 2025 is expected to be between 2 billion and 2.3 billion euros -

Restructuring and cost control measures have been significantly effective

-

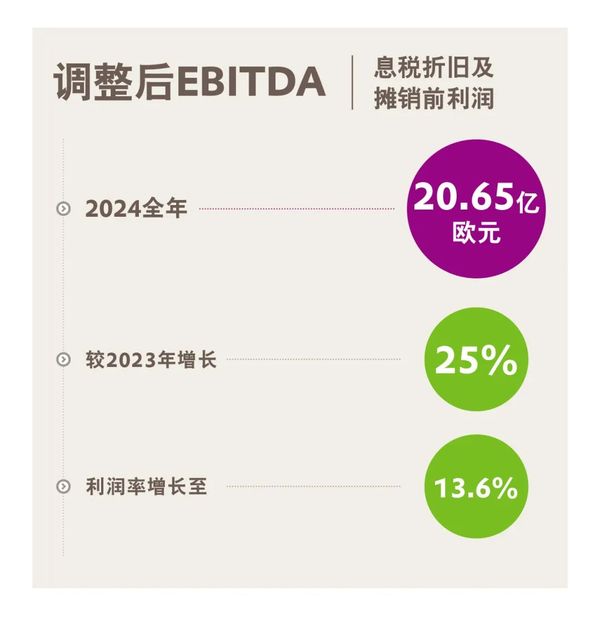

25% growth in adjusted EBITDA for 2024 -

Adjusted EBITDA for 2025 is expected to be between 2 billion and 2.3 billion euros -

Restructuring and cost control measures have been significantly effective

-

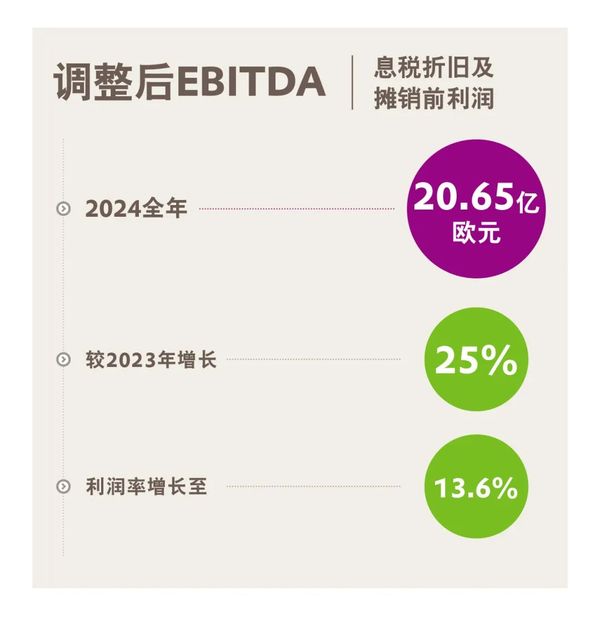

25% growth in adjusted EBITDA for 2024 -

Adjusted EBITDA for 2025 is expected to be between 2 billion and 2.3 billion euros -

Restructuring and cost control measures have been significantly effective

Evonik releases its full-year 2024 financial data, with the group achieving strong growth in operating profits for 2024.

"In last year's complex economic and political environment, we achieved countercyclical growth and became more robust. We will continue to achieve sustained growth in a challenging environment." — Christian Kullmann, Chairman of Evonik Industries AG

Key Points from the Full-Year 2024 Financial Report

Evonik releases its full-year 2024 financial results, achieving strong growth in operating profits for the year 2024.

Evonik releases its full-year 2024 financial results, achieving strong growth in operating profits for the year 2024.

"In last year's complex economic and political environment, we achieved counter-cyclical growth and became more robust. We will continue to achieve sustainable growth in a challenging environment." — Christian Kullmann, Chairman of Evonik Industries AG

"In last year's complex economic and political environment, we achieved counter-cyclical growth and became more robust. We will continue to achieve sustainable growth in a challenging environment." — Christian Kullmann, Chairman of Evonik Industries AG

"In the complex economic and political environment of last year, we achieved counter-cyclical growth and became more robust. We will continue to achieve sustained growth in a challenging environment." —— Chairman of Evonik Industries, Christian Kullmann

"In the complex economic and political environment of last year, we achieved counter-cyclical growth and became more robust. We will continue to achieve sustained growth in a challenging environment." —— Chairman of Evonik Industries, Christian Kullmann

"In the complex economic and political environment of last year, we achieved countercyclical growth and became more robust. We will continue to achieve sustainable growth in a challenging environment." — Christian Kullmann, Chairman of the Executive Board of Evonik Industries AG

