Drivers "Hijacked" by the Platform

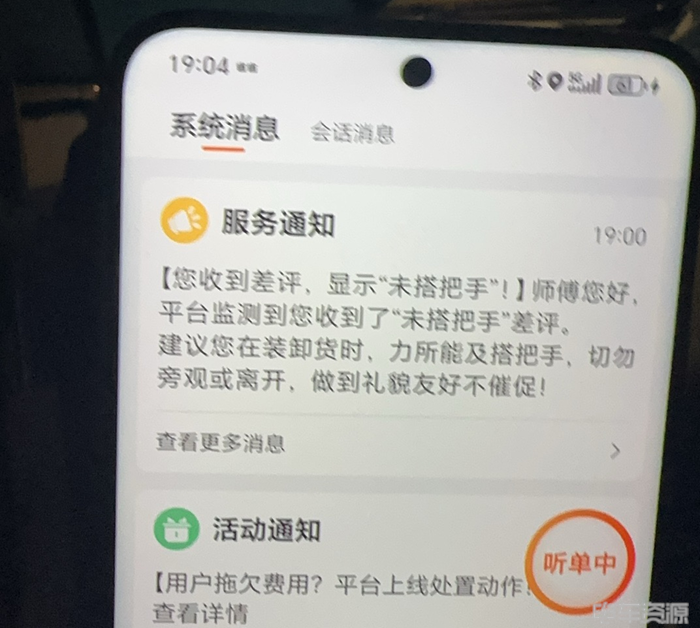

"Hello, Master, the platform has detected that you received a 'did not lend a hand' negative review. It is recommended that you lend a hand when loading and unloading goods as much as you can."

Freight driver Mr. Huang showed such a message to EV Resources and explained: “This kind of negative review doesn’t deduct points, but it limits the order-grabbing rate. I saw customized stickers online that charge extra for loading and unloading, but I haven't dared to use them because I'm afraid the platform will penalize me.”

These seemingly trivial troubles are a microcosm of the current living conditions of millions of truck drivers. When freight platforms use algorithms to reconstruct the operational logic of road logistics—platforms grow unchecked, from vehicle decal styles to order-taking permissions, from freight commissions to account withdrawals, and even the bottom line of professional dignity, drivers are gradually being deeply bound.

All of this coincided with the critical turning point in China's highway freight market, shifting from incremental expansion to stock competition. The changes in the market structure have further highlighted the dominant position of platforms, while the bargaining power of drivers has been continuously squeezed.

According to relevant reports, since 2021, regulatory authorities have held multiple meetings with online freight platforms including but not limited to Huolala, Manbang, and Kuaigou Dache, focusing on issues such as freight rates, platform rules, driver rights, and conflicts between drivers and passengers.

Can drivers "captured" by platforms finally see a moment of "release"?

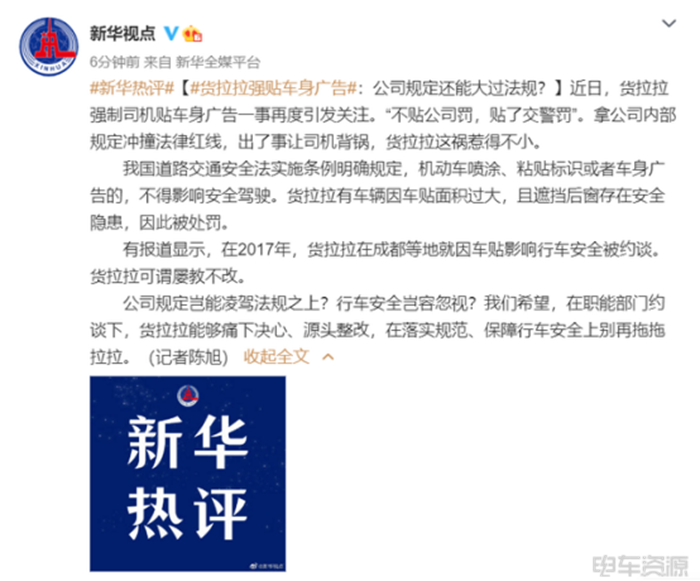

Car stickers management linked to commission, drivers have "no choice but to accept"

As early as July 8 this year, the China Road Transport Association organized the four major online freight platforms—Manbang Group, Huolala, Didi Freight, and Kuaigou Dache—to jointly sign and publicly release the "Self-Disciplinary Convention on Protecting the Legal Rights of Truck Drivers by Online Freight Information Transaction Matching Platforms," which explicitly mentioned that drivers should not be forced or indirectly forced to use vehicle stickers.

Car decals have evolved from their original purpose of identification to become a low-cost advertising medium. The core driving force behind this shift is the outdoor marketing needs of commercial brands, turning vehicles into "mobile billboards."

In the field of shared mobility, in foreign markets, platforms such as Uber and Lyft require drivers to display brand identifiers (such as windshield stickers), but explicitly prohibit car body advertisements in order to maintain uniform vehicle appearance. This approach places greater emphasis on user recognition efficiency rather than brand exposure density.

With the rise of the sharing economy and freight platforms, vehicle stickers have been assigned new functions by some platforms—driver management and traffic binding. Their business logic has shifted from "voluntary cooperation" to "mandatory imposition," which is also the core controversy surrounding the vehicle sticker model of the largest instant freight platforms in China.

Drivers may face difficulties in receiving orders if they do not accept unreasonable car allowance requirements, which is essentially a form of disguised coercion.

Master Huang said, "Although the platform no longer requires car stickers, it will withhold a 200 yuan deposit and deduct an extra 8% from each order. This is essentially still a disguised requirement to put on the car sticker."

