Everyone Complains That Parenting Subsidy Is Too Little? Car Purchase Policy Has Already Set an Example

On July 28th, the government announced the implementation plan for the childcare subsidy system. According to the plan, starting from January 1, 2025, a subsidy of 3,600 yuan per year can be received for each child, whether it is the first, second, or third child, until they reach the age of 3.

The policy sparked heated discussions, with most netizens believing that the annual 3,600 yuan is far below the actual cost of raising a child. Taking Shanghai as an example, the average cost of raising a child from 0 to 17 years old exceeds one million yuan, and the subsidy covers only 1% of the total cost. Middle-class families bluntly stated, "We would only consider having a child if we were given one million," highlighting the significant gap between the subsidy amount and expectations.

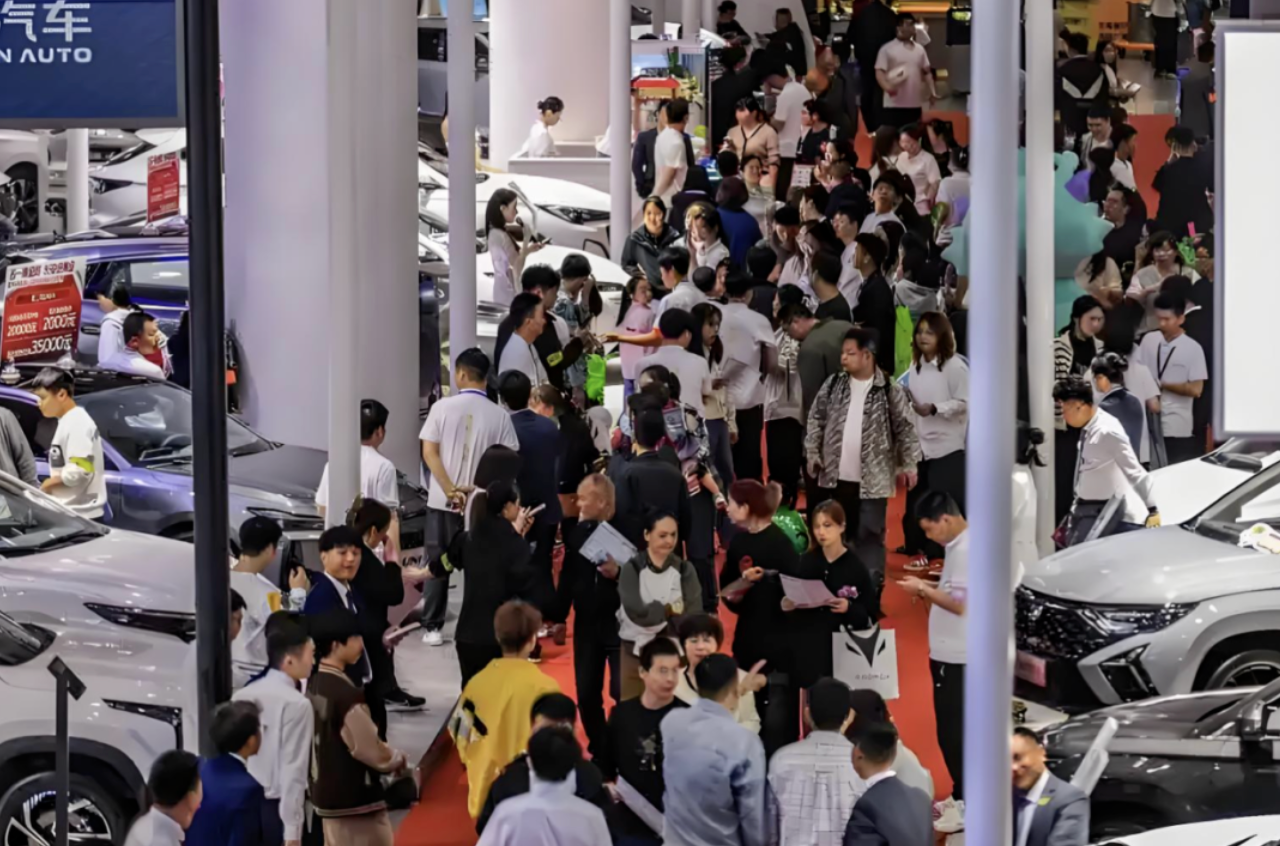

While the public debate on the effectiveness of childcare subsidies continues, the Chinese car market has demonstrated the power of the "real money" policy combination with a series of robust data.

