End of Expansion Cycle, Turning Point in PTA Industry Becoming Apparent

Demand growth absorbs advantageous production capacity, PTA landscape optimization "anti-involution" is imminent.

In recent years, with the continuous rise in demand from downstream sectors such as textiles, apparel, and consumer goods materials, China's PTA (Purified Terephthalic Acid) industry has shown a new development trend amidst capacity expansion and structural changes.

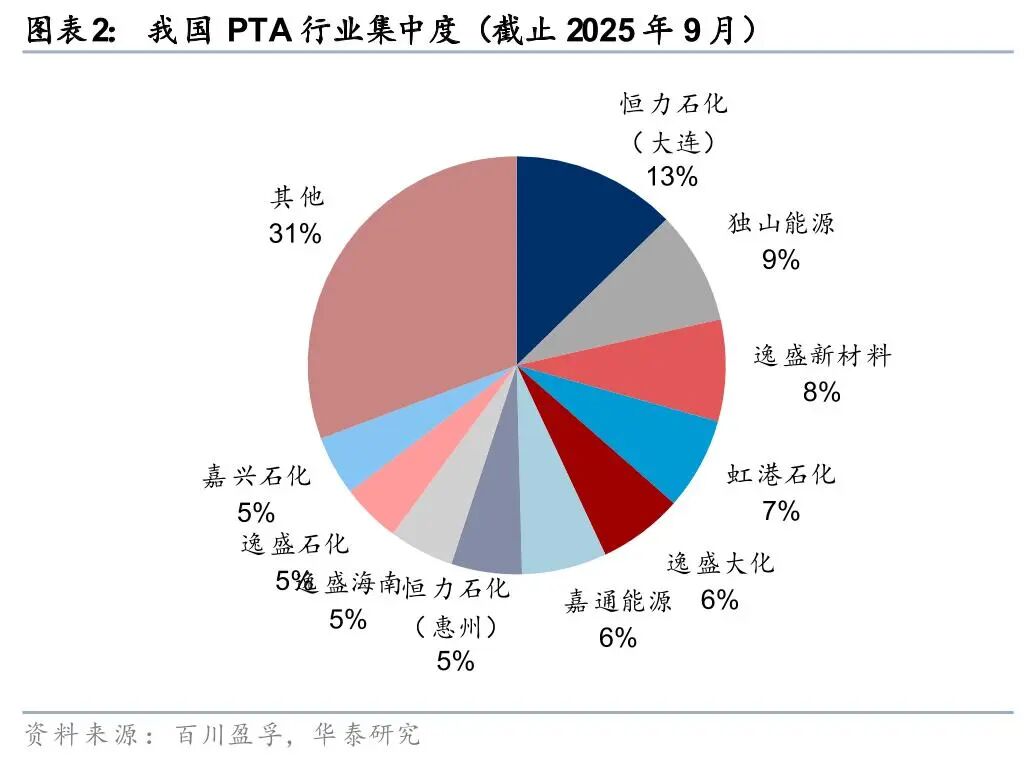

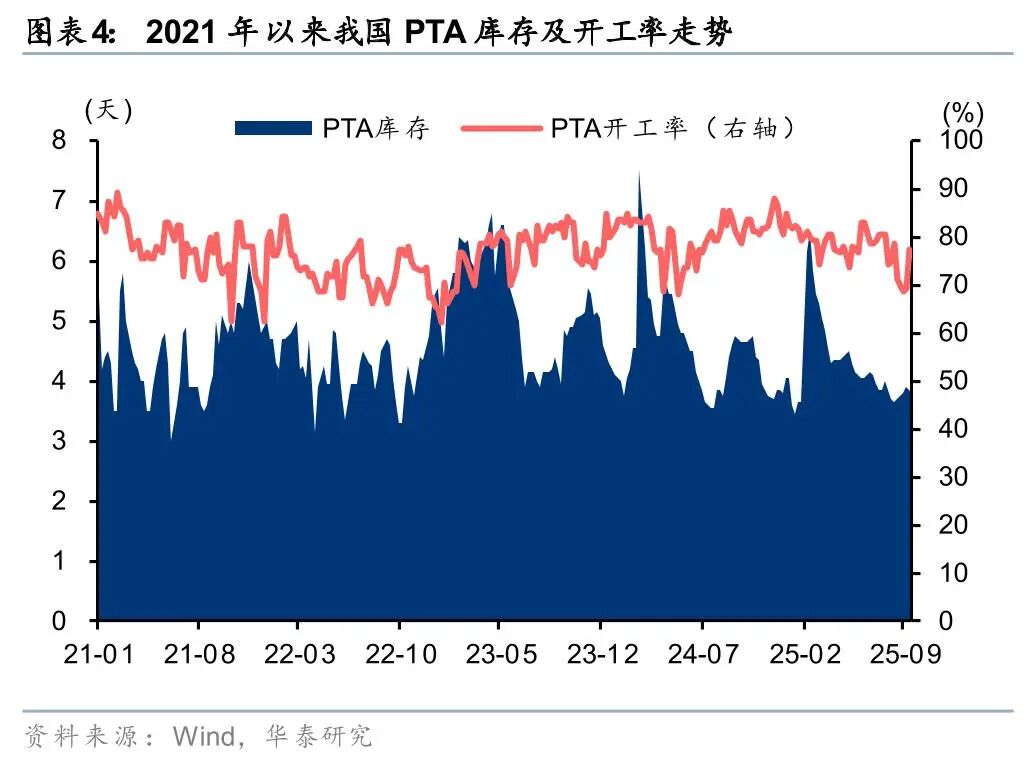

Since 2020, the production capacity of PTA in our country has seen a significant increase of 80%. Since then, the industry operating rate has remained at a healthy level.However, the profit slump has persisted for 13 years, primarily due to the continuous internal competition driven by the promotion of new technologies after 2018. By 2025, the market concentration of the top five companies (CR5) in China's PTA industry will reach 70%, with leading enterprises having a high proportion of new technology production capacity. Additionally, there will be no new production capacity in the PTA industry from 2026 to 2027. Given the limited space for technological optimization, outdated production capacity will gradually exit the market, and an "anti-involution" trend in the industry structure is set to emerge.