"In the complex economic and political environment of last year, we achieved countercyclical growth and became more robust. We will continue to achieve sustainable growth in a challenging environment." — Christian Kullmann, Chairman of the Executive Board of Evonik Industries AG

"In the complex economic and political environment of last year, we achieved counter-cyclical growth and became more robust. We will continue to achieve sustainable growth in a challenging environment." ——Christian Kullmann, Chairman of the Executive Board of Evonik Industries AGKey Points of the 2024 Full Year Financial Report

Key Points of the 2024 Full Year Financial Report

Key Points of the 2024 Full Year Financial Report

Key Points of the 2024 Full Year Financial Report

Key Points of the 2024 Full Year Financial Report

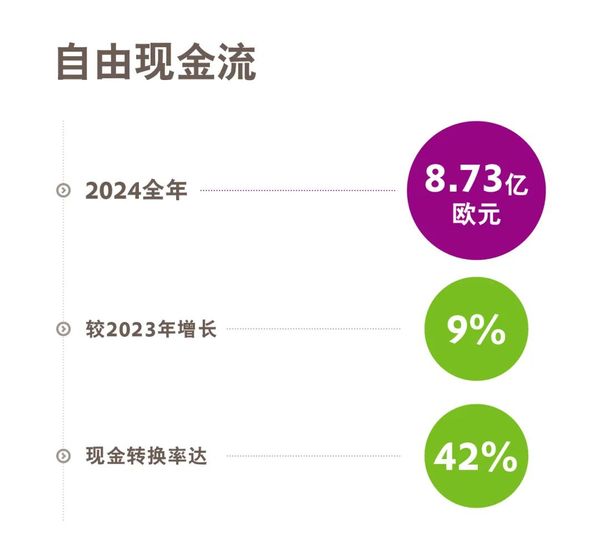

Overall, in 2024, Evonik achieved a net profit of 222 million euros, with the return on capital employed (ROCE) rising to 7.1% (2023: 3.4%). Sales volume for the year grew by 4%, surpassing global economic growth. The average sales price decreased by 2% year-on-year.

Evonik is confident about the fiscal year 2025. It is expected that the adjusted EBITDA for the first quarter will exceed the level of the same period last year (522 million euros). The full-year adjusted EBITDA is expected to reach between 2 billion and 2.3 billion euros, with a cash conversion rate maintained at around 40%, and ROCE is expected to continue to improve.

Overall, in 2024, Evonik achieved a net profit of 222 million euros, with the return on capital employed (ROCE) rising to 7.1% (2023: 3.4%). Sales volume for the year grew by 4%, surpassing global economic growth. The average sales price decreased by 2% year-on-year.

Overall, in 2024, Evonik achieved a net profit of 222 million euros, with the return on capital employed (ROCE) rising to 7.1% (2023: 3.4%). Sales volume for the year grew by 4%, surpassing global economic growth. The average sales price decreased by 2% year-on-year.Evonik is confident about the fiscal year 2025. It is expected that the adjusted EBITDA for the first quarter will exceed the level of the same period last year (522 million euros). The full-year adjusted EBITDA is expected to reach between 2 billion and 2.3 billion euros, with a cash conversion rate maintained at around 40%, and ROCE is expected to continue to improve.

Evonik is confident about the fiscal year 2025. It is expected that the adjusted EBITDA for the first quarter will exceed the level of the same period last year (522 million euros). The full-year adjusted EBITDA is expected to reach between 2 billion and 2.3 billion euros, with a cash conversion rate maintained at around 40%, and ROCE is expected to continue to improve.

“In the face of an uncertain economic environment, we need to work harder in 2025. Through rigorous cost and capital expenditure management, we are laying the foundation for improving profitability and capital returns.” — Maike Schuh, Chief Financial Officer of Evonik

“In the face of an uncertain economic environment, we need to work harder in 2025. Through rigorous cost and capital expenditure management, we are laying the foundation for improving profitability and capital returns.” — Maike Schuh, Chief Financial Officer of Evonik

"In the face of an uncertain economic environment, we need to work even harder in 2025. Through strict cost and capital expenditure management, we are laying the groundwork for improving profitability and capital returns." — Maike Schuh, Chief Financial Officer of Evonik

"In the face of an uncertain economic environment, we need to work even harder in 2025. Through strict cost and capital expenditure management, we are laying the groundwork for improving profitability and capital returns." — Maike Schuh, Chief Financial Officer of Evonik

"In the face of an uncertain economic environment, we need to work harder in 2025. Through strict cost and capital expenditure management, we are laying the foundation for improving profitability and capital returns." — Maike Schuh, Chief Financial Officer of Evonik