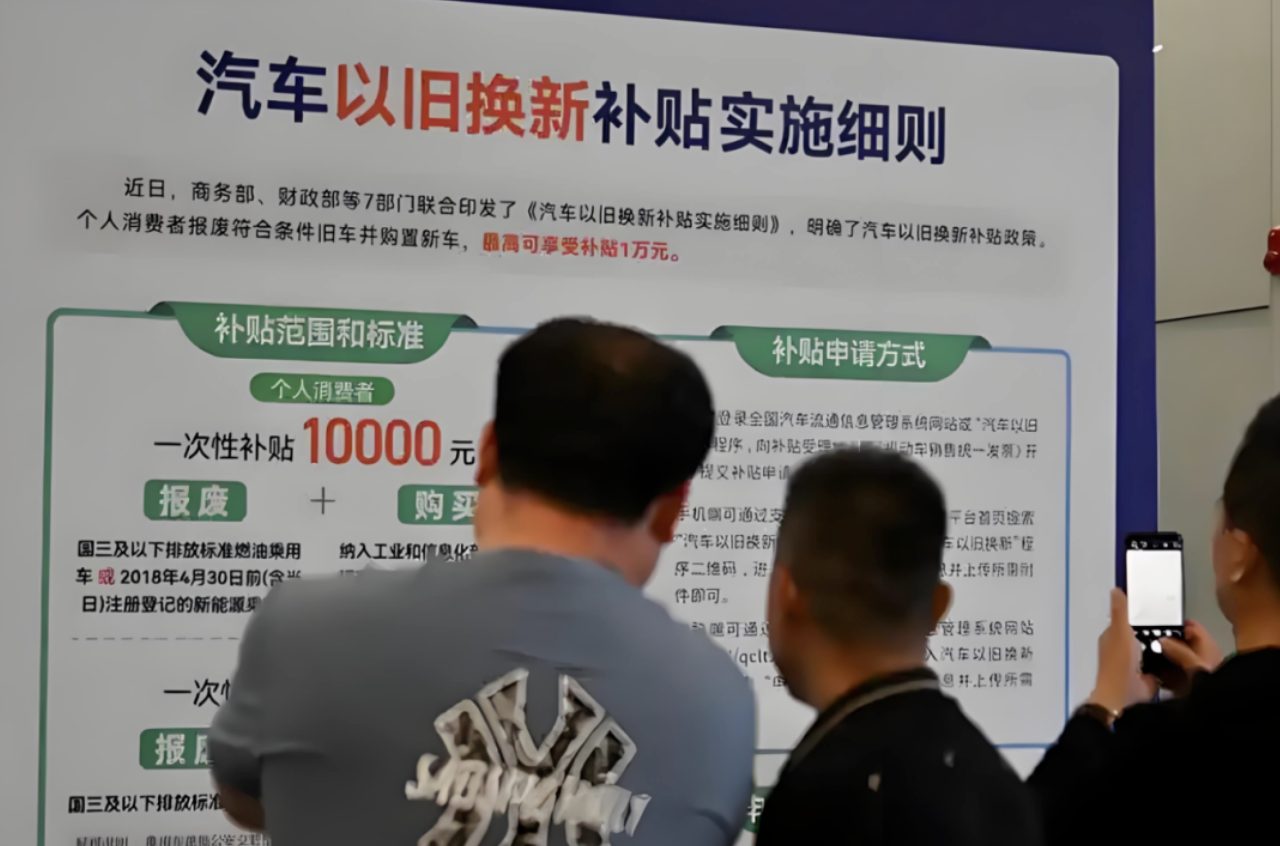

As of the end of May, the cumulative number of applications for automobile “trade-in” subsidies has exceeded 4.12 million! Driven by national strategies, enhanced local support, and active responses from car manufacturers forming a “rain of policy incentives,” the auto market in the first half of 2025 has not only successfully resisted the downturn, but also achieved structural growth. Among this, retail sales of new energy vehicles reached 5.468 million units, becoming a standout highlight. Counting from the beginning of policy implementation in 2024, the cumulative number of applications has now surpassed 10 million.

With the third batch of "trade-in" funds officially allocated in July, this "consumer promotion drama" is injecting stronger momentum into the car market for the second half of the year and providing an actual sample for understanding whether "childcare subsidies are effective."

01Policies boost the auto market, with remarkable results.

From the initial exploration of the "Vehicles to the Countryside" policy in 2009, to the deepening of the "New Energy Vehicles to the Countryside" initiative from 2019 to 2021, and then to the central government's financial consumption subsidy of up to 300 billion yuan in 2025, the national support policies for automobile consumption have never ceased, with increasing intensity. This conveys the country's firm determination to stabilize and expand automobile consumption and promote industrial upgrading.

According to data from the Ministry of Commerce, in 2024, over 2.9 million vehicles will be scrapped and replaced, with more than 3.7 million vehicles upgraded through replacement, directly driving sales exceeding 920 billion yuan. Among them, after the implementation of the "Two New" policies (trade-in and replacement upgrade), the proportion of trade-in purchases of new energy vehicles has exceeded 60%, effectively guiding green consumption and stimulating the vitality and potential of the automotive market.

