Electric vehicle purchase tax subsidy halved soon, who dares not to fight in this bottom-line battle?

Introduction

"In order to consolidate the foundation and to boost sales at the end of the year, it is also a kind of compromise."

As is well known, according to the announcement jointly issued by the Ministry of Industry and Information Technology, the Ministry of Finance, and the State Administration of Taxation, the purchase tax on new energy vehicles from 2026 to 2027 will be adjusted from a full exemption to a half exemption. This means that starting from January 1, 2026, the cost for consumers to purchase new energy vehicles will increase by 15,000 yuan per vehicle compared to before.

Recently, the Chinese car market seems to have launched an increasingly intense "bottom-line battle."

Taking Xiaomi as an example, considering that some car owners are worried that the delivery of their vehicles crossing into the new year may reduce the purchase tax benefits they enjoy, it has officially announced a purchase tax subsidy plan for the new year.

Specifically, for owners who complete their order lock-in before November 30, 2025, if the vehicle delivery is delayed to 2026 due to official reasons, they will be eligible for a purchase tax subsidy, ensuring that owners do not incur additional expenses due to changes in purchase tax policies.

In contrast, Deep Blue made a similar commitment.

For all vehicle models with orders locked before 24:00 on November 30, if the vehicle configured in the locked order is invoiced and delivered in 2026 due to non-customer reasons, the difference in the purchase tax for the new year will be subsidized.

As for Zeekr, it has also introduced related benefits for the newly launched 9X.

Orders finalized before or on October 31, 2025, will be eligible for a purchase tax difference subsidy if delivery and invoicing occur in 2026 due to official reasons. The subsidy amount will be directly deducted from the final payment of the vehicle price.

The subsidy amount is based on the difference in purchase tax that the user needs to pay for their orders in 2026 compared to 2025, with a maximum limit of 15,000 yuan.

The ideal then framed the officially promoted goal on the i6.

For orders finalized before October 31, 2025, if delivery and invoicing need to be completed in 2026 due to official reasons, customers can enjoy the cross-year purchase tax subsidy plan. This subsidy will be provided in the form of a cash discount on the final payment, offsetting the corresponding difference in purchase tax based on the car configuration, ensuring that users do not bear any additional purchase tax expenses.

In contrast, as the true initiator of this "battle of assurance," NIO provided everyone with a "reassurance pill" at the launch event of the brand-new ES8 on September 20th.

Orders locked in before (and including) December 31, 2025, will receive a purchase tax difference subsidy voucher per order. If, due to official reasons, orders locked in 2025 need to be invoiced and delivered in 2026, consumers can use the purchase tax difference subsidy voucher to offset the car price, with a maximum deduction of 15,000 yuan.