"In the face of an uncertain economic environment, we need to work harder in 2025. Through strict cost and capital expenditure management, we are laying the foundation for improving profitability and capital returns." — Maike Schuh, Chief Financial Officer of Evonik

"In the face of an uncertain economic environment, we need to work harder in 2025. Through strict cost and capital expenditure management, we are laying the foundation for improving profitability and capital returns." — Maike Schuh, Chief Financial Officer of Evonik ```A positive cash flow allows dividends to remain stable once again. The Executive Board and Supervisory Board plan to propose a dividend of 1.17 euros per share at the Annual General Meeting on May 28, which is in line with last year. Based on the current share price, the dividend yield is approximately 6%.

The group-wide efficiency enhancement program "Evonik Tailor Made" is being fully implemented. It is expected that by the end of 2026, this program will result in annual cost savings of around 400 million euros. Thomas Wessel, Chief Human Resources Officer and Labor Director of Evonik Industries, stated: "We are committed to advancing the restructuring in a responsible manner, and the plan is currently progressing smoothly. We maintain close consultations with employee representatives and are steadily advancing the restructuring and downsizing plans. At the same time, optimization projects for businesses such as animal nutrition and healthcare are also making good progress."

The organizational structure continues to be streamlined. In the future, Evonik will integrate its chemical business into two divisions, managed in a more differentiated way by members of the Executive Board. Lauren Kjeldsen and Claudine Mollenkopf will join the Executive Board, taking charge of the "Customized Solutions" and "Advanced Technologies" divisions, respectively. This change will take effect on April 1, eliminating the department level, thereby streamlining the management layer at this level. The new structure will manage each business more targetedly, achieving better allocation of resources for R&D and investment.

As part of the new innovation strategy, Evonik is focusing its resources on three areas with the greatest potential, namely bio-based solutions, energy transition, and circular economy. Meanwhile, Evonik's next-generation solutions, i.e., products and applications with significant sustainability advantages, have made substantial progress, increasing their sales proportion to 45% (2023: 43%).

The former Technology & Infrastructure business unit will be split into Base Infrastructure Services and Central Strategic Technologies starting from January 1, 2025. The production sites in Marl and Wesseling, Germany, will be divested in the second half of this year. This move will strengthen Evonik's technological leadership and enable it to focus more on its chemical business.

A positive cash flow allows dividends to remain stable once again. The Executive Board and Supervisory Board plan to propose a dividend of 1.17 euros per share at the Annual General Meeting on May 28, which is in line with last year. Based on the current share price, the dividend yield is approximately 6%.

A positive cash flow allows dividends to remain stable once again. The Executive Board and Supervisory Board plan to propose a dividend of 1.17 euros per share at the Annual General Meeting on May 28, which is in line with last year. Based on the current share price, the dividend yield is approximately 6%.The group-wide efficiency enhancement program "Evonik Tailor Made" is being fully implemented. It is expected that by the end of 2026, this program will result in annual cost savings of around 400 million euros. Thomas Wessel, Chief Human Resources Officer and Labor Director of Evonik Industries, stated: "We are committed to advancing the restructuring in a responsible manner, and the plan is currently progressing smoothly. We maintain close consultations with employee representatives and are steadily advancing the restructuring and downsizing plans. At the same time, optimization projects for businesses such as animal nutrition and healthcare are also making good progress."

The group-wide efficiency enhancement program "Evonik Tailor Made" is currently being fully implemented. It is expected to bring about annual cost savings of approximately 400 million euros by the end of 2026. Thomas Wessel, Chief Human Resources Officer and Labor Director of Evonik Industries, stated: "We are committed to advancing the restructuring in a responsible manner, and the plan is progressing smoothly at present. We maintain close consultations with employee representatives and are steadily advancing the restructuring and downsizing plans. Meanwhile, optimization projects for businesses such as animal nutrition and healthcare are also making good progress."The organizational structure continues to be streamlined. In the future, Evonik will integrate its chemical business into two major segments, which will be managed in a more differentiated way by members of the Executive Board. Lauren Kjeldsen and Claudine Mollenkopf will join the Executive Board, taking charge of the 'Tailor-Made Solutions' and 'Advanced Technologies' segments, respectively. This initiative will take effect on April 1st, streamlining management at the divisional level by eliminating this tier. The new structure will manage each business in a more targeted manner, achieving a better allocation of resources for R&D and investment.