Based on the success of last year's car purchase subsidy policy, shortly after the beginning of 2025, the Ministry of Commerce and eight other departments jointly issued the "Notice on the Work of Vehicle Trade-in for 2025" (hereinafter referred to as the "Notice"). This year's policy, building on last year's, not only includes some vehicles meeting the National IV emission standards in the scope of trade-in subsidies, but also specifies the specific standards for replacement subsidies.

Specifically, the "Notice" proposes that this year, individual consumers who scrap gasoline passenger vehicles registered before June 30, 2012, diesel and other fuel passenger vehicles registered before June 30, 2014, or new energy passenger vehicles registered before December 31, 2018, and purchase new energy passenger vehicles included in the Ministry of Industry and Information Technology's "Directory of New Energy Vehicles Eligible for Vehicle Purchase Tax Reduction and Exemption" or fuel passenger vehicles with an engine displacement of 2.0 liters or less, will be granted a one-time fixed subsidy.

A subsidy of 20,000 yuan will be provided for scrapping the aforementioned eligible old vehicles and purchasing new energy passenger cars; a subsidy of 15,000 yuan will be provided for scrapping the aforementioned eligible fuel-powered passenger cars and purchasing fuel-powered passenger cars with a displacement of 2.0 liters or less.

The Notice shows that the new policy includes certain eligible "China IV" emission standard gasoline passenger vehicles in the scope of old vehicles eligible for scrappage and renewal subsidies, and also standardizes the maximum subsidy limit for vehicle replacement and renewal nationwide. Notably, this is the first time that the scrappage scope for individual consumers has been expanded to include "China IV" vehicles.

Overall, this year's new subsidy policy builds on last year's scrap-and-replace initiative by further expanding the scope and intensity of subsidies. As a result, the country's "Two New" policies have been strengthened and expanded, forming a strong support that covers the entire automotive consumption chain.

According to data from the Ministry of Commerce, as of May 31, 2025, the cumulative number of applications for the car "trade-in" subsidy this year has reached 4.12 million. Related estimates indicate that the application volume for the month of June alone was as high as 1.23 million, a year-on-year increase of 13%. Behind this large number is the strong market stimulus provided by the policy.

Regarding this, industry insiders have pointed out that nearly 70% of private car buyers are beneficiaries of the "trade-in" program, with the proportion of first-time private buyers dropping to around 30%. This clearly indicates that under the stimulus of policies, the demand for additional and replacement purchases driven by consumption upgrading has become the main force in the current car market. Consumers are taking advantage of the subsidy window period to retire old vehicles and choose new cars that are of higher quality, smarter, and more environmentally friendly.

In this context, new energy vehicles have become the preferred choice for consumers. Data from 2024 shows that over 60% of vehicle trade-ins involved purchasing new energy vehicles. In the first half of 2025, the impressive retail sales of 5.468 million new energy passenger vehicles demonstrate the continuation and deepening of this trend, making the "two new" policies a key driver in accelerating the replacement of fuel vehicles with new energy vehicles.

Moreover, it is important to note that the core logic of the “trade-in” policy lies in revitalizing the vast stock of the automobile market by encouraging owners to replace old vehicles with new ones through subsidies. This not only directly boosts new car sales, but also promotes the circulation of the used car market, and indirectly stimulates related industries such as maintenance, financial services, and insurance, thereby unleashing tremendous incremental market potential.

02The second half, the real show begins.

Overall, this year's consumption subsidies totaling 300 billion yuan have been precisely and rhythmically distributed in batches—the first two batches amounting to 162 billion yuan have already been injected into the market. The remaining 138 billion yuan, serving as key ammunition for targeted distribution, will be delivered to local areas according to the scheduled timeline.

Recently, the National Development and Reform Commission also stated that the third batch of funds for the "trade-in" of consumer goods will be officially allocated in July, injecting a sense of certainty into the market for the second half of the year. With the release of the third batch of funds, the automotive market for the second half of the year has already secured a key growth driver.

First of all, the timely allocation of the third batch of funds has undoubtedly alleviated concerns about a potential policy gap, sending a stable and continuous positive signal to the market and consumers. This helps to maintain the current strong momentum of "trade-in" applications and ensures that policy support for the automobile market remains robust in the second half of the year.

At the same time, the third batch of funds will work in conjunction with previously implemented national subsidies, ongoing local subsidies, and the continuously introduced promotional offers from automakers. The combined effect of this policy package is expected to be unleashed in the second half of the year, likely driving applications for "old-for-new" vehicle replacements and overall automobile sales to new highs.

