[EVA Weekly Outlook] Domestic EVA Market Prices Expected to Rise First and Then Stabilize This Week

I. Points of Attention

1 、 Crude Oil:[Longzhong] 7/25: Although market concerns over U.S. tariffs have eased, some weak economic data have made traders cautious, causing international oil prices to decline. NYMEX crude oil futures September contract fell $0.87 to $65.16 per barrel, down 1.32% on a weekly basis; ICE Brent crude oil futures September contract dropped $0.74 to $68.44 per barrel, down 1.07% week-on-week. China's INE crude oil futures main contract 2509 rose 4.3 to 508.6 yuan per barrel, but fell 6.7 to 501.9 yuan per barrel during the night session.

2 、Ethylene: Production enterprises are not under significant pressure to ship goods. However, as there is still a relatively abundant supply of exportable goods in the market, suppliers have no intention to raise prices. Downstream, purchasing continues based on just-in-time demand, and there are no new bullish or bearish signals in the market fundamentals for now. It is expected that in the short term, prices will mainly remain stable. On the next working day, the spot transaction range in the East China region is expected to be around 6500-6700 yuan/ton, while the USD market is expected to be between 800-840 USD/ton.

Vinyl acetate The market price of vinyl acetate continues to rise, with expectations of a contraction in spot supply on the supply side. Producers are raising prices, and intermediaries are holding back sales, pushing up quotes. Downstream users are purchasing as needed and passively accepting high-priced raw materials. Spot transactions are not active, and the market is still digesting the price increase. Attention should be paid to the sales pace of intermediaries. It is expected that the short-term price focus of the vinyl acetate market will remain high.

Core Logic: The cost side of ethylene maintains a stable trend, with vinyl acetate expected to consolidate at high levels. The overall cost support remains stable, and EVA petrochemical manufacturers are expected to adjust prices steadily upward. Market spot sales are controlled, and prices are reported higher accordingly. The market is expected to temporarily continue in a firm price state. 。

2. Price List

|

Product Name |

Category |

2025/7/24 |

2025/7/25 |

Change in Value |

Unit |

|

Crude oil |

NYMEX |

66.03 |

65.16 |

-0.87 |

USD/barrel |

|

ICE |

69.18 |

68.44 |

-0.74 |

USD/barrel |

|

|

Ethylene |

Northeast Asia |

820 |

820 |

0 |

USD/ton |

|

Southeast Asia |

830 |

830 |

0 |

USD/ton |

|

|

Sinopec East China |

6800 |

6800 |

0 |

CNY/ton |

|

|

Vinyl acetate |

East China Market |

5825 |

5825 |

0 |

CNY/ton |

|

EVA |

Yangba V5110J |

10150 |

10150 |

0 |

CNY/ton |

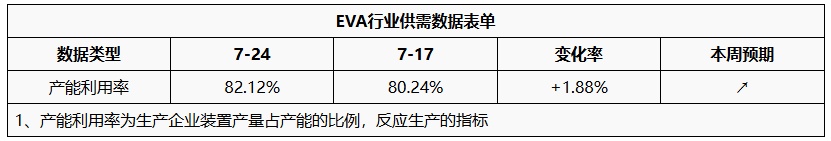

3. Data Form

4. Market Outlook

Last week, the domestic EVA market remained stable and strong. Looking at this week, there is no pressure on the supply side inventory or ex-factory price increases. The market for foaming materials is tight and may continue to rise. End-user factories will continue to procure based on just-in-time demand, but may resist high prices. It is expected that the domestic EVA market prices will first rise and then stabilize this week. The forecast is: soft materials are expected to be 9,800-10,600 yuan/ton, hard materials 9,600-10,500 yuan/ton, and photovoltaic materials 9,500-9,800 yuan/ton.

5. Data Calendar

|

Data Project |

Publication Date |

Data |

This period's trend forecast |

|

EVA Capacity utilization rate |

Thursday 4:00 PM |

80.24% |

↗ |

|

1 Treat ↑↓ as significant fluctuations, highlighting data dimensions with a change of more than 3%. 2 "Considered as narrow fluctuations, highlighting data with a rise or fall within the range of 0-3%." |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track