The organizational structure continues to be streamlined. In the future, Evonik will integrate its chemical business into two major segments, which will be managed in a more differentiated way by members of the Executive Board. Lauren Kjeldsen and Claudine Mollenkopf will join the Executive Board, taking charge of the 'Tailor-Made Solutions' and 'Advanced Technologies' segments, respectively. This initiative will take effect on April 1st, streamlining management at the divisional level by eliminating this tier. The new structure will manage each business in a more targeted manner, achieving a better allocation of resources for R&D and investment.As part of its new innovation strategy, Evonik focuses its resources on three areas with the greatest potential: bio-based solutions, energy transition, and circular economy. At the same time, Evonik's next-generation solutions

As part of its new innovation strategy, Evonik focuses its resources on three areas with the greatest potential: bio-based solutions, energy transition, and circular economy. At the same time, Evonik's next-generation solutions(i.e., products and applications with significant sustainability advantages) have made substantial progress, increasing their sales share to 45% (2023: 43%).

(i.e., products and applications with significant sustainability advantages) have made substantial progress, increasing their sales share to 45% (2023: 43%).The former Technology & Infrastructure business unit will be split into Site Infrastructure Services and Central Strategic Technologies starting January 1, 2025. The production sites in Marl and Wesseling, Germany, will be divested in the second half of this year. This move will consolidate Evonik's technological leadership and enable it to focus more effectively on its chemical business.

The former Technology & Infrastructure business unit will be split into Site Infrastructure Services and Central Strategic Technologies starting January 1, 2025. The production sites in Marl and Wesseling, Germany, will be divested in the second half of this year. This move will consolidate Evonik's technological leadership and enable it to focus more effectively on its chemical business.Business Segment Performance