The expansion cycle is nearing its end, and the concentration of leading enterprises has further increased.

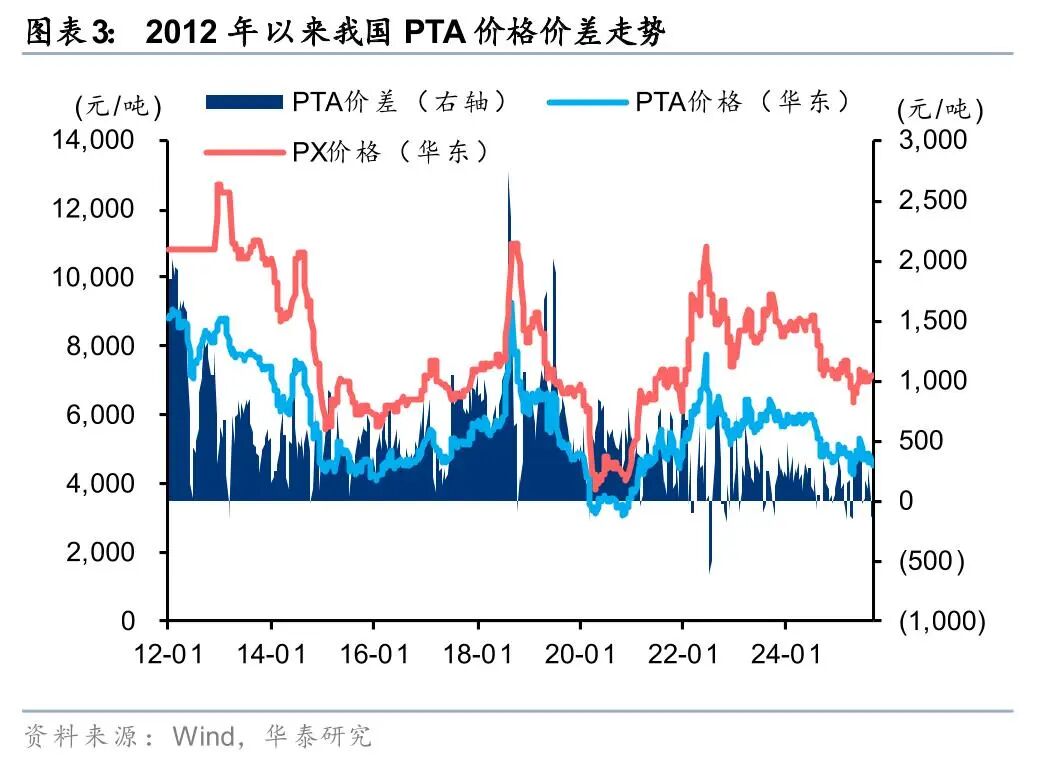

PTA, as the core raw material for polyester fibers, polyester bottle chips, and polyester films, has undergone two rounds of capacity expansion since 2010. By September 2025, China's effective PTA production capacity is expected to reach 91.35 million tons. The rapid approach to saturation on the supply side has led to the product price differentials remaining at low levels for nearly five years.

In terms of capacity distribution, China's PTA production capacity is highly concentrated among five leading companies. Hengli Petrochemical's Dalian and Huizhou facilities combined have a capacity of 16.6 million tons; Tongkun Group has a capacity of 10.2 million tons; Xinfengming Group has a capacity of 8 million tons; Yisheng (jointly owned by Hengyi Petrochemical and Rongsheng Petrochemical) has a combined capacity of 22 million tons; and a plant in Lianyungang has a capacity of 6.5 million tons. The industry concentration ratio (CR5) is nearly 70%, and there are no plans for additional capacity in the next two years, further solidifying the industry structure dominated by leading companies.

Technological iteration drives cost optimization, putting pressure on the profits of small-scale old facilities.

According to environmental assessment reports from various companies, the expansion cycle that began in 2019 has seen the adoption of new-generation technologies developed by BP, INVISTA, and others in newly constructed facilities. These new facilities each have a scale of 2.5 million tons or more, showing significant improvements in energy consumption, material usage, and environmental protection compared to the previous generation of facilities. However, the widespread application of new technology has intensified industry competition, resulting in a five-year period of downturn for the industry. Nevertheless, the cost advantages of the new facilities are gradually becoming apparent, forcing the phase-out of older, high-cost facilities. According to data from Longzhong Information, since 2020, outdated facilities with a capacity of less than 1.5 million tons have been gradually shut down. Currently, the nominal operating rate of the domestic PTA industry is around 75%, with new technology capacities achieving full production. The industry's supply structure is moving towards optimization.

Industry profits are expected to bottom out and rebound, benefiting leading companies in the sector.

Based on the comprehensive analysis of various factors, the domestic "anti-involution" policies and the technological updates in the industry will work together to continuously optimize the supply structure of the PTA industry. At the same time, the demand for textile, clothing, and consumption both domestically and internationally is expected to steadily increase. Against this backdrop, the PTA industry is likely to see a significant rebound in profits. Leading companies in the industry, with a high proportion of new installations, will benefit first from this round of industry transformation due to their cost advantages and economies of scale, ushering in new development opportunities.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track