Under the national policy framework, local governments have introduced supportive measures tailored to local conditions. Many regions have already launched local financial subsidies, creating a cumulative effect with national subsidies. This includes optimizing the subsidy application process to enhance consumer convenience; some cities have also introduced complementary measures such as easing license restrictions and optimizing traffic policies to create a better environment for automobile consumption. The proactive efforts of local governments have significantly amplified the implementation effects of national policies.

Moreover, car manufacturers have keenly seized policy opportunities and taken proactive actions. Mainstream brands generally launched corporate trade-in subsidies, which can be combined with national and local subsidies, offering discounts of up to tens of thousands of yuan. Among them, new energy vehicle companies are the main force, introducing value-added services such as exclusive financial plans, free charging benefits, and extended warranties.

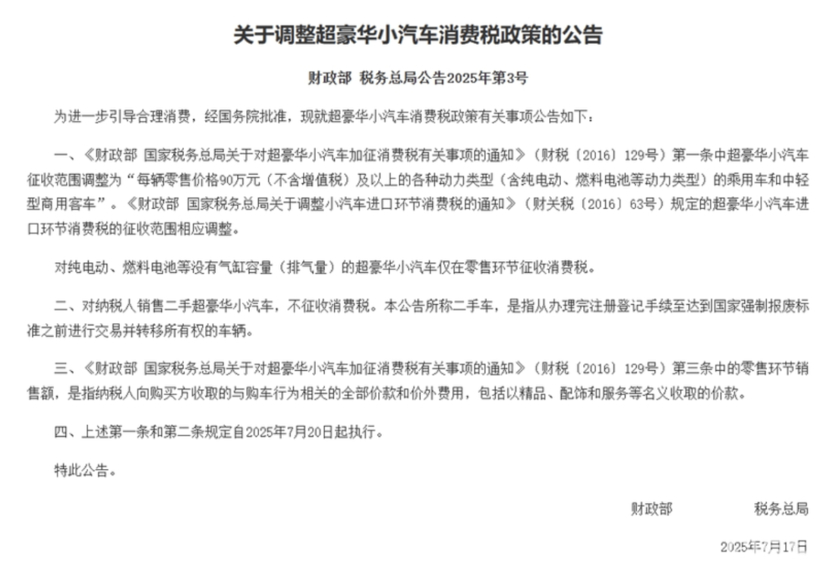

The adjustment of the consumption tax policy for ultra-luxury cars, from 1.3 million yuan (excluding tax) to 900,000 yuan (corresponding to a tax-inclusive price of about 1.017 million yuan), has expanded the tax coverage. It also includes new energy vehicles in the tax category for the first time.

Although this policy has little impact on ordinary consumers, it has a significant effect on car companies in the ultra-luxury vehicle market. After the policy was announced, brands such as Jaguar Land Rover and Mercedes-Benz quickly introduced tax subsidy policies to mitigate the market impact. The market expects that the price range of 800,000 to 900,000 yuan may become a new focus of competition among car companies in the future, and automakers will adjust their pricing strategies and market layouts accordingly.

In addition to tangible financial benefits, some companies also offer professional evaluations, handle paperwork, and provide one-stop services for new car delivery, reducing the barriers for users to trade in their vehicles. The deep involvement of automakers makes policy incentives more direct and convenient for consumers to access.

Therefore, whether considering the overlap of policies or the effects observed in the first half of the year, it is foreseeable that under the "dual carbon" goals and continued policy support, the stimulus effect of the third batch of funds will still primarily benefit new energy vehicles. This will continue to accelerate the replacement of fuel vehicles by new energy vehicles, drive the annual new energy penetration rate toward higher targets, and further optimize the market structure.

With the deepening of policies and the improvement of consumer awareness, replacement purchase demand will further concentrate on high-end, intelligent, and personalized models. The group of consumers engaged in replacement purchases will continue to be the core driving force supporting the mid-to-high-end market, especially the high-end new energy sector.

Therefore, the cumulative 4.12 million applications for the "trade-in" subsidy are the most direct evidence of market vitality fueled by the policy stimulus. The strong synergy formed by national strategic guidance, enhanced local support, and active response from car manufacturers has not only effectively offset some market pressures but also precisely stimulated the core momentum of consumption upgrading, driving the Chinese auto market to demonstrate additional resilience and vitality.

In the second half of the year, with the allocation of the third batch of funds, it is as if new fuel has been injected into a giant ship, propelling it forward in the wave of consumption upgrading. We have reason to believe that this policy windfall not only ensures the growth of China’s automobile market in 2025, but also plays a profound role in accelerating the elimination of old vehicles, promoting new energy vehicles, encouraging green consumption, and advancing industrial transformation and upgrading.

The Chinese automobile market is riding the wave of policy support towards a new phase of higher quality and more sustainable development.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track