Europe's Largest Folding Carton Company Reveals Its Performance, Who Is Stronger: It or Chinese Packaging Giant YUTO?

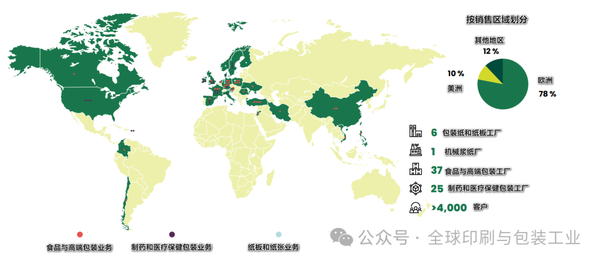

Currently, the entire MM Group has 14,710 employees, owning 6 packaging paper and cardboard factories, 1 mechanical pulp paper mill, 37 food and premium packaging factories, and 25 pharmaceutical and healthcare packaging factories. On March 18th, this well-known European folding carton and cardboard manufacturer released its 2024 annual performance report.

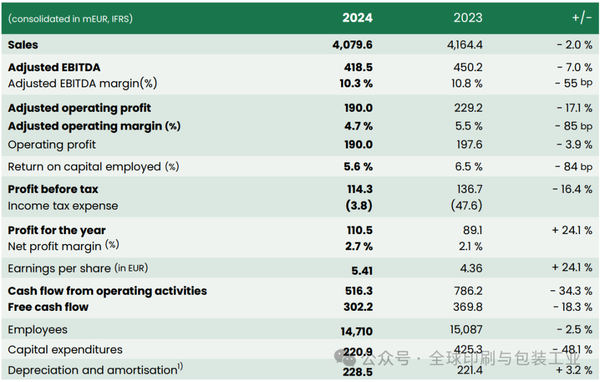

The report shows that the group's consolidated sales in 2024 were 4.0796 billion euros (approximately 32.272 billion yuan), a decrease of 2% compared to the same period last year. Despite significant growth in sales in the MM board and paper department, this growth was offset by a decline in the average price of products in the MM food and premium packaging department as well as the MM board and paper department.

The adjusted operating profit decreased from 2.292 billion euros in 2023 to 1.9 billion euros, mainly due to the performance of MM food and high-end packaging businesses. Therefore, the group's adjusted operating profit margin was 4.7%, and the return on capital employed reached 5.6%. The adjusted EBITDA totaled 4.185 billion euros, with an adjusted EBITDA margin of 10.3%.

The total pre-tax profit was 114.3 million euros, compared to 136.7 million euros in the previous year. The income tax expense decreased to 3.8 million euros, mainly due to the carryover and capitalization of the original Yishenghua Packaging's losses, which reduced the group's effective tax rate to 3.4%, and the annual net profit increased to 110.5 million euros (approximately 874 million yuan).

MM food and high-end packaging

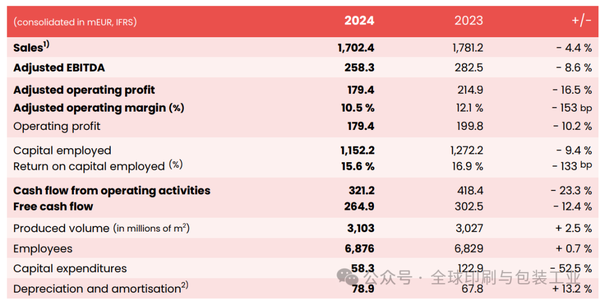

Given the continued weakness in the consumption of daily consumer goods, the overall market demand for all folding carton sub-sectors in 2024 has been suppressed. By focusing heavily on growth, the MM Food and high-end packaging sectors successfully increased production in the food and beauty sub-sectors. The total output reached 3.103 billion square meters (3.027 billion square meters in 2023), an increase of 2.5% over the previous year, with a unit price of approximately RMB 4.345 per square meter.

