European Phenol Crisis Escalates, Prices to Surge 50%-70%? Plastic Prices Mixed Today, PS Soars by 400

1. The European phenol crisis spreads, with prices expected to soar by 50%-70%?

Supply chain restructuring! Sudden tightening of supply, raw material prices may surge by 50%-70%!

The European chemical industry is facing a drastic restructuring of its supply chain. Global giants in phenol and acetone production are...InnospecAnnounced the permanent closure of its plant in Gladbeck, Germany, which originally had an annual production capacity of 650,000 tons of phenol and 400,000 tons of acetone. Subsequently,West Lake ChemicalA series of production cuts by companies has not only caused a sudden tightening of phenol supply in Europe but also led the market to anticipate a price surge of 50%-70% locally. The Asian market is also expected to follow suit, with an estimated increase of 20%-30%.

It is worth noting that INEOS explicitly pointed to three main reasons for the closures: the energy cost crisis, pressure from carbon tax policies, and global competitive imbalance.。

The exit of capacity in Europe is not coincidental. Energy costs remain high, with natural gas prices 30%-40% higher than in Asia, coupled with the EU Emissions Trading System (ETS) carbon price reaching €80 per ton. This multiple pressure makes it difficult for chemical companies to cope. Jim Ratcliffe, founder of Ineos, candidly stated that this is a result of Europe's energy policy and carbon tax mechanisms leading to "deindustrialization," and warned that unless regulators act quickly, the shutdown will not be the last.

Market sentiment is gradually warming up, and Chinese enterprises are

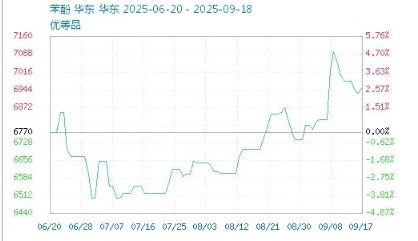

The domestic phenol market has swiftly responded to this wave of international changes. According to data from Business Society, the price of phenol in China has recently increased by approximately 200 yuan per ton, with mainstream price ranges between 6,800 and 9,080 yuan per ton. Market sentiment is gradually heating up, especially with the firm pricing atmosphere at ports and the positive outlook for the far month driving the prices of some offers back up to around 7,900 yuan per ton. This round of price increase is influenced by the spillover effects of a shortage in European supply, as well as supported by steady domestic demand and bidding activities.

Source*: Business Society

In the wave of global industrial rebalancing, Chinese manufacturers have demonstrated significant advantages. China is currently the largest producer of phenol in the world, with a total production capacity exceeding 4 million tons, accounting for nearly one-third of the global supply. By 2025, the total production capacity is expected to rise further to 7.38 million tons, continuing its rapid growth.

A number of leading enterprises, such as Weiyuan Co., Ltd. and Sinochem International, are enhancing their competitiveness through integrated industrial chain layouts. Weiyuan has an annual production capacity of 700,000 tons of phenol and acetone, 240,000 tons of bisphenol A, and 130,000 tons of polycarbonate; Sinochem International is advancing a propylene oxide industry chain project with an annual capacity of 650,000 tons of phenol and acetone and 240,000 tons of bisphenol A.

With the exit of capacity in Europe, the global phenol and ketone industry is undergoing a historic transition from dominance by Europe and America to the rise of Asia.Chinese companies are not only continuously expanding in scale but also gradually demonstrating cost control and risk resistance capabilities. Although industry profit margins are generally under pressure at present, through technological upgrades and internationalization strategies, they are striving for more central positions in the global chemical value chain.

II. Today's Latest Plastic Prices

(The above is compiled from Guanghua Trading and Dayi You Su.)

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track