Business Segment Performance

Performance of the Business Department

Performance of the Business Department

Performance of the Business Department

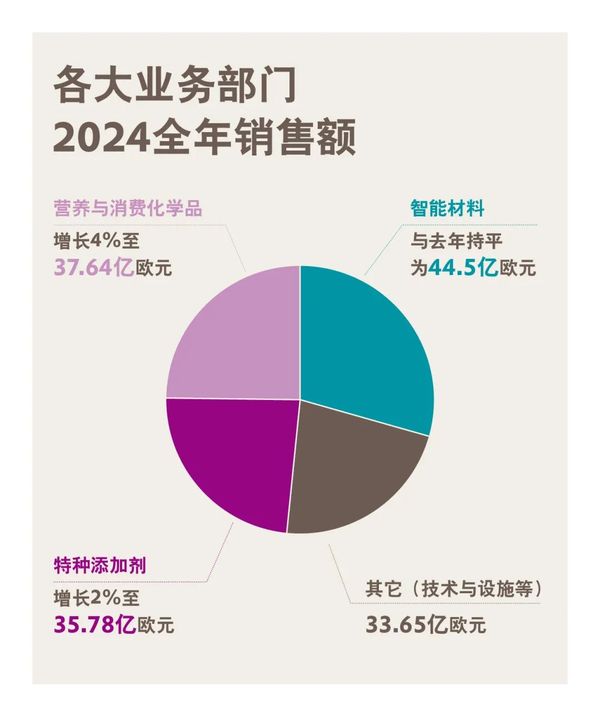

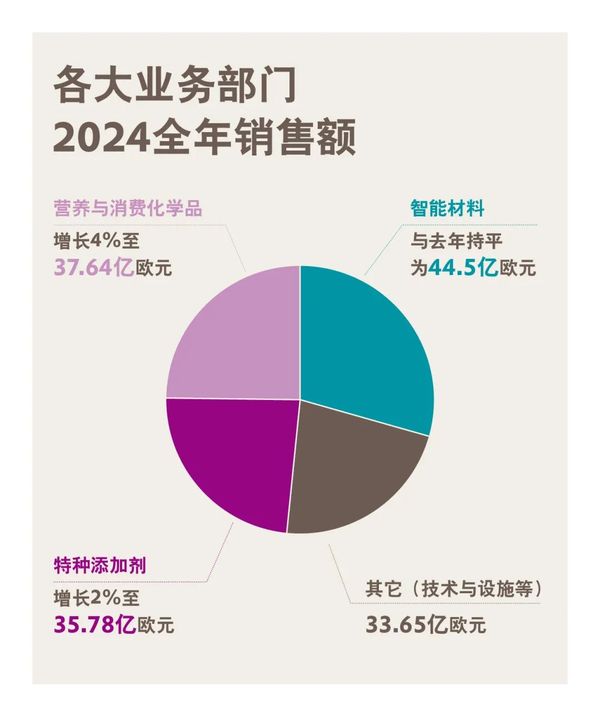

Specialty Additives Business Unit

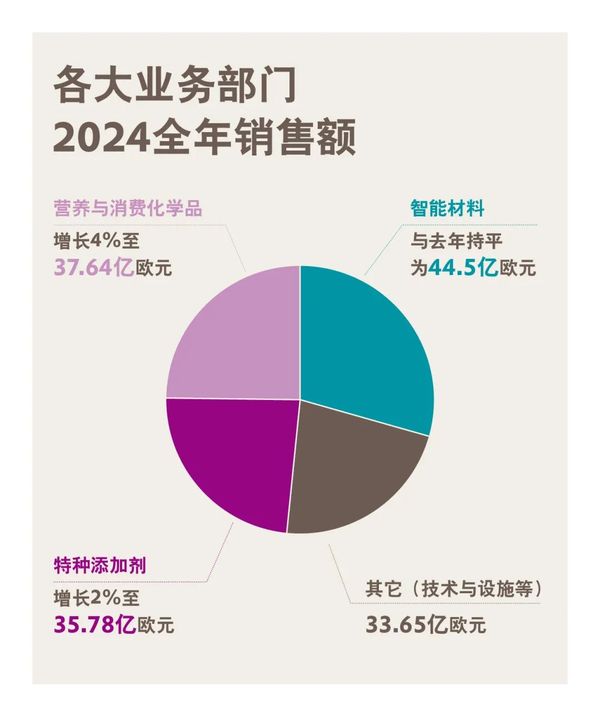

Primarily benefiting from increased sales volumes, the business unit's sales grew by 2% to reach 3.578 billion euros. However, due to lower raw material costs being passed on to downstream customers and a slight negative impact from exchange rates, selling prices decreased. The demand for products in the construction and coatings industries significantly increased, while selling prices slightly declined, leading to a substantial increase in sales compared to last year. Sales of oil additives grew as a result of higher volumes. Due to a slight decrease in selling prices, sales of additives for polyurethane foams and durable consumer goods slightly declined. In a highly competitive environment, the crosslinkers business had lower sales than last year due to price trends. Thanks mainly to a significant increase in sales volumes, improved capacity utilization of the corresponding production facilities, and cost-saving measures, the business unit's adjusted EBITDA rose by 11% to 744 million euros, with the adjusted EBITDA margin increasing from 19.1% last year to 20.8%.

Specialty Additives Business Unit

Primarily benefiting from increased sales volumes, the business unit's sales grew by 2% to reach 3.578 billion euros. However, due to lower raw material costs being passed on to downstream customers and a slight negative impact from exchange rates, selling prices decreased. The demand for products in the construction and coatings industries significantly increased, while selling prices slightly declined, leading to a substantial increase in sales compared to last year. Sales of oil additives grew as a result of higher volumes. Due to a slight decrease in selling prices, sales of additives for polyurethane foams and durable consumer goods slightly declined. In a highly competitive environment, the crosslinkers business had lower sales than last year due to price trends. Thanks mainly to a significant increase in sales volumes, improved capacity utilization of the corresponding production facilities, and cost-saving measures, the business unit's adjusted EBITDA rose by 11% to 744 million euros, with the adjusted EBITDA margin increasing from 19.1% last year to 20.8%.

Specialty Additives Business Unit

Primarily benefiting from an increase in sales volume, the business unit's sales grew by 2%, reaching 3.578 billion euros. However, due to lower raw material costs being passed on to downstream customers and a slight negative impact from exchange rates, selling prices declined. The demand for products in the construction and coatings industries significantly increased, while selling prices slightly decreased, leading to a substantial growth in sales compared to last year. Sales of oil additives grew due to an increase in sales volume. Due to a slight decrease in selling prices, sales of additives for polyurethane foams and durable consumer goods slightly decreased. In a highly competitive environment, the cross-linking agents business saw sales below last year's level due to the impact of price trends. Mainly thanks to a significant increase in sales volume, improved utilization of corresponding production facilities, and cost-saving measures, the business unit's adjusted EBITDA grew by 11% year-on-year, reaching 744 million euros, with the adjusted EBITDA margin rising from 19.1% last year to 20.8%.

Specialty Additives Business Unit

Primarily benefiting from an increase in sales volume, the business unit's sales grew by 2%, reaching 3.578 billion euros. However, due to lower raw material costs being passed on to downstream customers and a slight negative impact from exchange rates, selling prices declined. The demand for products in the construction and coatings industries significantly increased, while selling prices slightly decreased, leading to a substantial growth in sales compared to last year. Sales of oil additives grew due to an increase in sales volume. Due to a slight decrease in selling prices, sales of additives for polyurethane foams and durable consumer goods slightly decreased. In a highly competitive environment, the cross-linking agents business saw sales below last year's level due to the impact of price trends. Mainly thanks to a significant increase in sales volume, improved utilization of corresponding production facilities, and cost-saving measures, the business unit's adjusted EBITDA grew by 11% year-on-year, reaching 744 million euros, with the adjusted EBITDA margin rising from 19.1% last year to 20.8%.