In December 2024, MM Group reached an agreement with Changqing Mountain Enterprise Private Limited to sell 100% of the shares in Thain Group at an enterprise value of 360 million euros. The reason for taking this step is that the business of Thain (tipping paper) is not related to the group's core areas - paperboard and consumer packaging. The transaction is expected to be completed in the first half of 2025.

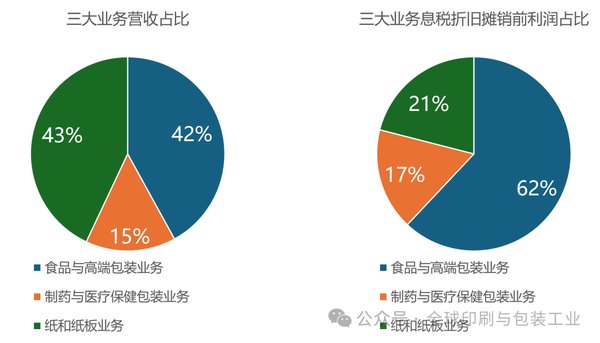

Driven by sales growth and cost savings, the food and premium packaging sectors achieved revenues of 1.7024 billion euros (approximately 13.467 billion yuan), accounting for 42% of the group's revenue, and a good adjusted operating profit margin of 10.5%. The adjusted operating profit was 179.4 million euros, compared to 214.9 million euros in the previous year.

MM pharmaceutical and healthcare packaging

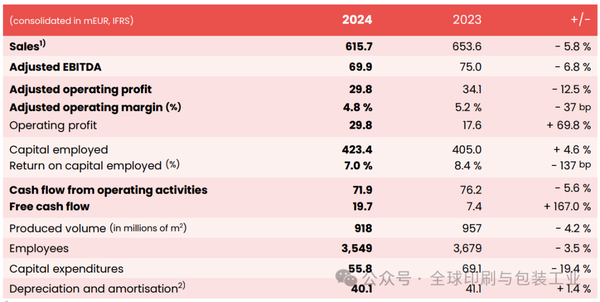

The fiscal year 2024 is characterized by a weak demand for secondary pharmaceutical packaging, especially in the European region. The main influencing factors include customers reducing inventory levels, shortages in the supply of active pharmaceutical ingredients and other components (especially in the GLP-1 drugs, i.e., diabetes/obesity treatment drugs), and a decrease in consumption in the over-the-counter drug sector. Against this backdrop, the sales volume of MM Pharmaceutical and Healthcare Packaging decreased by 4.2%, from 957 million square meters to 918 million square meters, with a unit price of approximately RMB 5.31 per square meter.

In terms of operations, the department's focus is on implementing a consistent pricing strategy, carrying out comprehensive cost-cutting measures, and actively expanding into new businesses. The expansion of the sales team and investments in innovation and development have been successfully completed. In the areas of patient safety and sustainability, some important innovative projects have been brought to market and reached maturity in collaboration with key customers. Currently, MM Pharmaceuticals and the healthcare packaging division have established clear growth strategies, focusing on attractive indications such as obesity, diabetes, and oncology.

The total sales of the department were 615.7 million euros (approximately 4.871 billion yuan), lower than the 653.6 million euros in the previous year, accounting for 15% of the group's revenue, mainly due to a decline in sales volume. The adjusted operating profit margin reached 4.8%, with an adjusted operating profit totaling 29.8 million euros. In addition, the department further advanced the transformation of sourcing products from the MM board and paper division, with its sister division becoming its largest board supplier.