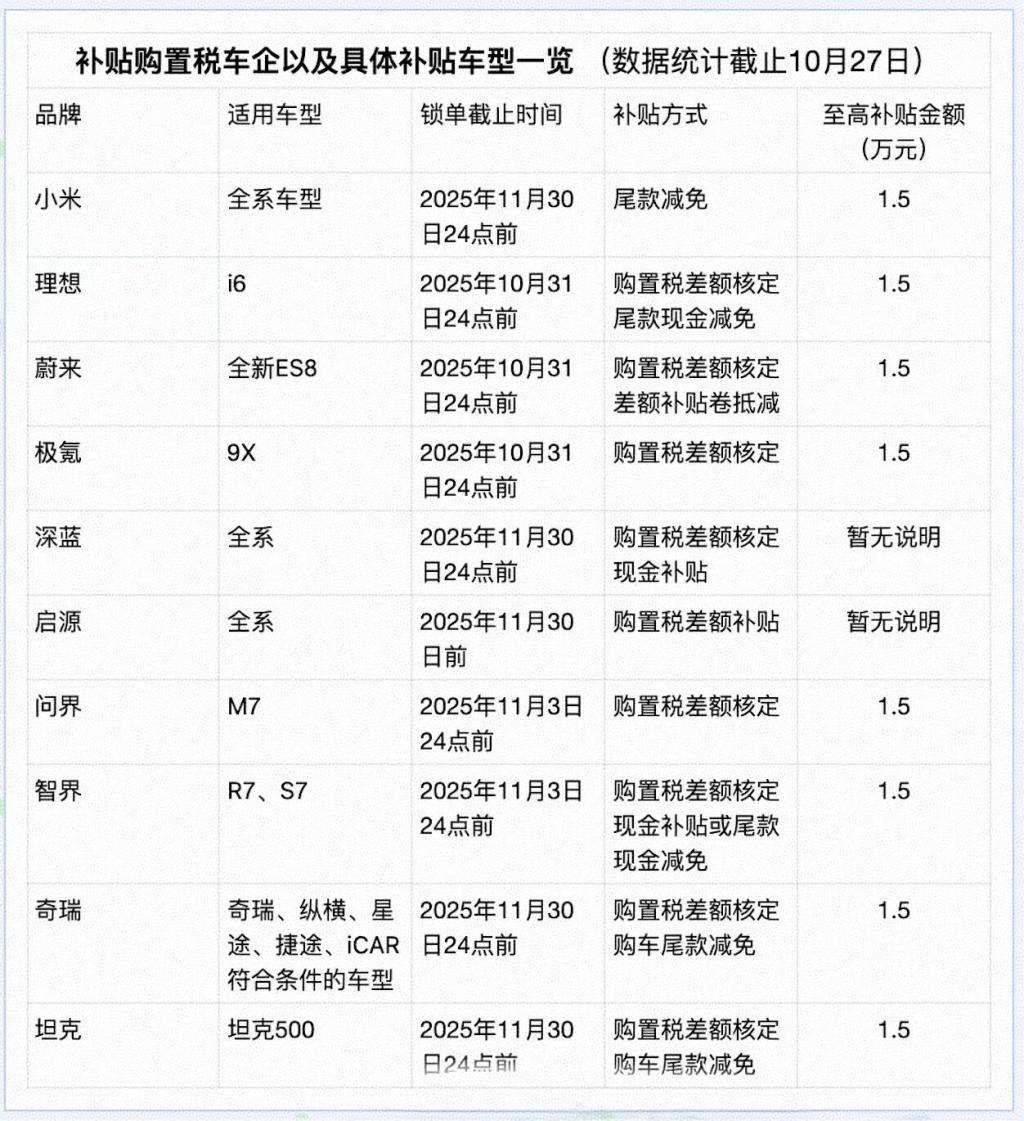

In addition to the aforementioned companies, other participants currently entering the scene include brands such as Qiyuan, Wenjie, Zhijie, Chery, and Tank. This week, the recently launched Denza N8L, as well as the entire lineup of Smart models, have also joined the "bottom-line battle."

With the momentum, new questions arise: why must this battle be fought? In my mind, there are two main reasons. First, it is still to solidify the base.

It is obvious that the "floor" purchase tax mainly targets some popular car models, which generally have very long delivery cycles.

For example, with the new ES8, according to the NIO app, orders placed now will have to wait until April 2026 for delivery. Such a long wait time is sure to cause a significant loss of potential customers. It's important to note that in the large three-row SUV market alone, there are already over a dozen competing models in the current Chinese car market.

Coincidentally, the expected delivery time for the Xiaomi YU7 entry-level version is currently 42 to 45 weeks. After locking the order for the Li Xiang i6, the expected delivery time is 16 to 19 weeks. Both are in the mid-size SUV market, which has long become a fiercely competitive "red ocean."

Faced with a dazzling array of choices and the imminent phase-out of national subsidies, most consumers will inevitably adjust their car purchasing plans, ultimately leading to order cancellations.

With official backing, it can indeed alleviate the anxiety of users with locked orders to some extent and reduce the likelihood of being "intercepted" by competitors. After all, for a popular new car, maintaining a steady stream of orders is very important.

Of course, the price to be paid is definitely "cutting losses and offering discounts." Especially for new power car manufacturers with insufficient cash reserves, it is undoubtedly a "big gamble."

Secondly, the main purpose of manufacturers launching a bottom-line battle is still to boost sales at the end of the year.

In the past, we used to say "Golden September and Silver October." This year, the Chinese car market clearly has a higher gold content in October. According to data released by the China Automobile Dealers Association, the customer gathering situation in the first half of October increased by 35.4% compared to the first half of September, and by 12.3% compared to the second half of September. The order situation improved by 13% compared to the first half of September.

The underlying "catalysts" include the imminent halving of the new energy vehicle purchase tax exemption and the impending phase-out of old car scrappage subsidies and replacement subsidies, prompting many long-term on-the-fence users with immediate needs to make their purchases.

In other words, the continuous push of policies, combined with the efforts of car companies, has led the entire market into a very excited sprint state in the fourth quarter, with each segment accelerating its growth.

The automakers' decision to take money out of their own pockets can be considered as going with the flow.

Moreover, in 2026, with the reduction of various subsidies, no one dares to give an accurate prediction of the impact on new energy vehicles that have just won the "Crossing the River Campaign."

Before this, everyone can only seize the remaining "policy window" of 2025 to the greatest extent possible to accumulate and reserve orders to cope with the many unknown challenges that follow.

Based on this background, it is entirely foreseeable that more and more car companies will actively participate in the "guarantee battle" in the future, which you could even consider as a new manifestation of the "price war."

A few days ago, I wrote an article titled "Who is still buying gasoline cars? Finally, I understand.The intense discussion in the comment section of the article surprised me.

In summary, the central idea is that "in the eyes of many readers, new energy vehicles are still products driven by policies rather than by the market and products."

From another perspective, the reason why manufacturers are willing to pay out of their own pockets to subsidize new energy vehicle purchase taxes is essentially a compromise, a helpless move.

Although the retail penetration rate of new energy vehicles has steadily surpassed the 50% mark, whether they can maintain their previous dazzling acceleration when the "crutches" that assisted this group to move forward are gradually being discarded remains fraught with uncertainty.

As for the answer to the question, we'll find out in 2026.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track