Specialty Additives Business Unit

Specialty Additives Business Unit

Specialty Additives Business UnitPrimarily benefiting from increased sales volumes, the business unit's revenue grew by 2% to reach 3.578 billion euros. However, due to lower raw material costs being passed on to downstream customers and a slight negative impact from exchange rates, selling prices declined. The demand for products in the construction and coatings industries significantly increased, while selling prices slightly decreased, leading to a substantial increase in sales compared to last year. Sales of oil additives grew as a result of higher volumes. Due to a slight decrease in selling prices, sales of additives for polyurethane foams and durable consumer goods slightly declined. In a highly competitive environment, the crosslinkers business saw lower sales than last year due to price trends. Thanks mainly to a significant increase in sales volumes, improved capacity utilization of corresponding production facilities, and cost-saving measures, the business unit's adjusted EBITDA grew by 11% to 744 million euros, with the adjusted EBITDA margin rising from 19.1% last year to 20.8%.

Primarily benefiting from increased sales volumes, the business unit's revenue grew by 2% to reach 3.578 billion euros. However, due to lower raw material costs being passed on to downstream customers and a slight negative impact from exchange rates, selling prices declined. The demand for products in the construction and coatings industries significantly increased, while selling prices slightly decreased, leading to a substantial increase in sales compared to last year. Sales of oil additives grew as a result of higher volumes. Due to a slight decrease in selling prices, sales of additives for polyurethane foams and durable consumer goods slightly declined. In a highly competitive environment, the crosslinkers business saw lower sales than last year due to price trends. Thanks mainly to a significant increase in sales volumes, improved capacity utilization of corresponding production facilities, and cost-saving measures, the business unit's adjusted EBITDA grew by 11% to 744 million euros, with the adjusted EBITDA margin rising from 19.1% last year to 20.8%.

Primarily benefiting from increased sales volumes, the business unit's revenue grew by 2% to reach 3.578 billion euros. However, due to lower raw material costs being passed on to downstream customers and a slight negative impact from exchange rates, selling prices declined. The demand for products in the construction and coatings industries significantly increased, while selling prices slightly decreased, leading to a substantial increase in sales compared to last year. Sales of oil additives grew as a result of higher volumes. Due to a slight decrease in selling prices, sales of additives for polyurethane foams and durable consumer goods slightly declined. In a highly competitive environment, the crosslinkers business saw lower sales than last year due to price trends. Thanks mainly to a significant increase in sales volumes, improved capacity utilization of corresponding production facilities, and cost-saving measures, the business unit's adjusted EBITDA grew by 11% to 744 million euros, with the adjusted EBITDA margin rising from 19.1% last year to 20.8%.

Nutrition & Consumer Chemicals Business Unit

Sales increased by 4% to 3.764 billion euros, mainly due to a slight increase in volume and a year-on-year rise in the selling prices of the animal nutrition business. The essential amino acids business within animal nutrition achieved significant sales growth, benefiting from a slight increase in volume and a substantial rise in selling prices. Sales in the pharmaceutical health business remained on par with last year. The systematic solution business for cosmetic active ingredients continued to perform excellently, similar to previous years. The innovative rhamnolipid (biosurfactant) production facility in Slovakia contributed to sales for the first time in 2024. Thanks primarily to the increase in the price of essential amino acid products and cost savings from business model optimization, the adjusted EBITDA of this business unit grew by 54% to 601 million euros, with the adjusted EBITDA margin rising from 10.8% in the same period last year to 16.0%.

Nutrition & Consumer Chemicals Business Unit

Sales increased by 4% to 3.764 billion euros, mainly due to a slight increase in volume and a year-on-year rise in the selling prices of the animal nutrition business. The essential amino acids business within animal nutrition achieved significant sales growth, benefiting from a slight increase in volume and a substantial rise in selling prices. Sales in the pharmaceutical health business remained on par with last year. The systematic solution business for cosmetic active ingredients continued to perform excellently, similar to previous years. The innovative rhamnolipid (biosurfactant) production facility in Slovakia contributed to sales for the first time in 2024. Thanks primarily to the increase in the price of essential amino acid products and cost savings from business model optimization, the adjusted EBITDA of this business unit grew by 54% to 601 million euros, with the adjusted EBITDA margin rising from 10.8% in the same period last year to 16.0%.