MM paper and paperboard business

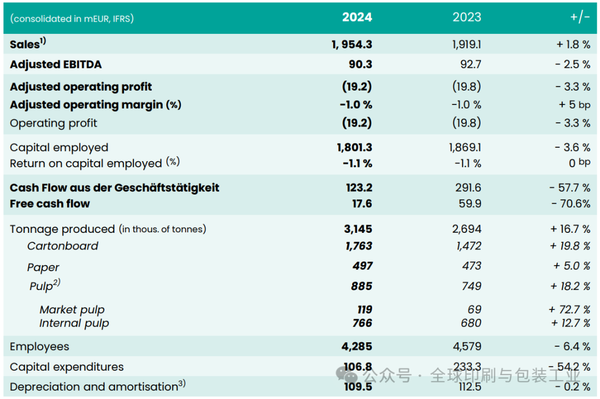

In the paper and paperboard business unit, the degree of market recovery was still below expectations, with sales amounting to 1.9543 billion euros (approximately 15.46 billion RMB), a decrease of 1.8% in price-related sales compared to the previous year. Following large-scale production shutdowns due to market factors and reconstruction work in the previous year, the output of the MM board and paper division significantly increased, growing by 16.7% to reach 3.145 million tons. As a result, capacity utilization was also noticeably higher than the previous year. The average order backlog for this division totaled 0.172 million tons.

However, the significant drop in average product prices offset the positive impact of increased production. At the same time, the cost of recycled paper and pulp rose sharply. Despite some selective price increases, they were not enough to compensate for the growth in costs. The adjusted operating margin remained poor, essentially flat with the previous year at -1%, with an adjusted operating profit of -19.2 million euros, which also benefited from higher CO2 emission allowances compared to the previous year.

From the above figure, we can see that the food and premium packaging segments of the MM Group are its main sources of profit, contributing more than 60% of the adjusted EBITDA, with a profitability significantly higher than other segments. The pharmaceutical and healthcare packaging segments also show a certain level of profitability. In contrast, although the paper and paperboard business is comparable to the food and premium packaging segments in terms of sales, it lags significantly behind in terms of profit contribution, with the adjusted EBITDA accounting for only about one-third of the former, which is related to various factors such as raw material costs and market price pressures.

In addition, it is estimated that the revenue of MM Group's paper and paperboard business is 15.46 billion yuan, with unknown sales volume, but a production volume of 3.145 million tons. Based on this, the average price is approximately 4,916 yuan per ton. In comparison, according to the annual report data of Guanhao High-Tech, its annual revenue from white card paper is 3.839 billion yuan, with a total production of 690,369 tons and sales of 632,830 tons, resulting in an average selling price of about 6,066 yuan per ton, which is 23.4% higher than the unit price of MM Group.

MM Group Folded Carton Business VS YUTO Tech

Overall, the total revenue of MM Group's folding carton business in 2024 was 18.338 billion yuan, with an operating profit of about 1.65 billion yuan. YUTO Technology, the world's largest producer of premium paper packaging, has not yet released its 2024 performance. Compared to the 2023 performance, YUTO Technology's total revenue was 15.223 billion yuan, with an operating profit of about 3.993 billion yuan, of which the revenue from premium paper packaging business was 11.036 billion yuan.

From the perspective of revenue scale, the total revenue of MM Group's folding carton business in 2024 is significantly higher than the total revenue of YUTO Technology in 2023. It is estimated that the total revenue of YUTO Technology in 2024 will not exceed 18.3 billion yuan. Even when comparing only the folding carton business of MM Group with the premium paper packaging business of YUTO Technology, the revenue scale of MM Group is larger. This indicates that in the field of folding cartons, the overall business volume of MM Group is greater than that of YUTO Technology.

However, in terms of operating profit, YUTO Technology's operating profit in 2023 is much higher than that of MM Group in 2024. This indicates that YUTO Technology has stronger profitability and a higher profit margin in the paper packaging business. A more comprehensive comparison will need to wait for YUTO Technology to release its 2024 performance.

Looking ahead, given the continued sluggish economic outlook in major European markets, market demand is expected to remain weak. The goal of the MM Group is to strengthen and expand its market position in the three business segments by pursuing leadership in cost, technology, and innovation in the core competencies of packaging and paperboard. Sales efforts will focus on expanding distribution channels, developing innovative solutions, and promoting alternatives to plastics.

In addition, the group will also improve profitability through cost management and structural optimization measures. Based on the encouraging progress made so far, a comprehensive efficiency enhancement program called "Fit for the Future" is being implemented across the entire group.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track