For orders with a car sticker, the commission is 11%; for those without, it’s 19%. Presented with such a choice, drivers are essentially being guided to make a decision without realizing it.

For drivers, the risks are even greater. On one hand, in some areas, vehicles with non-compliant exterior appearances may face penalties from traffic management authorities; on the other hand, if the vehicle stickers become damaged or faded, drivers may face the risk of having their deposit deducted by the platform.

It is not difficult to see that the evolution of car stickers revolves around the relationship between demand and power: when vehicle ownership is clear, car stickers are a tool for voluntary choice; when the platform holds the power of traffic distribution and the relationship between drivers and the platform is loosely cooperative, car stickers are prone to becoming a mandatory cost—in essence, a system design where the platform shifts the cost of brand building to the weaker party.

In addition, Didi does not have obvious mandatory management regarding car stickers, whereas Kuaigou Dache was the first to implement it.

In fact, after the signing of the "Self-Discipline Convention," the practice of indirectly forcing drivers to put on car stickers since November constitutes an illegal act. However, it is understood that some platforms are still continuing to require car stickers.

Low freight fees, a thousand yuan deposit, the unbearable burden on drivers.

Almost all freight platforms require drivers to pay a deposit of several thousand yuan, which is often refundable only upon meeting certain conditions, such as completing a specified number of orders and having no complaints.

When drivers withdraw funds from their accounts, many restrictions are imposed. Some platforms stipulate that withdrawals can only be made once a week, while others require the account balance to reach a certain amount before a withdrawal can be requested.

When a dispute arises between drivers and the platform, the platform may even freeze the account funds as a penalty. For drivers to recover their funds, they often need to go through a lengthy process of complaints and arbitration.

This kind of control over funds forces drivers to consider the risk of having their supply cut off when facing unreasonable demands from the platform.

On July 31, 2025, the State Administration for Market Regulation officially issued the "Compliance Guidelines for Charging Behaviors of Online Trading Platforms," which took effect immediately.

This guideline further regulates various types of fees charged by online trading platforms to operators within the platform, covering common charges such as commissions, percentages, membership fees, technical service fees, information service fees, and marketing promotion fees. The aim is to clarify compliance boundaries and guide platform charging practices toward standardization and transparency.

Drivers are also facing the survival challenge brought by the proliferation of low-priced orders. Although the platforms are not blameless in the downward trend of freight rates, what truly determines the fluctuations in rates is ultimately the fundamental supply and demand dynamic of "more vehicles than cargo."

The role played by the platform is more like a price discoverer and a magnifier of competition—it did not directly give rise to low prices, but rather presented the long-existing reality of low prices in a straightforward manner through an efficient and ruthless approach.

Rating Systems and Ubiquitous Finance

The platform introduced a passenger rating system to regulate driver behavior, which was originally an effective way to improve service quality. However, it has now turned into a “tightening curse” for drivers.

Once the rating falls below a certain threshold, the driver will be restricted from accepting orders or even have their account suspended. However, the objectivity of the ratings is hard to ensure, as some passengers may give negative reviews based on personal emotions, and drivers' appeals often fail to succeed.

In order to maintain high ratings and reduce conflicts between drivers and passengers, drivers have to unconditionally comply with passengers' unreasonable requests, such as overloading and detouring to pick up others, even if these requests may violate traffic regulations.

The alienation of the rating system has caused drivers to lose their professional dignity to some extent.

In addition, drivers are being continuously exposed to value-added services derived from freight platforms, such as ETC, energy, insurance, and finance. These are regarded as the most promising profit drivers for the platform's future.

Many freight platforms offer financial services to drivers, such as vehicle purchase loans, freight advances, and small loans. These financial services seem to solve the drivers' cash flow problems, but in fact, they hide many traps.

Some drivers, in order to own their own transport vehicles, hastily take out loans without fully understanding the detailed loan terms. They eventually find themselves under great repayment pressure, and if there are fluctuations in their transport business, they may face the risk of overdue payments, which in turn can affect their personal credit records.

Under the slogans of "interest-free usage" or low interest rates, Yunmanman and Huochebang, the two major freight platforms under Full Truck Alliance, attract truck drivers to apply for "driver loans." However, when it comes to actual repayment, drivers find themselves required to pay high interest rates. Many truck drivers who have used this loan product report that the actual interest rate reaches as high as 36%, far exceeding the regulatory annual borrowing rate limit of 24%.

It is precisely this huge gap between the publicity and the reality that ultimately led Yunmanman and Huochebang to end up in court with the truck drivers.

Tianyancha shows that Guizhou Huochebang Small Loan Co., Ltd., established in December 2016, has been involved in more than 570 judicial cases, over 90% of which are loan-related disputes with the company as the plaintiff. The platform bans freight drivers who fail to repay by blocking their accounts.

In addition to account suspension, many users of "Driver Loan" have reported on the Black Cat Complaints platform that after a loan default, they were either blocked or restricted from taking orders by the Yunmanman and Huochebang platforms. Additionally, the platforms resorted to aggressive collection methods, such as contacting friends and family or blocking their doors.

Frequent meetings with regulatory authorities also indicate that the online freight industry is in a state of disorder amid rapid development and intense competition. The intensive intervention by regulatory authorities is a signal of moving from disorder to order.

Regulation has arrived, and "unbundling" requires efforts from multiple parties. We look forward to the industry's maturity and hope that drivers can find a sense of identity in their profession, allowing freight transport to regain its rightful warmth.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track