Nutrition & Consumer Chemicals Division

Sales increased by 4% to 3.764 billion euros, mainly due to a slight increase in volume and the year-on-year rise in selling prices for the animal nutrition business. The essential amino acids business within animal nutrition benefited from a small increase in volume and a significant improvement in selling prices, achieving substantial sales growth. Sales in the healthcare business remained on par with last year. The systematic solutions business for cosmetic active ingredients continued its excellent performance similar to previous years. The innovative rhamnolipid (biosurfactant) production facility in Slovakia contributed to sales for the first time in 2024. Thanks to the increase in prices of essential amino acid products and cost savings from business model optimization, the division's adjusted EBITDA grew by 54% to 601 million euros, raising the adjusted EBITDA margin from 10.8% in the same period last year to 16.0%.

Nutrition & Consumer Chemicals Division

Sales increased by 4% to 3.764 billion euros, mainly due to a slight increase in volume and the year-on-year rise in selling prices for the animal nutrition business. The essential amino acids business within animal nutrition benefited from a small increase in volume and a significant improvement in selling prices, achieving substantial sales growth. Sales in the healthcare business remained on par with last year. The systematic solutions business for cosmetic active ingredients continued its excellent performance similar to previous years. The innovative rhamnolipid (biosurfactant) production facility in Slovakia contributed to sales for the first time in 2024. Thanks to the increase in prices of essential amino acid products and cost savings from business model optimization, the division's adjusted EBITDA grew by 54% to 601 million euros, raising the adjusted EBITDA margin from 10.8% in the same period last year to 16.0%.

Nutrition & Consumer Chemicals Division

Nutrition & Consumer Chemicals Division

Nutrition & Consumer Chemicals DivisionSales increased by 4% to 3.764 billion euros, mainly due to a slight increase in sales volume and a year-on-year rise in the selling prices of the animal nutrition business. The essential amino acids business for animal nutrition saw a significant increase in sales, benefiting from a small increase in sales volume and a substantial rise in selling prices. Sales in the healthcare business remained flat compared to last year. The systematic solutions business for cosmetic active ingredients continued to perform as excellently as in previous years. The innovative rhamnolipid (biosurfactant) production facility in Slovakia contributed to sales for the first time in 2024. Thanks mainly to the rise in prices of essential amino acid products and cost savings brought about by business model optimization, the adjusted EBITDA of this business unit grew by 54% to 601 million euros, with the adjusted EBITDA margin rising from 10.8% in the same period last year to 16.0%.

Sales increased by 4% to 3.764 billion euros, mainly due to a slight increase in sales volume and a year-on-year rise in the selling prices of the animal nutrition business. The essential amino acids business for animal nutrition saw a significant increase in sales, benefiting from a small increase in sales volume and a substantial rise in selling prices. Sales in the healthcare business remained flat compared to last year. The systematic solutions business for cosmetic active ingredients continued to perform as excellently as in previous years. The innovative rhamnolipid (biosurfactant) production facility in Slovakia contributed to sales for the first time in 2024. Thanks mainly to the rise in prices of essential amino acid products and cost savings brought about by business model optimization, the adjusted EBITDA of this business unit grew by 54% to 601 million euros, with the adjusted EBITDA margin rising from 10.8% in the same period last year to 16.0%.

Sales increased by 4% to 3.764 billion euros, mainly due to a slight increase in sales volume and a year-on-year rise in the selling prices of the animal nutrition business. The essential amino acids business for animal nutrition saw a significant increase in sales, benefiting from a small increase in sales volume and a substantial rise in selling prices. Sales in the healthcare business remained flat compared to last year. The systematic solutions business for cosmetic active ingredients continued to perform as excellently as in previous years. The innovative rhamnolipid (biosurfactant) production facility in Slovakia contributed to sales for the first time in 2024. Thanks mainly to the rise in prices of essential amino acid products and cost savings brought about by business model optimization, the adjusted EBITDA of this business unit grew by 54% to 601 million euros, with the adjusted EBITDA margin rising from 10.8% in the same period last year to 16.0%.

Smart Materials Business Unit

Due to the offsetting effects of volume growth and price decreases, the sales of this department remained flat at 4.45 billion euros. The demand for inorganic products (especially silica and catalysts) increased, but due to the impact of price decreases, sales remained at last year's level. The volume of polymer business showed a positive growth trend, with polyamide 12, for example, achieving a slight increase in sales despite a decrease in selling prices. Thanks mainly to the increase in volume and the reduction in variable costs, the adjusted EBITDA of this business unit grew by 11% to 601 million euros, and the adjusted EBITDA margin rose from 12.1% in the previous year to 13.5%.

