![[EVA周评]:发泡需求低迷 市场稳中窄幅整理(20250321-20250327) [EVA周评]:发泡需求低迷 市场稳中窄幅整理(20250321-20250327)](https://oss.plastmatch.com/zx/image/130939610d4a45e5bd5385b98783e0b8.jpg)

This week, the domestic EVA market continued to operate in a weak consolidation, with a persistent supply-demand imbalance. At the end of the month, some petrochemical firms had limited spot offers, and mainstream agents had little available inventory for foaming. EVA manufacturers primarily focused their production on the photovoltaic sector, maintaining firm ex-factory prices to support the market. However, the downstream foaming terminal demand remained weak and difficult to change, with demand mainly following the just-in-time principle, leading to transactions often negotiated on a case-by-case basis, focusing on low-priced sources, and some price points experiencing a slight decline. As of Thursday this week, the mainstream closing prices were: soft material at 11,400-11,700 yuan/ton, down about 100 yuan/ton from last week; hard material at 11,200-11,600 yuan/ton, down about 50 yuan/ton from last week; and photovoltaic material around 11,600-11,800 yuan/ton, unchanged from last week.

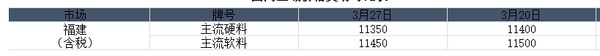

Domestic Regional Price Variation Comparison Table

Source: Longzhong Information

Market Impact Factor Analysis

This week, the EVA petrochemical ex-factory prices remain stable.

This week, the estimated capacity utilization rate of China's EVA industry is 86.47%, an increase of 3.52% compared to the previous period.

This week, the average profit in the domestic EVA industry is 2,263 yuan/ton, a decline of 1.22% compared to the previous week.

3. Market Forecast for Next Week

Looking ahead to next week, the domestic EVA market is expected to continue its stable and subdued consolidation. On the supply side, domestic EVA production facilities are operating steadily overall, with many prioritizing the production of photovoltaic orders from earlier periods, while supply for other types, such as foaming, remains limited. On the demand side, photovoltaic orders are relatively good, but demand for foaming may become more evident in the post-Qingming Festival off-season. Demand is mainly driven by just-in-time needs, and market participants are adopting a cautious and watchful attitude, with mainstream quotes following factory costs. In summary, next week the EVA production side is expected to remain relatively stable, and the domestic EVA market is likely to experience a stalemate with narrow fluctuations.