[EVA Daily Review] Petrochemical Prices Steady, Foaming Market Narrowly Declines

1 Today's Summary

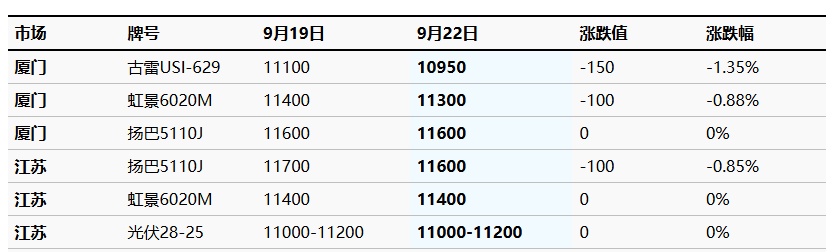

①. This week's EVA petrochemical ex-factory price remains stable.

This week, the EVA petrochemical plant: Yangba plans to shut down for maintenance soon, while the others are operating steadily.

Table 1 Domestic EVA Price Summary (Unit: Yuan/Ton)

Today, the domestic EVA market report shows a steady decline. At the beginning of the week, petrochemical factory prices remained stable, but the downstream foam market has been stocking up ahead of the holiday based on just-in-time needs. Some imported materials have recently arrived at the port, and holders are actively selling off before the holiday for peace of mind. Additionally, some downstream factories are also experiencing raw material outflow, leading to a chaotic market report, with actual transactions primarily based on negotiations. Mainstream prices: Soft material reference 11,300-11,700 yuan/ton, hard material reference 10,800-11,500 yuan/ton. 。

|

Figure 1 Domestic EVA Price Trend Chart (CNY/ton) |

Figure 2 Domestic EVA Price Trend by Category (Yuan/Ton) |

![[EVA日评]:石化稳价挺市 市场报盘窄幅走低(20250922)](https://oss.plastmatch.com/zx/image/518e06e4a4e046d2a3b88fa0c0dea840.png) |

![[EVA日评]:石化稳价挺市 市场报盘窄幅走低(20250922)](https://oss.plastmatch.com/zx/image/9791270ef8dc4e09a70efca0d95569fa.png) |

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

3 Production Dynamics

On September 19th, the domestic EVA petrochemical plant: Sinochem Quanzhou started up in the early morning to produce FL00628; Jiangsu Sailboat's tubular unit is producing photovoltaic materials, and the kettle unit is producing UE2806; Jiangsu Hongjing's PV1 line is producing photovoltaic materials, and the PV2 line is producing photovoltaic materials.Photovoltaic V2825On the PV3 line, photovoltaic V2825 is being produced; all three EVA units at Yanshan have been shut down; Ningxia Baofeng began producing 2806 in the early morning of the 22nd; Yanchang Yulin is producing V2825Y; Tieli High-Tech is producing photovoltaic products; Zhejiang Petrochemical is producing photovoltaic products. Additionally, the price of soft materials in the South China market is 11,300-11,600 RMB/ton, and the gross profit margin of the domestic EVA industry is around 2,600 RMB/ton.

|

Figure 3: Trends in Domestic EVA Capacity Utilization Rate |

Figure 4: Comparison of Domestic EVA Profit and Price (Yuan/Ton) |

![[EVA日评]:石化稳价挺市 市场报盘窄幅走低(20250922)](https://oss.plastmatch.com/zx/image/23f31f966fdb4269b6f1413311553c27.png) |

![[EVA日评]:石化稳价挺市 市场报盘窄幅走低(20250922)](https://oss.plastmatch.com/zx/image/8d9c8e70296a4340a2264eda1b0e2dac.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

4 Price prediction

In the short term, the supply side is relatively strong, providing support. The production of some petrochemical soft materials has increased, and overall inventory remains worry-free.Downstream photovoltaic demand follows pre-holiday procurement just-in-demand.Foam terminal factories are resistant to high-priced raw materials, and procurement is based on just-in-time needs. Holders are cautious, and the market mainly focuses on arbitrage selling. The market is expected to remain stable and consolidate.

5 Related Product Information

1 Ethylene: On September 19, CFR Northeast Asia was $845/ton, down $5/ton, and CFR Southeast Asia was $840/ton, stable. Sinopec Chemical Sales East China Branch's ethylene price remains stable at 7,050 yuan/ton, and Jintan Lianmao's ethylene price is also synchronized at 7,050 yuan/ton.

2 Vinyl acetate: Eastern China Acetic AcidEthylene MarketMainstream negotiations for high and low ends are at 5400-5500 RMB/ton. Petrochemical prices in the East China region are 5,400-5,500 yuan/ton, with new orders released as needed, and prices are consolidated within this range.

6 Data Calendar

Table 2 Domestic EVA Data Overview (Unit: 10,000 tons)

|

Data |

Publication Date |

Data |

Current trend forecast |

|

EVA Capacity utilization rate |

Thursday 16:00PM |

85.22% |

↓ |

|

EVA Weekly output |

Thursday 4:00 PM |

5.91 |

↓ |

|

Data source: Longzhong Information Notes: 1. ↓↑ is considered as significant fluctuations, highlighting data dimensions with a change of more than 3%. 2. ↗↘ is regarded as narrow fluctuations, highlighting data with a fluctuation range of 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track