Smart Materials Business Unit

Due to the offsetting effects of volume growth and price decreases, the sales of this department remained flat at 4.45 billion euros. The demand for inorganic products (especially silica and catalysts) increased, but due to the impact of price decreases, sales remained at last year's level. The volume of polymer business showed a positive growth trend, with polyamide 12, for example, achieving a slight increase in sales despite a decrease in selling prices. Thanks mainly to the increase in volume and the reduction in variable costs, the adjusted EBITDA of this business unit grew by 11% to 601 million euros, and the adjusted EBITDA margin rose from 12.1% in the previous year to 13.5%.

Smart Materials Business Unit

Due to the offsetting effects of increased sales volume and decreased selling prices, the sales of this department remained flat at 4.45 billion euros compared to the previous year. The market demand for inorganic products (especially silica and catalysts) increased, but due to the decrease in selling prices, the sales remained at last year's level. The sales volume of polymer business showed a positive growth trend; for example, polyamide 12 achieved a slight increase in sales despite a drop in selling price. Mainly thanks to the increase in sales volume and reduction in variable costs, the adjusted EBITDA of this business unit grew by 11% to 601 million euros, with the adjusted EBITDA margin rising from 12.1% in the same period last year to 13.5%.

Smart Materials Business Unit

Due to the offsetting effects of increased sales volume and decreased selling prices, the sales of this department remained flat at 4.45 billion euros compared to the previous year. The market demand for inorganic products (especially silica and catalysts) increased, but due to the decrease in selling prices, the sales remained at last year's level. The sales volume of polymer business showed a positive growth trend; for example, polyamide 12 achieved a slight increase in sales despite a drop in selling price. Mainly thanks to the increase in sales volume and reduction in variable costs, the adjusted EBITDA of this business unit grew by 11% to 601 million euros, with the adjusted EBITDA margin rising from 12.1% in the same period last year to 13.5%.

Smart Materials Business Unit

Smart Materials Business Unit

Smart Materials Business UnitDue to the offsetting effects of increased sales volume and decreased selling prices, the sales of this department remained flat at 4.45 billion euros compared to the previous year. The market demand for inorganic products (especially silica and catalysts) increased, but due to the decrease in selling prices, the sales remained at last year's level. The sales volume of polymer business showed a positive growth trend; for example, polyamide 12 achieved a slight increase in sales despite a drop in selling price. Mainly thanks to the increase in sales volume and reduction in variable costs, the adjusted EBITDA of this business unit grew by 11% to 601 million euros, with the adjusted EBITDA margin rising from 12.1% in the same period last year to 13.5%.

Due to the offsetting effects of increased sales volume and decreased selling prices, the department's sales remained flat at 4.45 billion euros compared to the previous year. The market demand for inorganic products (especially silica and catalysts) increased, but due to the impact of lower selling prices, sales remained at last year's level. The sales volume of polymer business showed a positive growth trend; for example, polyamide 12 achieved a slight increase in sales despite a decrease in selling price. Thanks mainly to the increase in sales volume and the reduction in variable costs, the adjusted EBITDA of this business unit grew by 11% year-on-year to 601 million euros, with the adjusted EBITDA margin increasing from 12.1% in the same period last year to 13.5%.

Due to the offsetting effects of increased sales volume and decreased selling prices, the department's sales remained flat at 4.45 billion euros compared to the previous year. The market demand for inorganic products (especially silica and catalysts) increased, but due to the impact of lower selling prices, sales remained at last year's level. The sales volume of polymer business showed a positive growth trend; for example, polyamide 12 achieved a slight increase in sales despite a decrease in selling price. Thanks mainly to the increase in sales volume and the reduction in variable costs, the adjusted EBITDA of this business unit grew by 11% year-on-year to 601 million euros, with the adjusted EBITDA margin increasing from 12.1% in the same period last year to 13.5%.

Due to the offsetting effects of increased sales volume and decreased selling prices, the department's sales remained flat at 4.45 billion euros compared to the previous year. The market demand for inorganic products (especially silica and catalysts) increased, but due to the impact of lower selling prices, sales remained at last year's level. The sales volume of polymer business showed a positive growth trend; for example, polyamide 12 achieved a slight increase in sales despite a decrease in selling price. Thanks mainly to the increase in sales volume and the reduction in variable costs, the adjusted EBITDA of this business unit grew by 11% year-on-year to 601 million euros, with the adjusted EBITDA margin increasing from 12.1% in the same period last year to 13.5%.【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track